Successor Trustee For Irrevocable Trust

Description

Form popularity

FAQ

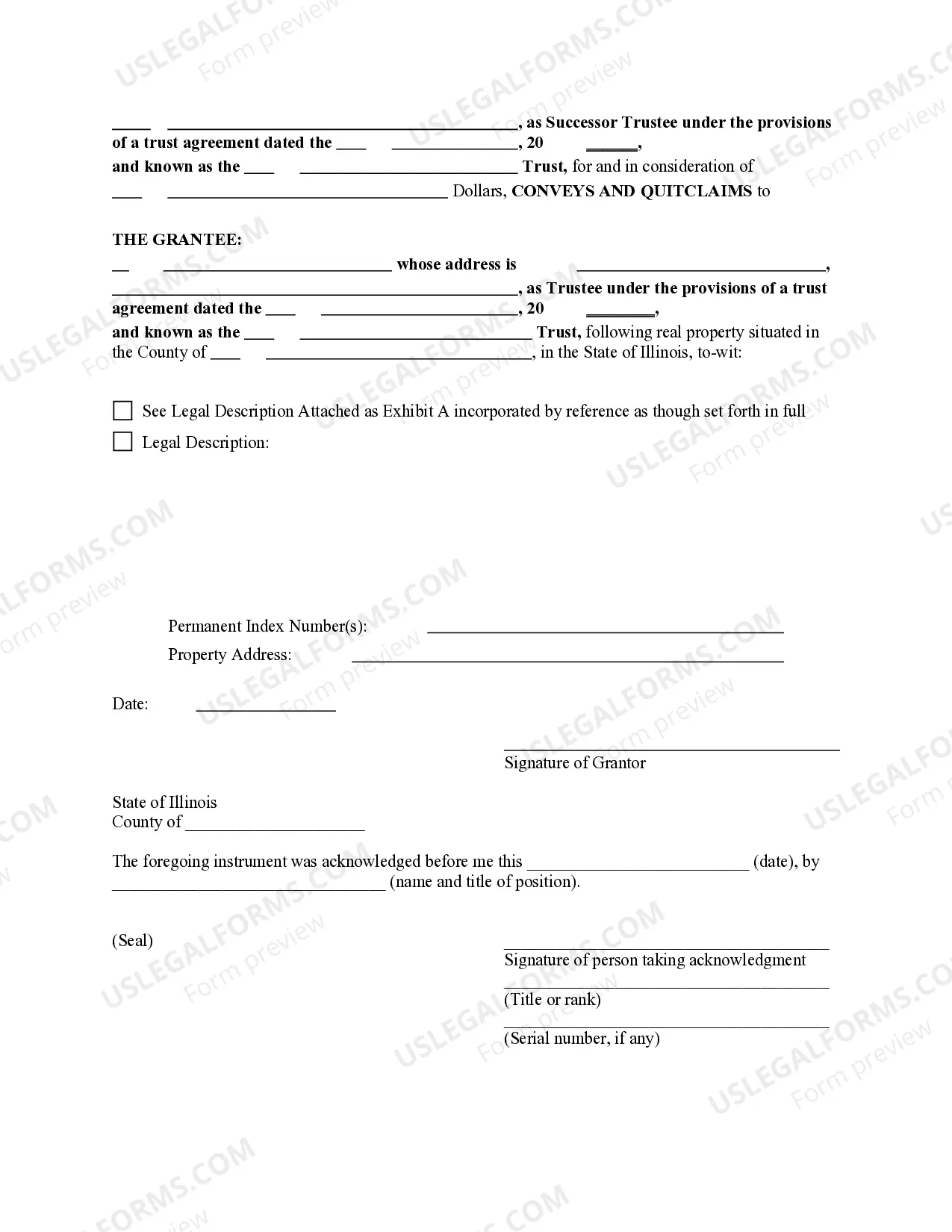

The affidavit of successor trustee form is a document that verifies the appointment of a new trustee for an irrevocable trust. This form is crucial for legitimizing the successor’s authority and enabling them to manage trust assets properly. It usually includes the trust’s name, the original trustee’s details, and the successor's acceptance of the role. Services like USLegalForms can provide you with templates to help you complete this process accurately.

Yes, a successor trustee for an irrevocable trust may need to file Form 56 with the IRS to notify them of the fiduciary relationship being established. This form is essential as it confirms your role and protects you under the law while managing the trust’s tax obligations. It is advisable to consult tax professionals or reliable resources like USLegalForms to ensure proper completion and submission.

A successor trustee for an irrevocable trust is responsible for managing and distributing the trust's assets according to the terms set forth in the trust document. This role entails understanding the trust’s terms and acting in the best interest of the beneficiaries. The trustee must also maintain accurate records and handle any tax implications. You can find detailed guidance on these responsibilities through platforms such as USLegalForms.

Generally, you cannot add a successor trustee to an irrevocable trust once it has been established, as the terms are usually set in stone. However, the original trustee may sometimes name a successor trustee within the trust document itself. If you're considering adjustments, it’s beneficial to consult legal professionals or utilize services like USLegalForms to ensure compliance and proper procedures.

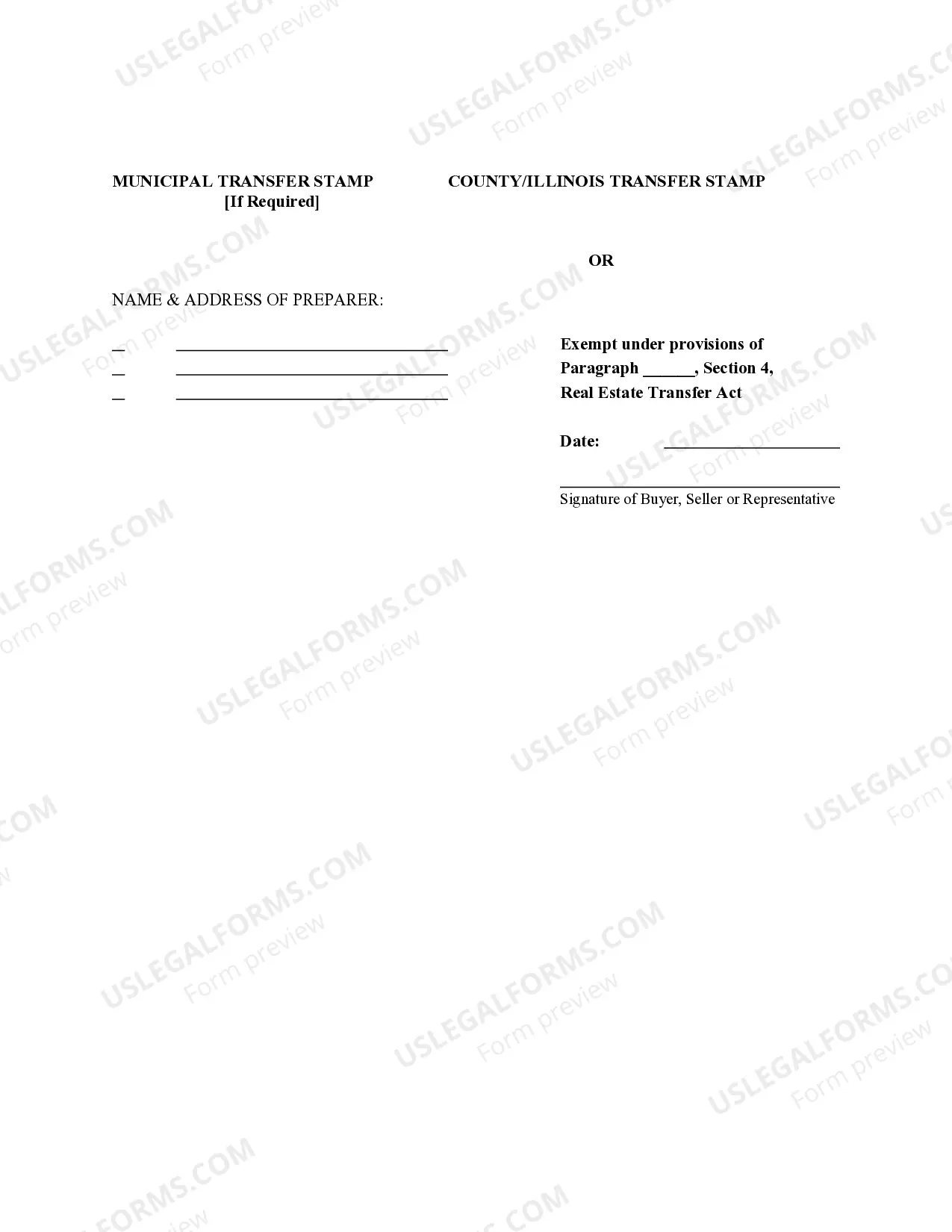

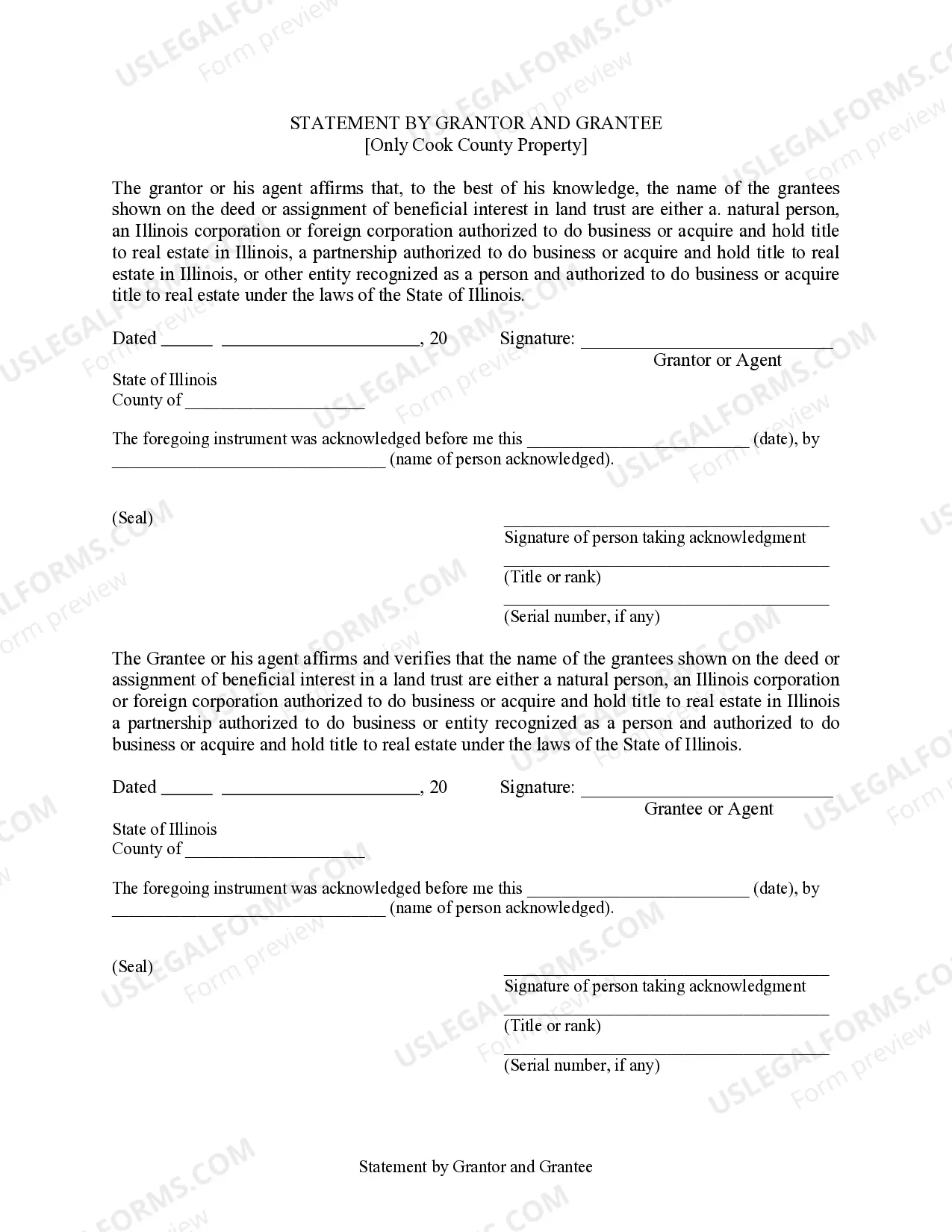

The paperwork for a successor trustee for an irrevocable trust typically includes a copy of the trust document and a written acceptance of the role. It's essential to have all documents in order to ensure a smooth transition. You'll also want to prepare any necessary notifications to beneficiaries and relevant financial institutions. By using platforms like USLegalForms, you can easily find templates and create the required paperwork efficiently.

Designating a successor trustee for your irrevocable trust involves identifying a suitable candidate and formalizing the appointment. Start by discussing your choice with the individual to confirm their willingness to accept the role. Then, update your trust documents to officially name them as the successor trustee, which can typically be done with the help of a legal professional. If you're navigating this process, consider using platforms like uslegalforms to simplify the legal aspect.

A successor trustee of an irrevocable trust is an individual or entity designated to take over the management of the trust's assets after the original trustee can no longer perform their duties. This may happen due to incapacity, resignation, or death. Selecting the right successor trustee is crucial, as they will uphold the trust's intentions and execute decisions in line with your established framework. A well-chosen successor ensures continuity and stability in managing the trust.

The best person to serve as a trustee for an irrevocable trust is someone who possesses integrity and the ability to manage finances. This could be a family member, a trusted friend, or a qualified professional. Evaluating their experience and reliability is critical, as they'll be responsible for fulfilling your desires regarding asset management and distribution. It's essential to choose someone you believe can execute your wishes effectively.

Naming a trustee for your irrevocable trust involves thinking about who has the right skills and knowledge. You want someone who can handle the responsibilities efficiently while adhering to your instructions. Many people opt for trusted family members, close friends, or even a financial institution that specializes in trust management. Ultimately, the right person or entity acts as a protector of your estate and your beneficiaries' interests.

Choosing a successor trustee for an irrevocable trust requires careful consideration. You should select someone who is reliable, organized, and has a good understanding of financial matters. This individual will be responsible for managing the trust assets and making decisions in accordance with your wishes, so trust is paramount. Often, a close family member or a professional trustee may be the best choice.