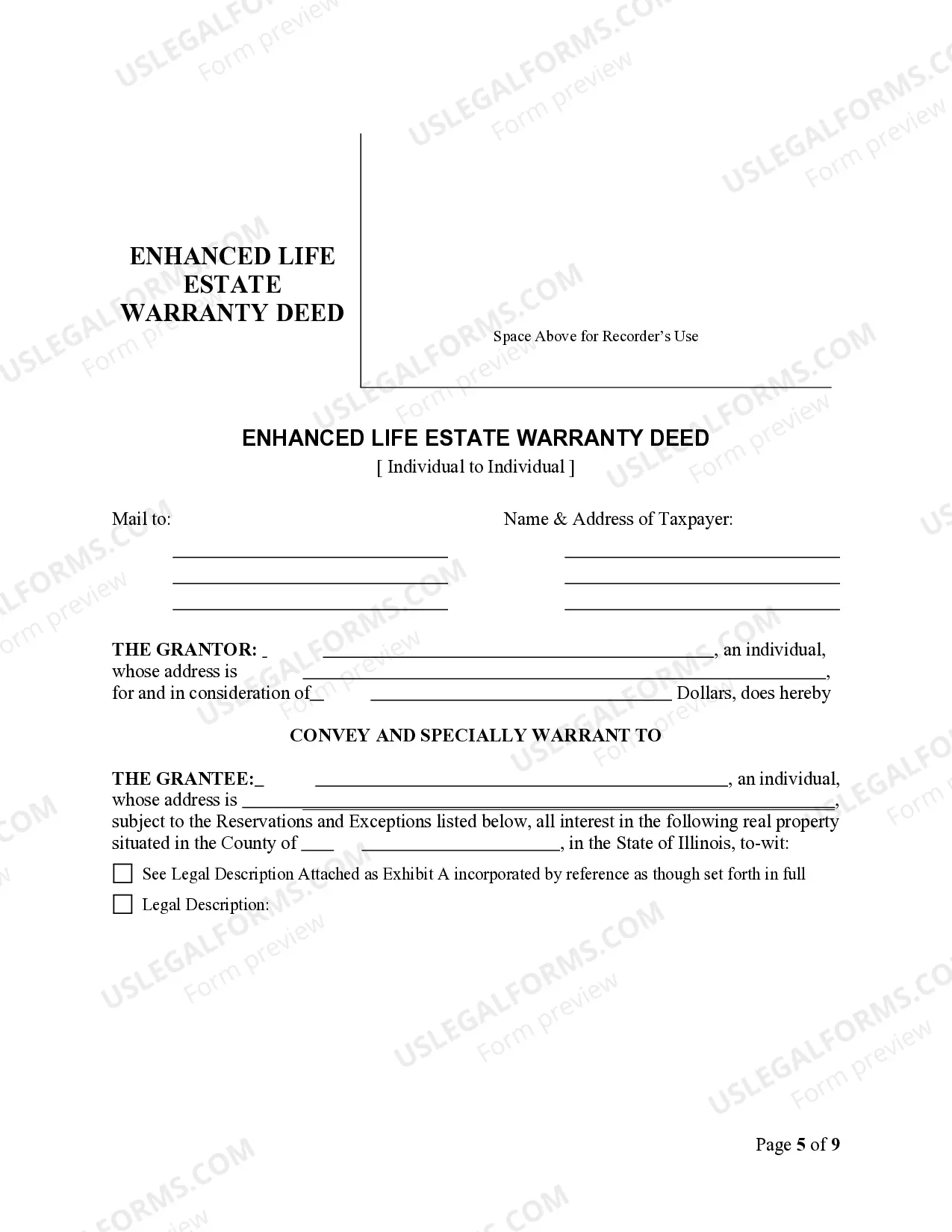

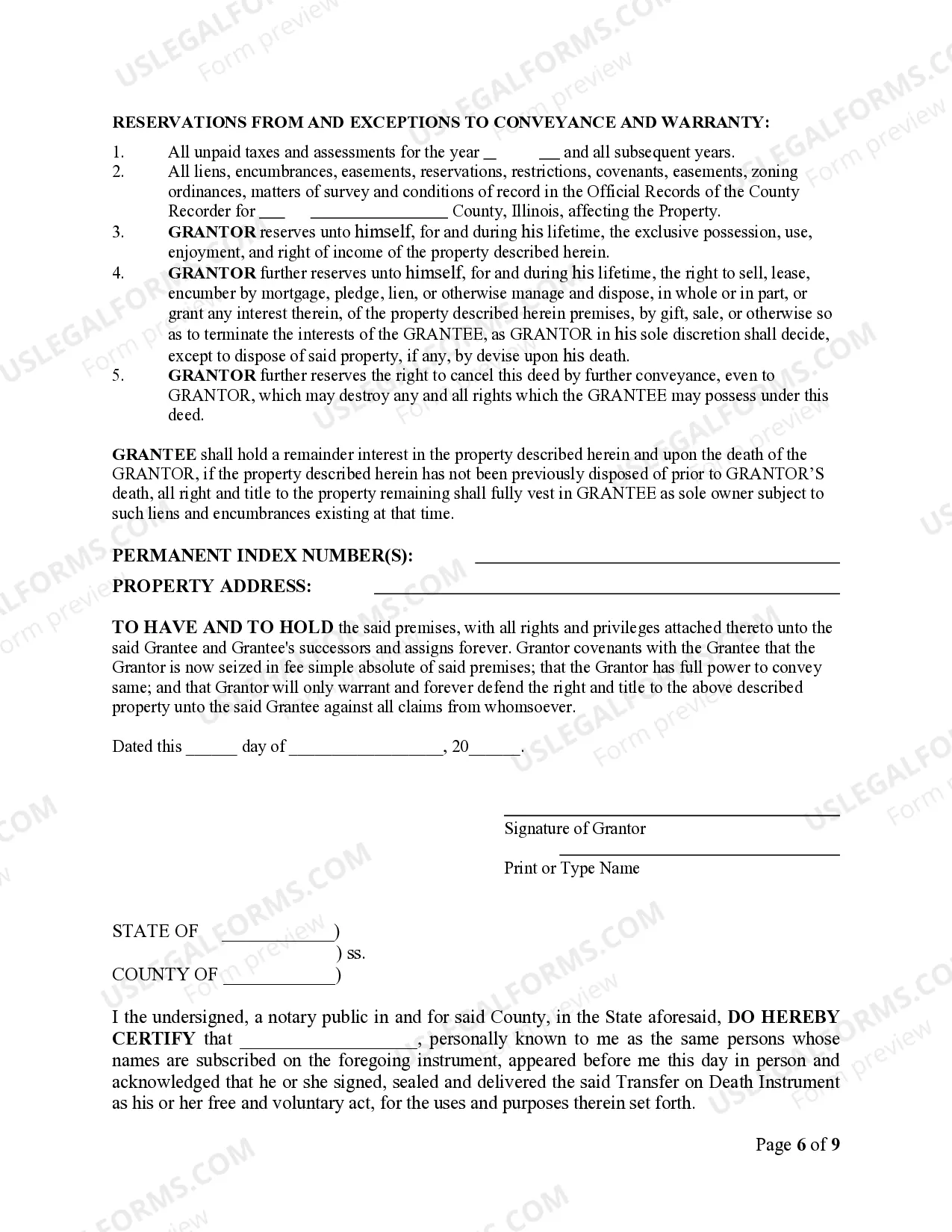

This form is a Warranty Deed with a retained Enhanced Life Estate where the Grantor is an individual and the Grantee is an individual. This form is also known as a "Lady Bird" Deed. Grantor conveys the property to Grantee subject to an enhanced retained life estate. The Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

Illinois Deed Of Trust Or Mortgage

Description

How to fill out Illinois Lady Bird Or Enhanced Life Estate Deed - Individual To Individual?

Finding a go-to place to take the most recent and appropriate legal templates is half the struggle of handling bureaucracy. Discovering the right legal documents demands precision and attention to detail, which is why it is very important to take samples of Illinois Deed Of Trust Or Mortgage only from reliable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have little to worry about. You may access and see all the details regarding the document’s use and relevance for your situation and in your state or region.

Take the listed steps to complete your Illinois Deed Of Trust Or Mortgage:

- Utilize the library navigation or search field to find your sample.

- Open the form’s description to see if it suits the requirements of your state and county.

- Open the form preview, if available, to ensure the template is the one you are searching for.

- Go back to the search and look for the appropriate template if the Illinois Deed Of Trust Or Mortgage does not fit your needs.

- When you are positive regarding the form’s relevance, download it.

- If you are a registered customer, click Log in to authenticate and access your picked forms in My Forms.

- If you do not have a profile yet, click Buy now to get the template.

- Pick the pricing plan that fits your needs.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by choosing a transaction method (bank card or PayPal).

- Pick the document format for downloading Illinois Deed Of Trust Or Mortgage.

- When you have the form on your gadget, you can modify it using the editor or print it and finish it manually.

Get rid of the headache that accompanies your legal documentation. Check out the comprehensive US Legal Forms collection to find legal templates, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

For a property deed transfer by quitclaim in Illinois, you must use the form that's used in the county where the property is located. If the property is located in a county other than the one in which you live, call the County Recorder of Deeds in the other county to determine the proper quitclaim deed form to use.

Illinois allows the use of both a deed of trust and a mortgage. Illinois is a lien-theory state. Mortgages are considered to be liens against the property and the vast majority of the liens in Illinois are mortgages.

The primary method for transferring Illinois real estate is for the current owner to create and record a deed. An Illinois deed transfers property from one or more current owners (grantors) to one or more new owners (grantees).