Il Name Change Form For Irs

Description

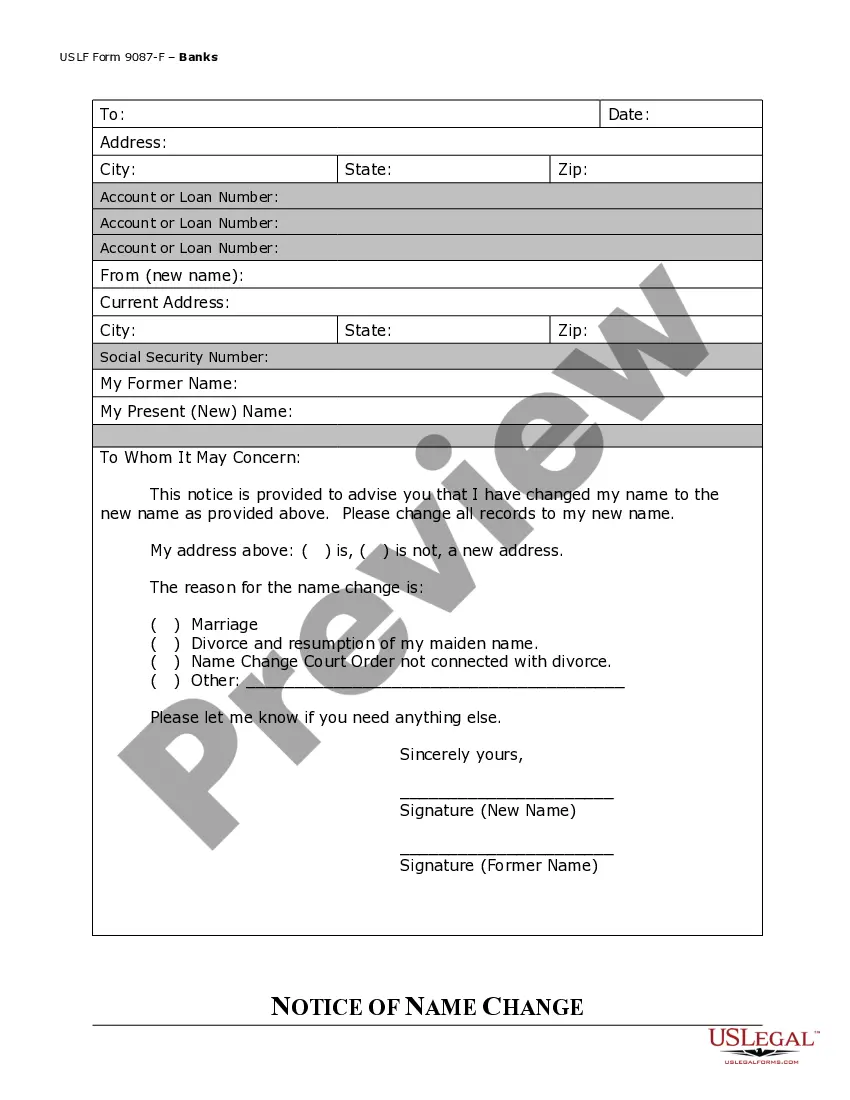

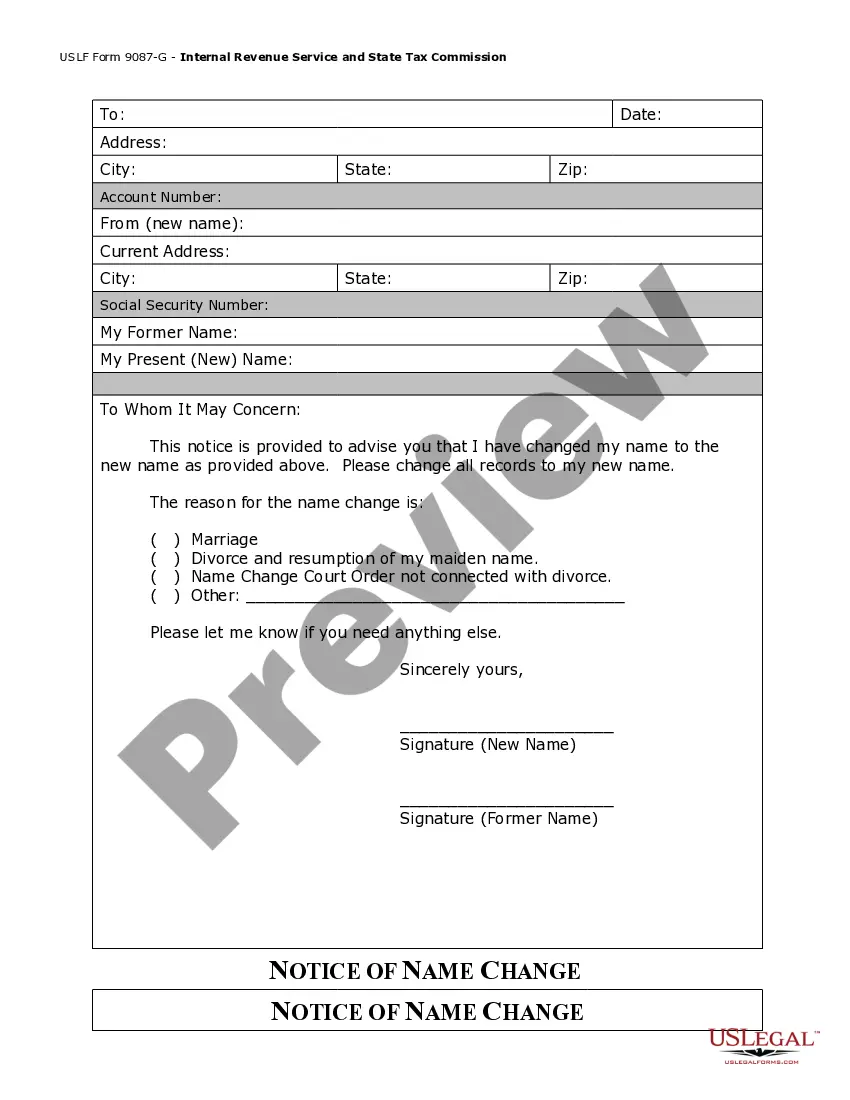

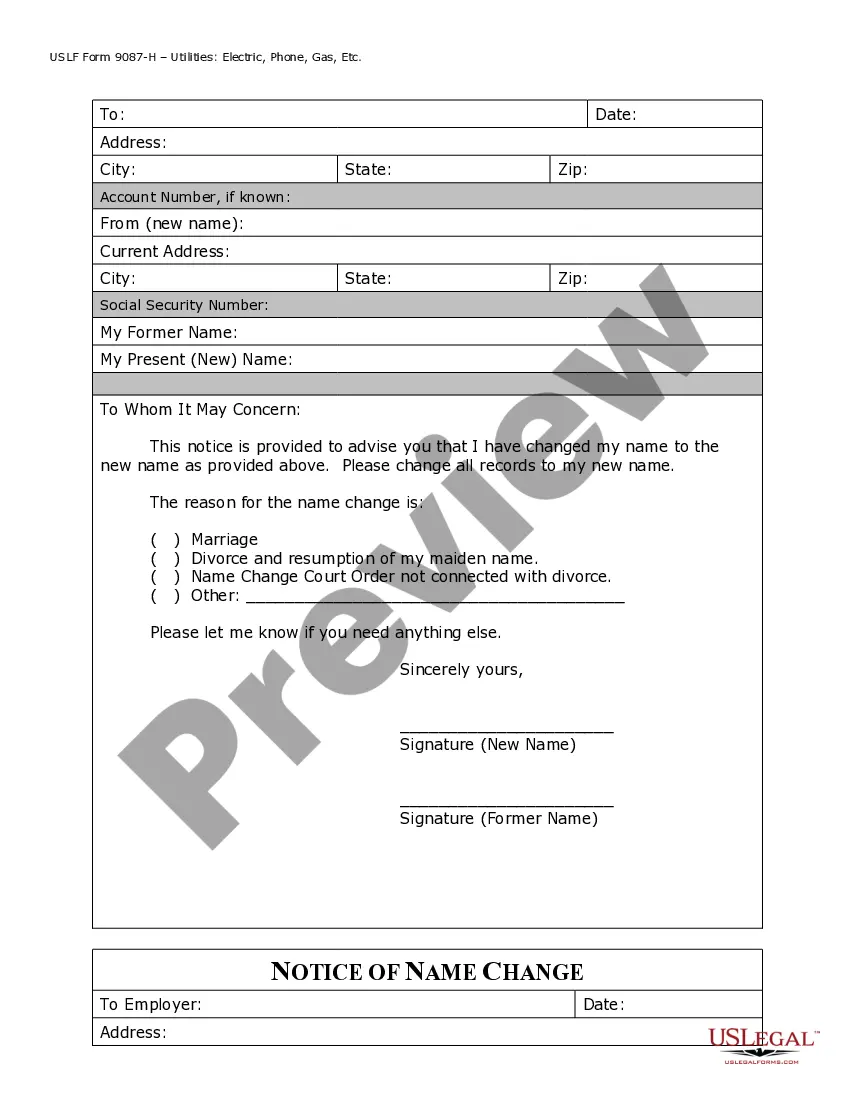

How to fill out Illinois Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

It’s clear that you cannot become a legal expert instantly, nor can you comprehend how to swiftly prepare the Il Name Change Form For Irs without having a specialized education.

Drafting legal documents is a lengthy process that necessitates specific training and expertise.

So why not entrust the creation of the Il Name Change Form For Irs to the professionals.

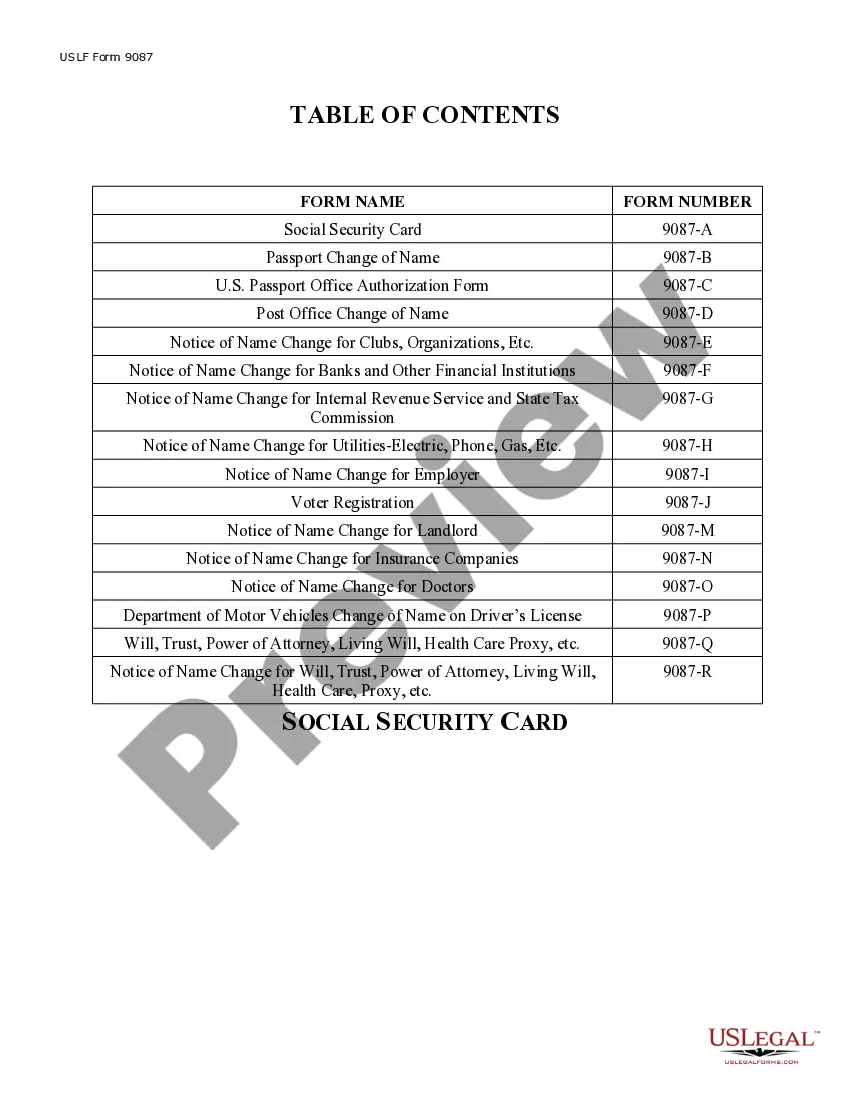

Preview it (if this option is available) and read the accompanying description to determine if the Il Name Change Form For Irs meets your needs.

If you require a different form, start your search again.

- With US Legal Forms, one of the most comprehensive collections of legal templates, you can find everything from court documents to templates for internal business communication.

- We understand how crucial adherence to federal and local regulations is.

- That’s why, on our site, all templates are location-specific and current.

- Here’s how to get started on our website and acquire the document you require in just minutes.

- Locate the form you need by utilizing the search bar at the top of the page.

Form popularity

FAQ

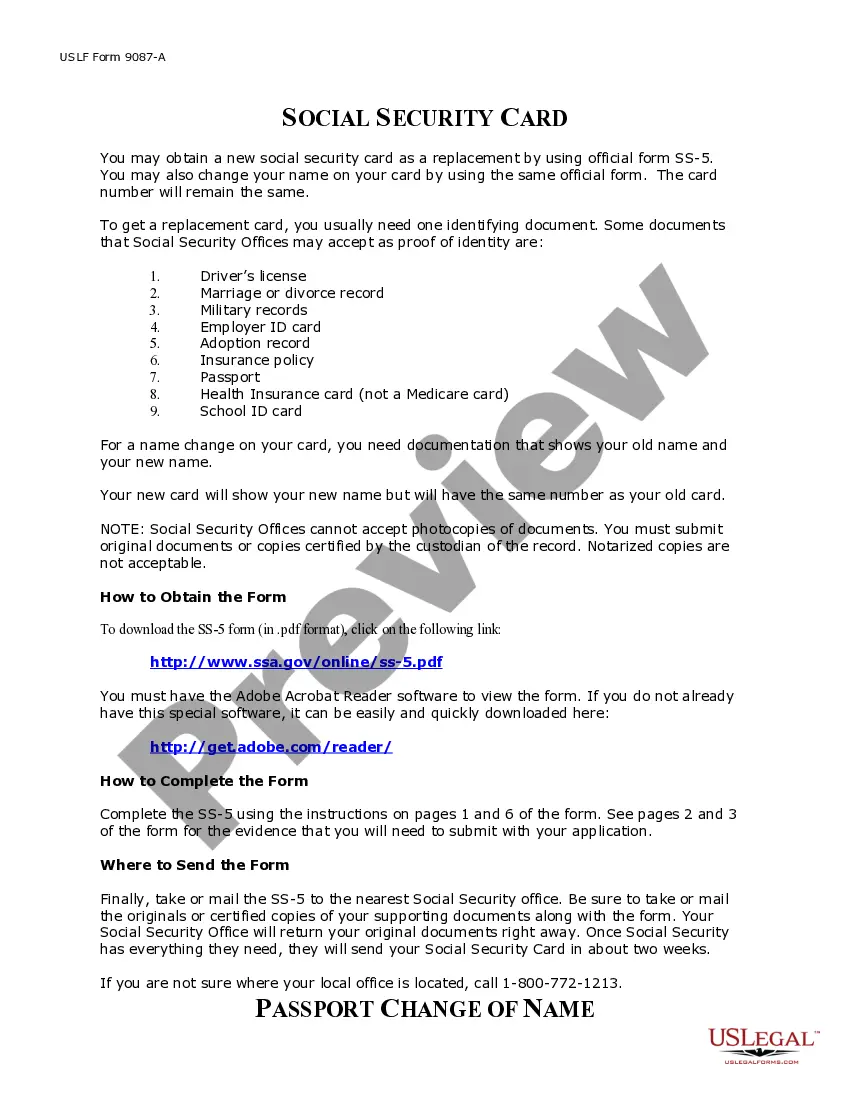

Whether you file Form SS-5 at your local Social Security office or by mail, you'll need to provide documents to support your legal name change, such as an original or certified copy of your marriage certificate. For more information, go to IRS.gov.

Contents of the Name Change Letter Your current EIN. The old name of the business as mentioned in the IRS records. Complete address of the business as it exists in the IRS records. The new name of your business. Date from which the name has been changed. New address if applicable.

If you change your name soon after you file your annual tax return, then you can inform the IRS of the EIN number change name through a signed notification, similar to a sole proprietorship.

Generally, businesses need a new EIN when their ownership or structure has changed. Although changing the name of your business does not require you to obtain a new EIN, you may wish to visit the Business Name Change page to find out what actions are required if you change the name of your business.

By Form. To change your address with the IRS, you may complete a Form 8822, Change of Address (For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns) and/or a Form 8822-B, Change of Address or Responsible Party ? Business and send them to the address shown on the forms.