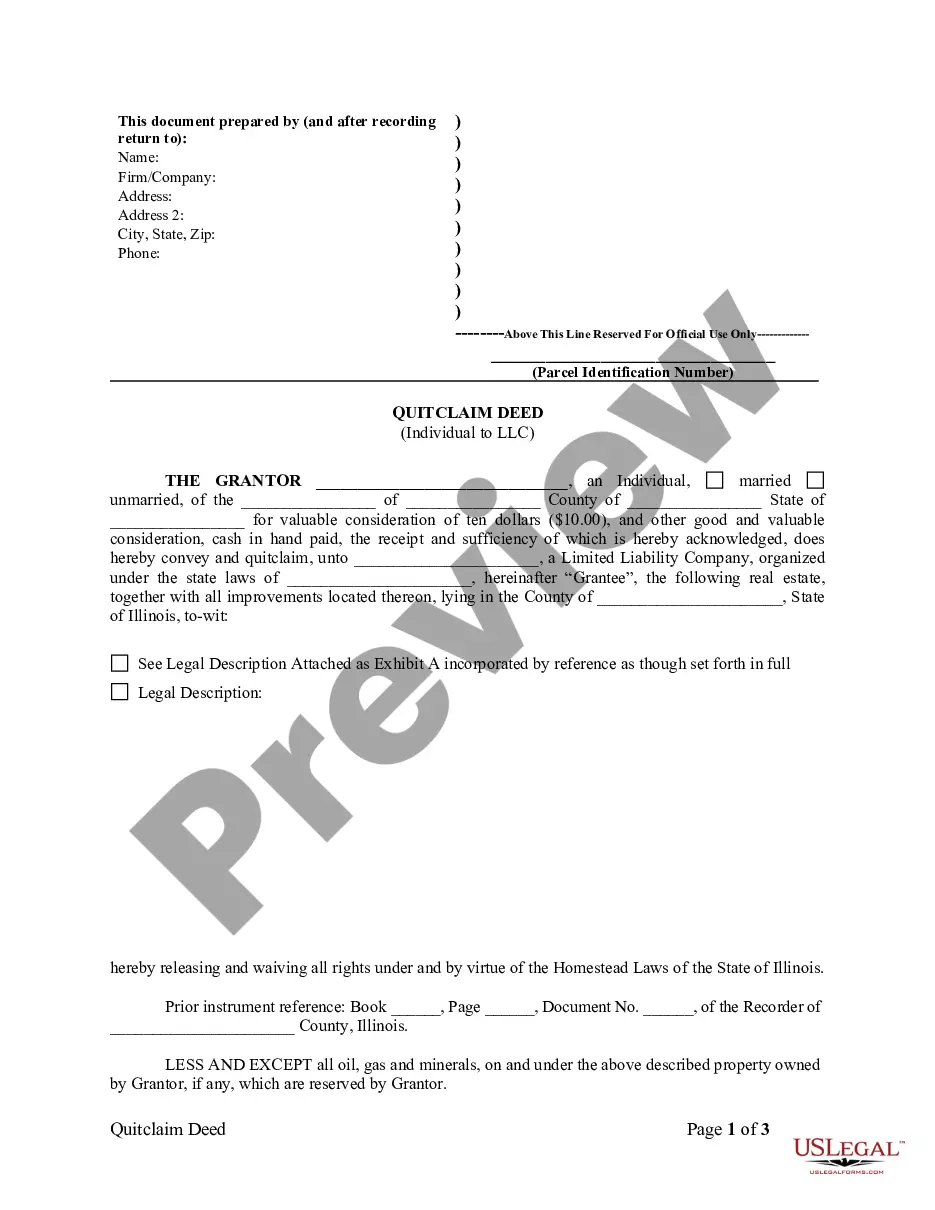

Quit Claim Deed For Illinois

Description

How to fill out Illinois Quitclaim Deed From Individual To LLC?

It’s clear that you can’t become a legal authority instantly, nor can you comprehend how to swiftly prepare a Quit Claim Deed for Illinois without possessing a specific set of expertise.

Creating legal documents is a lengthy process that demands particular education and abilities. So why not assign the preparation of the Quit Claim Deed for Illinois to the experts.

With US Legal Forms, one of the most comprehensive legal template repositories, you can find everything from court documents to templates for in-office correspondence.

If you require any other form, restart your search.

Sign up for a free account and select a subscription plan to purchase the template. Click Buy now. Once the payment is completed, you can download the Quit Claim Deed for Illinois, fill it out, print it, and deliver it to the specified individuals or entities.

- We understand how crucial it is to comply with federal and local laws and regulations.

- That’s why, on our site, all forms are location-specific and current.

- Here’s how to get started with our platform and acquire the form you need in just minutes.

- Locate the form you need by utilizing the search bar at the top of the page.

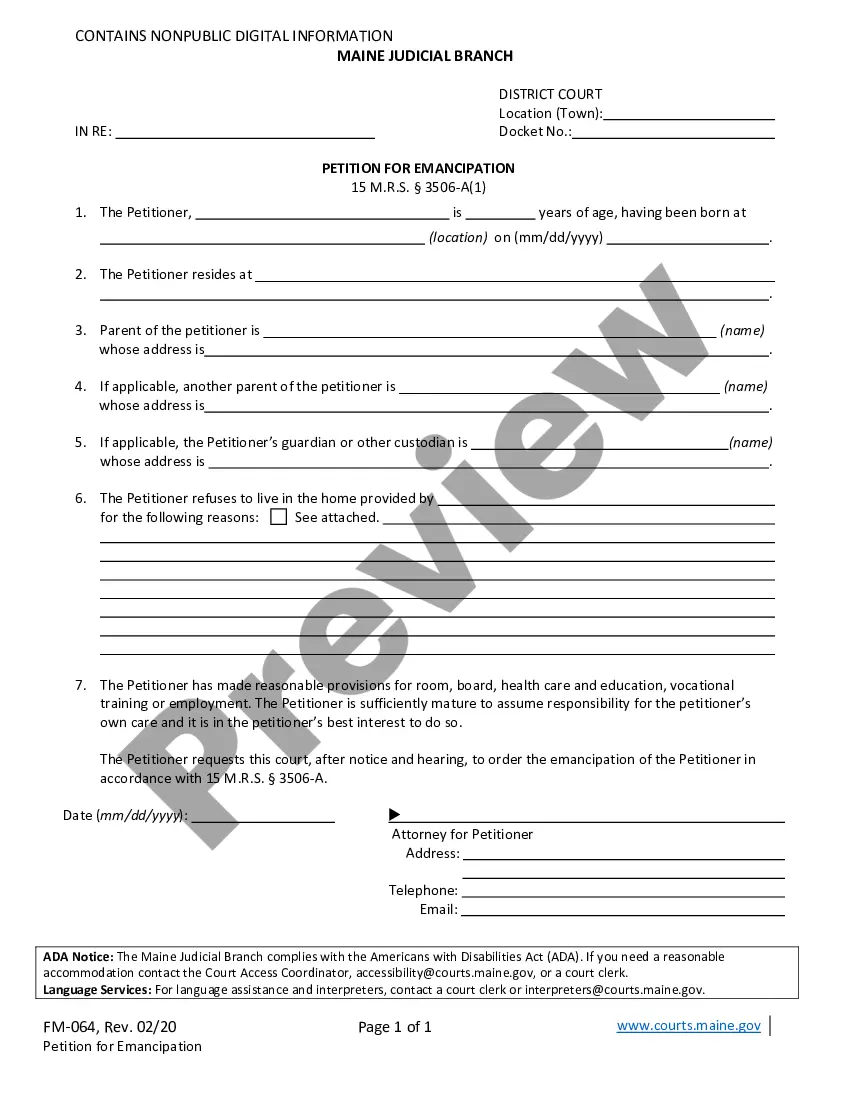

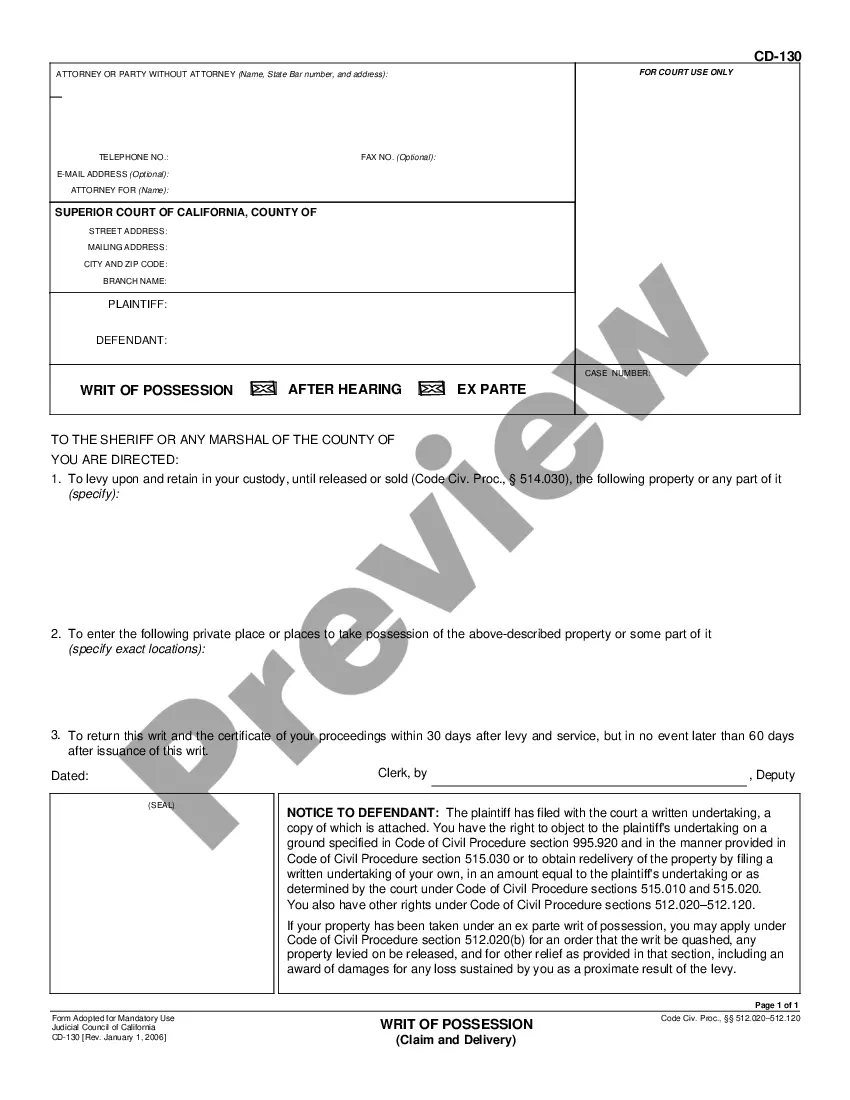

- Preview it (if this option is available) and review the accompanying description to determine if the Quit Claim Deed for Illinois is what you’re looking for.

Form popularity

FAQ

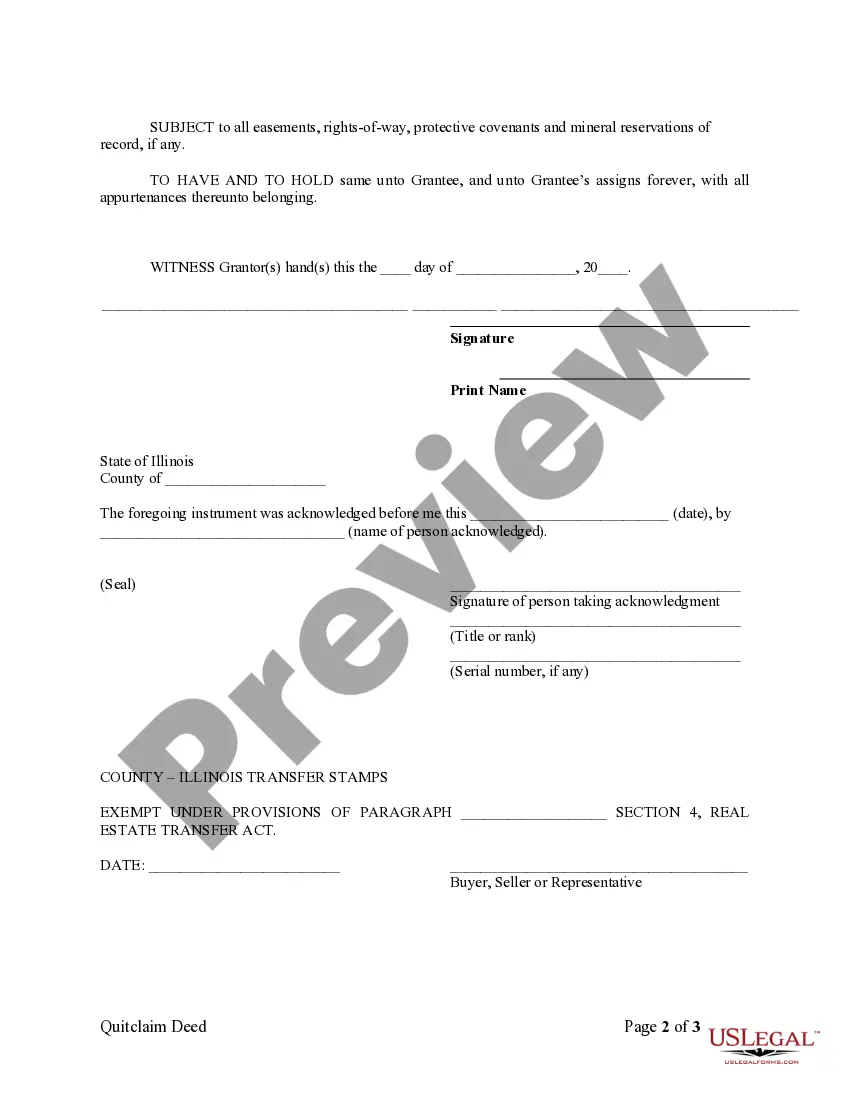

Overview of Illinois Real Estate Transfer Tax State real estate transfer tax are imposed at a rate of $0.50 per $500 of value stated in the Transfer Tax Return. County real estate transfer tax are imposed at a rate of $0.25 per $500 of value stated in the Transfer Tax Return.

Form PTAX-203, Illinois Real Estate Transfer Declaration, is completed by the buyer and seller and filed at the county in which the property is located. Form PTAX-203-A, Illinois Real Estate Transfer Declaration Supplemental Form A, is used for non-residential property with a sale price over $1 million.

A Quit Claim Deed is required to clearly identify the grantor and grantee, the address of the property being transferred, a legal description of the property, the manner in which the grantee is taking title, a notarized signature of the grantor, and the name and address of the party that has prepared the deed.

LEGAL FEES - ILLINOIS QUIT CLAIM DEEDS The fee is $150 (or $160 if paid by credit card). It will be your responsibility to get the transfer stamps (if necessary) and get the deed recorded with the County Recorder. There is nothing legal about obtaining the municipal stamp and recording the deed.

How Do Homeowners Add Spouses to Property Deeds? One of the most common ways property owners add spouses to real estate titles is by using quitclaim deeds. Once completed and filed, quitclaim deed forms effectually transfer a share of ownership from the owners, or grantors, to their spouses, or the grantees.