Registration A Trust In Idaho Form

Description

Form popularity

FAQ

Yes, you can write your own trust in Idaho, provided you adhere to state laws and requirements for such documents. However, drafting a trust can be complex, and mistakes may lead to unintended consequences. To enhance accuracy, consider using resources like US Legal Forms, which provide templates that help ensure you cover necessary elements. This way, you can confidently create a legally sound trust tailored to your needs.

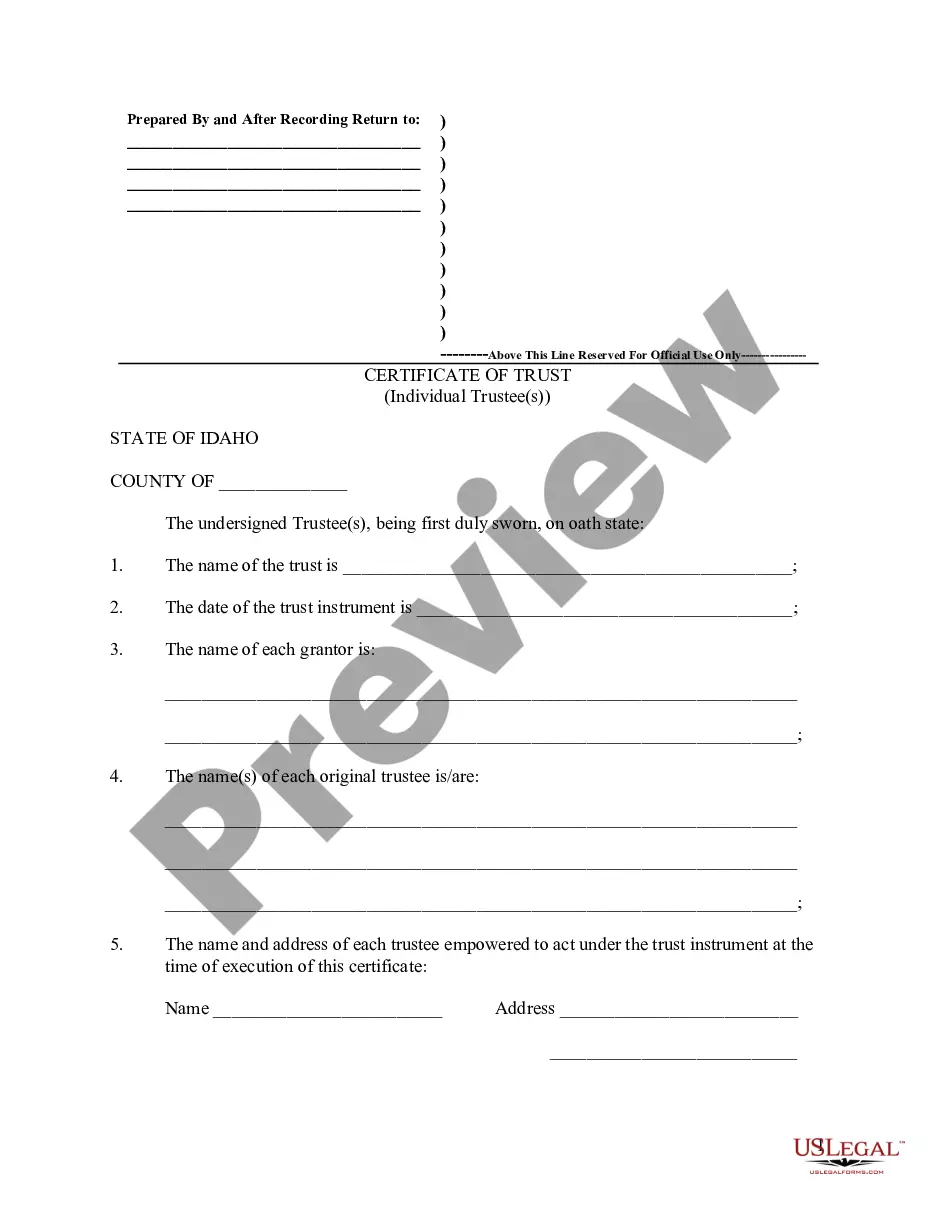

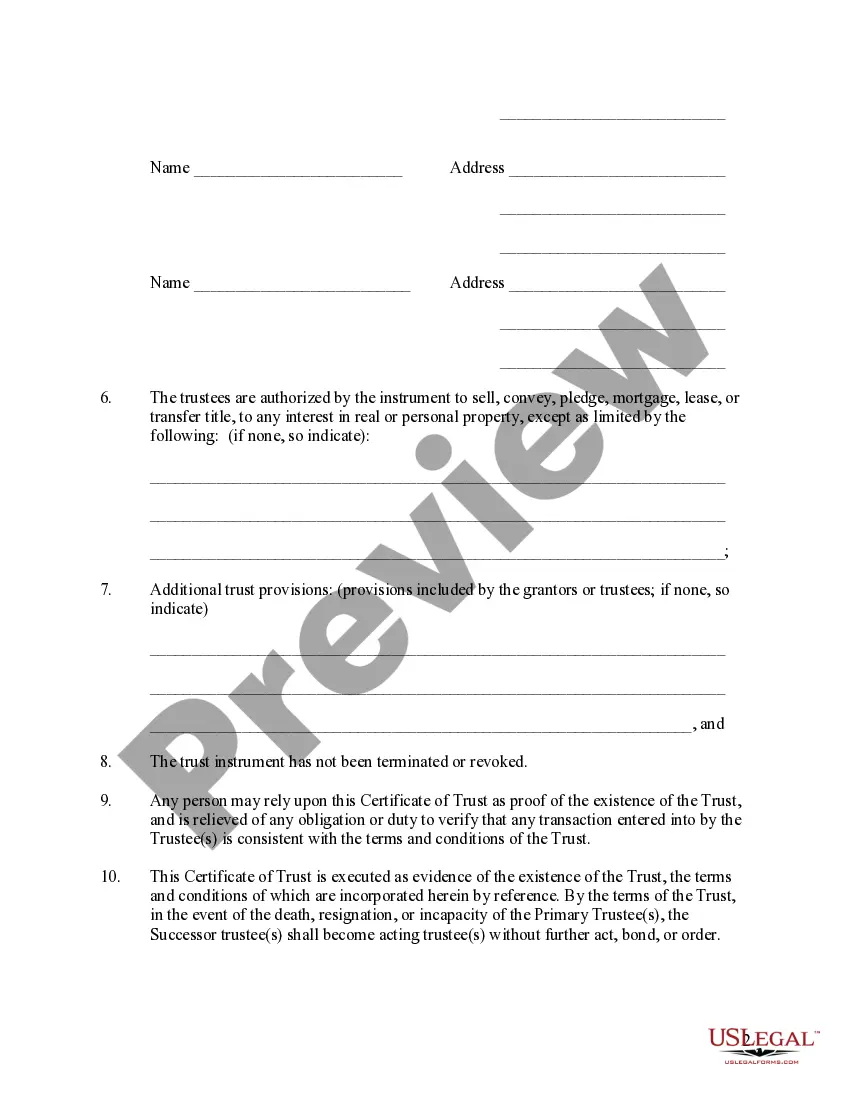

To register a trust in Idaho, start by completing the necessary registration form, which outlines key details about your trust. You must file this form with the county where you reside or where the trust property is located. Utilizing US Legal Forms can further assist you by offering templates and detailed instructions to ensure compliance with Idaho regulations. This makes the registration of your trust smoother and more efficient.

To register a trust in Idaho, you generally need to complete the registration form specific to your trust type. You will submit this form, along with any required documents, to the appropriate county office. Using a reliable platform like US Legal Forms can simplify this process by providing pre-made forms and guidance tailored to your needs. This way, you ensure that you properly complete the registration process for your trust in Idaho.

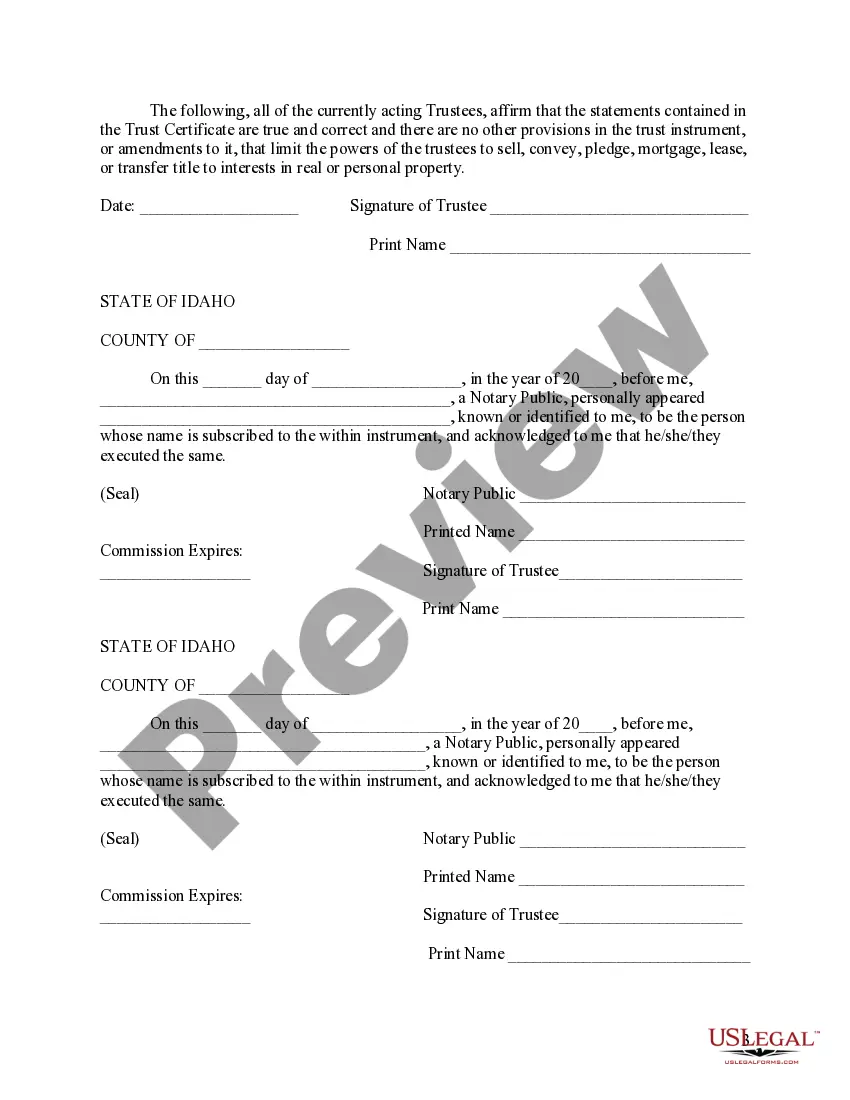

In Idaho, a trust does not necessarily require notarization to be valid. However, having the trust document notarized can provide additional legal protection and prove authenticity. It may also facilitate the process of registration and acceptance by financial institutions. Therefore, while it is not a strict requirement, notarization is highly recommended.

To register a trust in Idaho, you'll start with creating the trust documents, often best handled through a knowledgeable platform like USLegalForms. Once you have the necessary paperwork, you need to have it signed and notarized. Subsequently, you might want to file these documents with the appropriate court, depending on your trust type. By carefully following these steps, the registration of a trust in Idaho form can be completed seamlessly.

It’s crucial to know what assets to exclude when preparing the registration of a trust in Idaho form. Common items that should not be included are retirement accounts, life insurance policies, and assets that already have designated beneficiaries. Excluding these types of assets can help streamline the distribution process and avoid potential complications after your passing. Always seek guidance to ensure your living trust is properly structured.

When dealing with the registration of a trust in Idaho form, it’s important to understand that not all trusts need IRS registration. Typically, a revocable living trust does not require an IRS registration. However, if your trust generates taxable income or if it becomes irrevocable, you might need to obtain an Employer Identification Number (EIN) and file tax returns for the trust. Consulting a tax professional can help clarify your specific situation.

For a trust to be valid in Texas, it must have a clear intention, a competent trustee, and defined beneficiaries. The trust must comply with state laws regarding asset transfer and documentation. The ‘Registration a trust in idaho form’ can also support you in ensuring your trust meets all legal requirements in Texas.

Failing to file taxes on a trust can lead to penalties, interest, and audits from the IRS. It's crucial to understand your filing obligations to avoid potential legal issues. The ‘Registration a trust in idaho form’ can help outline your responsibilities and keep you on track with tax regulations.

Whether a trust needs to be filed with the IRS depends on its type and income level. Trusts that earn income over a specific threshold usually require filing a return. To keep your trust compliant, consider using the ‘Registration a trust in idaho form’ to guide your next steps regarding IRS requirements.