201k Letter Withdraw

Description

How to fill out Illinois Motion To Compel?

It’s clear that you cannot become a legal specialist instantly, nor can you swiftly learn how to effectively prepare a 201k Letter Withdraw without possessing a distinct set of abilities.

Assembling legal paperwork is an arduous task that demands specific training and expertise. So why not entrust the preparation of the 201k Letter Withdraw to the professionals.

With US Legal Forms, one of the most extensive libraries of legal templates, you can discover everything from court documents to templates for corporate communication.

Begin your search anew if you require an alternate form.

Create a free account and select a subscription plan to acquire the form. Then select Buy now. After the payment is processed, you can obtain the 201k Letter Withdraw, fill it out, print it, and either send it or mail it to the necessary parties or organizations.

- We understand how vital compliance and observance of federal and local regulations are.

- That’s why, on our platform, all forms are tailored to specific locations and current.

- Kick off your experience with our platform and obtain the document you require in just a few minutes.

- Find the document you need using the search bar located at the top of the page.

- Examine it (if this feature is available) and read the accompanying description to ascertain if the 201k Letter Withdraw is what you seek.

Form popularity

FAQ

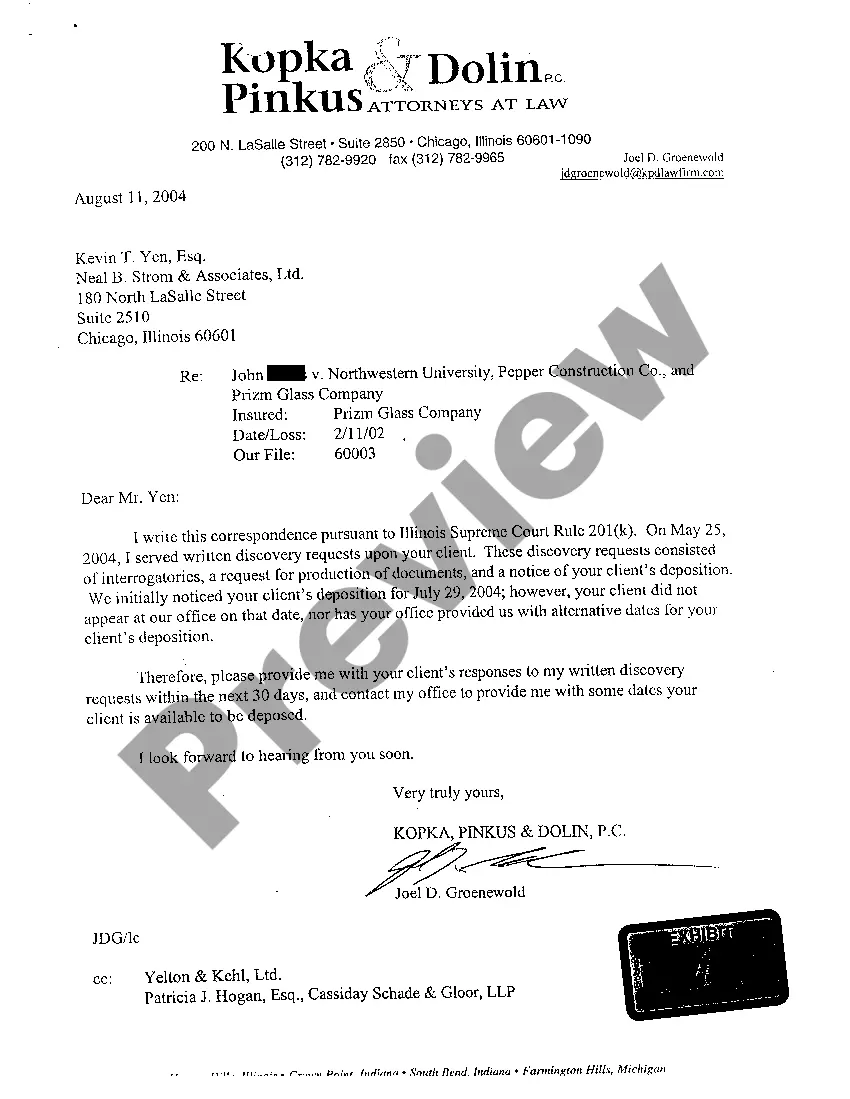

To write a meet and confer letter, start by outlining the specific issues that need discussion concerning discovery or other legal matters. Clearly state the purpose of the letter and propose dates and times for a meeting to address these concerns. When drafting, ensure to address topics that may include a 201k letter withdraw, as addressing these promptly can lead to better outcomes. US Legal Forms offers helpful templates that can simplify this process for you.

A motion to compel good faith letter is a document requesting the court to require a party to comply with discovery obligations that have not been met. This letter serves as a crucial step in addressing concerns characterized by the absence of adequate communication or cooperation. If you are involved in a situation related to a 201k letter withdraw, being well-versed in these motions may enhance your legal strategy. Consider using US Legal Forms for streamlined templates and guidance.

A discovery deficiency letter is a formal communication that identifies missing or incomplete information during the discovery phase of a legal case. This letter plays a critical role in ensuring that all parties comply with the rules of discovery. If you receive such a letter, understanding how to respond appropriately is essential, especially if your goal is to resolve issues around a 201k letter withdraw. Utilizing resources like US Legal Forms can help you draft an effective response.

A hardship for a 401k withdrawal typically includes situations like unexpected medical expenses, purchasing a primary residence, or covering tuition costs. Additionally, you may qualify if you experience financial loss due to job loss or other significant events. Be sure to assess your circumstances thoroughly to determine if they align with the criteria for a 201k letter withdraw.

You can request a withdrawal from your 401k by filling out the required paperwork provided by your plan administrator. They will guide you through the steps and any additional information you may need to provide. Leveraging your options for a 201k letter withdraw will help you navigate the process with confidence.

For a 401k hardship withdrawal, you need to provide documentation that supports your claim for financial need. This may include bills, a statement of expenses, or any other relevant financial records. Ensuring you have the right proof will help speed up your 201k letter withdraw process and make it easier to access your funds.

To request a withdrawal from your 401k, start by contacting your plan administrator or the financial institution managing your retirement account. They will provide you with the necessary forms and information regarding the withdrawal process. By utilizing the 201k letter withdraw option, you can ensure a smooth and efficient withdrawal experience.

The 60-day rule for discovery in Illinois mandates that parties have a specified period to complete discovery. This rule is essential for ensuring timely exchanges of evidence and information in legal disputes. If you are dealing with a 201k letter withdraw, being mindful of the 60-day timeframe can greatly assist in managing your case efficiently.

The 201k rule in Illinois allows a party to withdraw a motion or petition without a hearing under specific circumstances. This provision is beneficial as it provides a straightforward way to retract legal requests, especially if you need to issue a 201k letter withdraw. Understanding this rule can enhance your ability to navigate legal processes efficiently.

Rule 237 in Illinois pertains to the notice requirements for discovery and trial. This rule establishes the necessity for notifying parties involved about depositions or the production of documents. When navigating the complexities of a 201k letter withdraw case, understanding Rule 237 can significantly influence how you manage your communications and timelines.