Ladybird Deed Illinois With No Beneficiary Named

Description

Form popularity

FAQ

What Is the Difference Between TOD and Beneficiary? A transfer on death is an instrument that transfers ownership of specific accounts and assets to someone. A beneficiary is someone that is named to receive something of value.

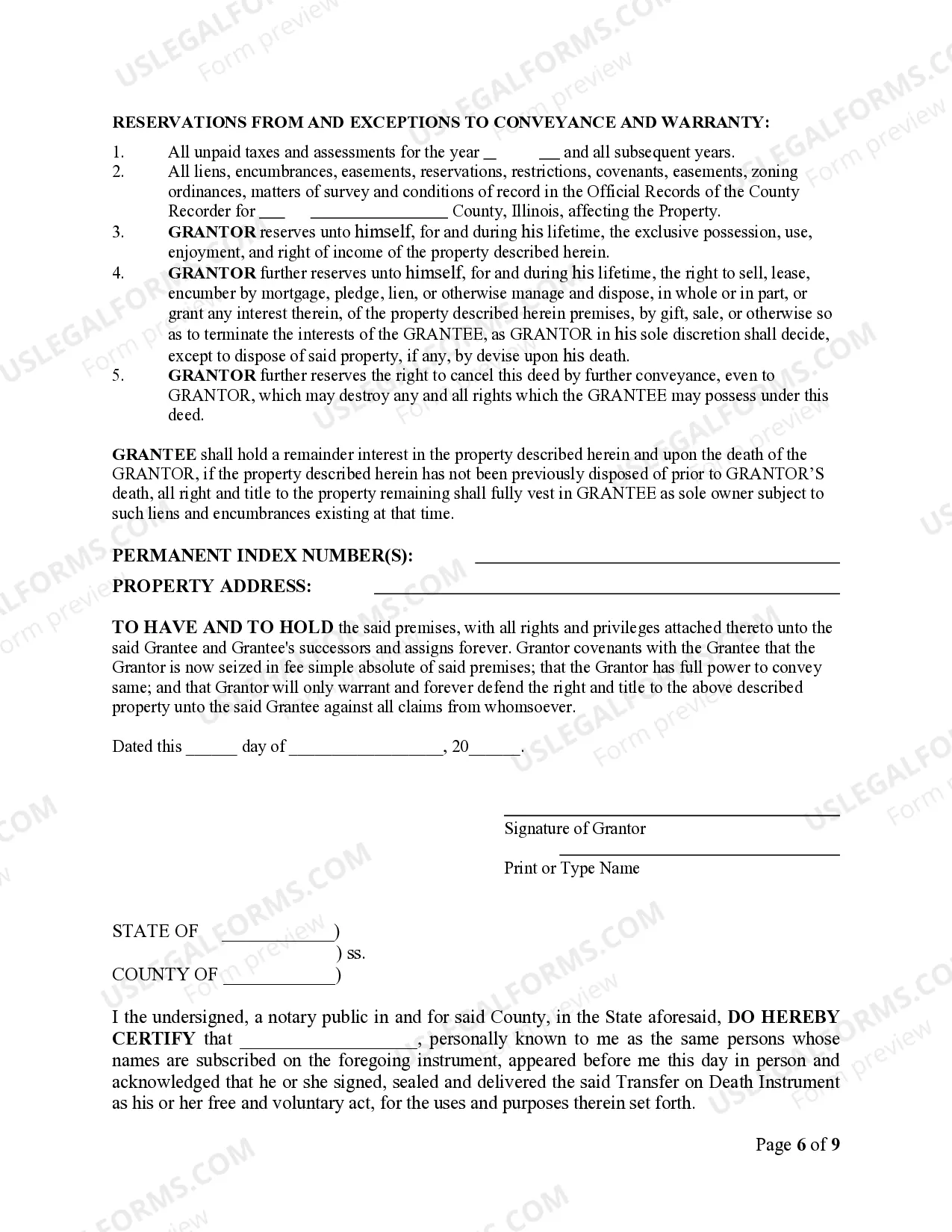

You and two witnesses must sign the TOD instrument while in the presence of a notary public, and then record (file) the document with the county recorder of deeds before your death. (See "Finalizing the Document.") Otherwise, it won't be valid. You can make an Illinois transfer on death instrument with WillMaker.

Types of Intestate Heirs and Their Inheritance Rights in Illinois. Key Takeaways: A spouse and children are given priority in inheritance. Parents, siblings, nieces, and nephews only inherit if closer relatives do not exist.

Lifetime Gift One way to avoid probate is to simply give property away during your lifetime. Because a gift of property removes it from your probate estate, there is no need to probate the property when you die. An Illinois quit claim deed can be used to give property to your family or loved ones during your lifetime.

Who Gets What in Illinois? If you die with:here's what happens:spouse but no descendantsspouse inherits everythingspouse and descendantsspouse inherits 1/2 of your intestate property descendants inherit 1/2 of your intestate propertyparents but no spouse, descendants, or siblingsparents inherit everything3 more rows