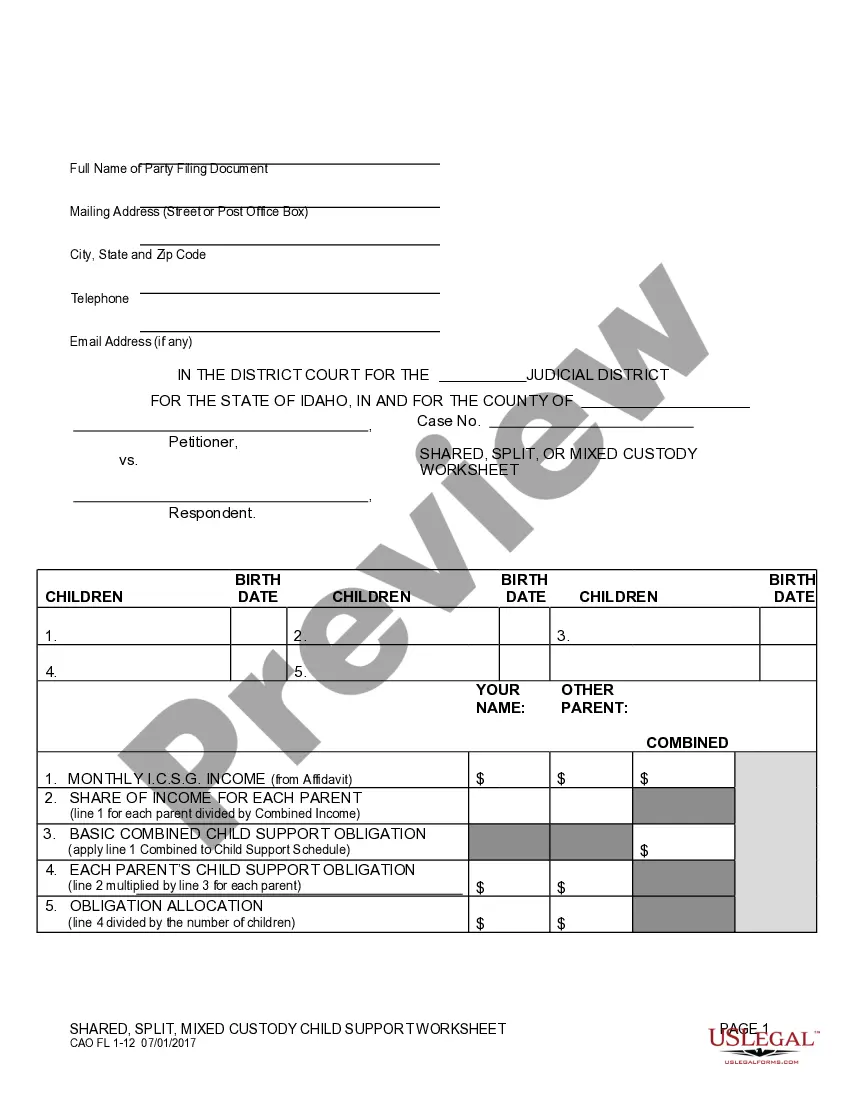

This is a Child Support Worksheet to be used by those parents where one has sole custody of their child or children. It is used in conjunction with the financial information supplied in the Child Support Affidavit in order to arrive at a correct amount of child support to be paid by the non-custodial parent.

Idaho Child Support Calculation Worksheet Form 14

Description

How to fill out Idaho Child Support Worksheet For Sole Custody?

Making your way through the red tape of official documents and templates can be challenging, particularly when one does not engage in that professionally.

Even locating the correct template to acquire a Idaho Child Support Calculation Worksheet Form 14 will be labor-intensive, as it should be valid and precise to the last digit.

However, you will need to invest significantly less time selecting a suitable template from a source you can trust.

Obtain the correct form in a few straightforward steps: Enter the document name in the search area. Select the appropriate Idaho Child Support Calculation Worksheet Form 14 from the results list. Review the description of the sample or view its preview. If the template fits your requirements, click Buy Now. Proceed to choose your subscription plan. Use your email and create a secure password to register an account at US Legal Forms. Choose a credit card or PayPal payment method. Save the template file on your device in your preferred format. US Legal Forms can conserve you much time verifying whether the form you encountered online is suitable for your needs. Create an account and gain unlimited access to all the templates you require.

- US Legal Forms is a platform that streamlines the process of searching for the appropriate forms online.

- US Legal Forms is the sole location one needs to find the latest samples of documents, verify their usage, and download these samples for completion.

- It is a repository with over 85K forms that pertain to various occupational fields.

- When seeking a Idaho Child Support Calculation Worksheet Form 14, you won't have to question its authenticity as all forms are verified.

- An account at US Legal Forms will guarantee you have all the required samples within your reach.

- Store them in your history or add them to the My documents catalog.

- You can access your saved forms from any device by clicking Log In on the library site.

- If you still do not possess an account, you can always search for the template you need.

Form popularity

FAQ

Filing for child support in Idaho starts with gathering important documents regarding income and expenses. After you have all necessary information, fill out the required forms, including the Idaho child support calculation worksheet form 14. This worksheet helps you calculate the amount of support needed based on your children's needs and parents' incomes. Finally, submit your completed forms to your local court, and don't hesitate to reach out to platforms like US Legal Forms for assistance in this process.

Filing for child support involves several steps to ensure everything is done correctly. Begin by compiling necessary documents and financial information, as this will support your case. Completing the Idaho child support calculation worksheet form 14 accurately can guide you through determining the right amount to request. Additionally, you can use platforms like US Legal Forms to simplify the filing process and ensure compliance with Idaho laws.

When deciding whether to file for child support or custody first, consider your situation carefully. If you need financial assistance quickly, you might prioritize filing for child support. However, establishing custody arrangements is equally important, especially if you seek legal rights to make decisions for your child. Using the Idaho child support calculation worksheet form 14 can help outline financial contributions clearly in your custody discussions.

Child support costs can differ widely by state, with some states imposing higher obligations than others. According to various studies, states like Massachusetts and New York tend to have some of the highest child support costs. Evaluating these expenses against the Idaho child support calculation worksheet form 14 can provide clarity on how Idaho compares to these states. By understanding these differences, you can make informed decisions regarding your child support responsibilities.

The maximum that can be deducted for child support from your paycheck in Idaho varies based on your financial obligations. Generally, it can range from 50% of disposable income for those supporting another household to 60% for others. The Idaho child support calculation worksheet form 14 is instrumental in determining these specific amounts and ensuring compliance with the law. By using this worksheet, you can stay informed about your financial responsibilities.

Idaho law mandates that child support payments are determined using specific guidelines, primarily outlined in the Idaho child support calculation worksheet form 14. This law aims to ensure that support is fair and reflective of both parents' financial situations. Additionally, Idaho law allows for modifications when circumstances change, ensuring that the child's needs remain a priority. Understanding these laws can help parents navigate their obligations more effectively.

To write a letter requesting a modification of child support, clearly state your reasons for the change and include any relevant financial information. Ensure you reference the Idaho child support calculation worksheet form 14 to support your case with concrete numbers and considerations. It's crucial to present your request professionally and to allow sufficient time for the court to review your situation. This systematic approach can enhance the likelihood of a successful modification.

In Idaho, the amount deducted for child support from your paycheck depends on your income and financial obligations. Typically, the deductions can reach up to 50% or 60% of your disposable income, depending on your circumstances. To get the specific numbers and calculations, you can refer to the Idaho child support calculation worksheet form 14. This form serves as a vital tool in understanding how much will be taken from your paycheck.

Child support in Idaho is primarily determined using the Idaho child support calculation worksheet form 14. This worksheet considers both parents' income, necessary expenses, and any extraordinary costs associated with raising the child, such as health care and education. The court aims to establish a fair support amount that reflects the child's needs and the parents' financial situations. By following the worksheet guidelines, you can navigate the process more effectively.

In Idaho, the courts can garnish wages for child support based on federal and state laws. The maximum allowed is generally up to 50% of disposable income for individuals who support another household and up to 60% for those who do not. It is also essential to complete the Idaho child support calculation worksheet form 14 to determine a fair payment amount. Understanding these details can ensure that you remain compliant while supporting your child.