Il Child Services Withholding

Description

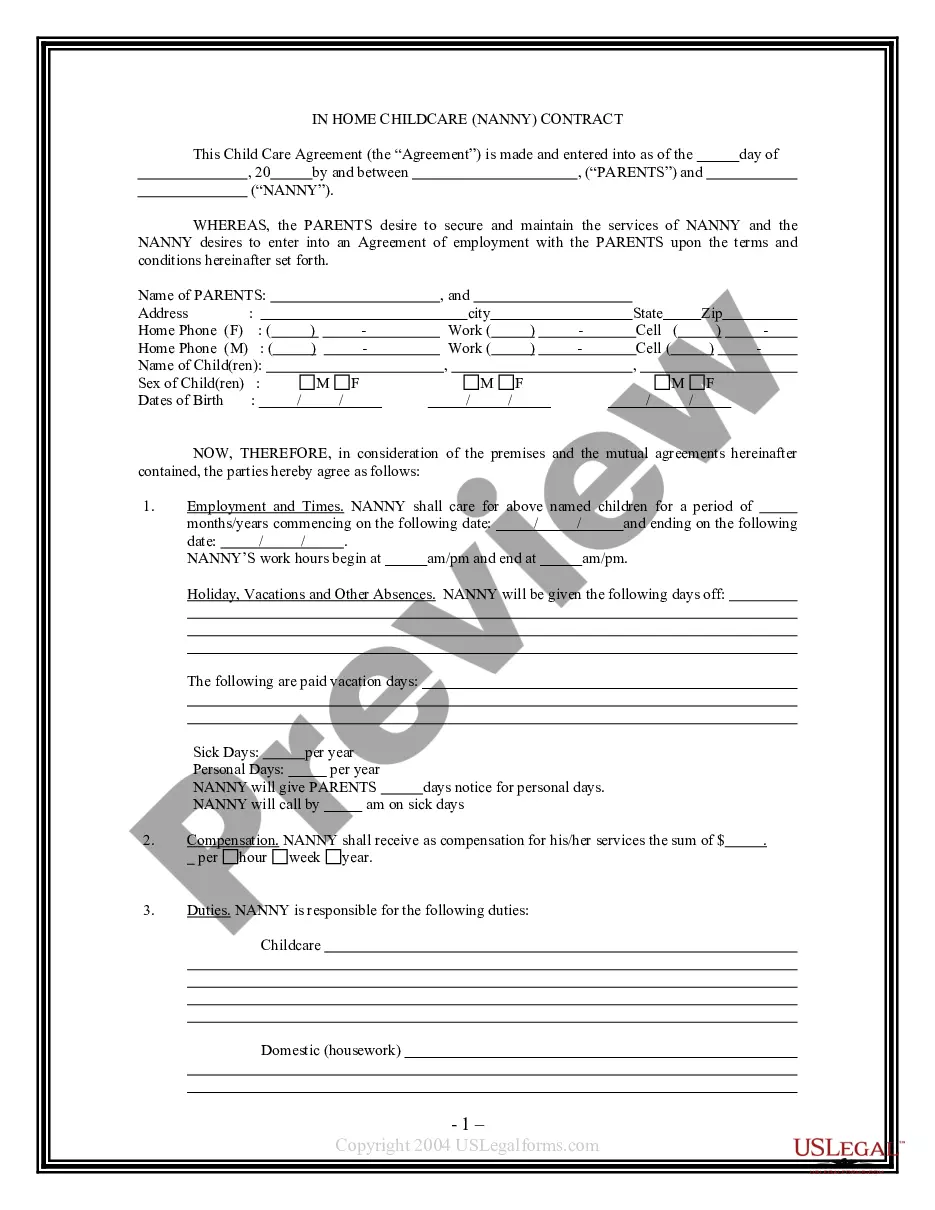

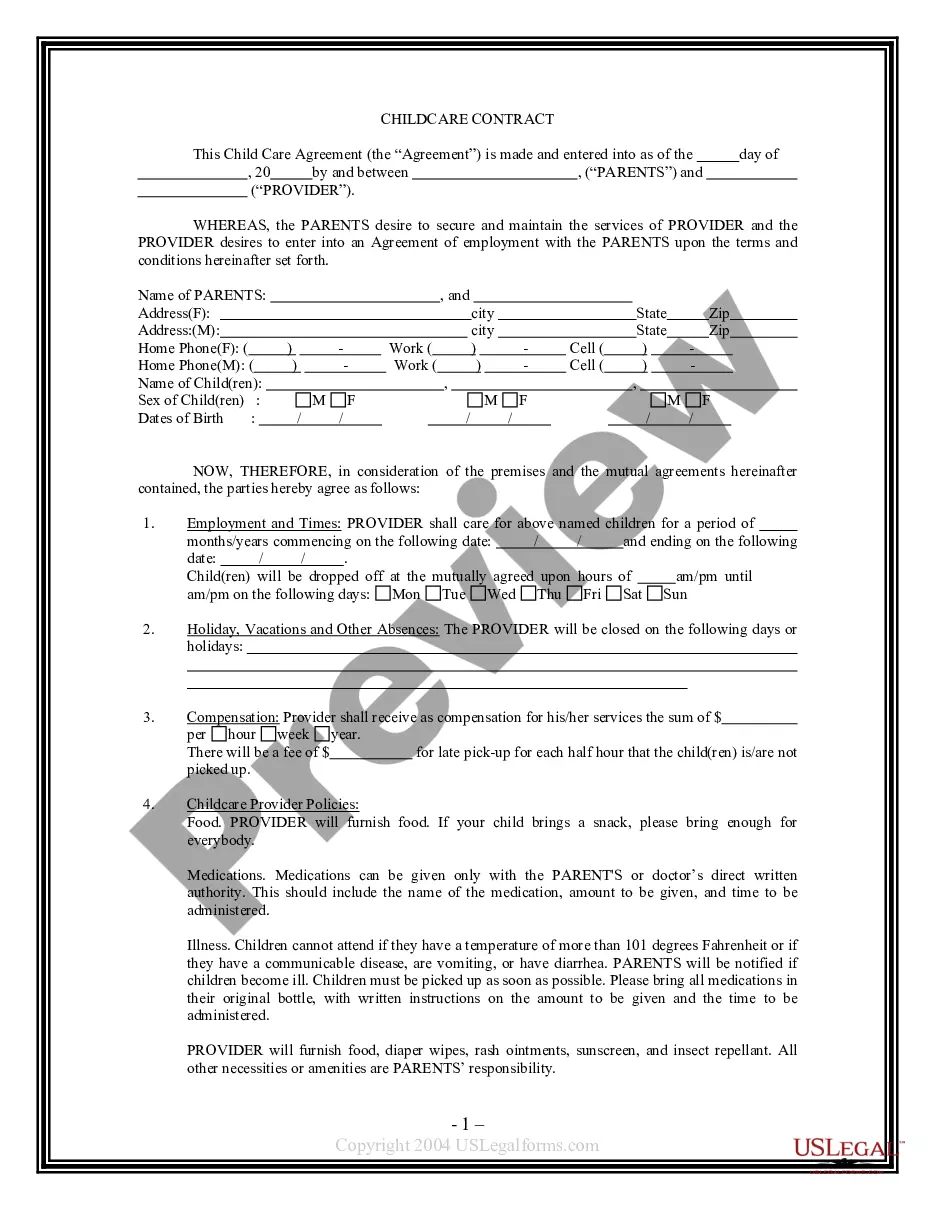

How to fill out Illinois Child Care Services Package?

Securing a reliable source to obtain the latest and suitable legal templates is half the challenge of dealing with bureaucracy. Selecting the correct legal documents requires precision and meticulousness, which is why it is vital to acquire samples of Il Child Services Withholding solely from reputable providers, such as US Legal Forms. An incorrect template will squander your time and prolong the circumstances you are facing. With US Legal Forms, you have minimal concerns. You can access and examine all the details regarding the document’s application and significance for your case and in your jurisdiction.

Follow these steps to complete your Il Child Services Withholding.

Eliminate the stress associated with your legal paperwork. Explore the vast US Legal Forms repository to discover legal templates, verify their relevance to your situation, and download them immediately.

- Utilize the catalog navigation or search bar to locate your template.

- Review the form’s details to determine if it meets the standards of your state and locality.

- Check the form preview, if available, to confirm the template is indeed the one you need.

- Return to the search and seek the appropriate document if the Il Child Services Withholding does not fulfill your criteria.

- If you are confident about the form’s applicability, download it.

- As a registered user, click Log in to verify and access your selected forms in My documents.

- If you do not yet have an account, click Buy now to acquire the form.

- Select the pricing option that aligns with your needs.

- Proceed to register to complete your transaction.

- Conclude your purchase by choosing a payment method (credit card or PayPal).

- Select the document format for downloading Il Child Services Withholding.

- Once you have the form on your device, you can edit it with the editor or print it and fill it out manually.

Form popularity

FAQ

If an employer fails to withhold child support as mandated, they may face legal repercussions, including fines and liability for the unpaid amounts. Employers must follow the income withholding orders issued by the court to ensure compliance with Illinois child services withholding laws. Additionally, the employee may face consequences for not receiving the necessary support for their child. It is crucial for both employers and employees to understand their responsibilities in this matter.

An income withholding order for child support typically takes a few days to a couple of weeks to process, depending on the court's schedule and the employer's response time. Once the order is issued, it must be served to the employer, who then has a specific timeframe to implement the withholding. Staying informed about Illinois child services withholding can help streamline this process. If you have questions, platforms like uslegalforms can provide valuable resources and guidance.

To find your Illinois withholding number, you can refer to the income withholding order issued by the court. This document typically contains the required number, which is essential for employers to process child support deductions. If you cannot locate the order, consider contacting the Illinois Department of Healthcare and Family Services for assistance. Keeping track of your withholding number ensures compliance with Illinois child services withholding regulations.

In Illinois, the garnishment law for child support allows the state to collect payments directly from the non-custodial parent's wages. Under Illinois child services withholding rules, up to 50% of disposable income can be withheld for child support, depending on the number of dependents. This ensures that children receive the financial support they need. Employers play a crucial role in this process by implementing the necessary withholding orders.

Yes, an employer can face penalties for failing to withhold child support as required by law. Under Illinois child services withholding regulations, employers must comply with income withholding orders. If they do not, they could be liable for the missed payments and may even face legal action. It is essential for employers to understand their responsibilities in this area to avoid complications.

To fill out an Illinois withholding form, begin by gathering the necessary information about the employee and the child support order. Clearly input the required details, making sure to double-check for accuracy. Once completed, submit the form to your payroll department to ensure proper Il child services withholding. If you need assistance, US Legal Forms offers templates and resources to simplify the process.

If an employer fails to withhold child support in Illinois, they may face serious consequences. The state can enforce penalties, including fines and legal action against the employer. Additionally, the non-custodial parent may face difficulties in providing for their child. Using a reliable platform like US Legal Forms can help employers understand their responsibilities regarding Il child services withholding.