201 K Letter With Name

Description

How to fill out Illinois Motion To Compel?

Dealing with legal paperwork and processes can be a lengthy addition to your entire day.

201 K Letter With Name and similar forms typically necessitate searching for them and grasping the most effective way to fill them out correctly.

As a result, whether you are managing financial, legal, or personal issues, utilizing a comprehensive and user-friendly online directory of forms readily available will significantly help.

US Legal Forms is the leading online platform for legal templates, featuring over 85,000 state-specific forms and various tools to help you finalize your documents swiftly.

Is this your first time using US Legal Forms? Register and establish your account in a few minutes to gain access to the form catalogue and 201 K Letter With Name. Afterwards, follow the steps outlined below to finalize your form: Ensure you have located the correct form by utilizing the Review feature and examining the form details. Choose Buy Now when ready, and select the monthly subscription option that suits your requirements. Click Download, then fill out, sign, and print the form. US Legal Forms has 25 years of expertise assisting users manage their legal documents. Obtain the form you desire today and enhance any process effortlessly.

- Browse the directory of pertinent documents accessible to you with just a single click.

- US Legal Forms provides you with state- and county-specific forms available at any moment for download.

- Safeguard your document management processes with a superior service that allows you to create any form within minutes without additional or concealed fees.

- Simply Log In to your account, locate 201 K Letter With Name, and download it right away from the My documents tab.

- You can also retrieve previously saved forms.

Form popularity

FAQ

The divorce discovery process in Illinois involves the exchange of relevant financial and personal information between spouses. Typically, this includes documents like tax returns, bank statements, and asset valuations. Utilizing tools like the 201 k letter with name can enhance communication, making the discovery process smoother and less contentious.

Supreme Court Rule 201 outlines the procedures for discovery in Illinois civil cases. It mandates that parties must attempt to resolve their discovery disagreements without court involvement whenever possible. This rule not only streamlines the legal process but also encourages transparency between litigants.

The 201k Rule in Illinois refers to the requirements surrounding the informal resolution of discovery disputes. This rule emphasizes the importance of communication between parties before seeking court intervention. By utilizing the 201 k letter with name, litigants can foster a more cooperative atmosphere, ultimately benefiting their cases.

Discovery Rule 201 in Illinois governs the exchange of information between parties in a legal proceeding. It establishes guidelines for how and when parties must disclose evidence and documents. Understanding this rule is crucial for anyone navigating the legal landscape, as it helps ensure a fair and orderly process.

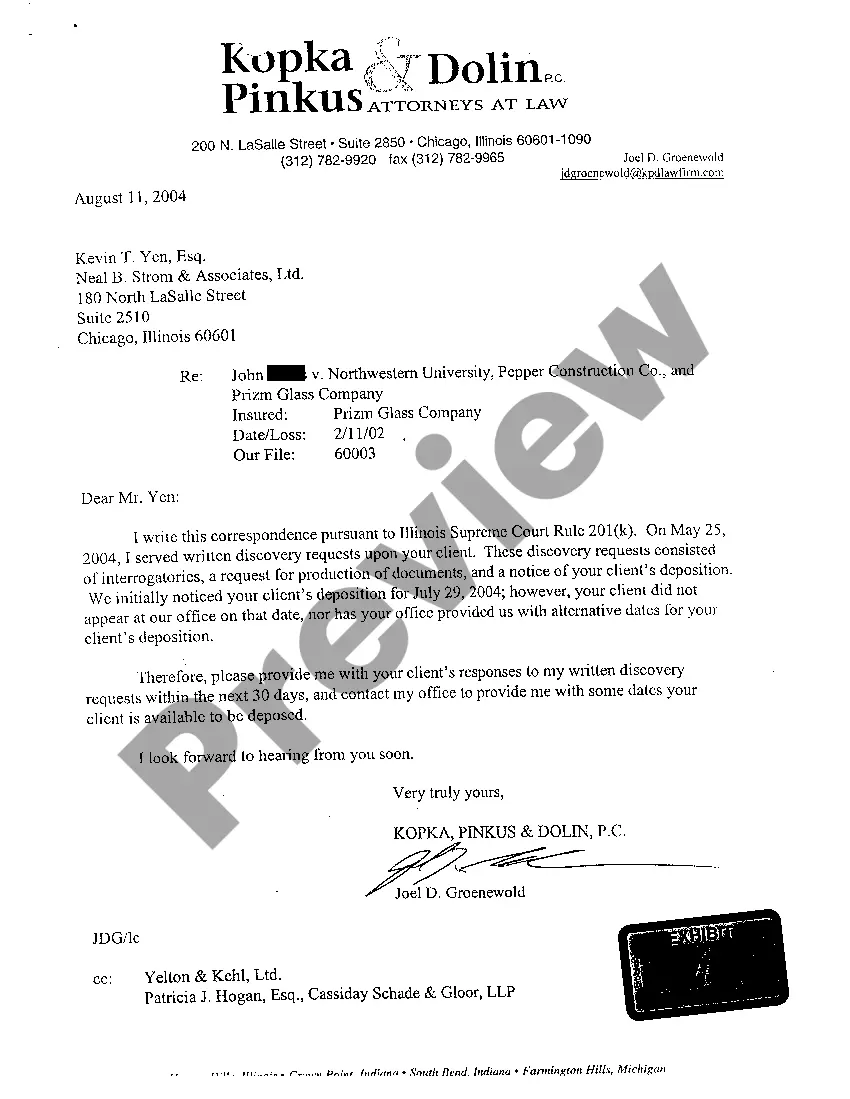

A 201 k letter is a specific type of correspondence used in the discovery phase of litigation in Illinois. It serves as a formal request for information, allowing attorneys to gather necessary evidence from each other. This letter is essential for ensuring that both parties are transparent and cooperative during the legal process.

Under Illinois Supreme Court Rule 201, attorneys or litigants are required to address and resolve their discovery disputes informally before escalating the matter to the court. This rule encourages communication and negotiation, helping to reduce court congestion. By adhering to this rule, parties can often reach a resolution without needing a formal motion.

A 201 k letter in Illinois is a written communication that attorneys send to each other to facilitate the discovery process in a lawsuit. This letter outlines specific requests for information or documents that are essential for building a case. When you receive a 201 k letter with name, it typically means the sender is seeking clarity on certain matters before moving forward in court.