Collection Letter Sample With Attachment

Description

How to fill out Illinois Collection Letter By Contractor?

There is no further justification to squander time searching for legal documents to adhere to your local state laws.

US Legal Forms has gathered all of them in one location and made their accessibility easier.

Our site provides over 85,000 templates for any business and personal legal matters categorized by state and area of use.

Using the Search field above to find another template if the current one does not suit you.

- All forms are correctly drafted and confirmed for accuracy, allowing you to be confident in receiving an updated Collection Letter Sample With Attachment.

- If you are acquainted with our platform and already possess an account, ensure that your subscription is active before acquiring any templates.

- Log In to your account, select the document, and click Download.

- You can also return to all obtained documents anytime needed by opening the My documents tab in your profile.

- If you have not used our platform previously, the procedure will require a few additional steps to finalize.

- Here is how new users can find the Collection Letter Sample With Attachment in our library.

- Examine the page content thoroughly to ensure it features the sample you need.

- To do this, use the form description and preview options if available.

Form popularity

FAQ

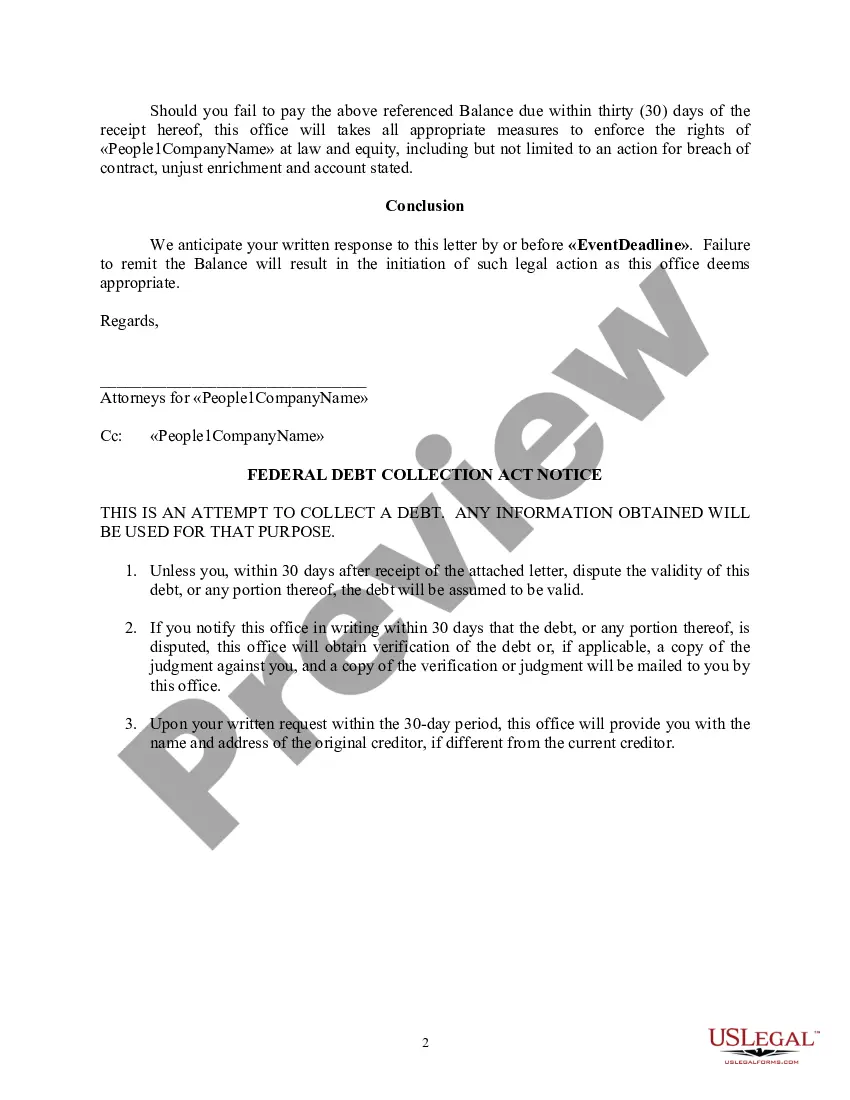

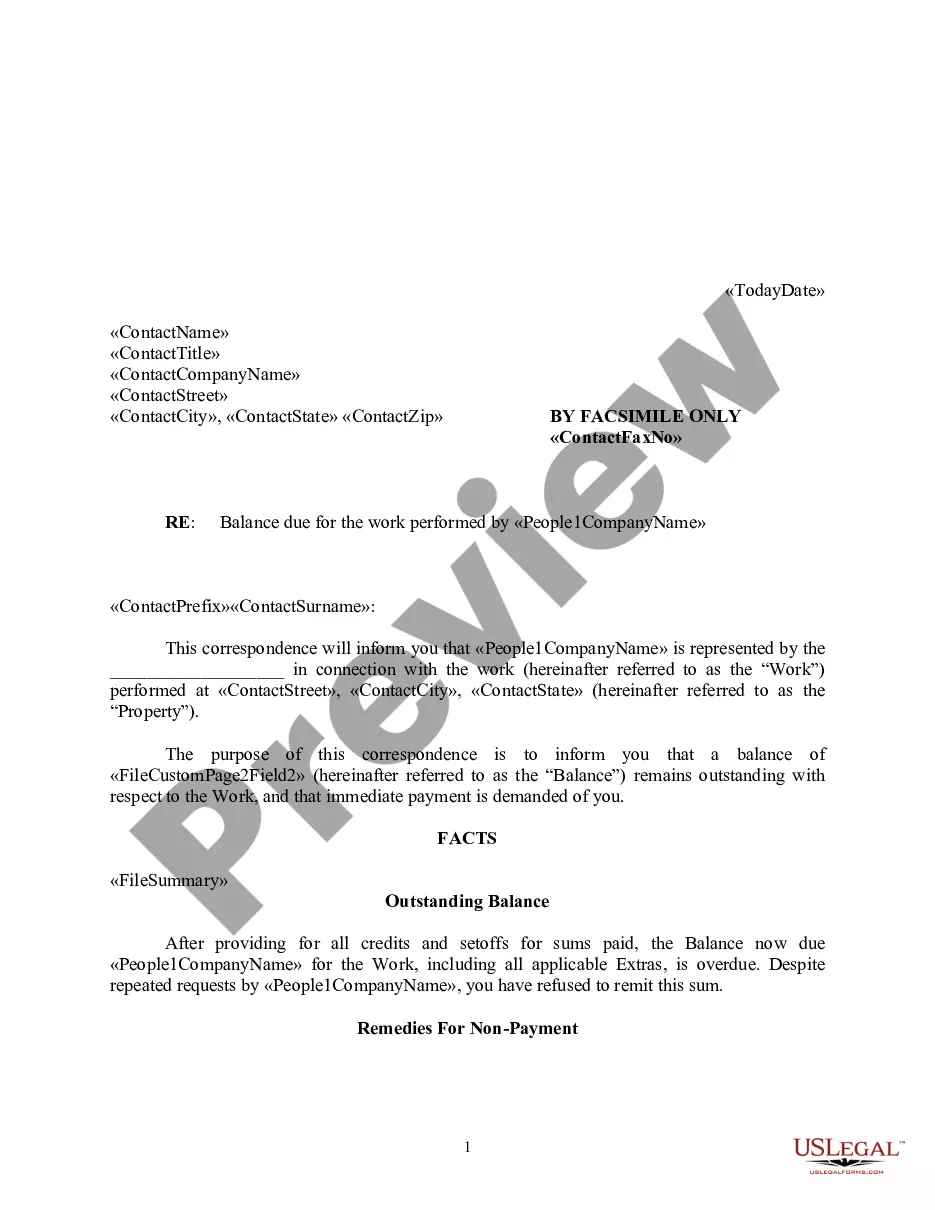

Debt collectors must prove three key elements: the existence of the debt, the amount owed, and their legal right to collect it. They should provide documentation to support these claims, such as a signed contract or invoices. Having a reliable collection letter sample with attachment can streamline this process by giving a clear structure to the proof they present. With uslegalforms, you can easily access tools to ensure your collection processes comply with legal standards.

To write a collection notice, start by clearly stating your intention to collect a debt. Use a courteous yet firm tone, outline the amount owed, and include any relevant payment deadlines. Additionally, attach a collection letter sample with attachment to provide a clear format for your recipient. This way, you guide them on how to respond appropriately and facilitate faster communication.

When informing a customer that you will send their account to collections, communicate with clarity and empathy. Explain the situation, including the amount due and any efforts you made to resolve the matter. A professional approach, supported by a collection letter sample with attachment, can help maintain goodwill despite the circumstances. Consider using US Legal Forms to create an appropriate notification letter that reflects your intentions clearly.

To write an effective letter for debt collection, begin by clearly stating the purpose of your message. Include the amount owed, the due date, and any relevant account information to avoid confusion. A collection letter sample with attachment can guide your drafting process, ensuring you cover all necessary details. Utilizing tools like US Legal Forms can simplify your experience and help you create professional letters.

To obtain a deletion letter from a collection agency, first request confirmation of the account’s status and your payment history. If you’ve settled the debt, ask them directly for a written statement that confirms the deletion of the record. A collection letter sample with attachment can provide a useful template for this request.

To send a debt collection email, begin with a subject line that indicates the purpose clearly. Include a professional greeting, a summary of the debt details, and specific requests for payment. Utilizing a collection letter sample with attachment can guide you in crafting a concise and effective email.

Yes, you can send a debt validation letter via email, but ensure you follow up with a physical copy for documentation. In your email, clearly request validation of the debt and include relevant account information. Using a collection letter sample with attachment can help you format your email effectively.

A nice collection letter should be polite but firm, clearly stating the debt amount and due date. It should express understanding, while emphasizing the importance of payment. For inspiration, you can reference a collection letter sample with attachment to create a considerate yet effective communication.

To send a collection letter, start by clearly stating the amount owed and the due date. Use a professional tone and include your contact information for any questions. You can also use a collection letter sample with attachment to create a well-structured letter that conveys your message effectively.

Yes, debt collectors can email you, but they must follow certain regulations. They are required to identify themselves and provide you with important information about the debt. For your records, having a collection letter sample with attachment can help ensure clarity in communication.