Land Lease Agreement With Option To Buy

Description

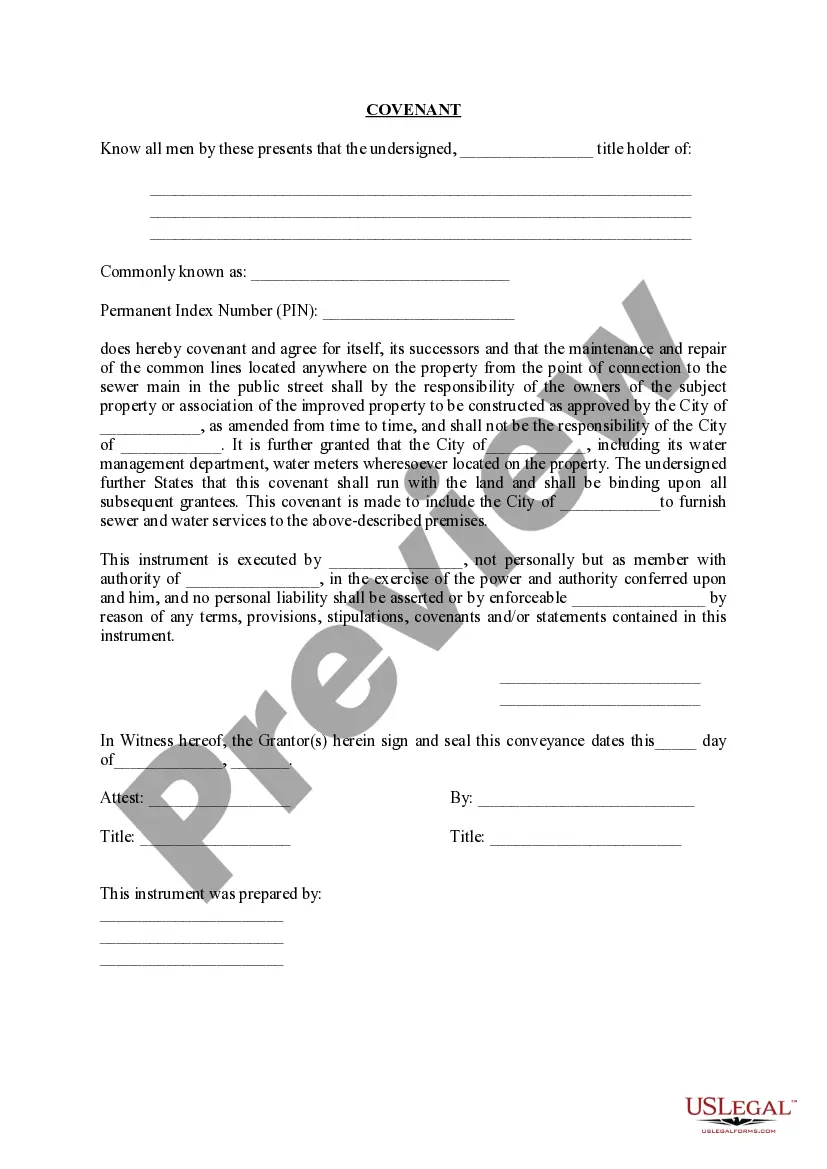

How to fill out Illinois Covenant?

Properly written official documents are a crucial safeguard for preventing issues and legal disputes, yet obtaining them without assistance from an attorney may require time.

Whether you are in search of a current Land Lease Agreement With Option To Buy or any other forms for work, family, or business matters, US Legal Forms is always available to assist.

The procedure is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button next to the selected document. Additionally, you can access the Land Lease Agreement With Option To Buy at any time in the future, as all documents previously acquired on the platform remain accessible under the My documents section of your profile. Save time and resources on creating official documents. Give US Legal Forms a try today!

- Ensure that the document suits your needs and locality by reviewing the description and preview.

- Look for another example (if necessary) using the Search bar in the page header.

- Press Buy Now once you locate the suitable template.

- Choose the payment plan, Log In to your account, or create a new one.

- Select your preferred payment method to acquire the subscription plan (via credit card or PayPal).

- Choose PDF or DOCX format for your Land Lease Agreement With Option To Buy.

- Hit Download, then print the template to complete it or use it in an online editor.

Form popularity

FAQ

What is a lease-option-to-buy? A lease-option is a contract in which a landlord and tenant agree that, at the end of a specified period, the renter can buy the property. The tenant pays an up-front option fee and an additional amount each month that goes toward the eventual down payment.

They give the tenant the ability, prior to the conclusion of the lease term, to continue leasing the premises. An option to renew or extend the lease means that upon the tenant's exercise of the option (choice), the provisions of the agreed-upon option are adopted for another defined term.

What is an "option to purchase" agreement? An option to purchase is an agreement that gives a potential buyer (optionee) the right, but not the obligation, to buy property in the future. The optionee must decide by a certain time whether to exercise the option and thereafter by bound under the contract to purchase.

Considerations for a SellerA lease purchase agreement may be attractive to a seller in a competitive market since he is able to lock in a buyer and secure a monthly payment. The seller is typically able to charge a higher rent than he would normally receive in a traditional lease.

Unlike a sale agreement with seller financing, a lease-option allows the owner to continue to receive tax deductions as the owner. Interest, taxes, maintenance and depreciation may still be deducted against the rent received.