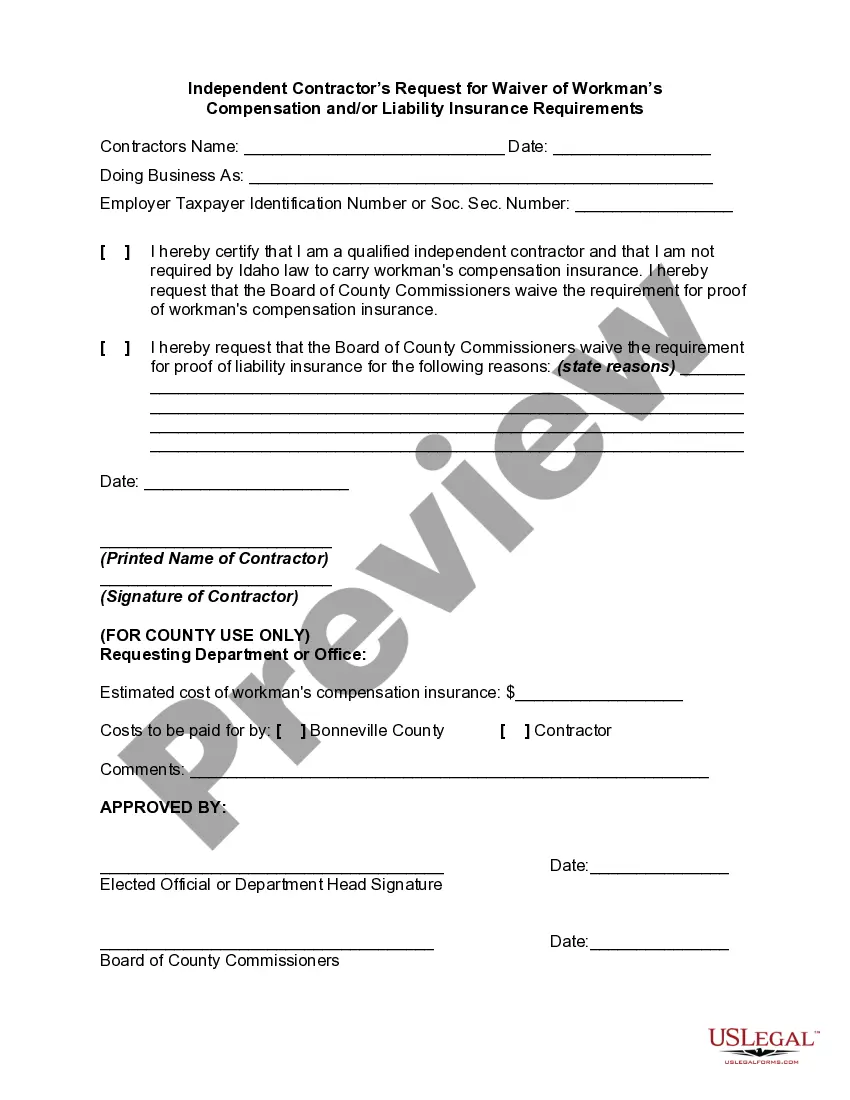

For most kinds of employment, state workers' compensation statutes govern compensation for injuries. The statutes provide that the injured employee is entitled to compensation for accidents occurring in the course of employment. Every State has some form of workers' compensation legislation. The statutes vary widely from State to State. When an employee is covered by a workers' compensation statute, and when the injury is job connected, the employee's remedy is limited to what is provided in the worker's compensation statute. In other words, the employee cannot sue his employer for negligence.

Workers' compensation acts sometimes prohibit contractual limitations on their operation or the waiver or release of compensation benefits prior to the occurrence of an injury. Even where a statute contains no express provisions curtailing the waiver of benefits, any attempt to nullify or limit access to workers' compensation has been held invalid as against public policy. Thus, unless provided by statute, there can be no curtailment of compensation rights by a contract between an employer and an insurer.

Workers may waive their compensation rights if they are provided for in another manner.

Workman compensation formulas are used to calculate the amount of compensation an injured worker is entitled to receive. These formulas take into account various factors such as the severity of the injury, the worker's average weekly wage, and the applicable state laws. The following are the commonly used formulas in the Workman compensation system: 1. Temporary Total Disability (TTD) Formula: This formula calculates the compensation for workers who are temporarily unable to work due to their injuries. It typically involves taking a percentage (e.g., 2/3) of the worker's average weekly wage. 2. Permanent Total Disability (LTD) Formula: This formula is used when a worker is permanently unable to return to any gainful employment. The compensation amount is determined based on the worker's average weekly wage and factors such as age, education, and the severity of the disability. 3. Scheduled Loss of Use (SLOW) Formula: This formula is applied when a worker suffers a permanent partial disability in a specific body part or function. The compensation is calculated by assigning a specific number of weeks to the particular body part or function and multiplying it by a percentage of the worker's average weekly wage. 4. Non-Scheduled Loss of Use (SLOW) Formula: Unlike SLOW, SLOW refers to the loss of function or disability that does not involve a specific body part or function. The compensation amount is determined based on factors like the worker's average weekly wage, the severity of the impairment, and the impact on the worker's ability to earn wages. 5. Wage Loss Formula: In cases where the worker's disability leads to a reduction in earning capacity or a loss of income, this formula is used. The compensation is calculated by assessing the difference between the pre-injury average weekly wage and the post-injury wage-earning capacity. It's important to note that the specific formulas and their usage may vary from state to state, as each state has its own rules and regulations regarding workman compensation. Consulting with an attorney or an expert in workman compensation law is recommended to understand the specific formula applicable to a worker's situation.