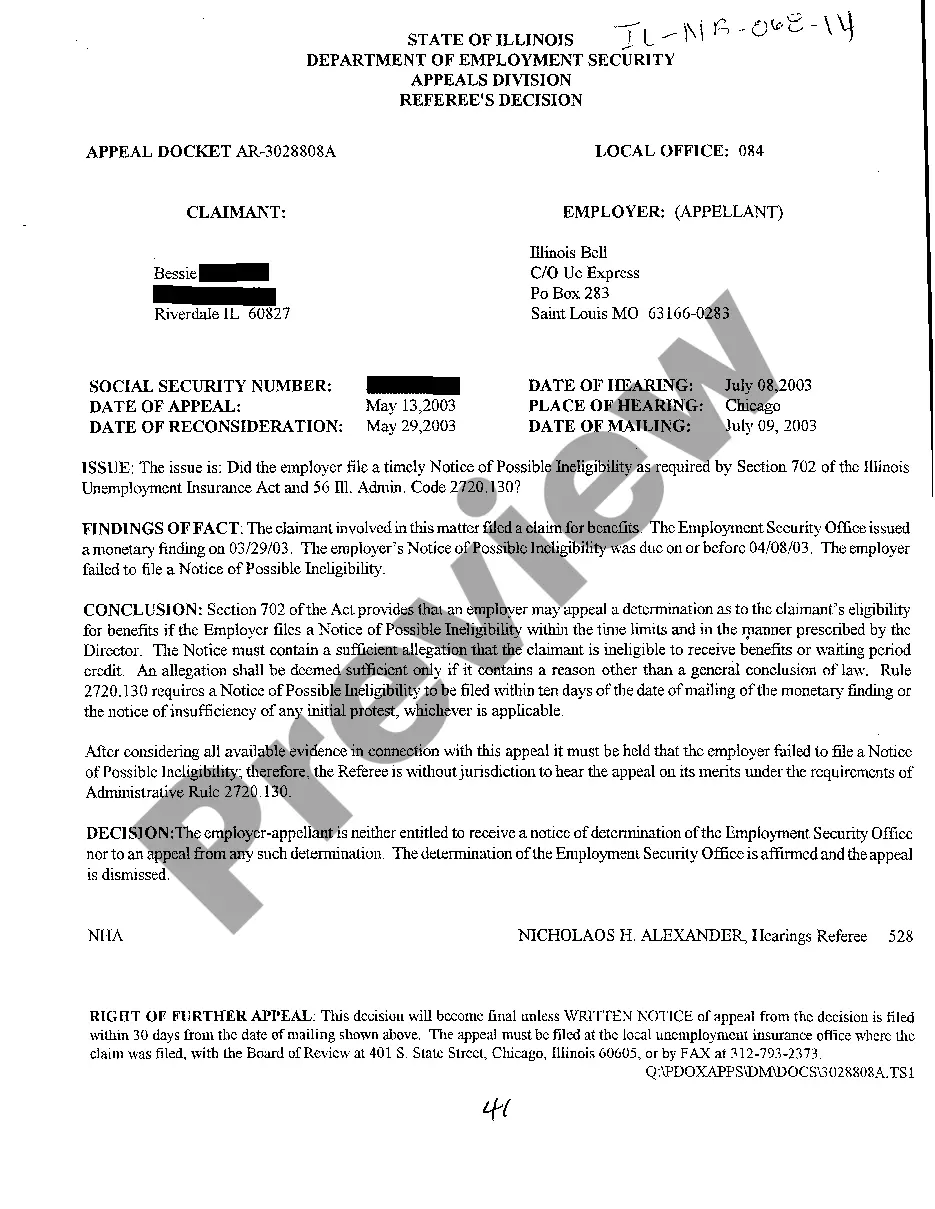

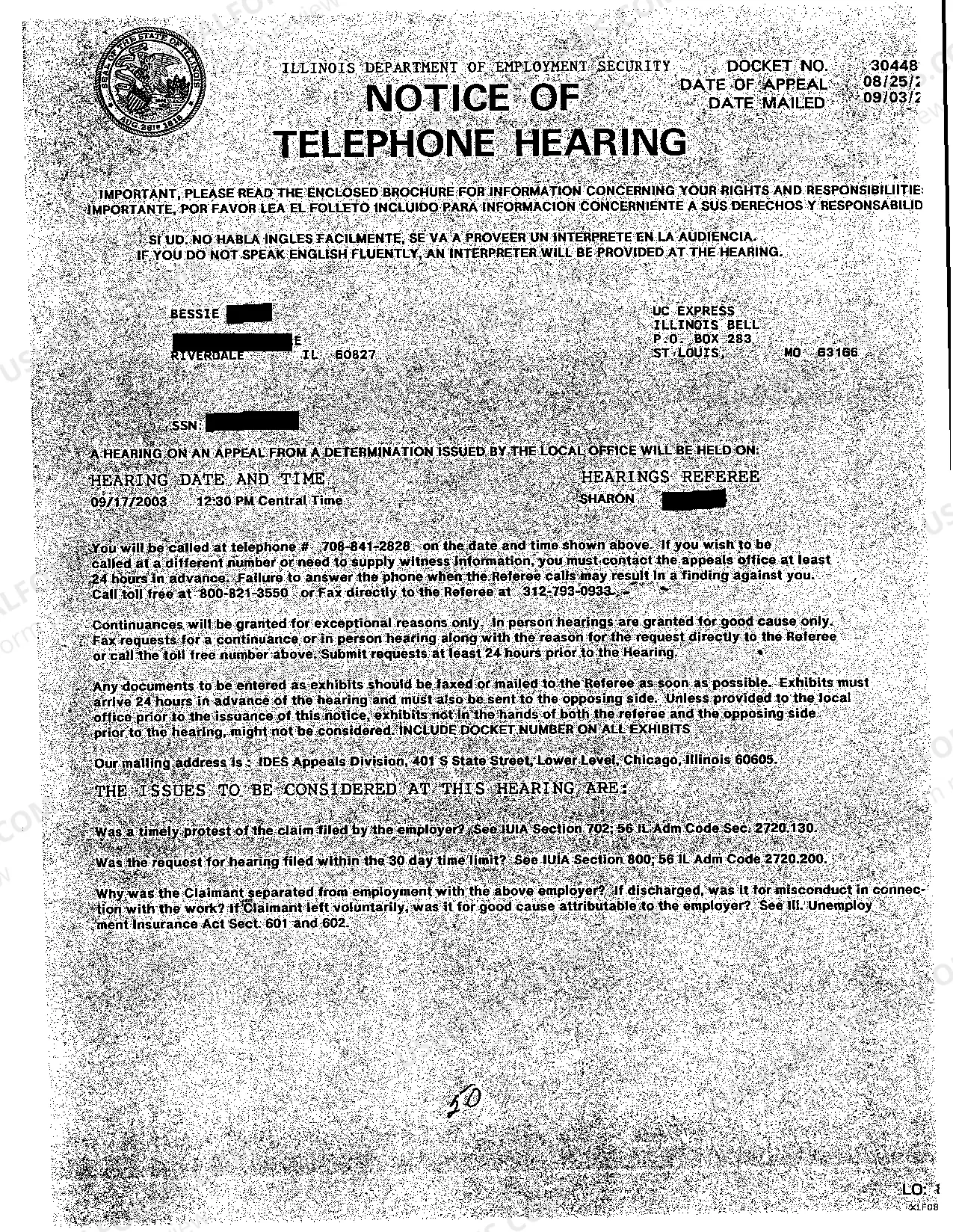

Illinois Unemployment Determination Letter Format

Description

How to fill out Illinois Referee's Decision?

The Illinois Unemployment Determination Letter Template displayed on this page is a reusable official layout created by experienced attorneys in compliance with national and local laws and regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 authenticated, state-specific documents for any commercial and personal situation. It’s the fastest, easiest, and most reliable method to acquire the documentation you require, as the service ensures the utmost level of data protection and anti-malware safeguards.

Access the same document again whenever required. Open the My documents tab in your profile to redownload any previously acquired forms. Subscribe to US Legal Forms to have verified legal templates available for all of life’s situations.

- Search for the necessary document and review it.

- Browse the file you located and preview it or read the form description to verify it meets your needs. If it doesn’t, use the search functionality to find the appropriate one. Click Buy Now once you have found the template you require.

- Choose a pricing plan that best fits your needs and create an account. Make a swift payment using PayPal or a credit card. If you already possess an account, Log In and verify your subscription to proceed.

- Select the format desired for your Illinois Unemployment Determination Letter Template (PDF, Word, RTF) and download the example to your device.

- Print the template to complete it manually. Alternatively, use an online versatile PDF editor to quickly and accurately fill out and sign your form with a valid signature.

Form popularity

FAQ

To convey that you are unemployed, you can state, 'I am currently unemployed due to reason, if applicable.' Expand on this by mentioning your job search activities and willingness to explore new opportunities. Being straightforward yet professional enhances your message. Crafting this statement in the Illinois unemployment determination letter format will aid in clear and effective communication.

A transfer of mortgage is the reassignment of an existing mortgage, usually on a home, from the current holder to another person or entity. Not all mortgages can be transferred; if they are, the lender has the right to approve the person assuming the loan.

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender's interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage's terms should remain the same.

The purpose of the mortgage or deed of trust is to provide security for the loan that's evidenced by a promissory note. Loan Transfers. Banks often sell and buy mortgages from each other. An "assignment" is the document that is the legal record of this transfer from one mortgagee to another.

Doing so allows your mortgage provider to ensure future financial liquidity so that it can keep extending home loans to other borrowers. Under such a scenario, your original loan holder basically ?flips? the mortgage and assigns its security rights in a home to the new owner of the note instead.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

Assignments are generally freely permitted in most modern mortgage agreements. Once the borrower has received proper notice of the assignment, payments will be made to the new creditor. A mortgage assumption occurs when a buyer agrees to take on the seller's current loan and mortgage obligations.

Assignments are generally freely permitted in most modern mortgage agreements. Once the borrower has received proper notice of the assignment, payments will be made to the new creditor. A mortgage assumption occurs when a buyer agrees to take on the seller's current loan and mortgage obligations.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.