Trust Amendment In Budget 2021

Description

Form popularity

FAQ

Typically, there is no penalty for simply filing an amended tax return; however, if you owe additional taxes as a result, interest and penalties may apply. It's important to file accurately and on time to avoid complications. Utilizing resources related to the trust amendment in budget 2021 can help you navigate these amendments confidently, reducing the likelihood of incurring penalties.

To file an amended 1041, you will need to use Form 1041-X, which is specifically for amending estate and trust returns. Follow the form’s instructions closely to detail your adjustments clearly. Ensure all calculations are accurate, as this will help streamline the process and relate to improvements stemming from changes in the trust amendment in budget 2021.

Amending a tax return can often be beneficial, especially if you discover errors or missed deductions. Correcting mistakes allows you to ensure compliance and might even lead to potential refunds. It is particularly wise to consider these amendments in the context of the trust amendment in budget 2021, as they can reflect changes in your financial situation.

To fill out an amended tax form, start with the correct version of the form for the tax year in question. Clearly indicate the changes, using the original form for reference. Make sure to include any additional documentation, and be aware that an improper submission could delay processing, particularly when dealing with timelines related to the trust amendment in budget 2021.

Filling out a tax amendment form requires you to gather your original tax return and relevant documentation. You must provide specific details on the changes being made and explain the reasoning behind each adjustment. It's essential to carefully follow the instructions provided for the tax amendment form, especially if you reference the trust amendment in budget 2021.

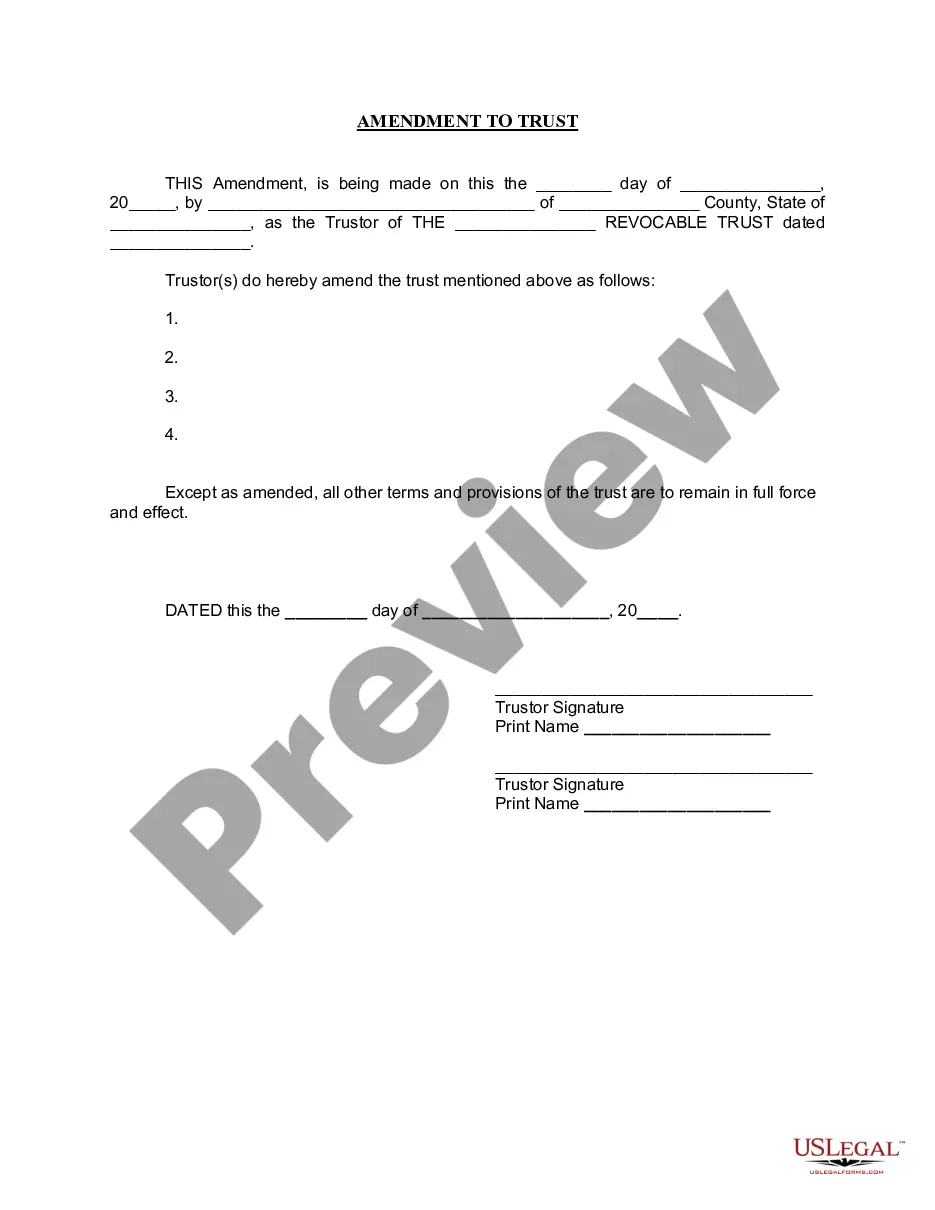

To write an amendment to a trust, start by clearly identifying the trust you are amending, including the title and date. Then, state the specific changes you wish to make, detailing each adjustment precisely. Ensure you sign and date the amendment, and consider having it notarized to bolster its validity in light of the trust amendment in budget 2021.

A trust expense typically includes costs related to the administration of the trust, such as legal fees, tax preparation fees, and any necessary accounting costs. These expenses can usually be deducted from the trust's taxable income. Staying informed about deductions under the trust amendment in budget 2021 is essential for efficient financial management.

When you close a trust, its assets are distributed according to the terms outlined in the trust agreement. The trustee must ensure all tax obligations are settled and finalize any necessary filings. Remember, understanding adjustments from the trust amendment in budget 2021 can make this transition smoother.

The time it takes for the IRS to close an estate can vary significantly based on the complexity of the estate and the completeness of the tax filings. On average, it may take several months or even longer if issues arise. Keeping track of changes related to the trust amendment in budget 2021 can help streamline this process.

Trust capital losses typically cannot be distributed to beneficiaries for tax purposes. Instead, the trust can usually carry the losses forward to offset future capital gains. If you're navigating through the details, knowing the nuances from the trust amendment in budget 2021 can be particularly helpful.