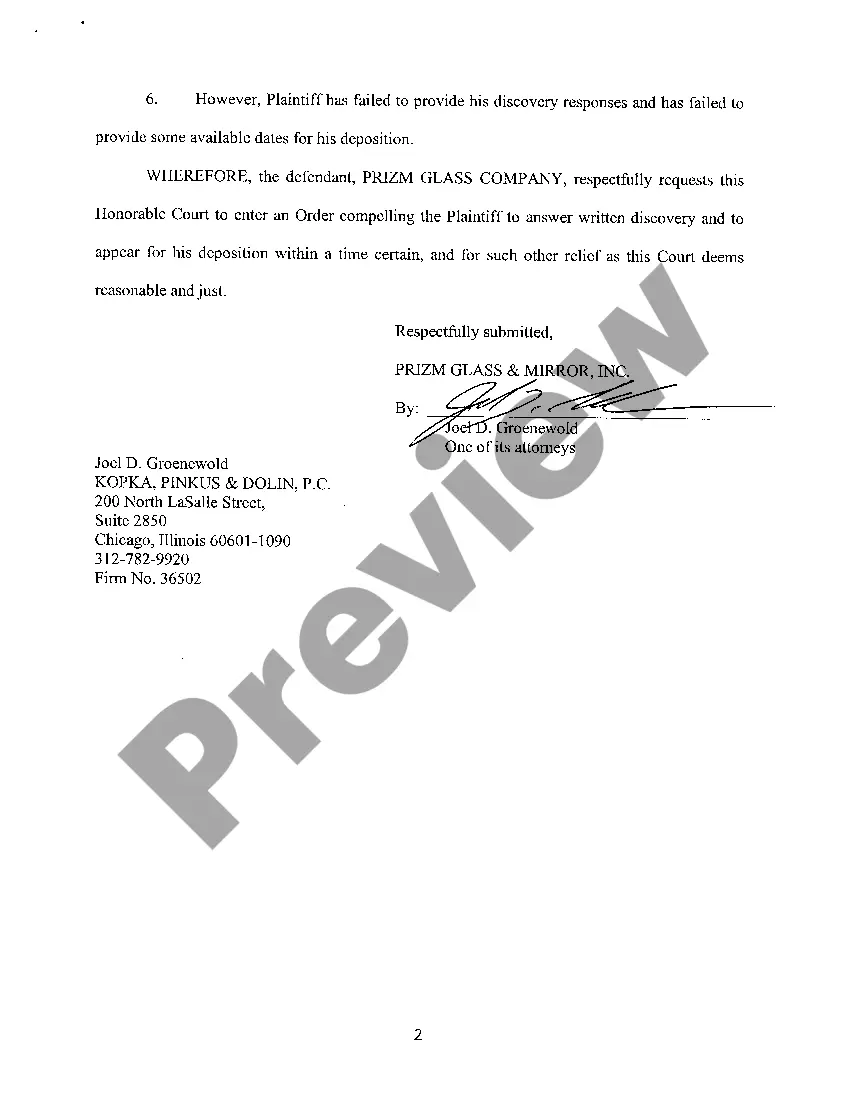

201k Letter Sample With Payment

Description

How to fill out Illinois Motion To Compel?

Whether for corporate reasons or personal matters, everyone must handle legal circumstances at some point in their lives.

Completing legal paperwork requires careful consideration, starting with choosing the correct form template.

Once it is saved, you can complete the form with editing software or print it out and finish it manually. With an extensive US Legal Forms library available, you will never have to waste time searching online for the correct template. Use the library's intuitive navigation to find the suitable form for any situation.

- For instance, if you choose an incorrect version of the 201k Letter Sample With Payment, it will be rejected upon submission.

- It is thus crucial to obtain a reliable source of legal documents such as US Legal Forms.

- If you need to acquire a 201k Letter Sample With Payment template, adhere to these straightforward steps.

- Utilize the search bar or browse the catalog to find the template you require.

- Review the description of the form to confirm it fits your circumstance, state, and area.

- Click on the form's preview to inspect it.

- If it is not the correct form, return to the search feature to locate the 201k Letter Sample With Payment template you need.

- Download the document if it satisfies your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the profile registration form.

- Choose your payment method: utilize a credit card or PayPal account.

- Select the document format you desire and download the 201k Letter Sample With Payment.

Form popularity

FAQ

However, you can object to interrogatories that call for legal conclusions. You can also object to questions if they are not at all related to the court case. To object, you need to write out the reasons for the objection instead of answering the question.

(a) Any party may by written request direct any other party to produce for inspection, copying, reproduction photographing, testing or sampling specified documents, including electronically stored information as defined under Rule 201(b)(4), objects or tangible things, or to permit access to real estate for the purpose ...

Rule 213 - Written Interrogatories to Parties (a)Directing Interrogatories. A party may direct written interrogatories to any other party. A copy of the interrogatories shall be served on all other parties entitled to notice. (b)Duty of Attorney.

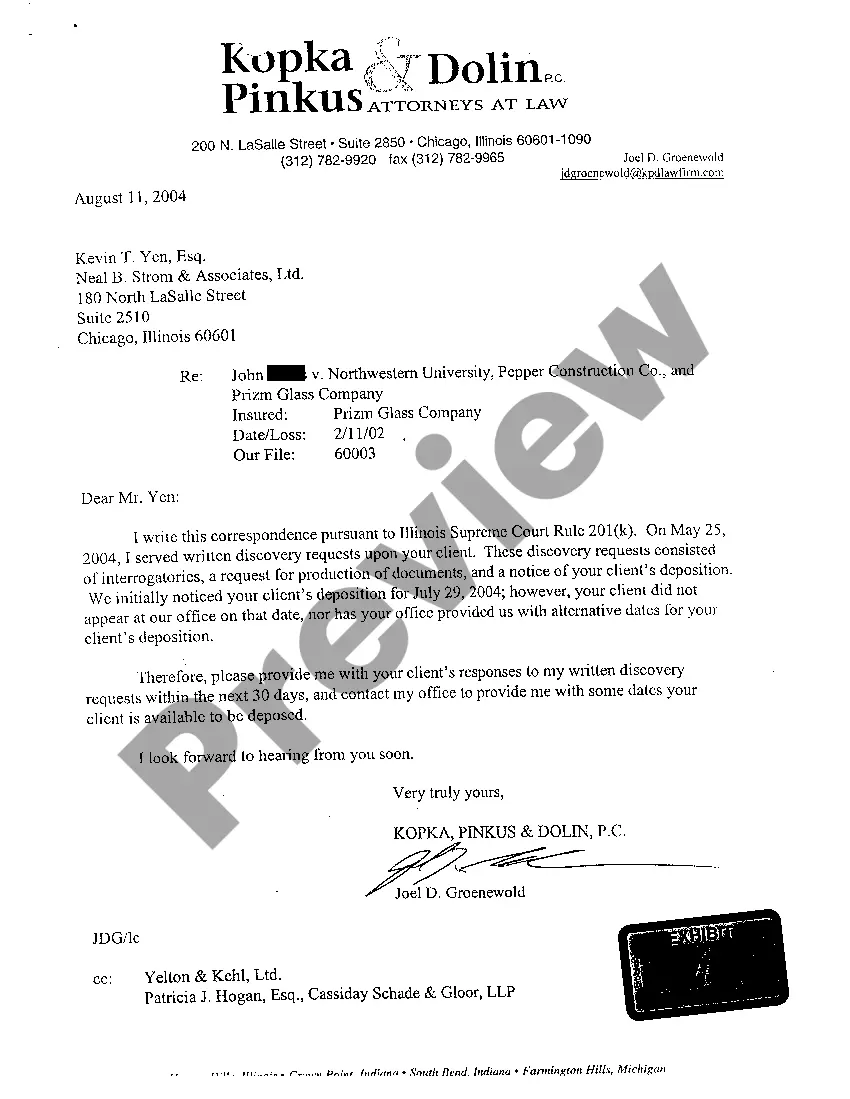

One of those rules, 201(k), requires the parties to cooperate in resolving any disputes they have regarding discovery. ?Reasonable Attempt to Resolve Differences Required. The parties shall facilitate discovery under these rules and shall make reasonable attempts to resolve differences over discovery.

The most important aspect of Rule 213 is the requirement that parties disclose the identity of any witnesses they plan to call at trial to provide expert testimony as well as a written report detailing the opinions and basis for those opinions of the witness.