Change Name After Marriage With Hmrc

Description

How to fill out Illinois Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

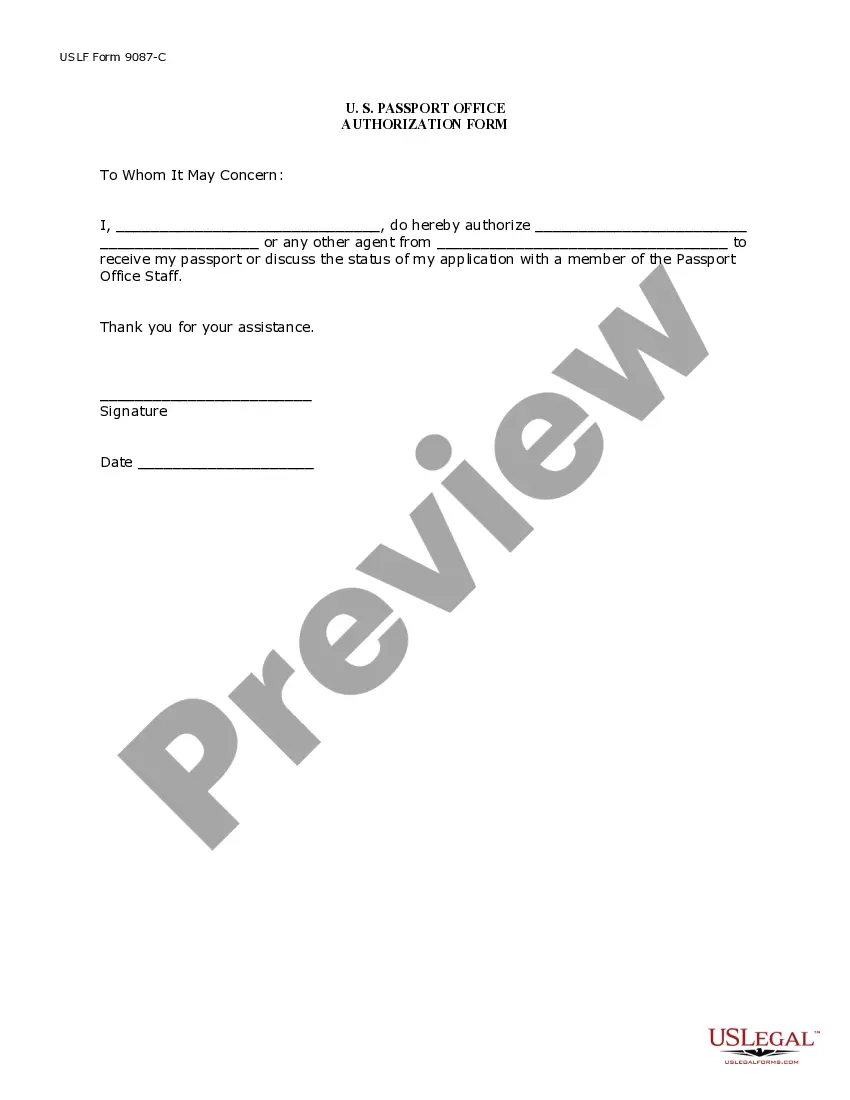

- Log in to your existing account on US Legal Forms to download the necessary template. Ensure your subscription is active or renew it if needed.

- Preview the form and read the description carefully. Verify that it matches your requirements and complies with local regulations.

- If the selected template is not suitable, use the search feature to find another form that fits your needs.

- Once you've found the correct document, click on the 'Buy Now' button to select your preferred subscription plan. You will need to create an account to access the library.

- Complete your purchase by entering your payment information, either via credit card or PayPal.

- Download the template to your device and access it at any time through the 'My Forms' section of your profile.

By using US Legal Forms, you gain access to an extensive library of over 85,000 fillable legal forms. This empowers individuals and attorneys to efficiently create and manage necessary legal documents.

Get started today and ensure your name change is filed correctly. Explore the resources available on US Legal Forms for a seamless experience!

Form popularity

FAQ

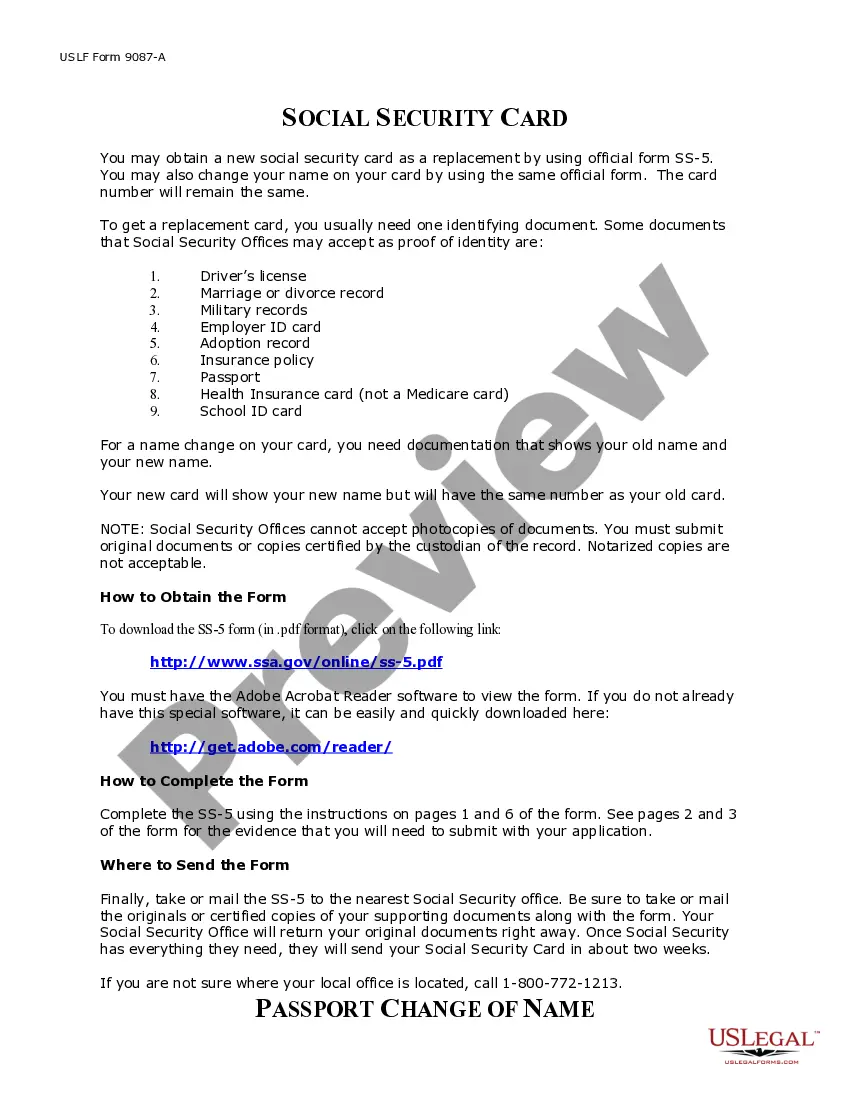

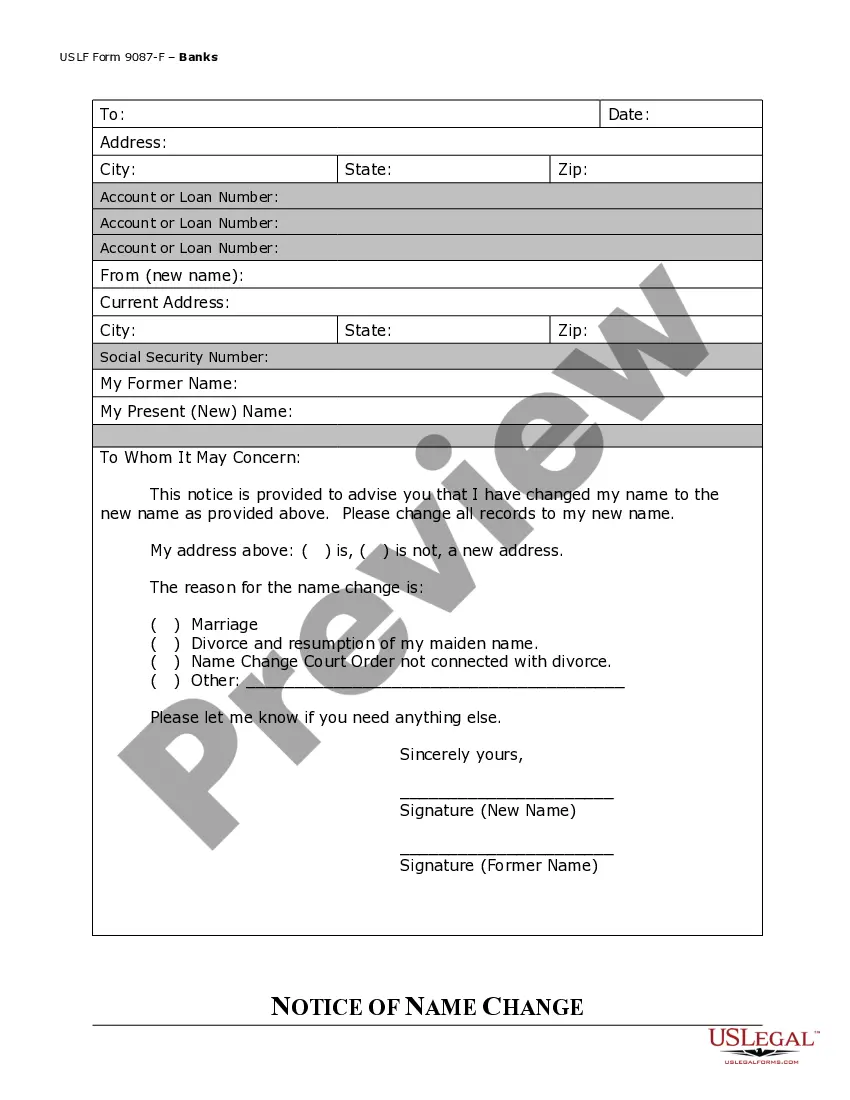

To support your name change after marriage with HMRC, you will need to provide certain evidence. Typically, this includes your marriage certificate, which verifies your name change. Some organizations may also request additional identification, like a passport or driver's license. Be sure to prepare these documents beforehand to streamline your name change process.

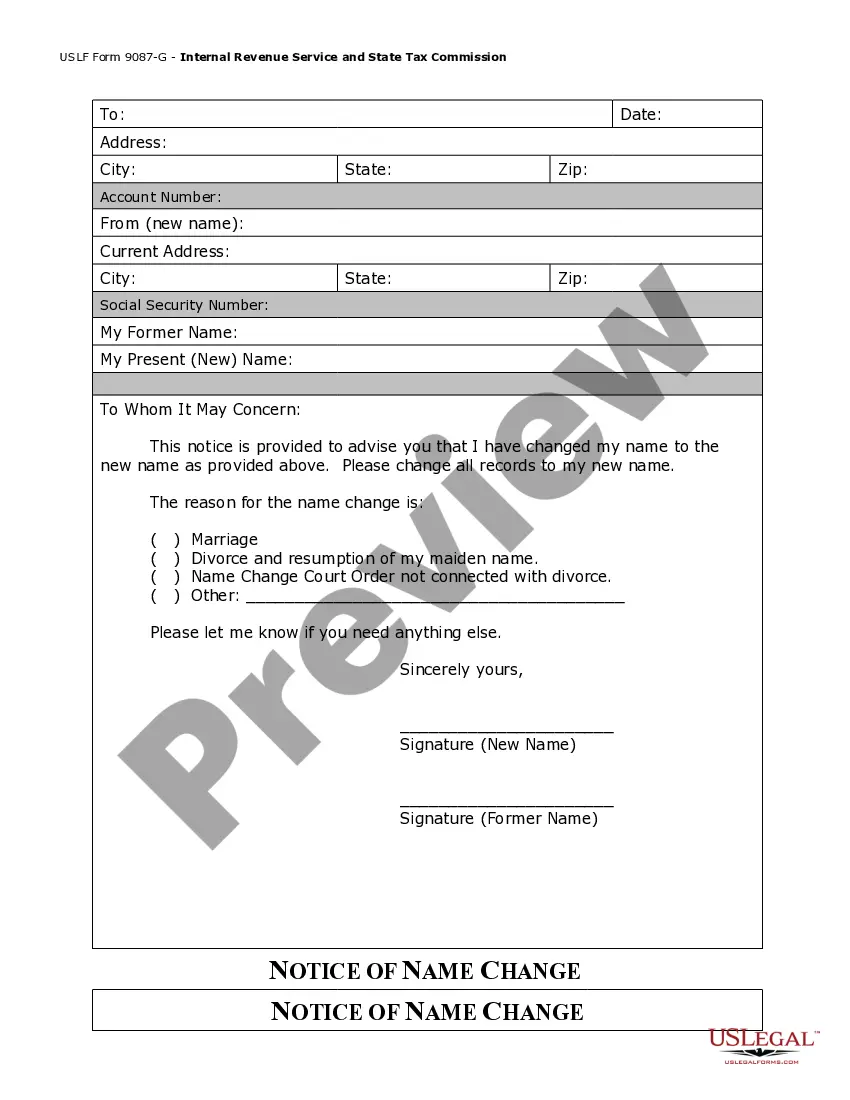

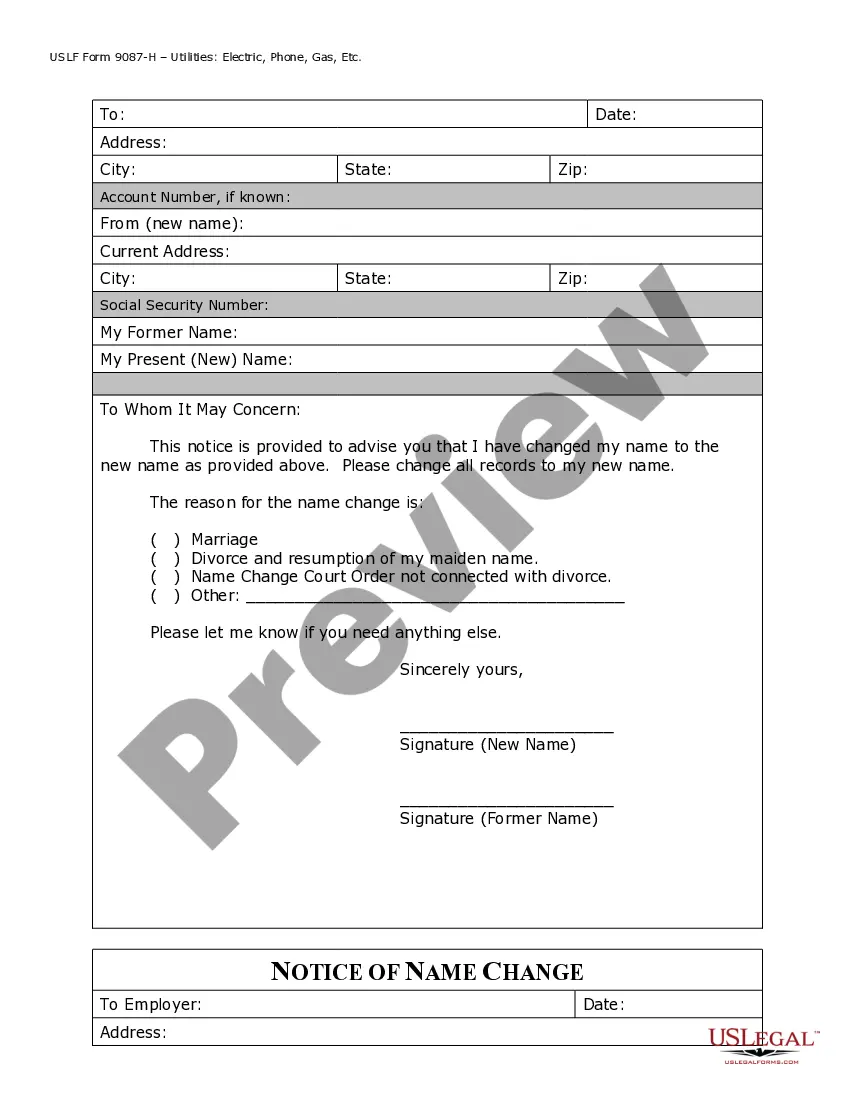

In the UK, changing your name after marriage with HMRC requires you to update several important documents. First, notify HMRC, as they need to match your name with your tax details. Next, update your National Insurance records, and don't forget to inform your bank and utility companies. This will help ensure you maintain your identity and avoid any issues with official transactions.

When you decide to change your name after marriage with HMRC, it is important to update your personal records. Start by notifying HMRC of your new name, as this ensures that your tax information remains accurate. Additionally, consider updating your passport, bank accounts, and driver's license. Keeping these records up to date helps prevent any complications in the future.

If you do not change your last name after marriage, all your official documents will still reflect your maiden name. This can create confusion in many aspects of life, including travelling, banking, and financial matters. Additionally, failing to update HMRC may affect your tax filings and marital status recognition in the future.

You can use your husband's last name informally without legally changing it, but this may lead to complications with official documents. For instance, your identification and tax records will not match if you do not update your name legally with HMRC. It's important to weigh the benefits of legal name change against the convenience of using an informal name.

Deciding whether to change your name after marriage in the UK is a personal choice. Consider factors such as professional identity, family traditions, and personal comfort. However, if you opt to change your name, updating your information with HMRC is essential to keep your tax records aligned with your new identity.

After marriage, you should update various important documents even if you choose not to change your name. These include insurance policies, beneficiary forms, and bank account details to reflect your married status. It is also a good idea to inform HMRC about your marital status for tax purposes, even if your name remains the same.

Keeping your maiden name can provide a sense of continuity and personal identity, especially in professional settings. If you have established a career or brand under your maiden name, it may be beneficial for your recognition. Additionally, there are implications for tax documentation and family heritage that should be considered when changing your name after marriage with HMRC.

There is no specific deadline for changing your name after marriage in the UK, but it is advisable to do so promptly to avoid confusion. Keep in mind that updating your name with HMRC and other institutions at your earliest convenience will help ensure accurate records. This can streamline other processes, like tax filings or changing bank information.

Yes, you can use your married name informally without legally changing it in the UK. However, keep in mind that official documents like passports or driver's licenses will still reflect your maiden name unless you go through the legal name change process. For tax purposes, you should still update your name with HMRC.