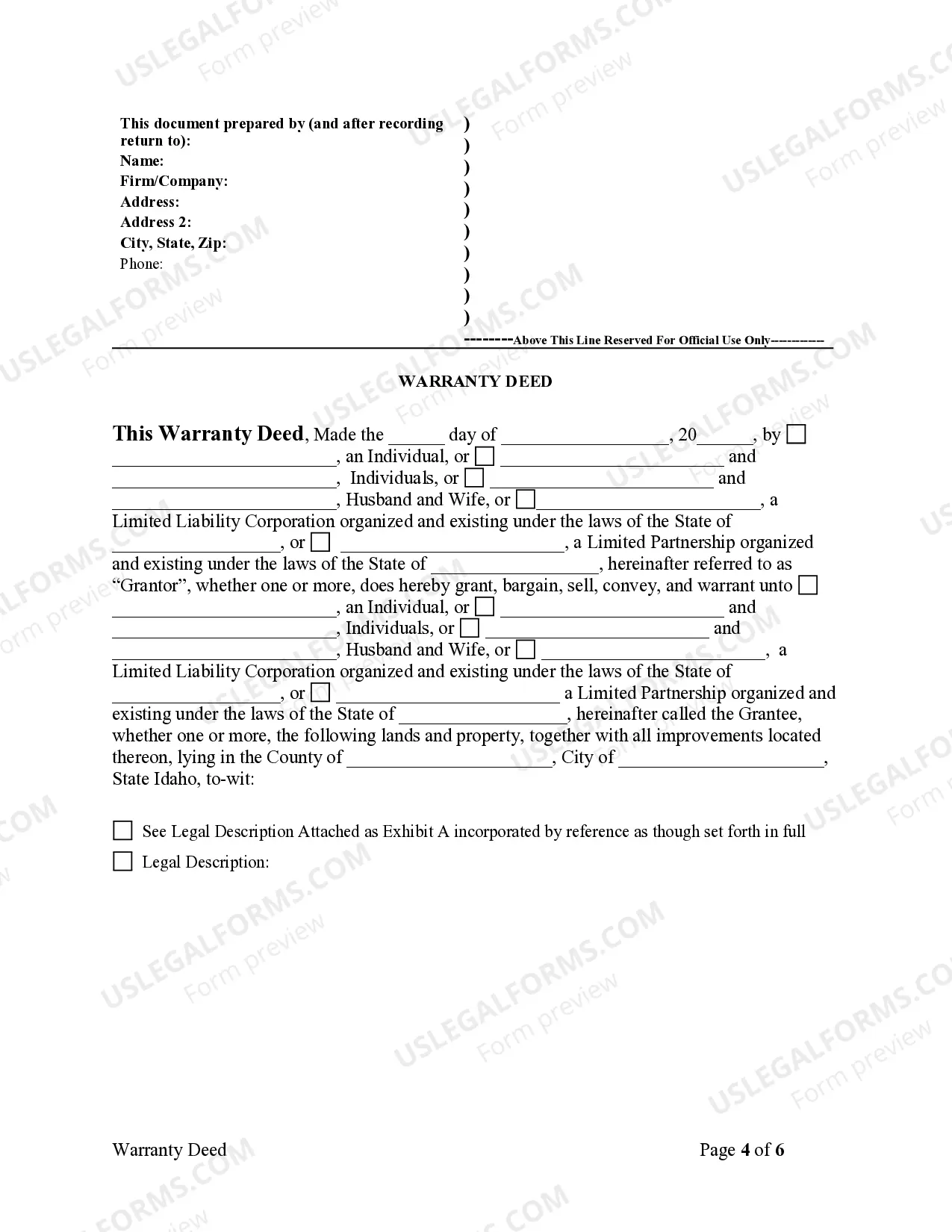

This form is a Warranty Deed where the grantor and/or grantee could be a limited partnership or LLC.

Limited Liability Company With One Member

Description

How to fill out Idaho Warranty Deed From Limited Partnership Or LLC Is The Grantor, Or Grantee?

- Start by logging into your US Legal Forms account. If you've not registered yet, create an account to access their extensive library.

- Review the available forms by selecting the preview mode to find the one that specifically addresses a Limited liability company with one member. Verify its alignment with your local jurisdiction.

- If the initial template does not fit your requirements, utilize the search function to locate another suitable form.

- Once you've found the appropriate document, click the 'Buy Now' button to choose a subscription plan that works for you.

- Proceed to payment by entering your credit card information or opting to pay through PayPal.

- Finally, download your completed form to your device and find it in the 'My Documents' section of your profile for future reference.

In conclusion, US Legal Forms simplifies the process of establishing a Limited Liability Company with one member by providing users with a robust library of resources and support. With their user-friendly platform, you can ensure that your documents are both accurate and compliant.

Don't wait—begin your journey towards formalizing your business today with US Legal Forms!

Form popularity

FAQ

Filling out a W-9 form for a limited liability company with one member is straightforward. Start by entering your LLC's name as the business name. In the 'Tax Classification' section, select 'Limited Liability Company' and write 'S' next to it to indicate that it's a single-member LLC. Make sure to provide your Taxpayer Identification Number, which could be your Social Security Number if you haven't obtained an Employer Identification Number yet. Finally, sign and date the form to validate it for businesses or banks requesting it.

Being a limited liability company with one member can be a great choice for many entrepreneurs. It offers flexibility in management, ease of setup, and liability protection. However, each individual’s situation is unique, so it’s essential to consider your business goals and consult resources like USLegalForms for tailored guidance.

member LLC can write off various business expenses, which can significantly reduce taxable income. Common deductions include costs for business supplies, travel, and home office expenses, among others. Keeping accurate records of these expenses is essential in maximizing your tax benefits as a limited liability company with one member.

A limited liability company with one member enjoys several tax advantages. For example, the Internal Revenue Service considers a single-member LLC a disregarded entity, meaning the owner reports business income directly on their personal tax return. This approach simplifies tax filing and can lead to potential savings compared to other business structures.

Yes, a limited liability company with one member is known as a single-member LLC. This structure allows one individual to own and operate the business while still enjoying the liability protections that an LLC offers. It’s a popular choice for solo entrepreneurs who wish to keep their personal assets separate from their business liabilities.

Yes, hiring contractors is a feasible option for a limited liability company with one member. This flexibility allows you to bring in specialized skills without the full commitment of hiring employees. Just ensure that you have clear agreements in place outlining the terms of the contractor's work. Our platform, uslegalforms, can provide templates for contracts that help protect both your interests and those of your contractors.

Adding an employee to a limited liability company with one member involves several steps, such as updating your payroll system and filing necessary tax forms. You will need to ensure compliance with federal and state employment regulations. To simplify this process, consider exploring uslegalforms for helpful templates and resources that cover hiring practices.

Yes, you can hire someone as a single-member LLC. This allows you to delegate tasks and expand your capabilities. When hiring, ensure that you understand your obligations as an employer regarding taxes and benefits. Using resources from uslegalforms can help you navigate the hiring process smoothly.

Absolutely, a single-member LLC can hire employees, allowing you to manage your workload more effectively. You will need to handle payroll, taxes, and compliance with employment laws like any other employer. This flexibility can significantly enhance your business operations. Get started with uslegalforms to find the right tools for managing your hiring process.

To set up a limited liability company with one member, you need to file your articles of organization with the state where you plan to operate your business. You'll also want to create an operating agreement to outline the management and operational procedures. Our platform, uslegalforms, can streamline this process by providing the necessary templates and guidance to ensure compliance with state laws.