Agreement Between Two Parties For Payment

Description

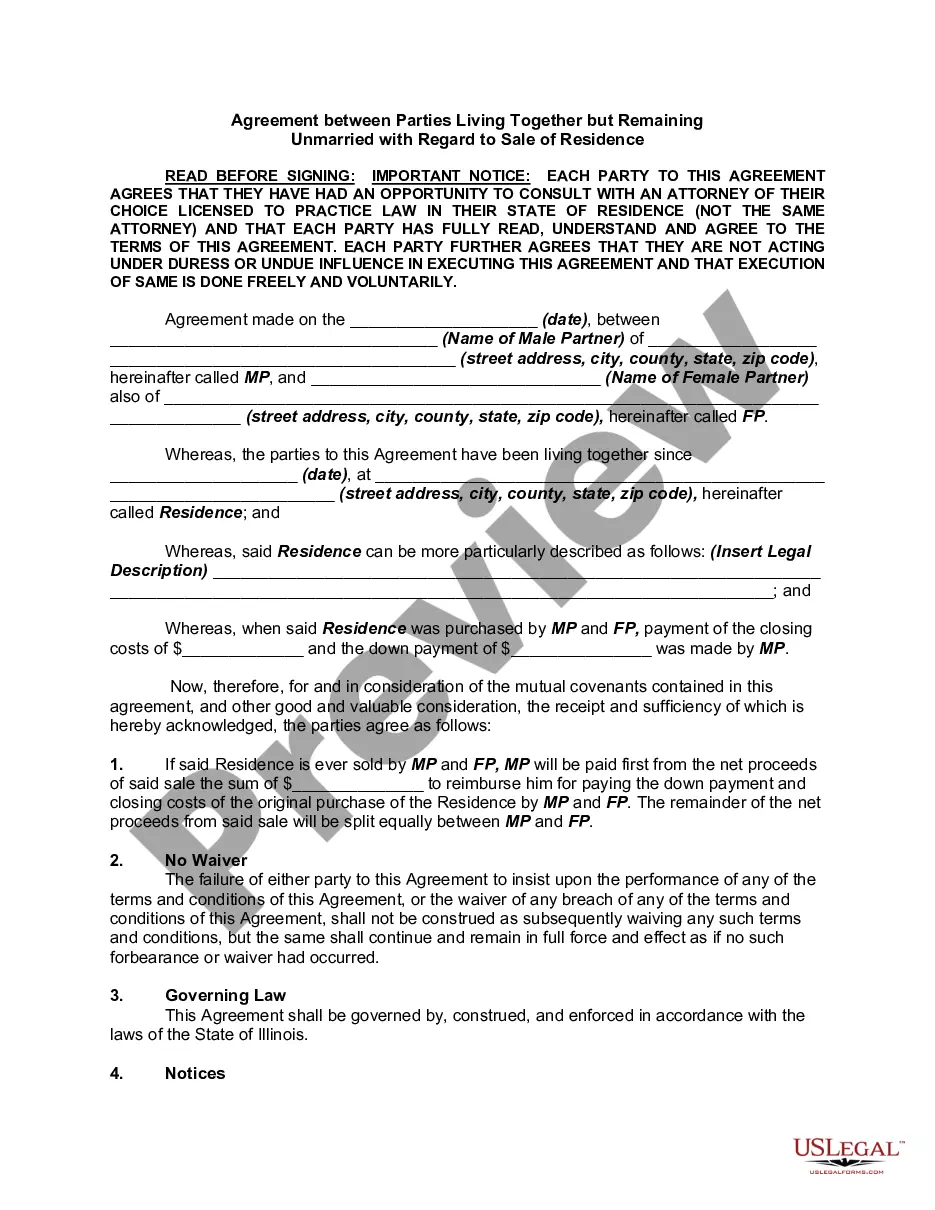

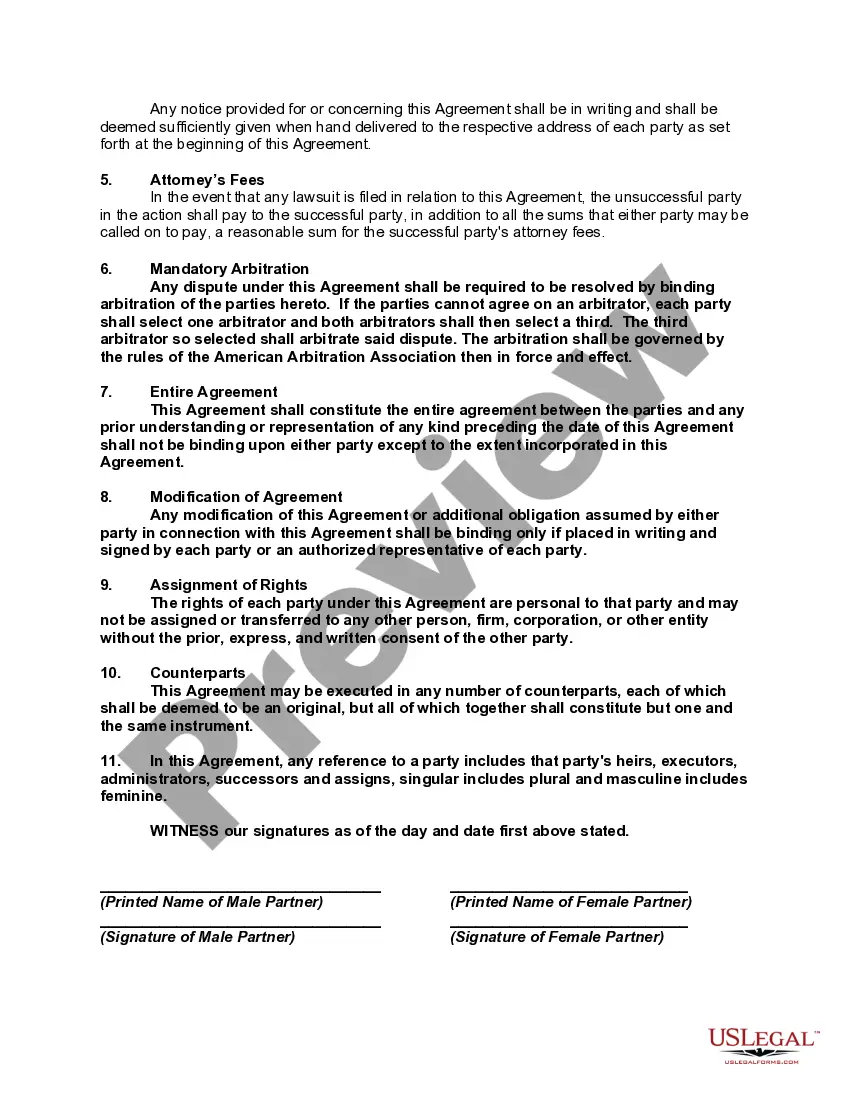

How to fill out Illinois Agreement Between Parties Living Together But Remaining Unmarried With Regard To Sale Of Residence?

Utilizing legal document examples that adhere to federal and state statutes is essential, and the web provides numerous options to choose from.

However, what is the benefit of spending time searching for the correct Agreement Between Two Parties For Payment template online when the US Legal Forms digital library already has such documents consolidated in one location.

US Legal Forms is the largest online legal repository with more than 85,000 editable templates created by attorneys for various business and personal scenarios.

Review the template using the Preview feature or through the text description to confirm it meets your requirements.

- They are straightforward to navigate with all documents organized by state and intended use.

- Our specialists stay informed of legal updates, ensuring you can always trust that your form is current and compliant when acquiring an Agreement Between Two Parties For Payment from our site.

- Obtaining an Agreement Between Two Parties For Payment is quick and easy for both existing and new users.

- If you already possess an account with a valid subscription, Log In and download the document template you need in your preferred format.

- If you are unfamiliar with our website, follow these steps.

Form popularity

FAQ

Yes, a payment agreement between two parties for payment is legally binding provided it meets certain criteria. For an agreement to hold up in court, it must include clear terms, mutual consent, and legal capacity of both parties. Additionally, both parties should have a clear understanding of their obligations and rights within the agreement. To ensure your agreement is enforceable, consider using US Legal Forms, which offers templates tailored to create valid agreements.

To make a payment plan legally binding, ensure that both parties sign the agreement after fully understanding the terms. Include specific details such as payment amounts, due dates, and penalties for non-compliance. Additionally, having witnesses or a notary can strengthen the agreement between two parties for payment. Using a platform like US Legal Forms can help you create a comprehensive and legally sound payment plan.

Generally, a payment agreement does not have to be notarized to be legally valid. However, notarization can add a layer of security and authenticity to the agreement between two parties for payment. If either party has concerns about enforceability, they may choose to have the document notarized. Consulting with a legal professional can provide clarity on this matter.

To write a simple agreement between two parties, begin with a title that reflects the nature of the agreement. Clearly state the parties’ names and roles, followed by the terms of the agreement, including what is being exchanged and any deadlines. Keep the language clear and straightforward, ensuring that both parties can easily understand the agreement between two parties for payment.

Drawing up a payment agreement involves several key steps. First, gather all necessary information about both parties, including names and contact details. Next, specify the terms of the payment, such as the total amount, installment amounts, and payment schedule. Finally, ensure both parties review the document, making adjustments as needed, to achieve a mutual agreement between two parties for payment.

To write a payment agreement between two parties, start by clearly identifying the parties involved. Include the payment amount, due dates, and the method of payment. Be sure to outline any consequences for late payments or defaults. This structured approach ensures both parties understand their obligations, creating a solid agreement between two parties for payment.

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

Money Agreement Between Two Parties When they're written and structured in the correct way, these agreements allow for legal action to recover money that's owed. A money agreement clarifies how much money will be paid for a particular good or service. It also sets clear expectations regarding payments.

Including a clear description of the payment plan Clearly state the date the payment plan agreement is being created. List the full names of the parties involved in the agreement. Provide an itemized list of the payments that need to be made, including the payment amount and due date for each payment.

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.