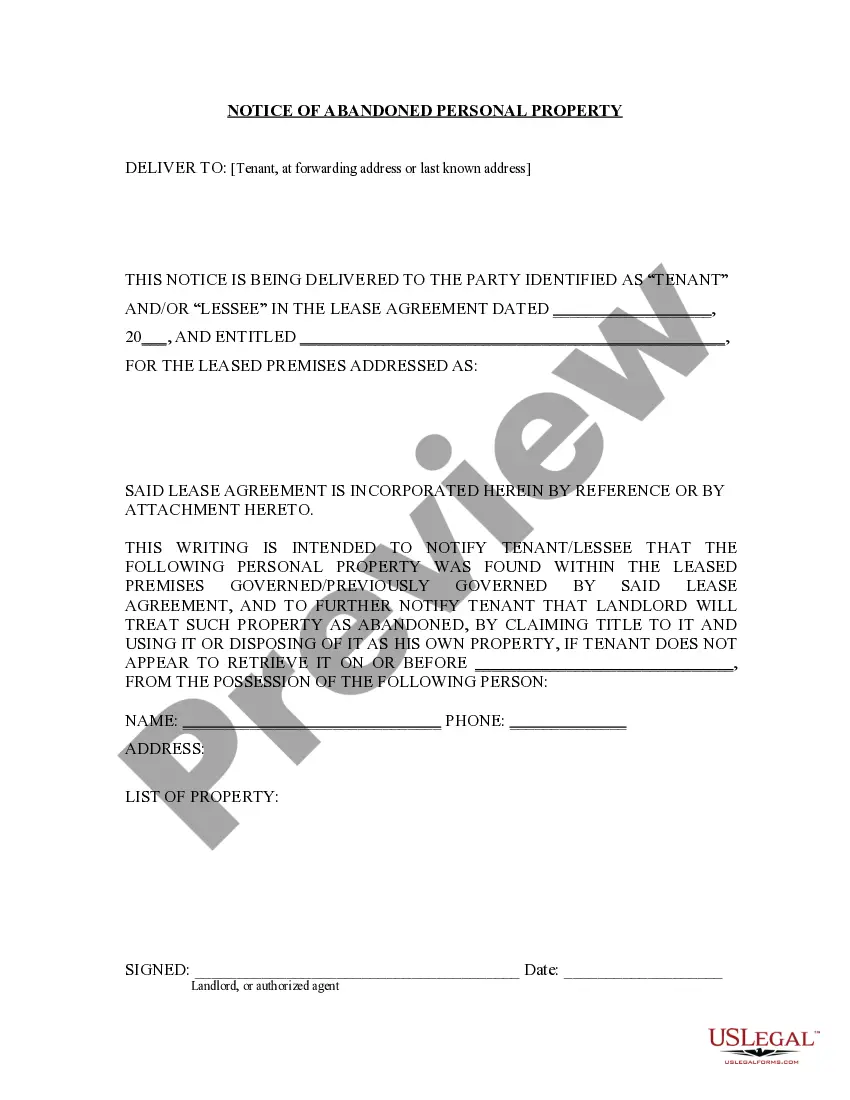

Abandoned property is property left behind intentionally and permanently, often by a tenant, when it appears that the former owner or tenant has no intent to reclaim or use it. Examples may include possessions left in a house after the tenant has moved out or autos left beside a road for a long period of time.

Abandoned personal property is that to which the owner has voluntarily relinquished all right, title, claim and possession, with the intention of terminating his ownership, but without vesting ownership in any other person, and without the intention of reclaiming any future rights therein, such as reclaiming future possession or resuming ownership, possession, or enjoyment of the property.