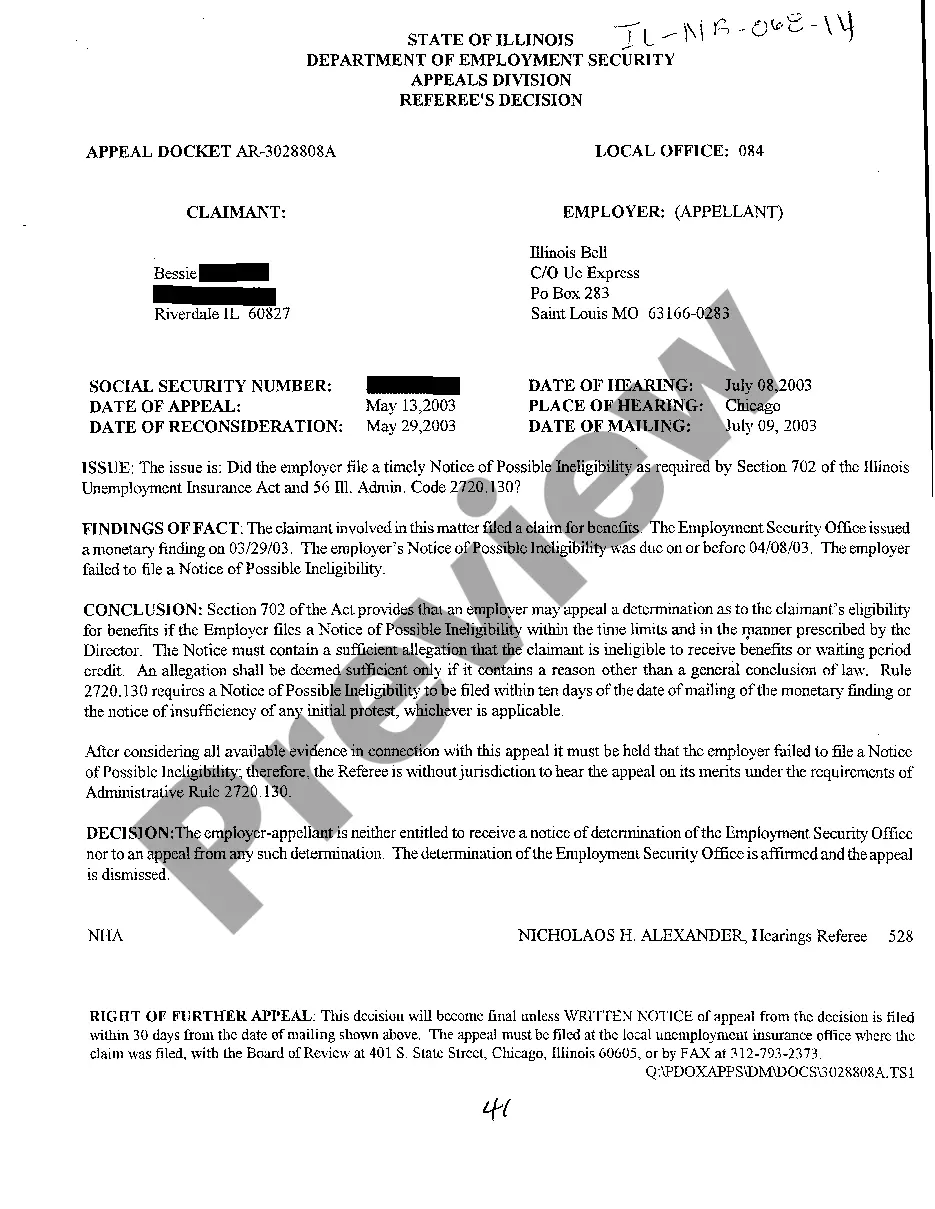

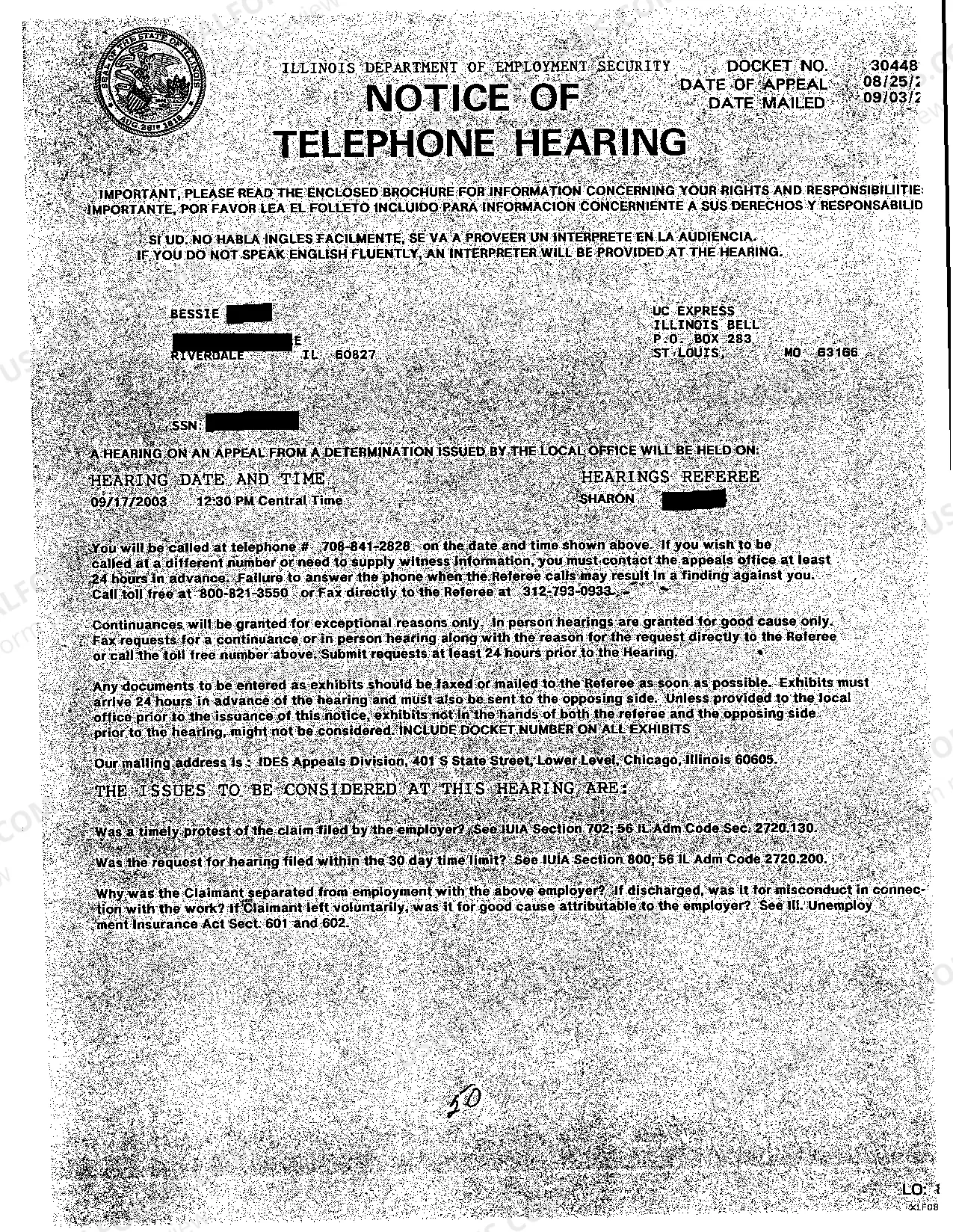

Illinois Unemployment Determination Letter With A Name

Description

How to fill out Illinois Referee's Decision?

Creating legal paperwork from the ground up can occasionally feel daunting.

Certain situations may require extensive research and significant financial resources.

If you’re looking for a simpler and more economical method of preparing the Illinois Unemployment Determination Letter With A Name or any other forms without unnecessary hassle, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal matters.

Check the document preview and descriptions to ensure you have located the document you need.

- With just a few clicks, you can instantly reach state- and county-specific templates carefully assembled for you by our legal experts.

- Utilize our website whenever you require a dependable and trustworthy service through which you can swiftly locate and download the Illinois Unemployment Determination Letter With A Name.

- If you're a returning user and have already registered with us, simply Log In to your account, choose the template, and download it or retrieve it anytime later in the My documents section.

- Not registered yet? No worries. It requires very little time to sign up and browse the catalog.

- But before you download the Illinois Unemployment Determination Letter With A Name, be sure to follow these tips.

Form popularity

FAQ

To write a letter of employment verification, start by including the full name of the employee and verify their job title, dates of employment, and duties. This letter should also include your name, position, and contact information as the verifier. An Illinois unemployment determination letter with a name can be an essential reference to support the employment verification process.

Writing 'I am unemployed' can be straightforward. Simply state your situation clearly, perhaps including how long you have been unemployed and any actions you are taking to seek new employment. This direct approach can also be incorporated into a formal letter should you need documentation, such as an Illinois unemployment determination letter with a name, for your records or officials.

To write an employment letter, start by including your name, address, and contact information at the top. Next, clearly state the purpose of the letter, such as 'This letter verifies the employment of Employee’s Name.' Include details like the employee's position, dates of employment, and salary if applicable. Finally, close with a professional signature, which adds credibility to the document, especially if you need an Illinois unemployment determination letter with a name.

Monetary re-determination does not automatically mean approved; rather, it signifies that your eligibility for benefits is under review. This process evaluates changes in your earnings or eligibility criteria, affecting your claim status. If the re-determination shows that you qualify, you will receive a new Illinois unemployment determination letter with a name confirming your approval. Stay informed about your claim status to avoid confusion.

The Form K-5 is used to report withholding statement information from Forms W-2, W-2G, and 1099. Once the form is completed, it may be filed electronically by clicking the Submit Electronically button or it may be downloaded, printed, and mailed to DOR at the address on the form.

The use of Form 720-V identifies the payment as a payment for a Kentucky electronic filed tax return. DO NOT send a copy of the electronically filed return with the payment of tax due. For balance due returns, taxpayers should complete Form 720-V and submit it along with payment.

If you received a letter from us, your return has been selected for identity confirmation and verification is required in order to complete the processing of your tax return.

No. 86?272, a Kentucky Unitary Combined. Corporation Income Tax and LLET Return (Form 720U) must. be filed by every corporation doing business in this state.

Non-residents and part-year residents must file an income tax return (Form 740-NP, Kentucky Nonresident and Part-Year Resident Individual Income Tax Return) if any gross income from Kentucky sources or other sources exceeds the modified gross income limits for their family size.

A Limited Liability Entity Tax (LLET) applies to both C corporations and Limited Liability Pass-Through Entities (LLPTEs) and is not an alternative to another tax. However, corporations paying the LLET are allowed to apply that amount as a credit towards its regular corporate income tax.