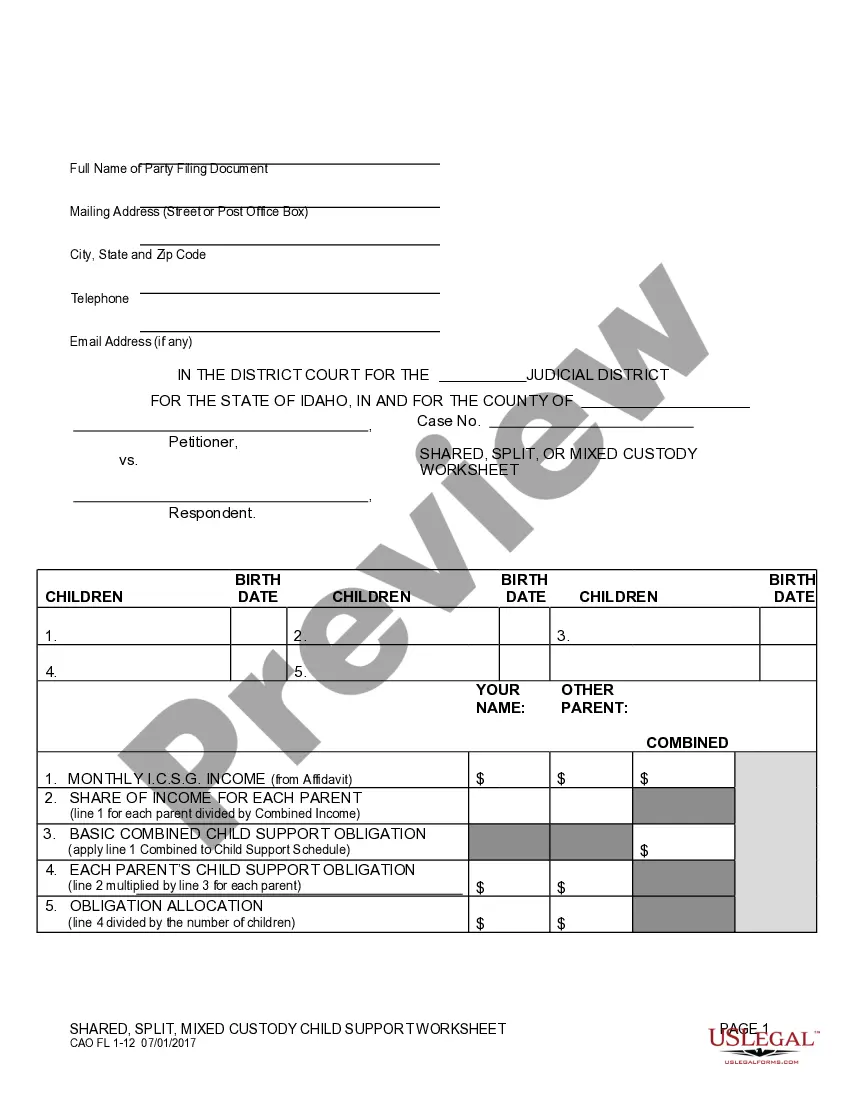

This is a Child Support Worksheet to be used by those parents where one has sole custody of their child or children. It is used in conjunction with the financial information supplied in the Child Support Affidavit in order to arrive at a correct amount of child support to be paid by the non-custodial parent.

Idaho Child Support Calculation Worksheet Form

Description

How to fill out Idaho Child Support Worksheet For Sole Custody?

Steering through the red tape of official documents and formats can be challenging, particularly if one does not engage in that professionally.

Even selecting the correct format for the Idaho Child Support Calculation Worksheet Form will be labor-intensive, as it must be accurate and precise to the final digit.

However, you will significantly reduce the time required to find a fitting template if it originates from a reliable source.

Acquire the correct form in a few straightforward steps: Input the document title in the search box, find the suitable Idaho Child Support Calculation Worksheet Form in the results, review the description of the sample or view its preview, if the template fits your requirements, click Buy Now, proceed to choose your subscription plan, use your email and create a password to register an account at US Legal Forms, select either a credit card or PayPal payment method, and save the template document to your device in your preferred format. US Legal Forms can save you significant time verifying whether the form you found online fulfills your needs. Establish an account and gain unrestricted access to all the templates you require.

- US Legal Forms is a service that streamlines the task of locating the appropriate documents online.

- US Legal Forms serves as a sole destination for obtaining the latest document samples, consulting their application, and downloading these samples for completion.

- It boasts a repository of over 85,000 forms applicable to various sectors.

- When searching for an Idaho Child Support Calculation Worksheet Form, you won't have to doubt its authenticity since all forms are validated.

- Having an account with US Legal Forms guarantees that you have all the necessary samples readily accessible.

- You can store them in your history or add them to the My documents collection.

- Your saved documents can be accessed from any device by clicking Log In on the library webpage.

- If you still do not possess an account, you can always search for the required template.

Form popularity

FAQ

Filling out a check for child support is straightforward. Begin by writing the date at the top right corner, followed by the recipient's name on the payee line. Next, enter the dollar amount in numbers and then spell it out in words on the line below. Lastly, sign the check and keep a record of the transaction which can coincide with your Idaho child support calculation worksheet form for accurate tracking.

The primary factor in calculating child support involves the income of both parents. Courts often look at both parents' earnings, potential earnings, and any special circumstances that may affect financial capabilities. Additionally, the needs of the child, including health and education expenses, are also considered. Understanding the Idaho child support calculation worksheet form can help clarify how these factors influence your support obligations.

The best way to file for child support is to begin by completing the necessary forms accurately. You can gather your financial documents and use the Idaho child support calculation worksheet form to ensure you have a precise calculation. After preparing your forms, submit them to your local child support enforcement agency or family court. For ease and reliability, USLegalForms provides all the necessary resources to guide you.

A child support worksheet is a legal document used to calculate the amount of child support owed by one parent to another. It considers various factors, such as income, expenses, and the number of children involved. By accurately completing the form, parents can ensure fair support that meets their child's needs. The Idaho child support calculation worksheet form is a helpful tool provided by USLegalForms to simplify this process.

In North Carolina, the primary difference between worksheet A and B lies in their application. Worksheet A is used for parents with a simple income structure, while Worksheet B caters to those with complex financial situations, including multiple sources of income. Both worksheets help calculate child support obligations accurately in accordance with state guidelines. If you're navigating these forms, consider using the Idaho child support calculation worksheet form from USLegalForms for clarity.

Child support received by a parent is assumed to be spent on the child and is not income to the parent. (B) Overtime or Additional Income. Overtime pay or income from a second job is not included in gross income if the court finds: i.

Gross earnings: Gross earnings are established based on tax records and current pay stubs. Idaho law requires the use of both parents' incomes from the equivalent of one full-time job to determine a child support amount.

There shall be a rebuttable presumption that a minimum amount of support is at least $50.00 per month per child.

The court estimates that the cost of raising one child is $1,000 a month. The non-custodial parent's income is 66.6% of the parent's total combined income. Therefore, the non-custodial parent pays $666 per month in child support, or 66.6% of the total child support obligation.

Idaho, like some other states, follows the "Income Shares Model" for child support. Under the "Income Shares Model," a judge estimates the amount parents would spend on their children if the family was still intact. This amount is divided between each parent according to their income to create a child support award.