Illinois Statutory Withdrawal

Description

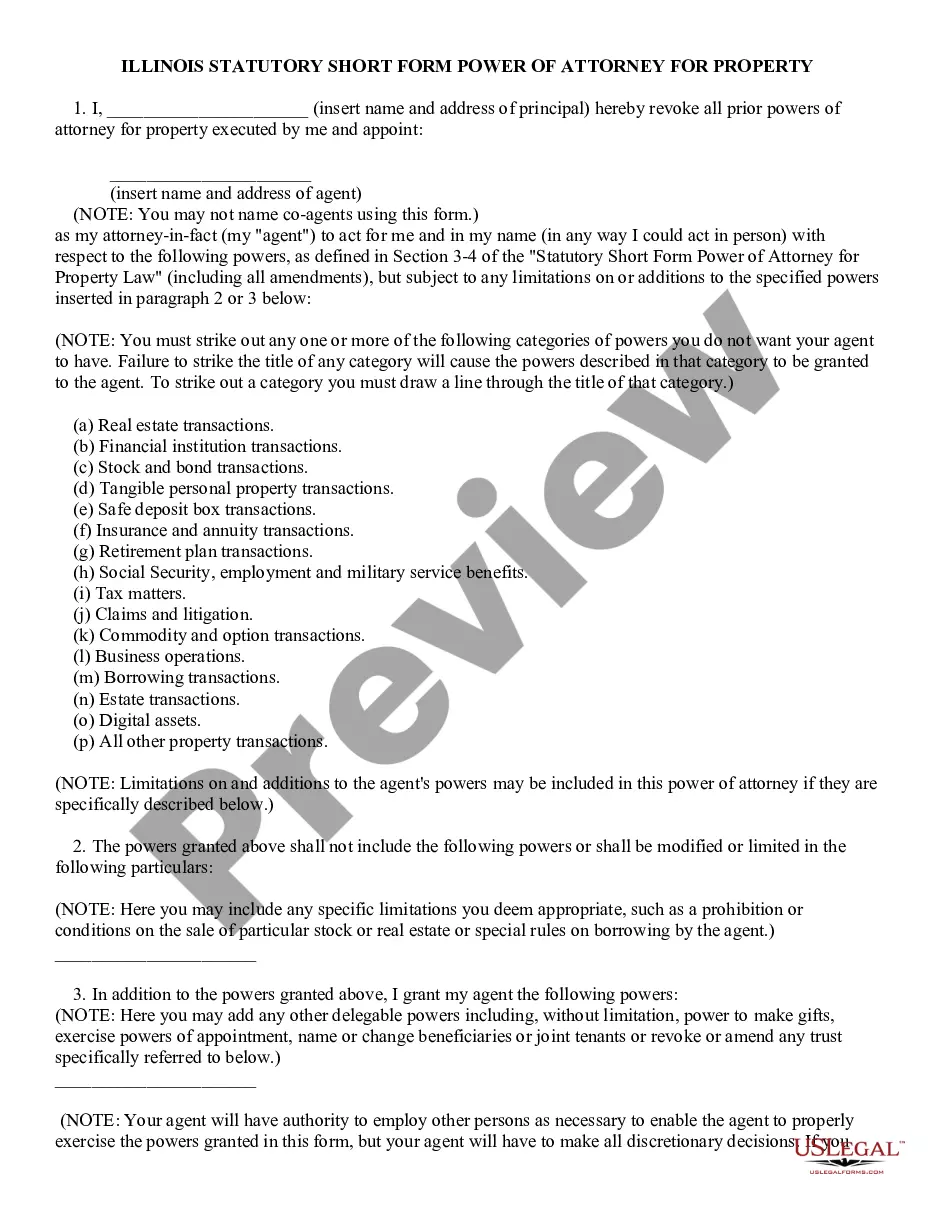

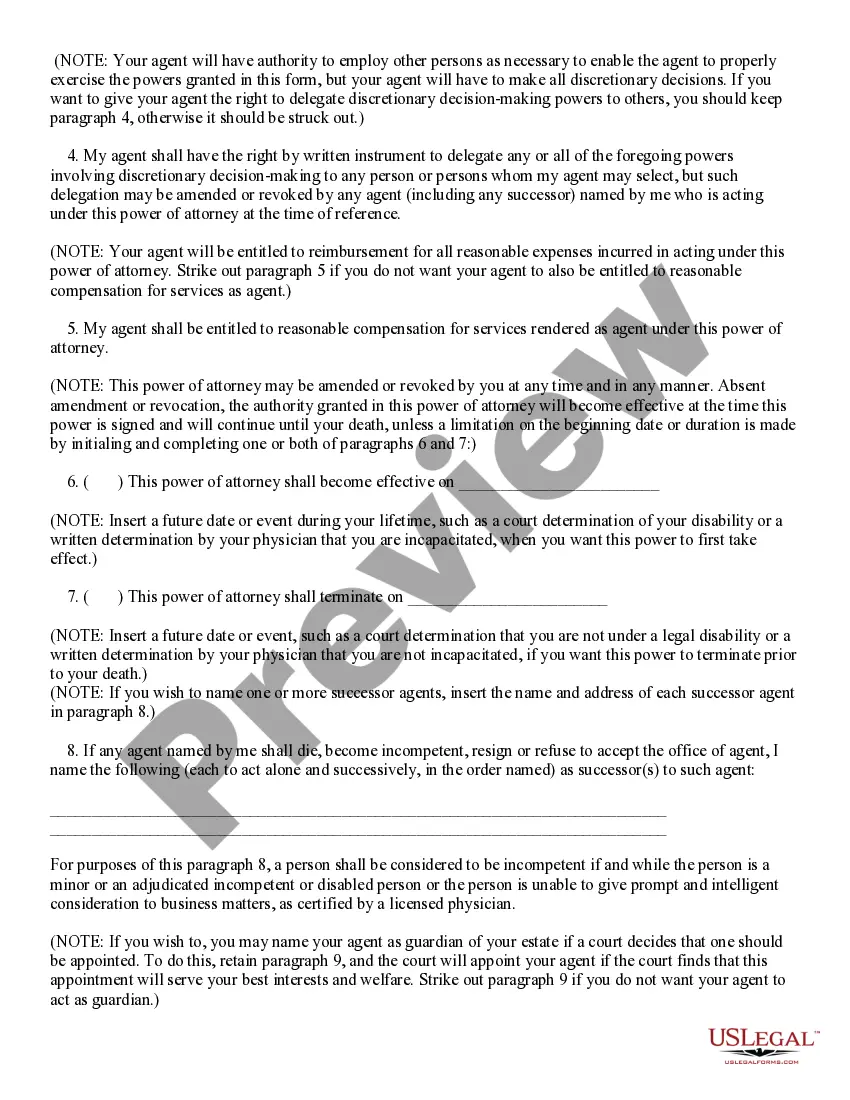

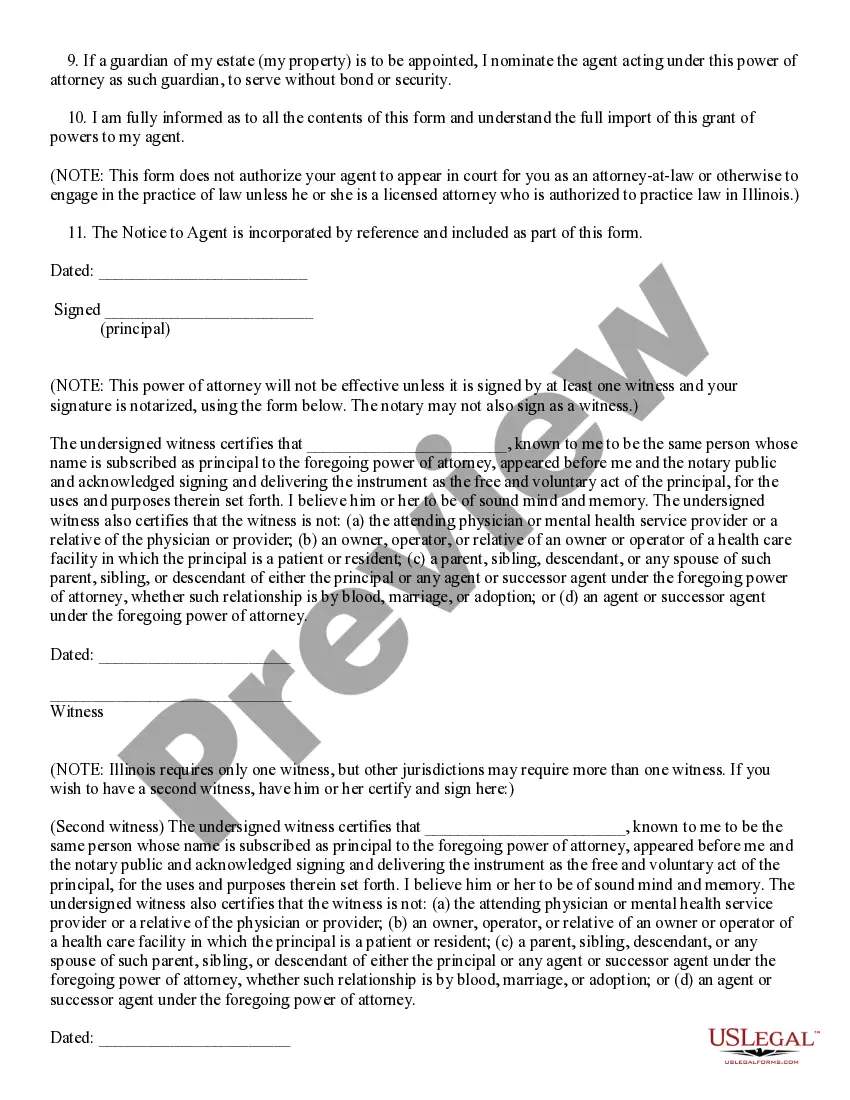

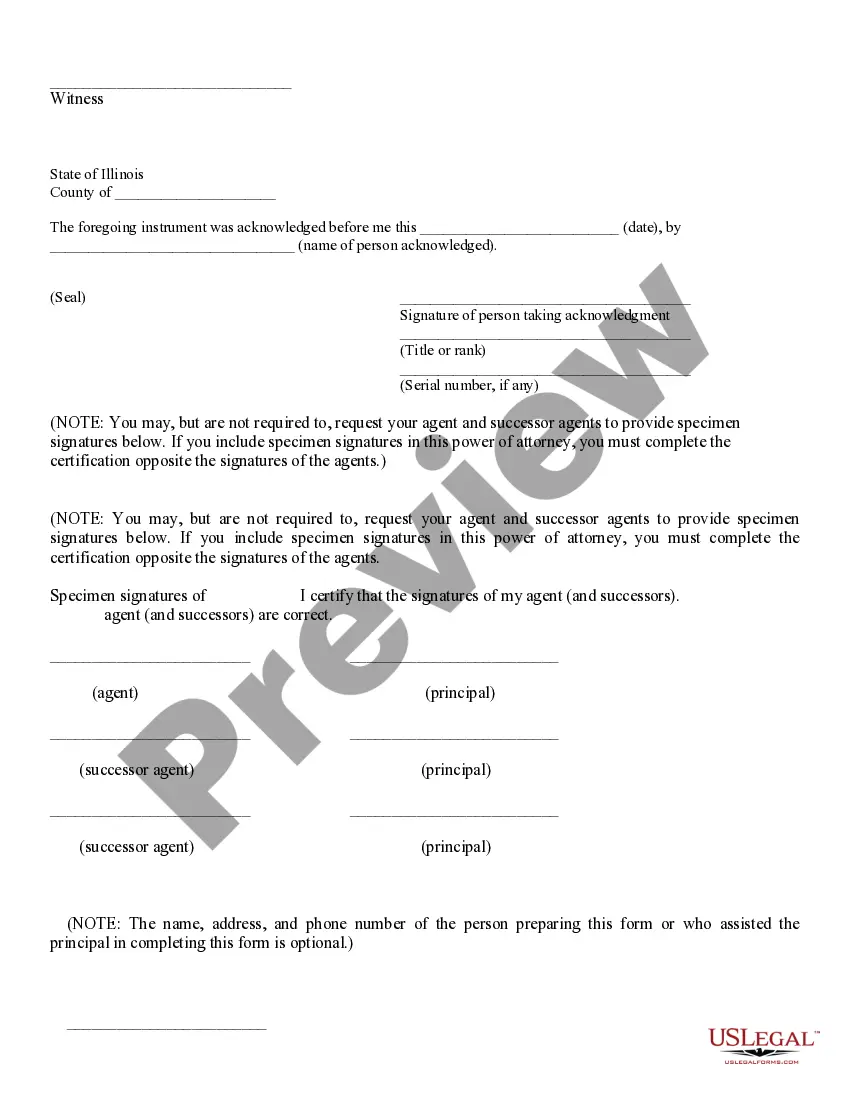

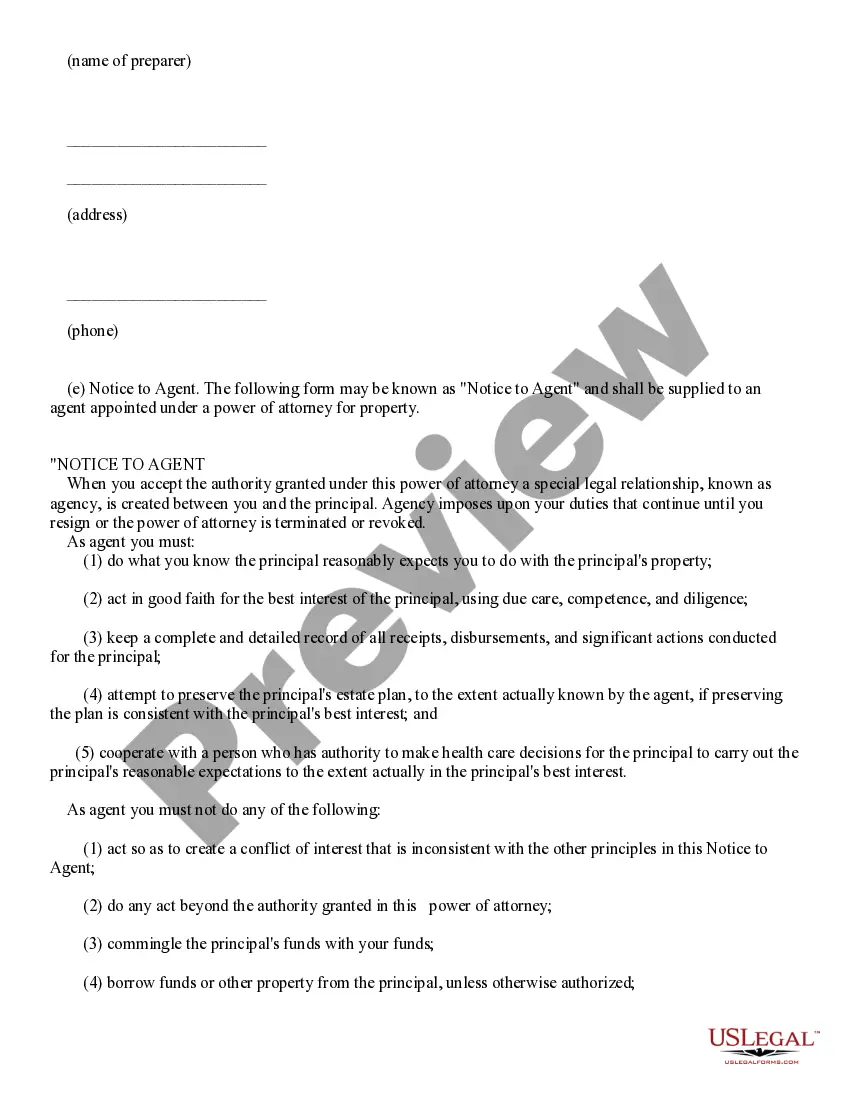

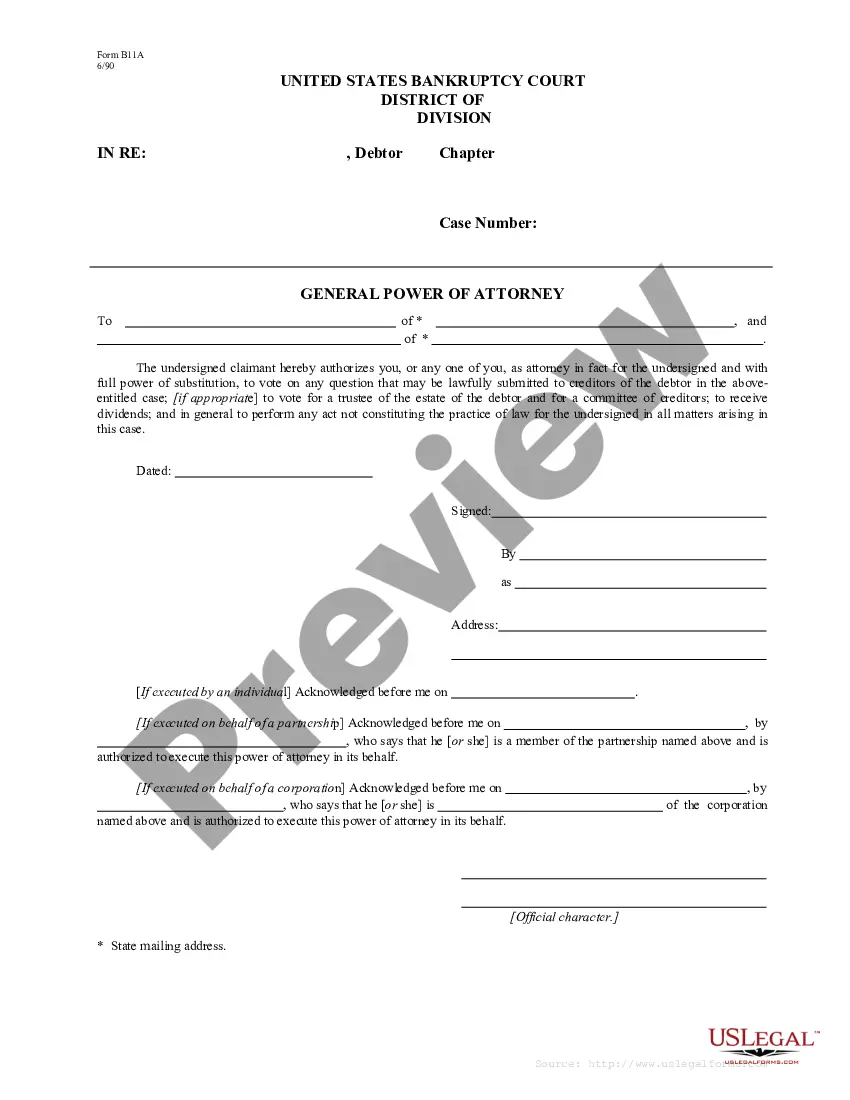

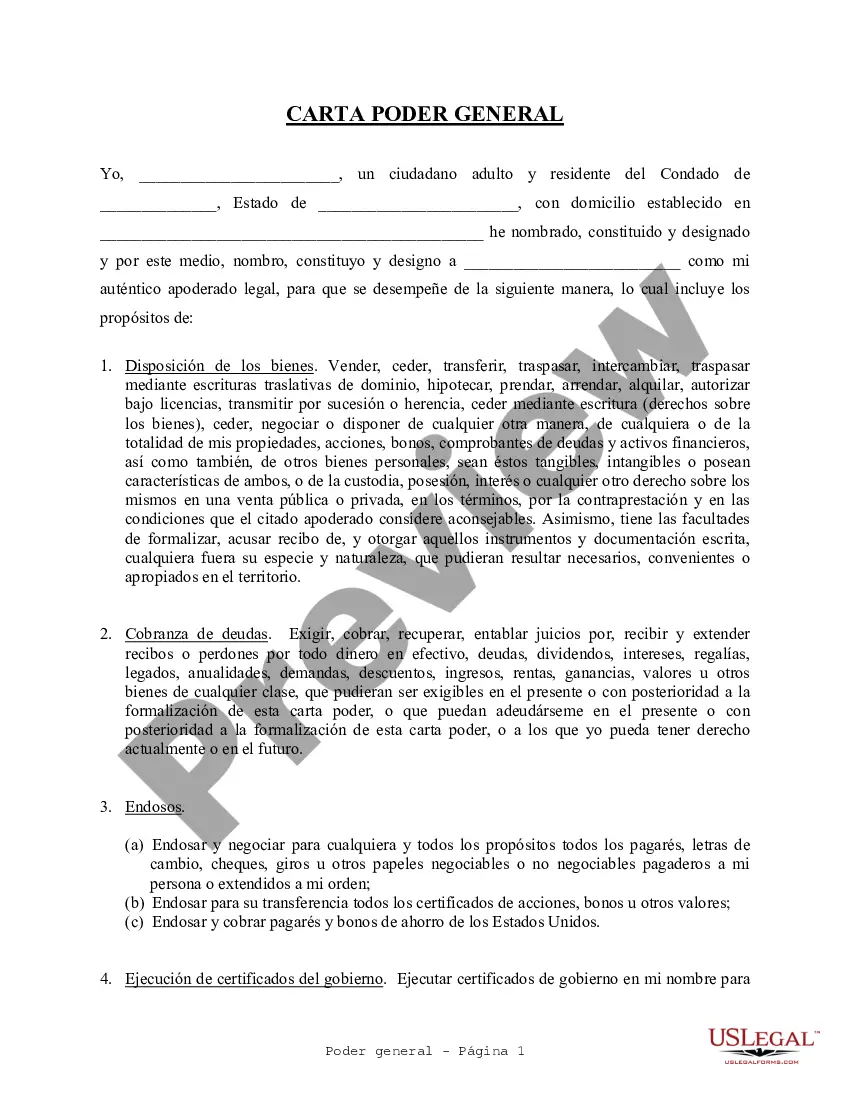

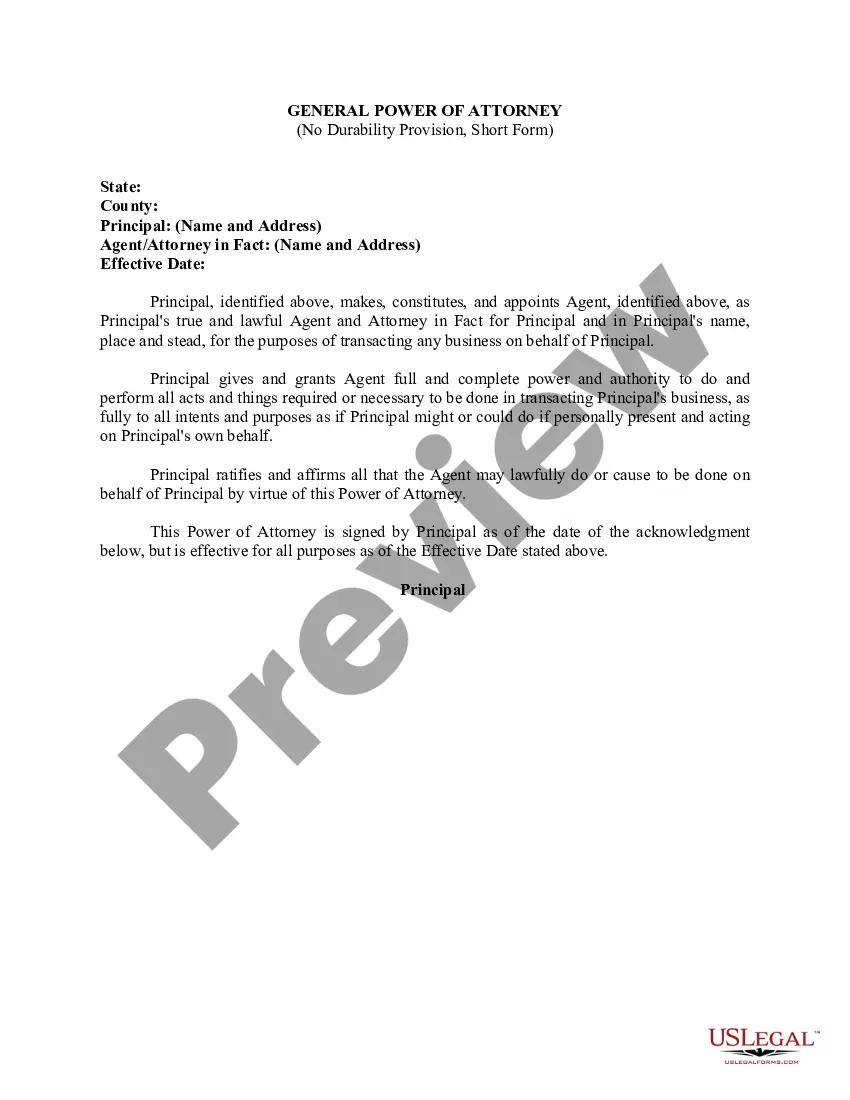

How to fill out Illinois Statutory General Power Of Attorney With Durable Provisions - Short Form Power Of Attorney For Property?

Managing legal documents and procedures can be a lengthy addition to your entire day.

Illinois Statutory Withdrawal and similar forms typically necessitate that you search for them and comprehend how to fill them out accurately.

Therefore, whether you are addressing financial, legal, or personal issues, utilizing a comprehensive and user-friendly online repository of forms available will be extremely beneficial.

US Legal Forms is the leading online service for legal templates, featuring over 85,000 state-specific documents and a variety of resources to help you complete your paperwork effortlessly.

Is it your first time using US Legal Forms? Register and create a free account in a few minutes, and you will gain access to the form library and Illinois Statutory Withdrawal. Then, follow the steps outlined below to complete your document: Ensure you have the correct form using the Review function and examining the form details. Select Buy Now when prepared, and choose the subscription plan that suits you best. Click Download then fill out, sign, and print the document. US Legal Forms has twenty-five years of expertise assisting users in managing their legal documents. Obtain the form you desire today and simplify any process without breaking a sweat.

- Explore the collection of relevant documents accessible with just a click.

- US Legal Forms provides state- and county-specific documents available for download at any time.

- Protect your document management workflows by utilizing a high-quality service that enables you to prepare any form within minutes without extra or hidden fees.

- Simply Log In to your account, locate Illinois Statutory Withdrawal, and obtain it instantly from the My documents section.

- You can also retrieve previously downloaded documents.

Form popularity

FAQ

The motion for leave to withdraw shall be in writing and, unless another attorney is substituted, shall state the last known address(es) of the party represented. The motion may be denied by the court if granting the motion would delay the trial of the case, or would otherwise be inequitable.

File the original and 1 copy of your Motion, and the Certification, with the clerk's office in person or by mail. o To e-file, create an account with an e-filing service provider. Visit efile.illinoiscourts.gov/service-providers.htm to select a service provider.

Be as persuasive as possible as you write your motion in a sequential, logical format. Express your ideas clearly, and make sure you outline what steps are necessary and how they will help your case. Use facts of the case whenever you can to avoid baseless emotional appeals.

Trusts and Estates - All taxpayers must attach a copy of your federal Form 1041, U.S. Income Tax Return for Estates and Trusts, Pages 1 and 2, to your Illinois return if you are required to file federally. See Form IL-1041 instructions for more information.

Use MyTax Illinois to electronically file your original Individual Income Tax Return. It's easy, free, and you will get your refund faster.