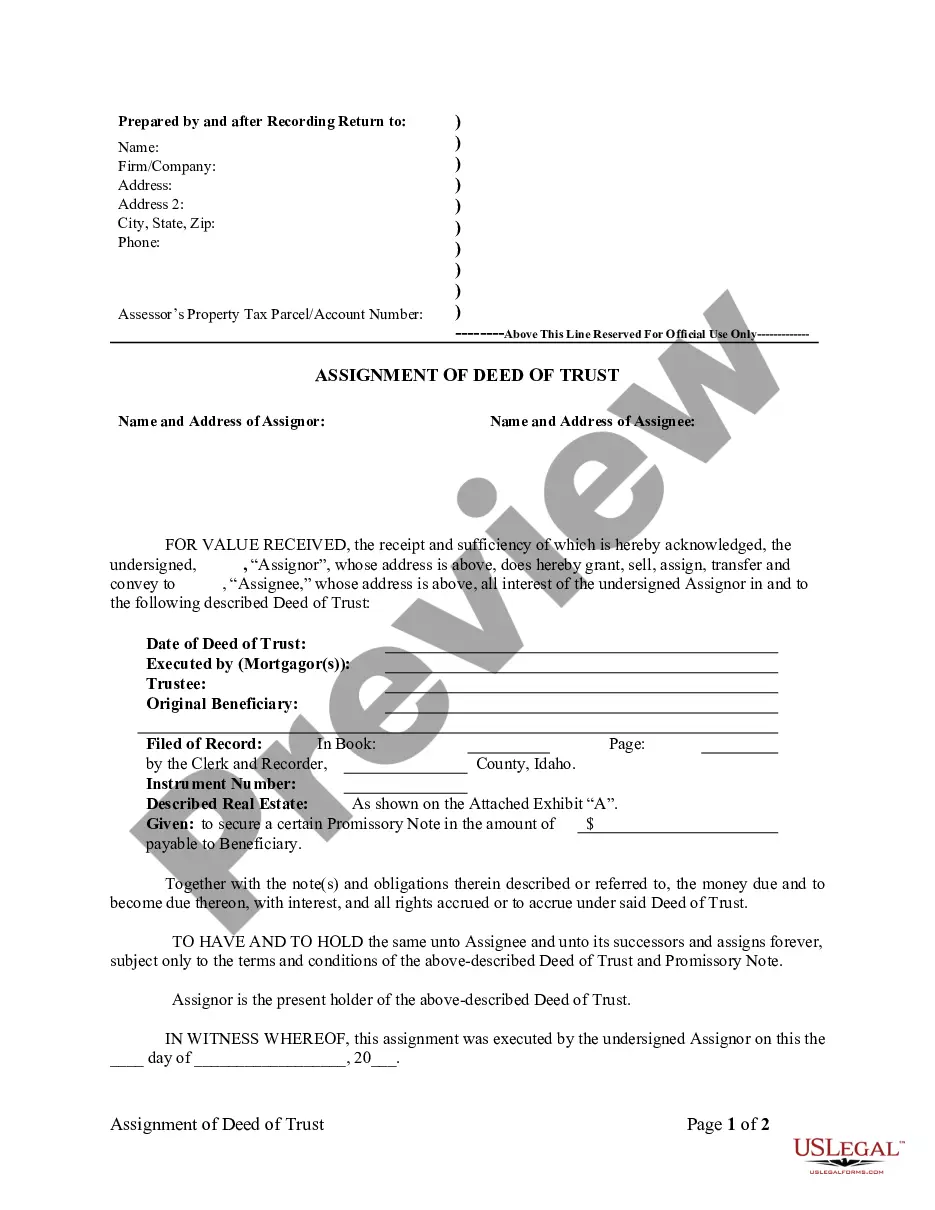

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Idaho Deed Of Trust Form

Description

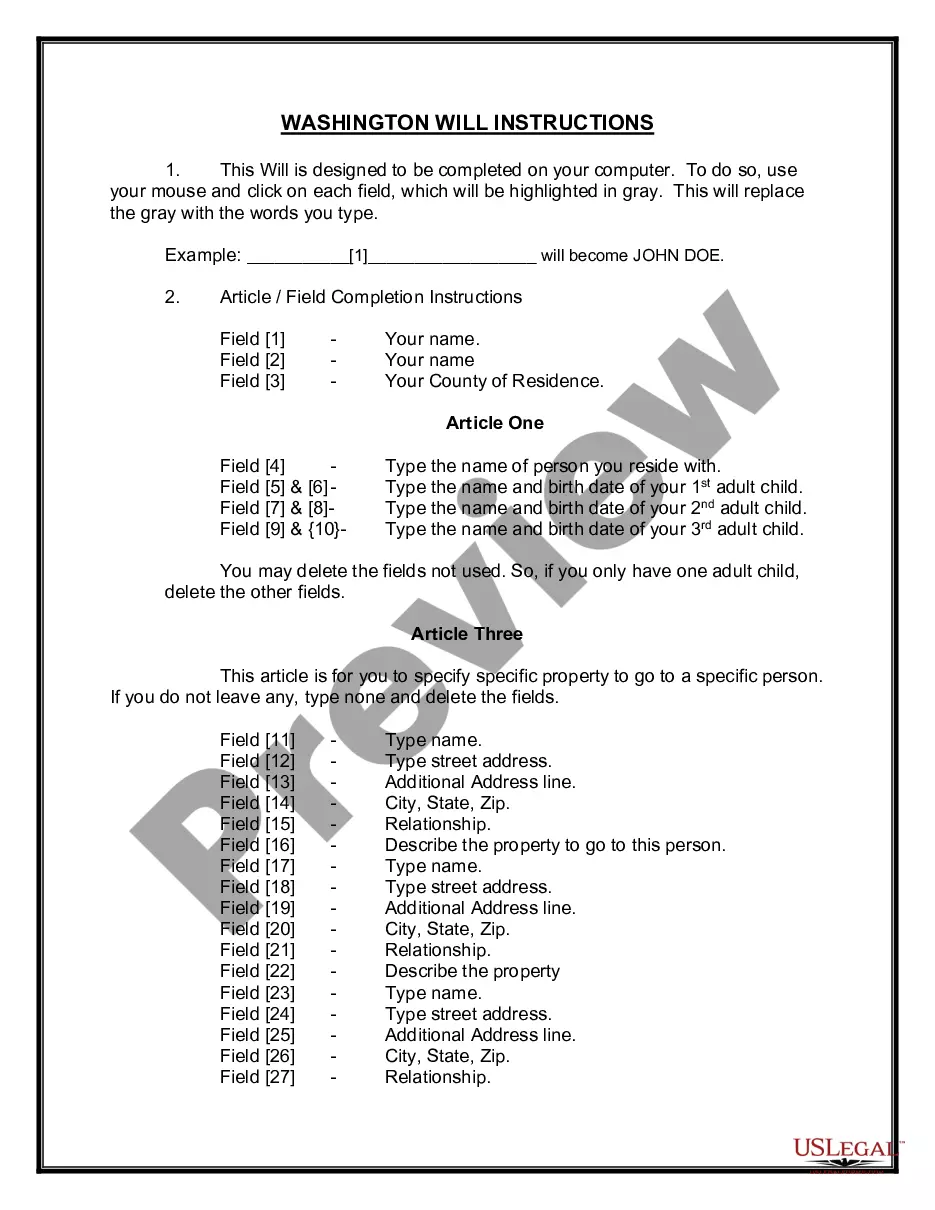

How to fill out Idaho Deed Of Trust Form?

Regardless of whether you handle documents routinely or occasionally need to present a legal document, it is crucial to find a resource that contains all relevant and current samples.

The initial step to take with an Idaho Deed Of Trust Form is to ensure that it is the latest version, as this determines its submitability.

If you wish to streamline your search for the most recent document samples, look for them on US Legal Forms.

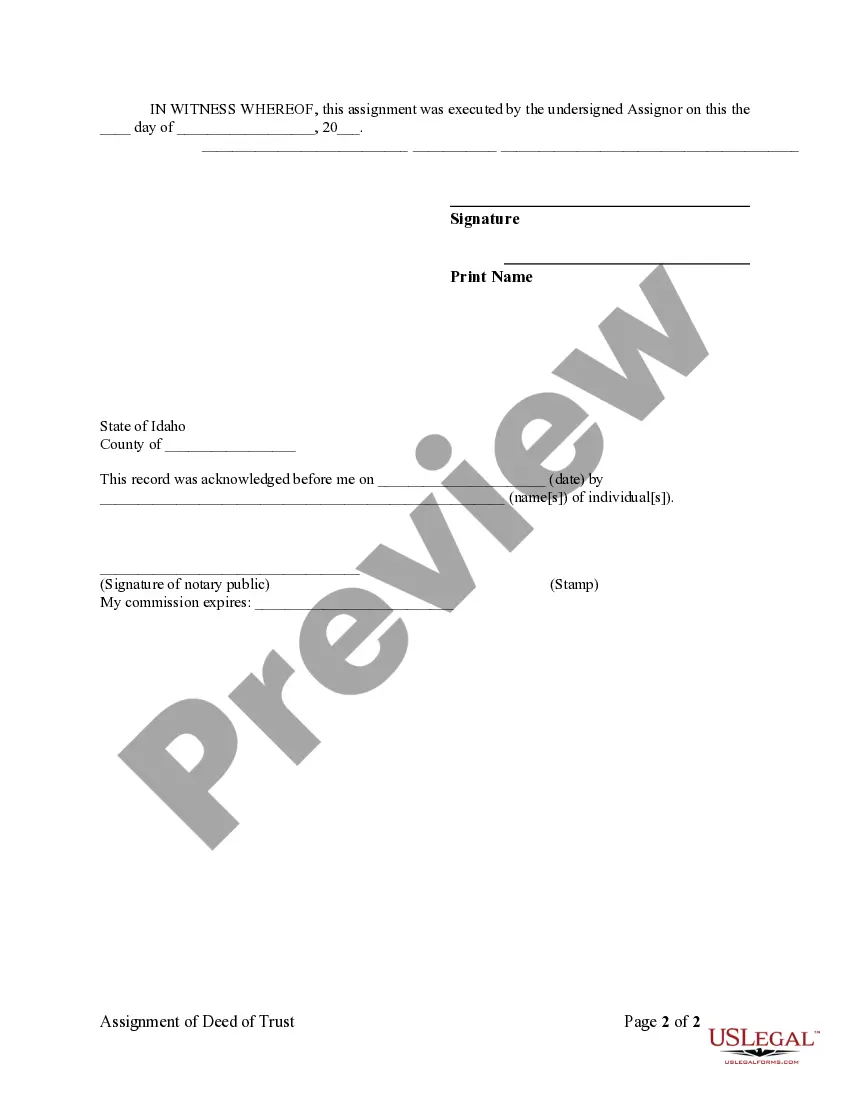

1. Use the search menu to find the form you need. 2. Review the preview and description of the Idaho Deed Of Trust Form to confirm it is exactly what you want. 3. After verifying the form, just click Buy Now. 4. Choose a subscription plan that suits you. 5. Create an account or Log In to your existing account. 6. Enter your credit card information or PayPal account details to complete the purchase. 7. Select the download file format and confirm. 8. Eliminate the confusion of dealing with legal documents. All your templates will be systematically organized and validated with a US Legal Forms account.

- US Legal Forms is a repository of legal documents that encompasses nearly every document template you might require.

- Search for the forms you need, verify their applicability instantly, and explore their usage.

- With US Legal Forms, you gain access to over 85,000 document templates across various domains.

- Locate the Idaho Deed Of Trust Form samples in just a few clicks and save them at any time in your account.

- Having a US Legal Forms account allows you convenient access to all necessary samples with minimal hassle.

- Simply click Log In in the header of the website and navigate to the My documents section, where all the forms you require are readily available, eliminating the need to waste time seeking the right template or verifying its authenticity.

- To obtain a form without an account, follow these instructions.

Form popularity

FAQ

The trust deed UK template is a legal document similar to the Idaho deed of trust form, but tailored for use in the United Kingdom. It outlines the roles of the borrower, lender, and trustee while adhering to UK laws. However, if you are looking for a US-compliant document, focusing on the Idaho deed of trust form will better fit your needs.

While trust deeds present benefits, they also have disadvantages. For instance, they may require more paperwork compared to a standard mortgage, and if the borrower defaults, the trustee has the authority to sell the property without going through court. Understanding these aspects ensures you are informed before using the Idaho deed of trust form.

To fill out the quitclaim deed form, start by gathering the necessary information such as the names of the grantor and grantee, property description, and any applicable legal disclaimers. Ensure each section is clearly filled out and sign the document in front of a notary public. Lastly, remember to file the completed form with the appropriate county office to make it legally binding.

Filing a quitclaim deed in Idaho involves several steps to ensure a proper transfer of property rights. Start by obtaining the appropriate Idaho deed of trust form, which you can find on platforms like US Legal Forms. Fill out the form with necessary details, sign it in front of a notary, and then submit it to your local county recorder for filing. This official recording establishes the new ownership and protects your interest in the property.

To transfer property in Idaho, you typically need to use a deed, such as a warranty deed or a quitclaim deed. First, ensure you complete the correct Idaho deed of trust form to establish the financial transaction associated with the property. Next, have the deed signed, notarized, and then recorded with the county recorder's office. This process ensures that the transfer of property rights is legally recognized and provides protection for both the buyer and seller.

Choosing between a deed of trust and a mortgage depends on your situation. A deed of trust typically enables a quicker foreclosure process since it involves a trustee rather than going through the courts, which can be more cumbersome with a mortgage. Ultimately, the best choice rests on your specific needs. Using an Idaho deed of trust form can streamline this decision-making process.

Yes, Idaho does have a beneficiary deed, allowing property owners to transfer their property upon death without going through probate. This type of deed can simplify estate planning and provide peace of mind. If you're considering using a beneficiary deed, it might be useful to compare it with the Idaho deed of trust form to determine which option best fits your situation.

Wyoming primarily uses mortgages rather than deeds of trust. However, it is important to know that both options exist and can serve different needs. When dealing with real estate in Wyoming, you may want to consult resources specific to the state's laws. If you're also looking into Idaho properties, the Idaho deed of trust form might be relevant for your needs.

Yes, Idaho is a deed of trust state. This means that instead of a mortgage, lenders use a deed of trust to secure loans for real estate purchases. The deed of trust involves three parties: the borrower, the lender, and the trustee. To navigate this process effectively, you should utilize the appropriate Idaho deed of trust form.

A warranty deed in Idaho is a legal document that guarantees the seller holds clear title to the property being sold. It includes warranties that protect the buyer against future claims on the title. This document plays a critical role in real estate transactions. If you are considering a property transfer, understanding both warranty deeds and Idaho deed of trust forms is essential.