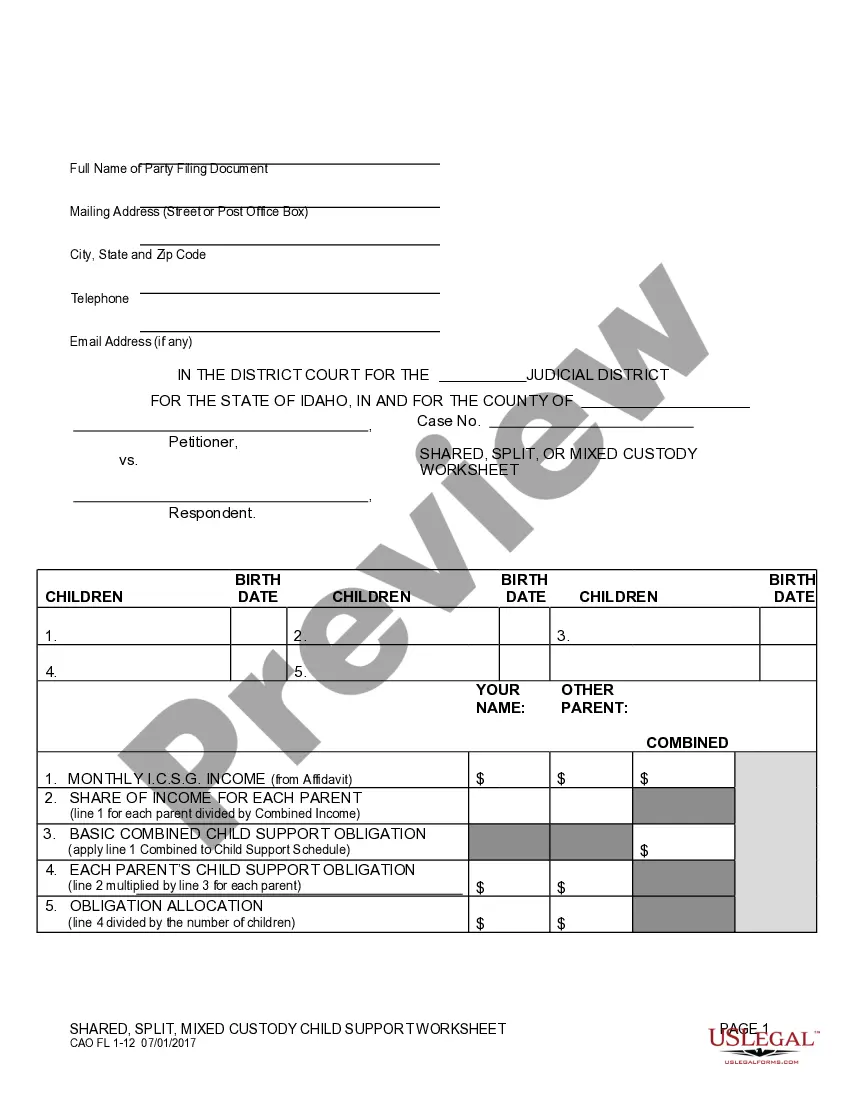

This is a Child Support Worksheet to be used by those parents where one has sole custody of their child or children. It is used in conjunction with the financial information supplied in the Child Support Affidavit in order to arrive at a correct amount of child support to be paid by the non-custodial parent.

Idaho Child Support Withholding Limits

Description

How to fill out Idaho Child Support Worksheet For Sole Custody?

Finding a go-to place to access the most recent and relevant legal samples is half the struggle of handling bureaucracy. Finding the right legal papers requirements accuracy and attention to detail, which is why it is vital to take samples of Idaho Child Support Withholding Limits only from trustworthy sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You may access and view all the details regarding the document’s use and relevance for the situation and in your state or county.

Consider the following steps to finish your Idaho Child Support Withholding Limits:

- Use the library navigation or search field to find your template.

- View the form’s description to ascertain if it suits the requirements of your state and region.

- View the form preview, if available, to make sure the form is definitely the one you are interested in.

- Return to the search and find the correct template if the Idaho Child Support Withholding Limits does not match your requirements.

- When you are positive regarding the form’s relevance, download it.

- If you are a registered user, click Log in to authenticate and gain access to your selected templates in My Forms.

- If you do not have an account yet, click Buy now to get the template.

- Pick the pricing plan that suits your preferences.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by selecting a transaction method (credit card or PayPal).

- Pick the document format for downloading Idaho Child Support Withholding Limits.

- When you have the form on your gadget, you may change it with the editor or print it and complete it manually.

Eliminate the hassle that comes with your legal documentation. Explore the extensive US Legal Forms catalog to find legal samples, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

Child support is meant to provide minor children with necessary food, clothing, healthcare, education and shelter. If you aren't able to reach an agreement on child support, you will an Idaho Falls family law attorney represent you at court and request that a judge decide for you.

Idaho's Statute of Limitations on Back Child Support Payments (Arrears) Idaho's statute of limitations for child support arrears is 5 years from the child's emancipation or reaching the age of majority.

Both parents share legal responsibility for supporting their child. That legal responsibility should be divided in proportion to their Guidelines Income, whether they be separated, divorced, remarried, or never married.

Child support obligations in Idaho are calculated using the Income Shares Model. The idea is to estimate the amount of support that the children would have received if the marriage hadn't failed. This support amount is then divided between the parents in proportion to their respective incomes.

5-245. Actions to collect child support arrearages. An action or proceeding to collect child support arrearages must be commenced within five (5) years after the child reaches the age of majority or within five (5) years after the child's death, if death occurs before the child reaches majority.