Limited Power Of Attorney Withdrawal

Description

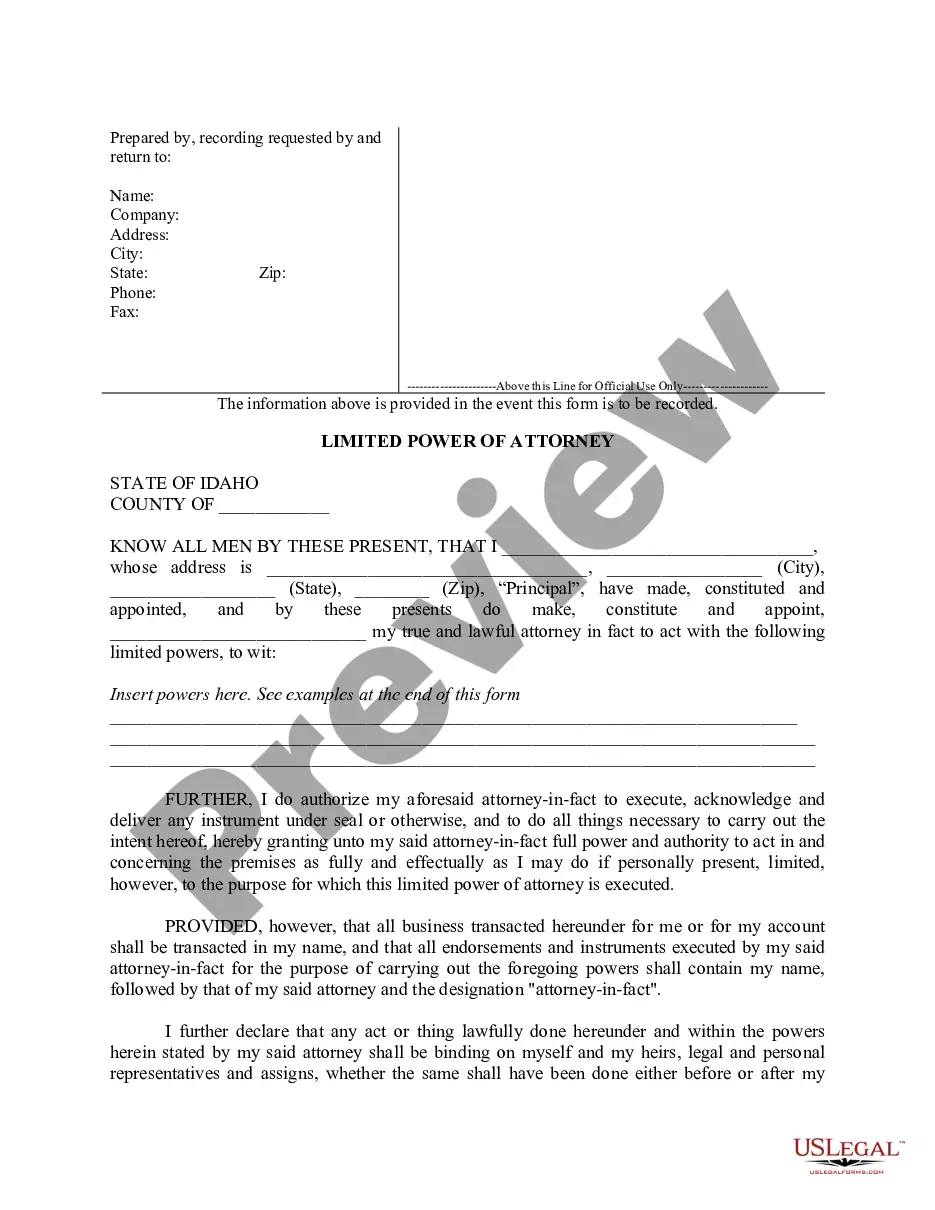

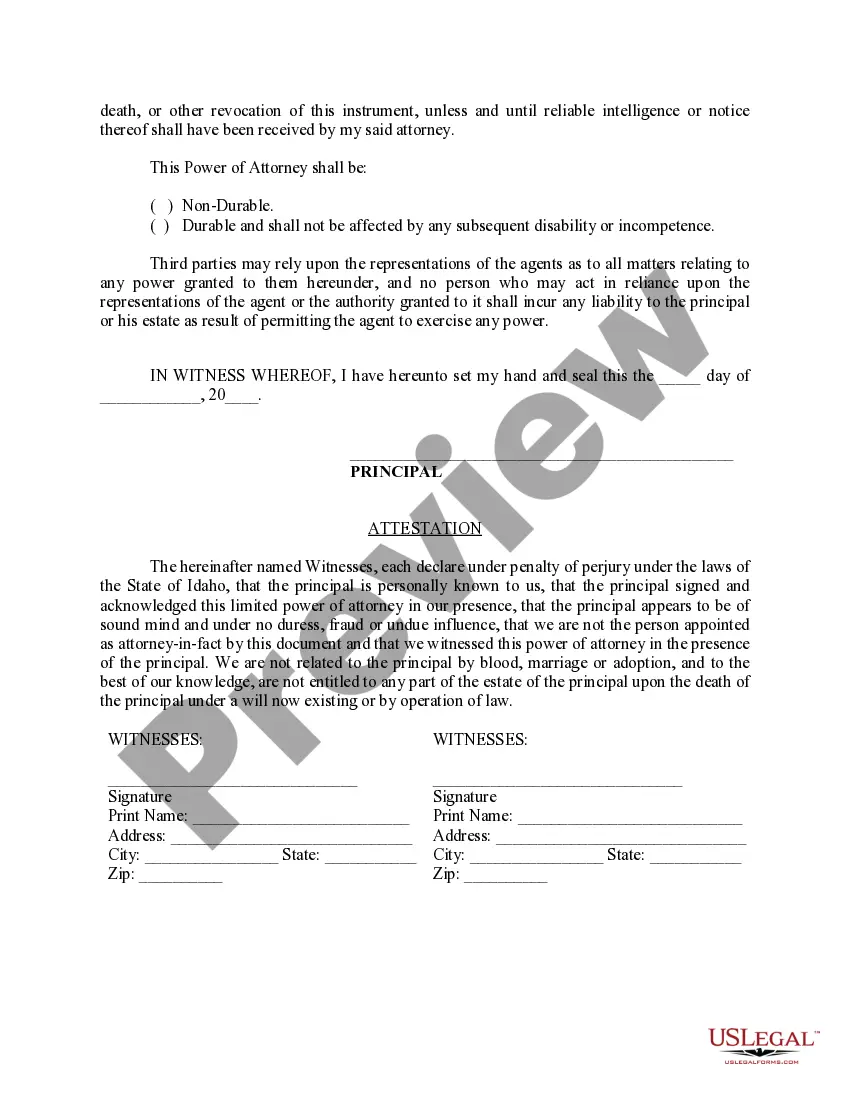

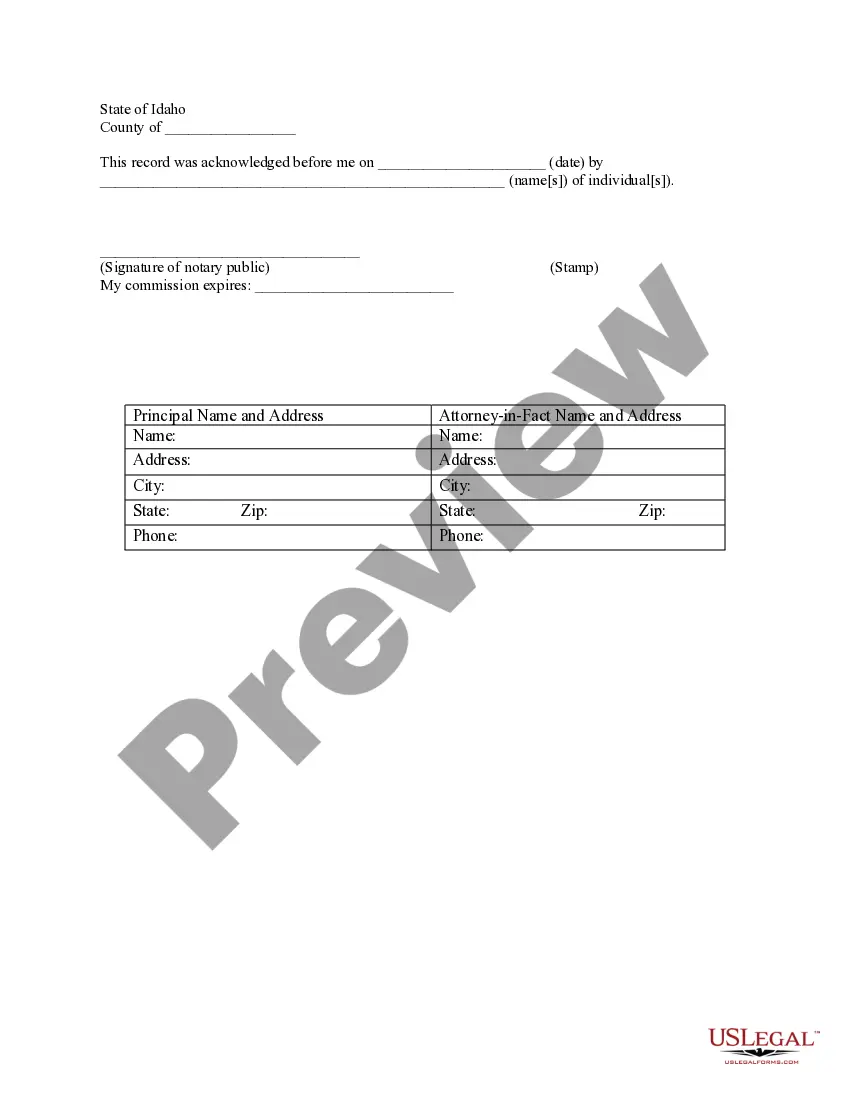

How to fill out Idaho Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

Individuals typically link legal documentation with something complicated that only an expert can handle.

In a specific manner, this is accurate, as creating Limited Power Of Attorney Withdrawal requires significant knowledge in subject matter, including state and municipal statutes.

However, with US Legal Forms, processes have become simpler: pre-prepared legal documents for any personal and business scenario tailored to state regulations are compiled in a unified online repository and are now accessible to all.

All templates in our library are reusable: once obtained, they remain saved in your profile. You can access them whenever required via the My documents tab. Explore all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- Examine the page content carefully to ensure it aligns with your requirements.

- Review the form description or verify it through the Preview function.

- Search for another document using the Search bar above if the previous one does not meet your criteria.

- Click Buy Now once you locate the correct Limited Power Of Attorney Withdrawal.

- Select the pricing plan that fits your needs and financial considerations.

- Establish an account or Log In to advance to the payment page.

- Compensate for your subscription using PayPal or a credit card.

- Choose the format for your document and click Download.

- Print your document or upload it to an online editor for a faster fill-out.

Form popularity

FAQ

If you want to revoke a previously executed power of attorney and do not want to name a new representative, you must write REVOKE across the top of the first page with a current signature and date below this annotation.

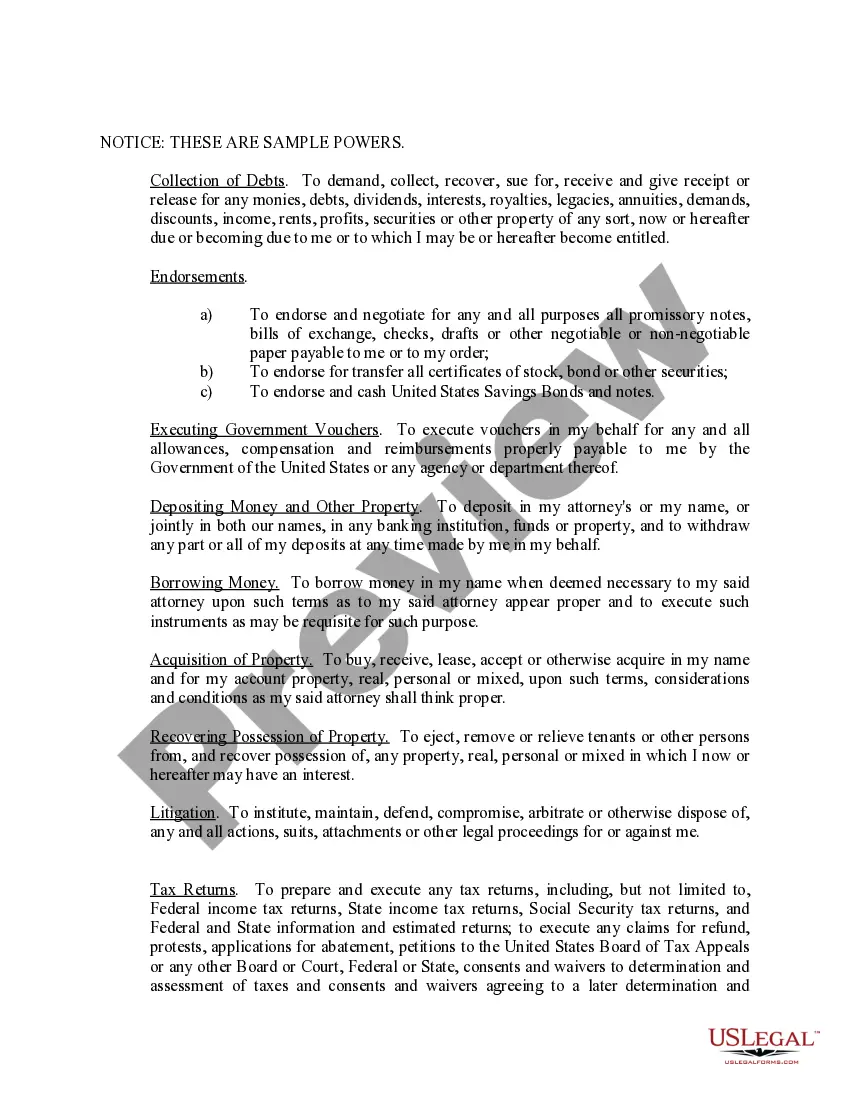

Form 8821 is a taxpayer's written authorization designating a third party to receive and view the taxpayer's information. The taxpayer and the tax professional must sign Form 2848. If the tax professional uses the new online option, the signatures on the forms can be handwritten or electronic.

Form 8821 authorizes the IRS to disclose your confidential tax information to the person you designate. This form is provided for your convenience and its use is voluntary. The information is used by the IRS to determine what confidential tax information your designee can inspect and/or receive.

Use: Form 2848, Power of Attorney and Declaration of Representative PDF when you want to authorize an individual to represent you before the IRS, or. Form 8821, Tax Information Authorization PDF, when you want to name an individual to inspect confidential tax return information related to the bond issuance.

Withdrawing Form 2848 or 8821 Authorization Practitioners may withdraw an authorization at any time. To do so, they must write "WITHDRAW" across the top of the first page of the Form 2848 or 8821 with a current signature and date below the annotation.