Il Anatomical Gift For Therapy

Description

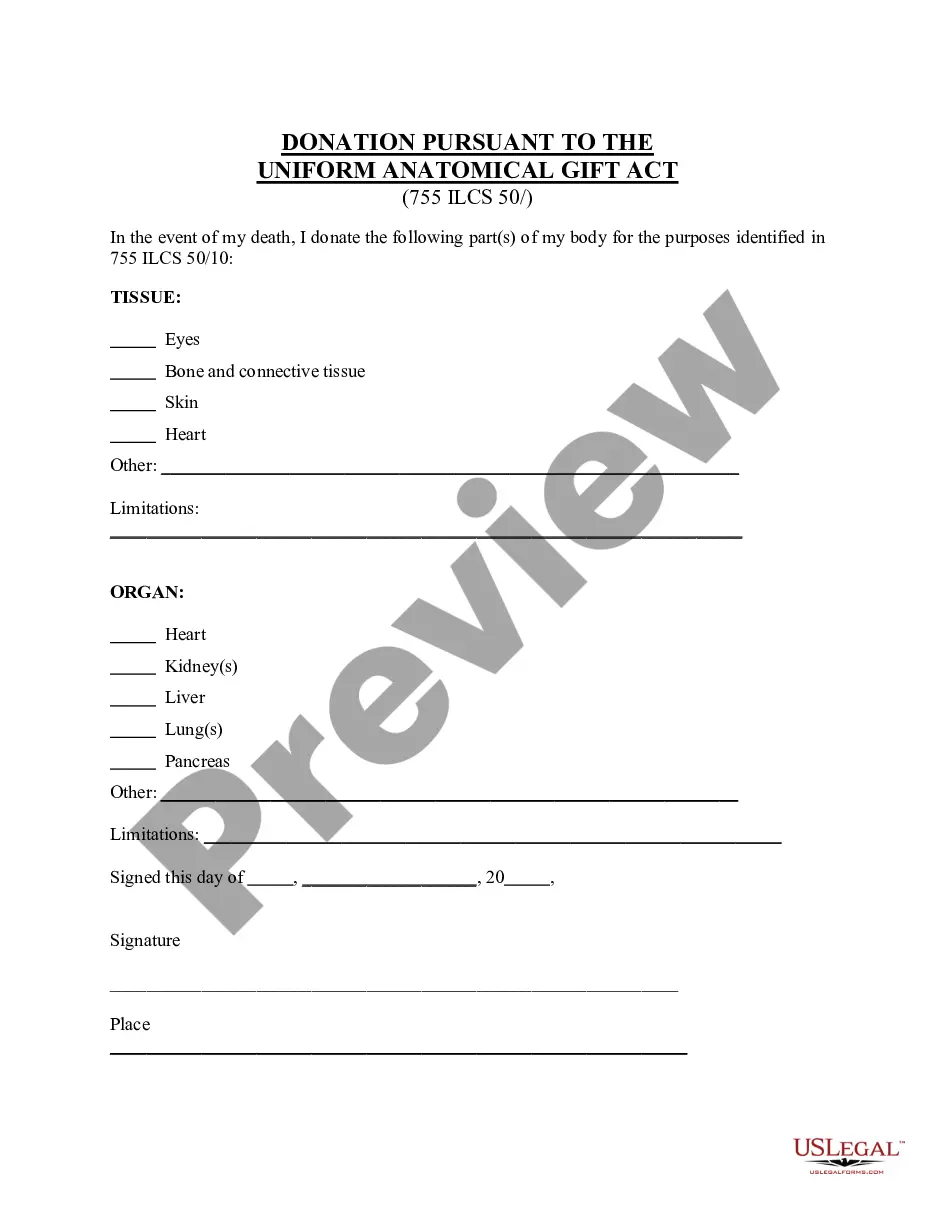

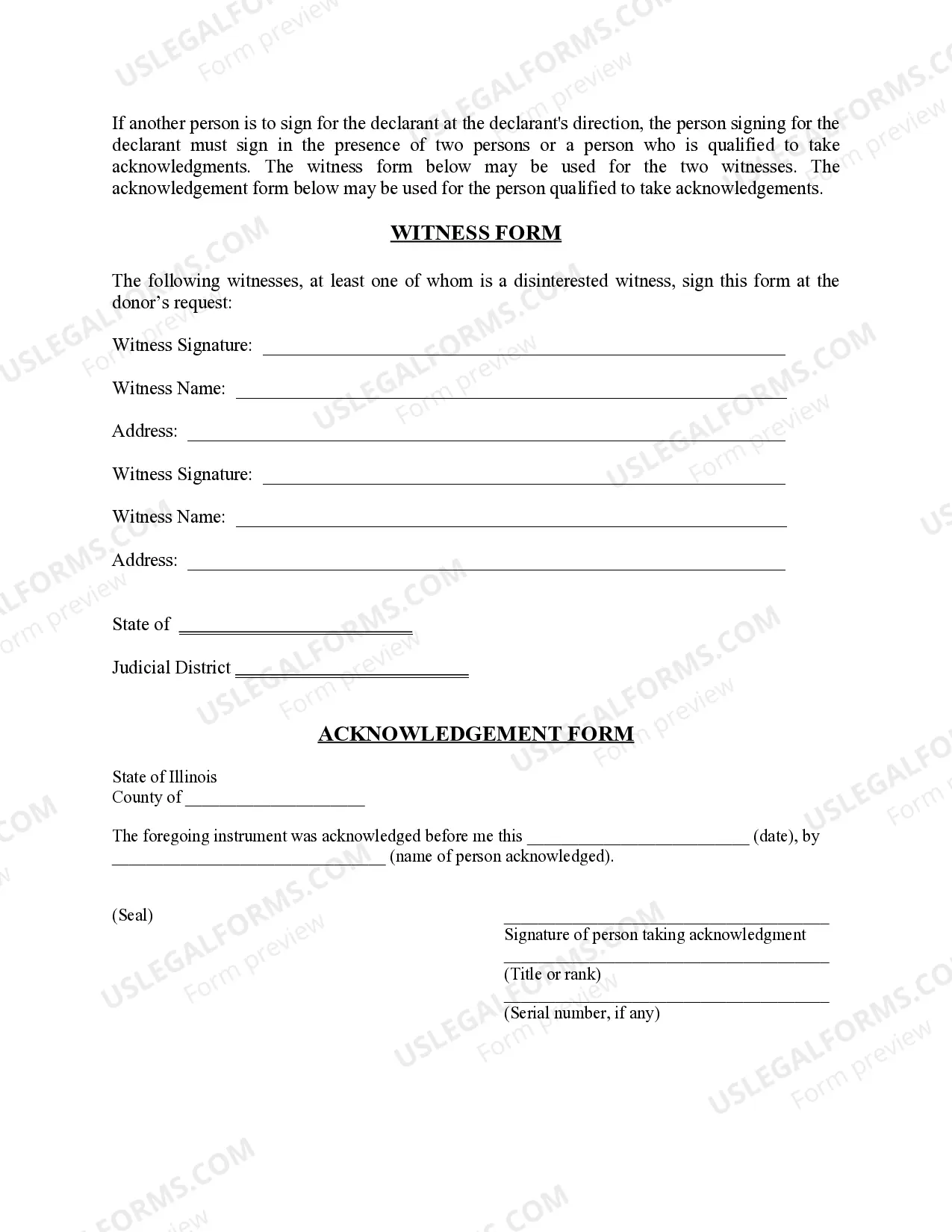

How to fill out Illinois Uniform Anatomical Gift Act Donation?

It’s clear that you cannot instantly become a legal specialist, nor can you swiftly acquire the ability to prepare an Il Anatomical Gift For Therapy without having a dedicated set of expertise.

Drafting legal documents is a labor-intensive endeavor that necessitates specific instruction and capability. So why not entrust the formulation of the Il Anatomical Gift For Therapy to the specialists.

With US Legal Forms, one of the most extensive collections of legal templates, you can discover everything from court documents to models for internal corporate communication. We recognize the significance of compliance and adherence to federal and state statutes and regulations. That’s why, on our platform, all forms are tailored to locations and remain current.

Select Buy now. After the payment is processed, you can access the Il Anatomical Gift For Therapy, complete it, print it, and forward or send it to the relevant individuals or organizations.

You can revisit your documents from the My documents section at any time. If you’re a current client, you can simply Log In, and find and download the template from the same section. No matter the intention behind your paperwork—whether it’s financial and legal or personal—our platform has you covered. Try US Legal Forms today!

- Start your journey on our site and obtain the document you require in just a few minutes.

- Locate the form you need using the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to determine if the Il Anatomical Gift For Therapy fits your needs.

- If you require another template, begin your search again.

- Create a free account and choose a subscription plan to purchase the form.

Form popularity

FAQ

A mortgage discharge is a signed document from the lender indicating that the mortgage contract has been fulfilled. Discharging the mortgage ends the lender's legal claim to your property.

With a release, your creditor confirms that all the sums due have been paid. The document certifies that the property is mortgage-free. The discharge releases only part of the property or only one of the individuals responsible for the mortgage payments.

As soon as the mortgage lender receives the form, as well as the mortgage discharge fee for administration costs and paperwork, you should receive your title within 21 to 28 days. It usually takes mortgage lenders longer if you are going to refinance a loan and significantly longer when a partial discharge is required.

Tennessee is a deed of trust state. However, a mortgage is enforceable. The trustee must be a resident of Tennessee or a corporation domiciled in Tennessee. There is a reciprocal agreement in which a trustee can serve in Tennessee if the trustee's home state allows a Tennessee trustee to serve.

Discharging your mortgage isn't complicated - the steps are as follows: Notify your lender: Reach out to your lender and discuss your plans to release the mortgage with them. ... Complete and return the Discharge Authority form: ... Register your discharge and Certificate of Title:

What Is a Deed of Trust in Tennessee? A deed of trust is a way for a third party (the trustee) to hold an interest in the property while another person (a borrower) performs a promise they have made to someone else (the lender).

A defeasance clause is a provision in some mortgage contracts indicating that the borrower will receive the title to the property once all of the mortgage payments have been made.

A mortgage discharge is a signed document from the lender indicating that the mortgage contract has been fulfilled. Discharging the mortgage ends the lender's legal claim to your property.