Living Trist

Description

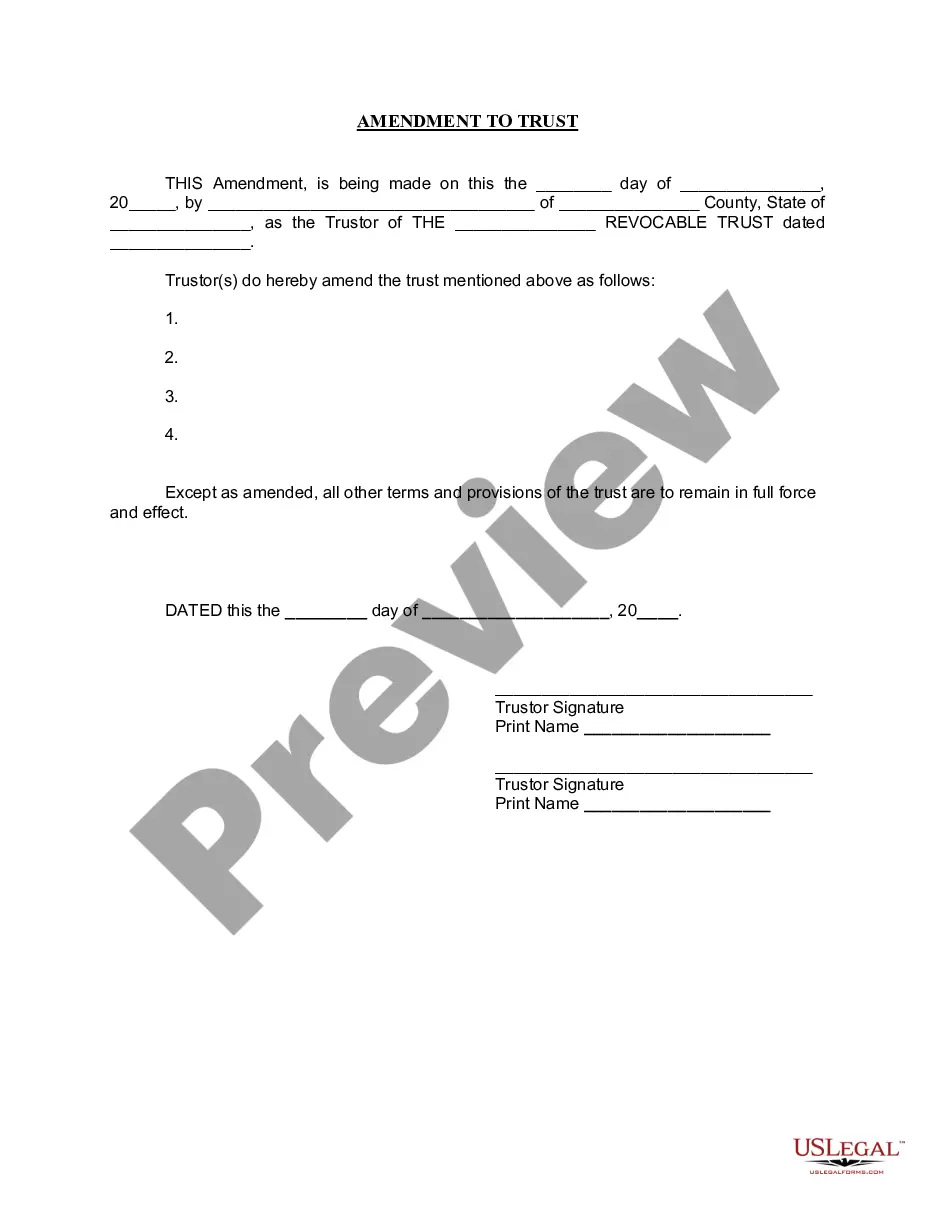

How to fill out Idaho Amendment To Living Trust?

- If you're a returning user, simply log in to your account and download the necessary form template directly to your device using the Download button. Ensure your subscription is active or renew it if necessary.

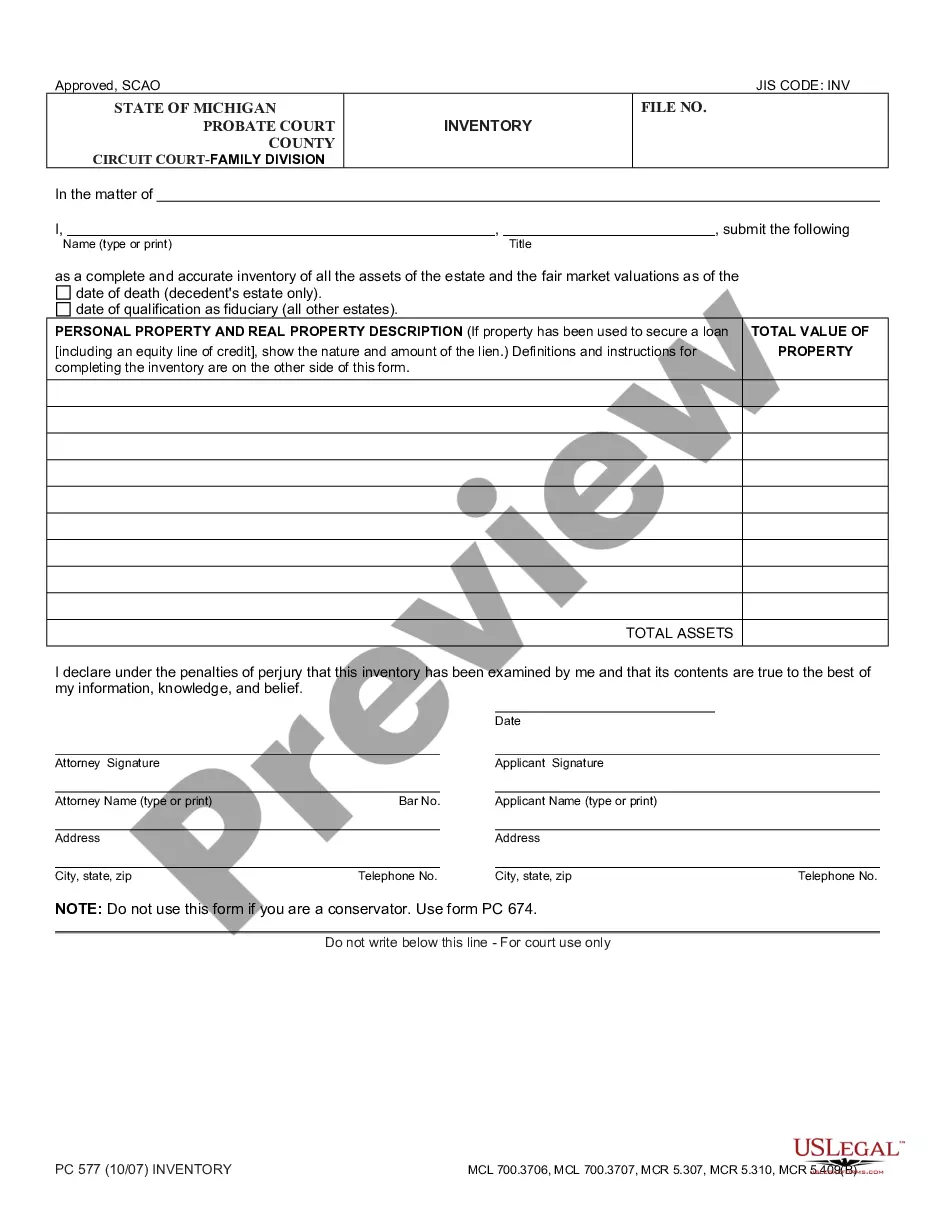

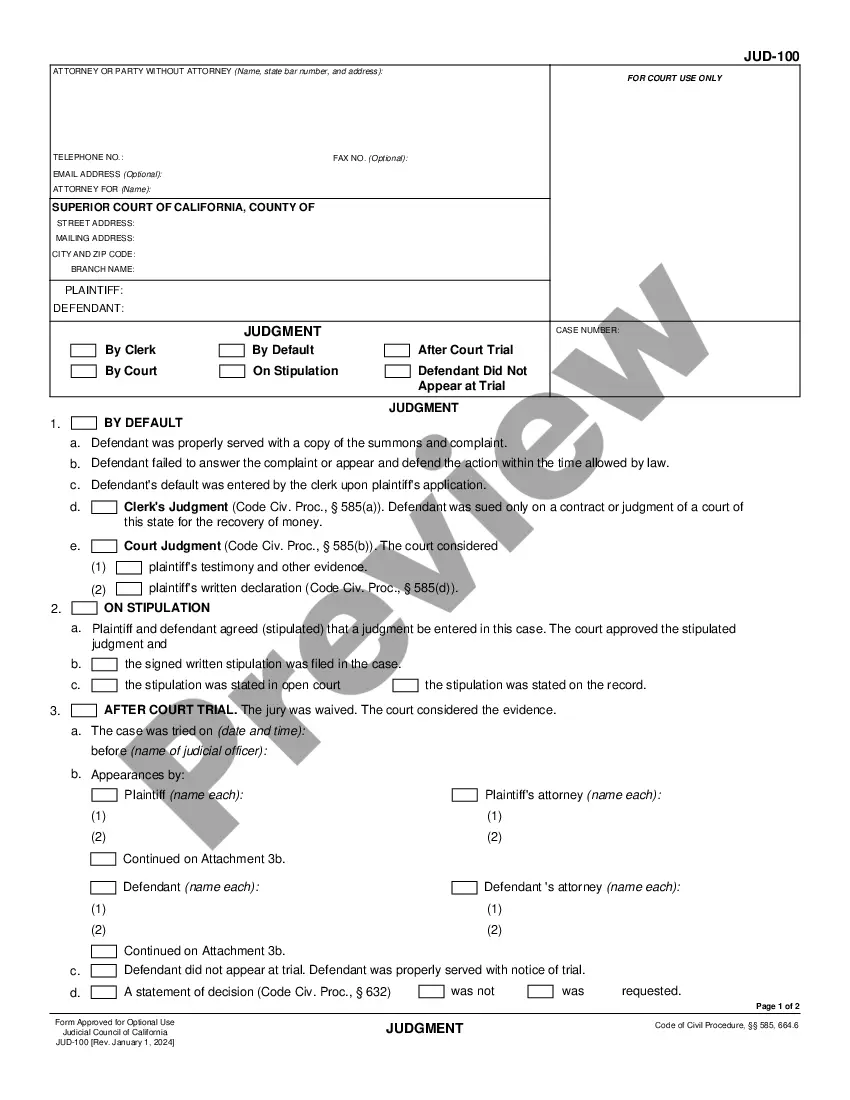

- If you’re new to the service, start by checking the Preview mode and reviewing the form description to confirm it meets your requirements and local jurisdiction.

- Use the Search tab to locate another template if you encounter any inconsistencies or if your needs change. Ensure the new form is appropriate before proceeding.

- Purchase your selected document by clicking on the Buy Now button, where you can also choose a suitable subscription plan. You'll need to create an account for full access.

- Finalize your purchase by providing your payment details, either using a credit card or PayPal to pay for your subscription.

- Download your completed form and store it on your device. You can also access it anytime via the My Forms section in your profile.

By following these steps, you can efficiently secure your legal documents with US Legal Forms and enjoy their robust collection and expert assistance.

Experience the ease of securing your legal forms today—start your journey with US Legal Forms!

Form popularity

FAQ

Filling a living trust involves several steps to ensure it meets your specific needs. Begin by selecting a trustee, who will manage the trust assets after your passing. Next, you will need to list the assets you wish to place into the trust, including real estate, bank accounts, and personal belongings. Lastly, you can benefit from using USLegalForms, where you will find easy-to-follow templates and guides to help you complete your living trust accurately.

The best way to set up a living trust involves several key steps. First, clearly define your assets and determine how you want them allocated. Next, consult with a legal professional or use platforms like USLegalForms to draft the trust document correctly. Finally, be sure to transfer ownership of your assets to the living trust to ensure they are covered according to your wishes.

One of the biggest mistakes parents often make when setting up a living trust is failing to adequately fund it. Many assume that simply creating the trust is enough, but assets must be transferred into the trust for it to work effectively. Additionally, some overlook detailing how the assets will be managed or distributed, which can lead to confusion. Ensuring that your living trust is properly funded is essential for smooth estate management.

While a living trust offers many benefits, there are some downsides to consider. Setting up a living trust can require time and effort, as you need to transfer ownership of your assets into the trust. Additionally, it may not provide the same tax benefits as other estate planning tools. However, the long-term benefits of avoiding probate and ensuring that your wishes are carried out can outweigh these initial challenges. For tailored assistance, check out US Legal Forms to create a living trust that suits your needs.

The most common form of trust is the living trust, which allows you to manage your assets during your lifetime and ensures a smooth transition after your death. Living trusts can be revocable, meaning you can change them, or irrevocable, meaning they cannot be altered once established. They help to avoid probate, making the distribution of your assets more efficient. Using a living trust can simplify your estate planning, and US Legal Forms has the resources you need to create one.

The main types of trusts are living trusts, testamentary trusts, and special needs trusts. Living trusts can be revocable or irrevocable, providing flexibility in managing your assets while you are alive. Testamentary trusts become effective after your death and are part of your will. Special needs trusts are designed to benefit individuals with disabilities without jeopardizing their eligibility for government benefits.

The three types of trusts include revocable trusts, irrevocable trusts, and testamentary trusts. Each type serves distinct purposes and offers various advantages depending on your financial goals. Revocable trusts allow you to maintain control during your lifetime, while irrevocable trusts offer greater protection against creditors. Understanding these types can help you choose the right living trust for your needs.

An irrevocable trust is typically established by a grantor, who transfers assets into the trust but relinquishes control over those assets. After the trust is created, the grantor cannot alter its terms or retrieve the assets. This ownership structure provides certain benefits, like asset protection and reduced estate taxes. If you are considering setting up an irrevocable trust, the US Legal Forms platform can guide you through the process seamlessly.

Yes, you can put your house in a trust in Pennsylvania. A living trust can help you manage your real estate while providing ease of distribution upon your death. To set up a living trust in PA, you may want to consult resources like UsLegalForms, which offers guidance and templates to simplify the process. Establishing a trust can be an effective way to safeguard your home for your beneficiaries.

The main purpose of a living trust is to manage your assets during your lifetime and distribute them after your passing. A living trust allows for smooth transitions of ownership, which can save your loved ones from the lengthy probate process. Moreover, it provides privacy regarding your estate, as it does not go through public probate. By utilizing a living trust, you gain control over your assets while ensuring your wishes are met.