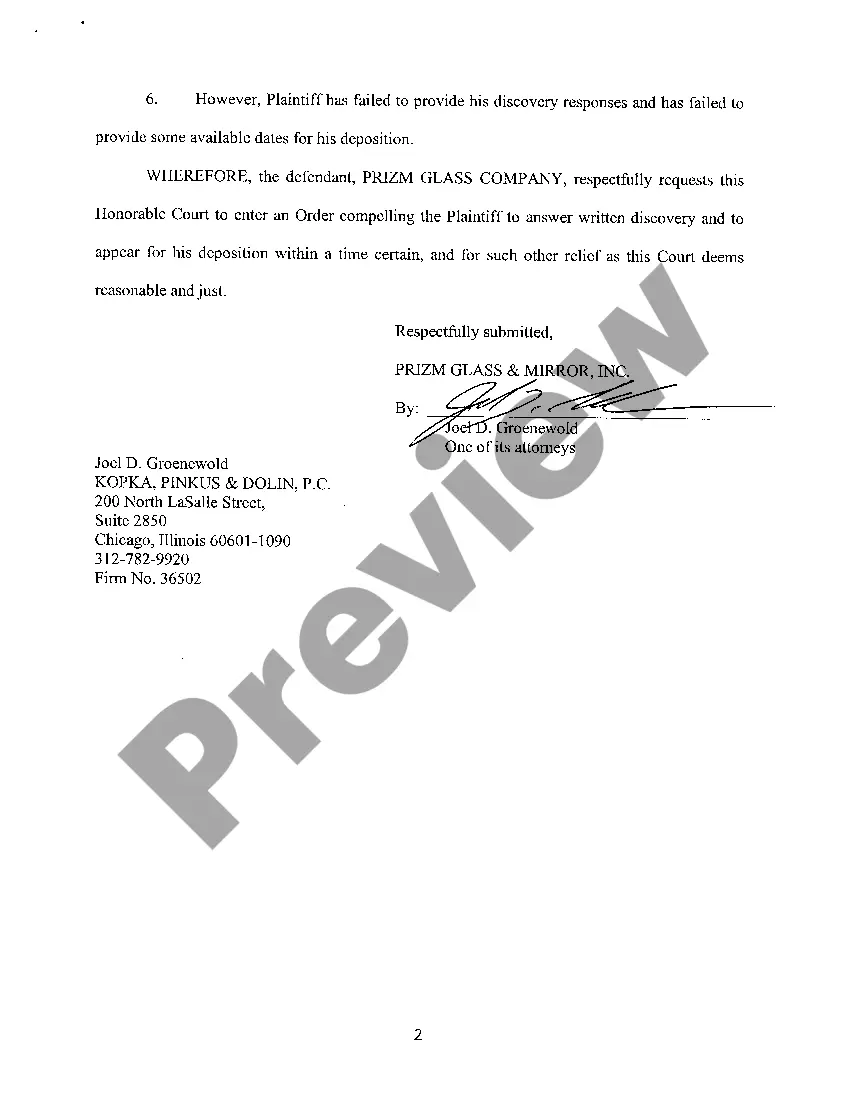

201 K Letter With Signature

Description

How to fill out Illinois Motion To Compel?

The 201 K Letter With Signature displayed on this page is a versatile formal template created by qualified attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 authenticated, state-specific documents for any commercial and personal circumstance. It’s the fastest, simplest, and most reliable method to acquire the paperwork you require, as the service assures the utmost level of data protection and anti-malware safeguards.

Pick the format you desire for your 201 K Letter With Signature (PDF, DOCX, RTF) and download the sample onto your device.

- Search for the document you require and examine it.

- Browse through the sample you searched and preview it or review the form description to confirm it meets your requirements. If it does not, utilize the search feature to find the correct one. Click Buy Now when you have located the template you need.

- Choose and Log In.

- Select the pricing option that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

A signed letter can indeed hold up in court, especially if it clearly outlines the terms and intentions of the parties involved. When you use a 201 k letter with signature, it serves as a formal document that can demonstrate your agreement or acknowledgment. Courts often consider the context and clarity of such letters, so it’s essential to ensure that all relevant details are included. If you need assistance drafting a legally sound letter, consider using USLegalForms, which provides templates and guidance tailored to your needs.

Discovery Rule 201 in Illinois outlines the processes and requirements for obtaining evidence and information from the opposing party in a legal case. This rule is essential for ensuring that both sides have a fair opportunity to present their arguments and evidence during litigation. Effective use of tools like a 201 k letter with signature can facilitate this discovery process, helping you gather necessary information efficiently. Consider using platforms like uslegalforms to help manage your legal documents.

Rule 609 in Illinois governs the admissibility of prior convictions as evidence in court proceedings. It allows a party to impeach the credibility of a witness based on their criminal history, provided certain conditions are met. This rule plays a significant role in trial strategy and witness examination. Knowing how to effectively incorporate a 201 k letter with signature can strengthen your case presentation when addressing issues related to evidence.

The 201k Rule in Illinois provides guidelines for the management of certain legal documents and the responsibilities of parties involved in civil litigation. This rule aims to ensure that all parties have access to relevant information, promoting fairness and transparency in legal proceedings. Understanding this rule is essential for anyone navigating the Illinois legal system. A well-prepared 201 k letter with signature can help you adhere to the requirements set forth by this rule.

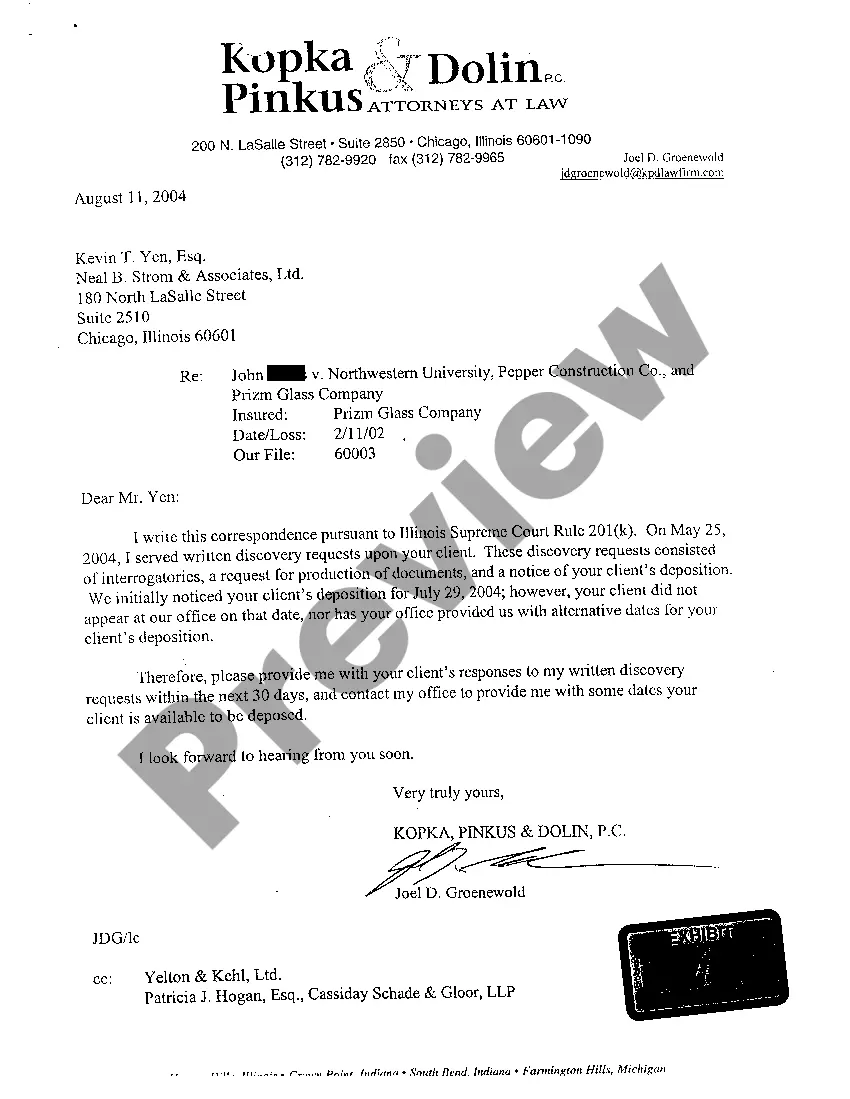

A 201k letter is a specific type of correspondence used primarily in legal contexts to request documentation or responses from involved parties. It outlines the necessary information or actions required and usually includes a signature for verification. This letter is crucial for maintaining formal communication and record integrity in legal situations. By utilizing a 201 k letter with signature, you enhance the credibility of your requests.

A 201k letter in Illinois is a written document that serves as a formal request for information or action concerning a legal matter. This letter often requires a signature to validate its authenticity and ensure compliance. It typically relates to matters in the realm of legal proceedings, making it essential for clarity and record-keeping. Using a 201 k letter with signature can help streamline your legal process.

By Practical Law Litigation. Maintained ? Illinois. A sample statement regarding attempts to resolve discovery disputes under Illinois Supreme Court Rule 201(k) that counsel may include in a discovery-related motion in Illinois circuit court civil litigation.

It is evidence that may be used in court. It is also designed to prevent the opposing party from ?ambushing? at trial and surprising the other side with facts that had not been revealed. Without discovery your attorney is working in the dark. Your attorney does not know all the ins and outs of your marriage.