Sample Collection Letter For Nsf Check

Description

How to fill out Sample Collection Letter For Nsf Check?

Regardless of whether you regularly handle paperwork or occasionally need to send a legal document, it's essential to have a reliable source of information where all samples remain pertinent and current.

The first step you should take with a Sample Collection Letter For Nsf Check is to verify that you have the most recent version, as this determines its eligibility for submission.

If you wish to make your search for the most recent document examples easier, look for them on US Legal Forms.

To obtain a form without an account, follow these steps: Use the search menu to locate the needed form. Review the Sample Collection Letter For Nsf Check preview and description to confirm it is the correct one. After confirming the form's accuracy, click Buy Now. Select a subscription plan that suits you. Create an account or Log Into your existing one. Provide your bank card details or PayPal account to finalize the purchase. Choose the file format for download and confirm it. Eliminate confusion when handling legal documents. All your templates will be organized and verified with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents that encompasses almost any document sample you might need.

- Search for the templates you require, quickly assess their relevance, and learn more about how to use them.

- With US Legal Forms, you gain access to over 85,000 document templates across various fields.

- Acquire the Sample Collection Letter For Nsf Check samples in just a few clicks and save them at any time in your account.

- Having a US Legal Forms account empowers you to access all the samples you need with ease and minimal hassle.

- Simply click Log In in the site header and navigate to the My documents section, where all necessary forms will be readily available.

- You won't need to waste time searching for the right template or verifying its authenticity.

Form popularity

FAQ

You have several options.Contact the district attorney. Some states have a bad-check restitution program where the DA's office has someone contact the check writer and urge them to pay up.Work through a collection agency.Use a check recovery service.Take your customer to court if they refuse to resolve things.

This means the bank will not honor the check if presented. Banks usually charge a fee for this service. According to the Uniform Commercial Code Section 4-403(a), an oral stop payment order is binding on the bank for 14 calendar days.

Under criminal penalties, you can be prosecuted and even arrested for writing a bad check. A bounced check typically becomes a criminal matter when the person who wrote it did so intending to commit fraud, such as writing several bad checks in a short time frame knowing there is no money to cover them.

Include a letter in your postal mail or a note in your email recapping the date of purchase, when you were notified of the bounced check and the extra fees charged to your account. Respectfully request payment by a reasonable date. Do not exhibit anger or threats to your customer.

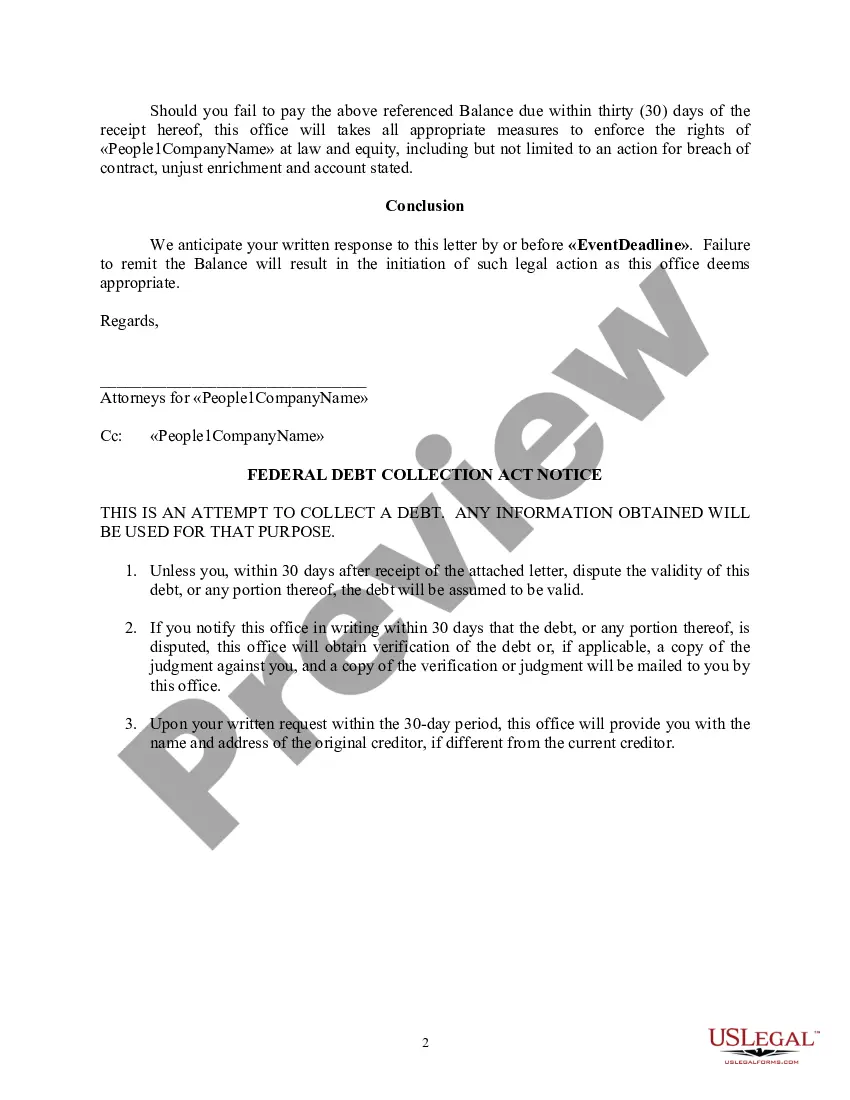

RE: Notice of Dishonored Check Dear Name of Bounced-Check Writer: I am writing to inform you that check #Check Number dated Date on Bounced Check, in the amount of $Amount of Bounced Check made payable to Your Name/Payee's Name has been returned to me due to insufficient funds, a closed account, etc..