Ladybird Deed Illinois With Right Of Survivorship

Description

Form popularity

FAQ

In Illinois, spouses have the option of owning property by the entirety, which functions like a joint tenancy in that the surviving spouse will immediately take ownership of the property on the death of the other spouse. Illinois recognizes joint tenancy with right of survivorship as a common form of joint ownership.

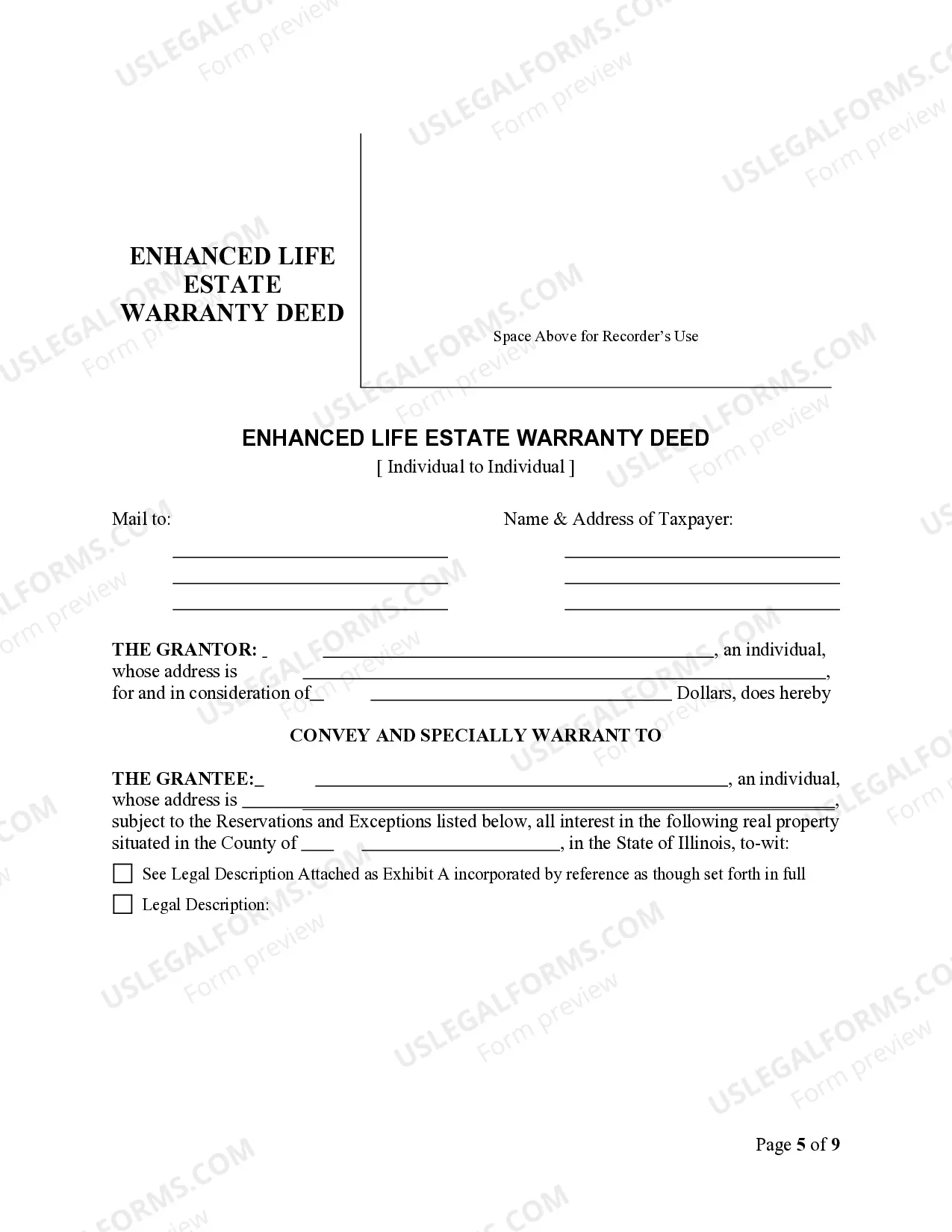

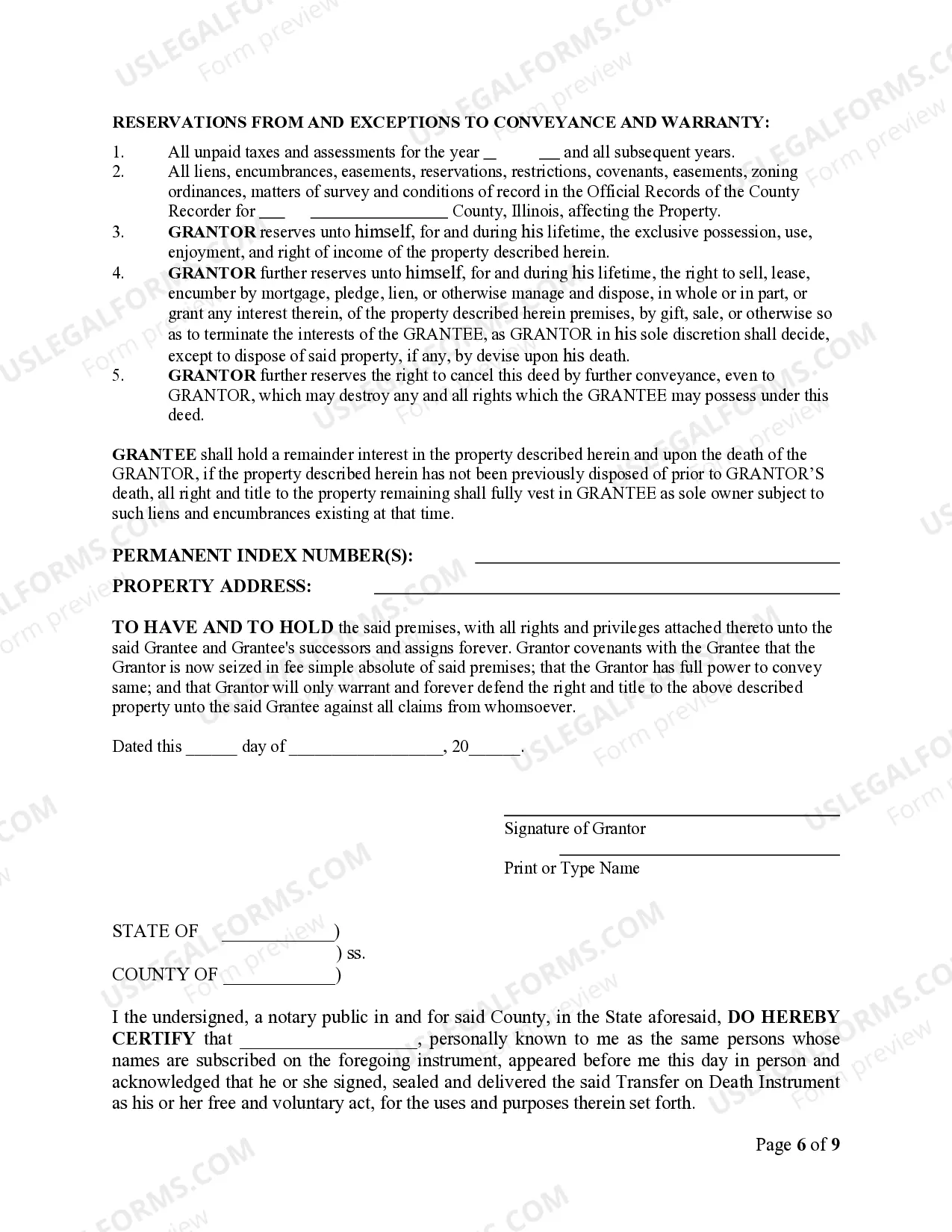

However, Lady Bird deeds are not recognized in Illinois. Nonetheless, similar outcomes can often be achieved through the use of a revocable living trust or a TOD deed, as previously discussed.

Key Takeaways. Some of the main benefits of joint tenancy include avoiding probate courts, sharing responsibility, and maintaining continuity. The primary pitfalls are the need for agreement, the potential for assets to be frozen, and loss of control over the distribution of assets after death.

Disadvantages of joint tenants with right of survivorship JTWROS accounts involving real estate may require all owners to consent to selling the property. Frozen bank accounts. In some cases, the probate court can freeze bank accounts until the estate is settled.

In general, joint assets are held in joint tenancy (with right of survivorship) or tenancy in common. A joint tenancy (with right of survivorship) is a form of ownership by 2 or more persons in which each person owns the whole asset. Real property held in joint tenancy is usually identified as such on the deed.