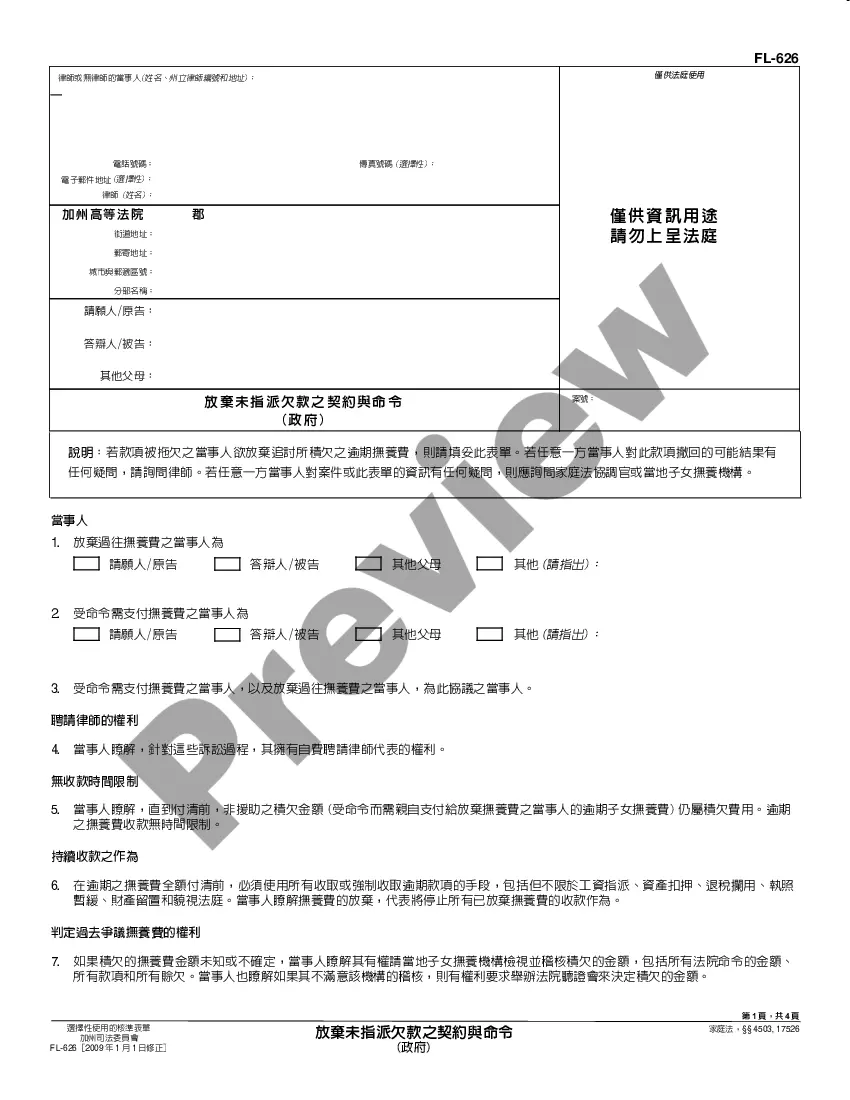

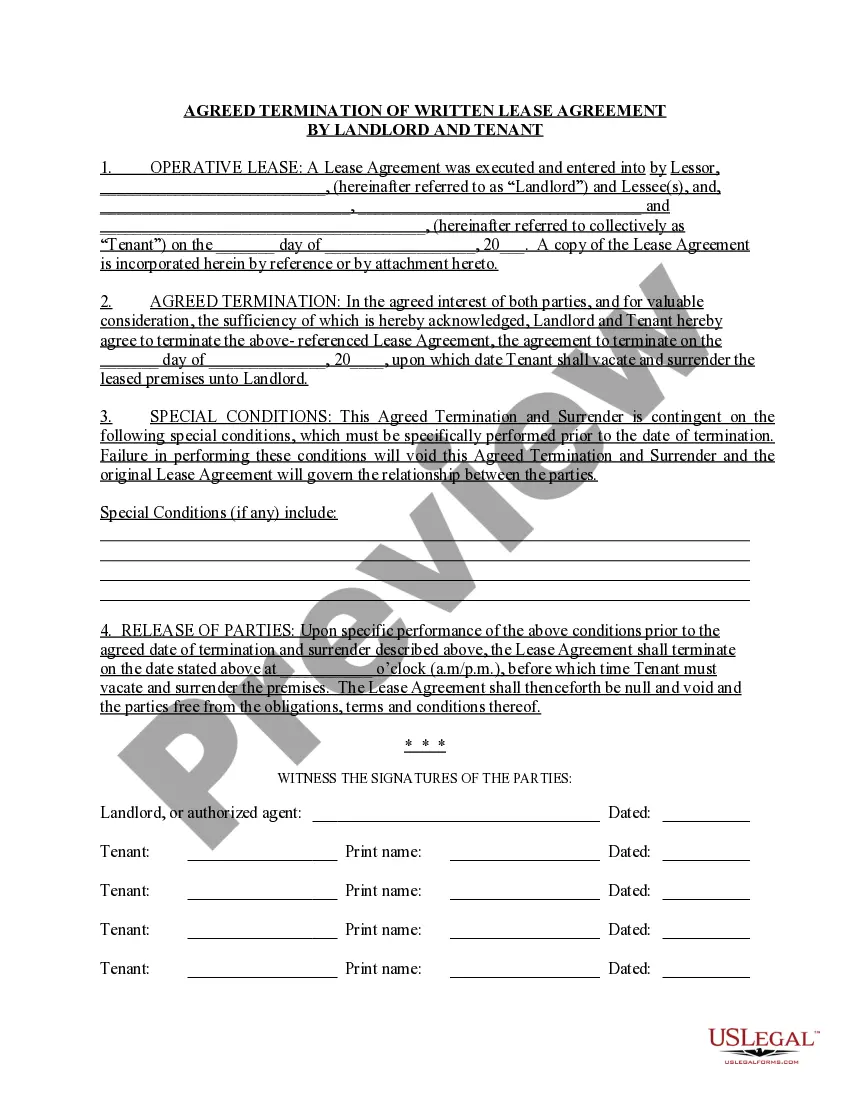

Termination Lease Form Agreement For Vehicle

Description

How to fill out Illinois Agreed Written Termination Of Lease By Landlord And Tenant?

There's no longer any justification for spending countless hours searching for legal documents to meet your local state stipulations.

US Legal Forms has gathered all of them in a single location and streamlined their accessibility.

Our platform offers over 85k templates for any business and personal legal situations categorized by state and area of use.

Utilize the Search field above to find another sample if the current one doesn’t suit your needs.

- All forms are professionally composed and validated for authenticity, so you can feel confident in acquiring an up-to-date Termination Lease Form Agreement For Vehicle.

- If you are acquainted with our platform and already have an account, ensure your subscription is active before accessing any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all obtained documentation whenever necessary by accessing the My documents tab in your profile.

- If you haven't used our platform before, the process will involve a few more steps to complete.

- Here’s how new users can acquire the Termination Lease Form Agreement For Vehicle in our catalog.

- Examine the page content closely to ensure it includes the sample you need.

- To do this, make use of the form description and preview options if available.

Form popularity

FAQ

The payoff amount is similar to the car's residual value, but not exactly the same. It's the amount you would have to pay to buy the car at any given point during the lease. You can calculate it by adding the car's residual value plus the amount you still owe on it, including interest.

How to Calculate a Lease Buyout in 4 Easy StepsFind your car's residual value. Residual value is how much your vehicle was estimated to be worth at the end of the lease.Figure out your car's actual value.Figure out which value is higher.Add sales tax, license, and registration fees.

Look for a buyout amount or payoff amount that will be listed on your monthly leasing statement. This buyout amount is calculated by adding up the residual value of your vehicle at the beginning of the lease, the total remaining payments, and possibly a car purchase fee (depending on the leasing company.)

The early termination charge is typically the difference between the balance remaining on the lease (lease payoff amount) and the amount credited for the vehicle (realized value of the vehicle). Suppose, for example, that your lease early termination payoff is $16,000 and the amount credited for the vehicle is $14,000.

Dear Landlord, This letter will constitute written notice of my intention to vacate my apartment on date, the end of my current lease. I am doing so because explain the reason if you desire, such as a large increase in rent. Please recall that I made a security deposit of $ on date.