Probate Inventory Form With No Will

Description

Form popularity

FAQ

Inventory can hold significant value, representing the monetary worth of the goods ready for sale or distribution. In the probate context, understanding the value of assets is crucial, especially when using a probate inventory form with no will. These values directly impact tax obligations and the distribution to heirs. Proper valuation can help ensure that all beneficiaries receive a fair share based on the inventory assessed during probate.

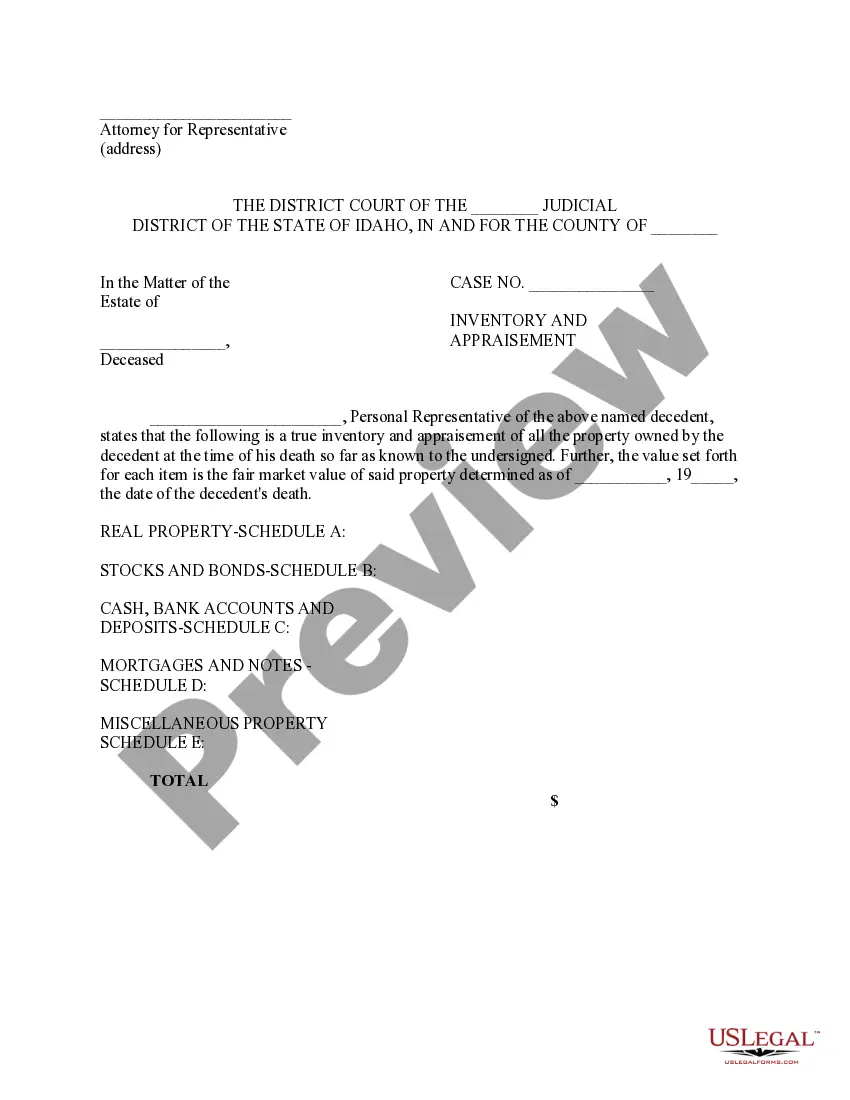

An asset inventory should include any tangible or intangible items owned by the deceased, such as real estate, bank accounts, vehicles, stocks, and personal belongings. When completing a probate inventory form with no will, it is essential to itemize all these assets accurately. This thorough approach ensures transparency and helps facilitate the probate process. Accurate inventories prevent disputes among heirs by clearly outlining what assets are available.

Inventory refers to the goods and materials a business holds for the purpose of resale. In the context of a probate inventory form with no will, it includes all assets of the deceased that may need to be assessed for value. Yes, inventory is typically considered a current asset because it is expected to be sold or used within a year. Understanding inventory can help you manage the distribution of assets more effectively.

Inheritance inventory refers to the comprehensive list of assets that beneficiaries are entitled to receive from an estate. This inventory typically includes both movable and immovable properties, and it serves to clarify what each heir will inherit. Utilizing a probate inventory form with no will helps streamline this process, allowing for smoother transitions in the estate settlement.

Assets of a deceased estate encompass everything the individual owned and had an interest in at the time of death. This can range from property such as homes and vehicles to financial accounts and personal belongings. Accurately listing these in a probate inventory form with no will is essential for the probate process, ensuring that all heirs receive their rightful share.

Inventory property includes tangible and intangible assets owned by the deceased. Common elements are real estate, cars, jewelry, stocks, and retirement accounts, among others. When preparing a probate inventory form with no will, it is crucial to account for every item to ensure a fair distribution among heirs or beneficiaries.

The inventory of assets of the deceased consists of all property and belongings owned at the time of death. This includes real estate, bank accounts, investments, personal items, and any other valuable possessions. It serves as a detailed list for probate purposes, providing clarity during the estate settlement process, especially when using a probate inventory form with no will.

While accountants typically focus on managing financial records, they can assist with inventory assessments in various contexts. Estate accountants can help prepare a probate inventory form with no will, ensuring that all assets are accurately valued and reported. Their expertise can be invaluable in streamlining the probate process.

To create an inventory list for probate, start by gathering comprehensive information about the deceased's assets. Organize items into categories such as real property, financial accounts, and personal belongings. A probate inventory form with no will simplifies this process, ensuring all assets are documented correctly and efficiently.

An inventory focuses specifically on listing and valuing an estate’s assets, while accounting tracks financial transactions over a specific period. Essentially, inventory is a snapshot of assets at a point in time, while accounting reflects ongoing financial activities. Completing a probate inventory form with no will is a vital step for the estate’s administration.