Id Workman Compensation For Employees

Description

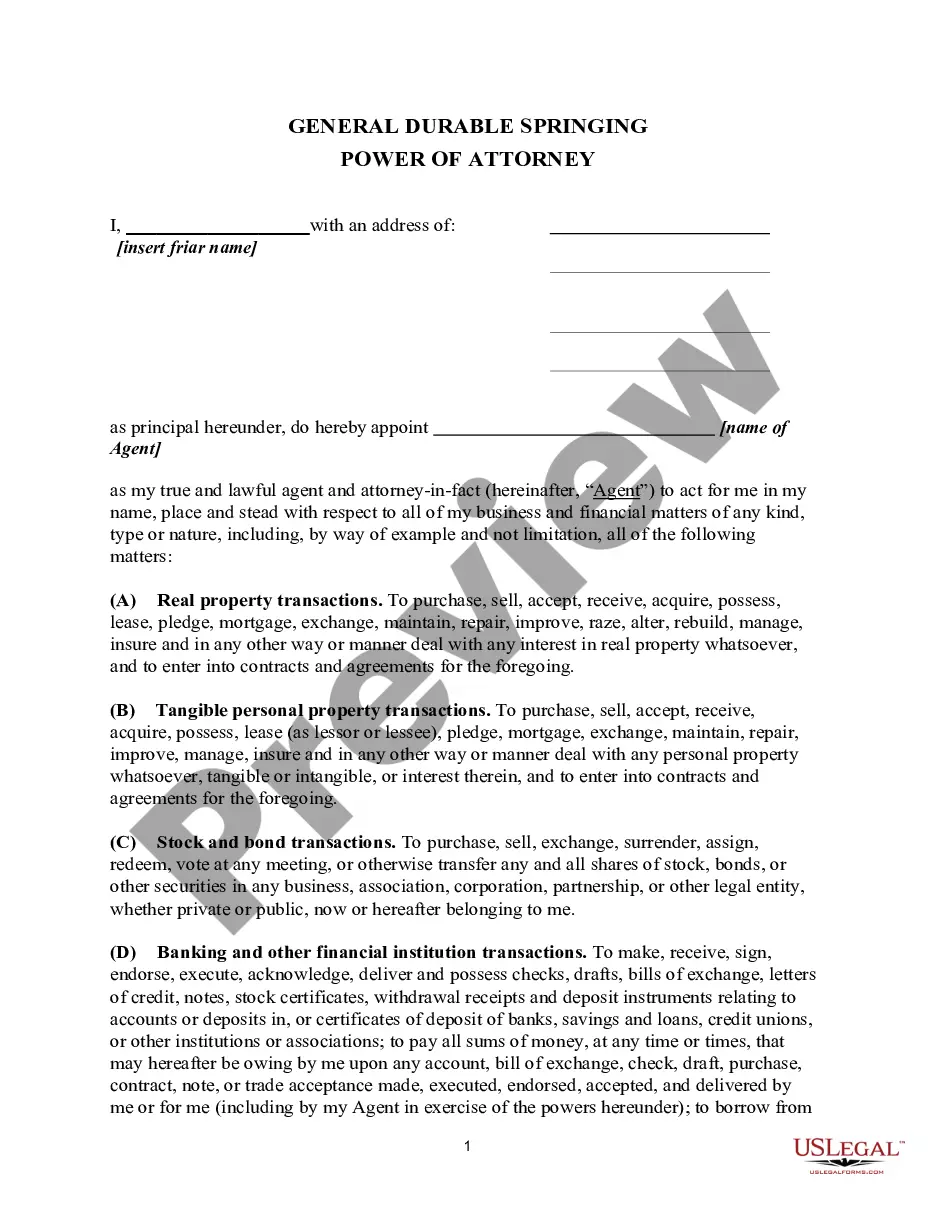

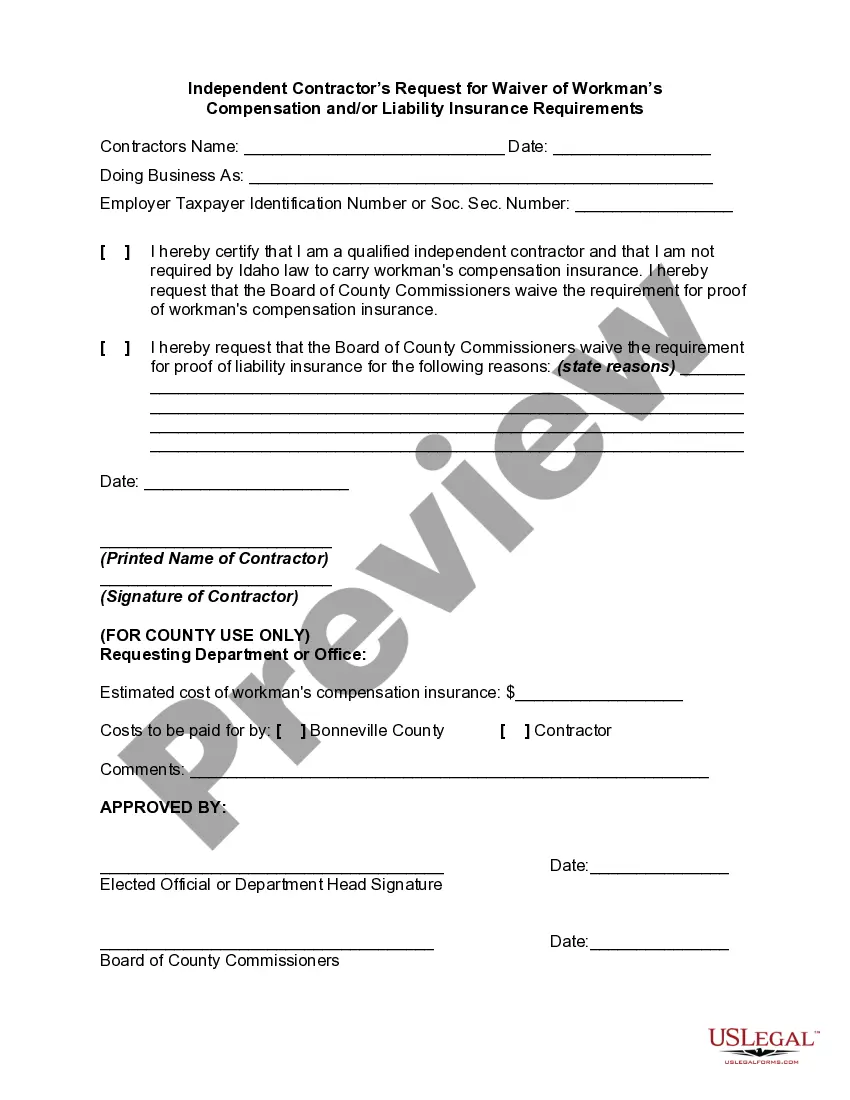

How to fill out Idaho Independent Contractor's Request For Waiver Of Workman's Compensation And/or Liability Insurance Requirements?

Utilizing legal document templates that comply with federal and state regulations is essential, and the web provides a plethora of choices to select from.

However, what is the purpose of squandering time in pursuit of the appropriate Id Workman Compensation For Employees template online if the US Legal Forms digital library already houses such examples gathered in one location.

US Legal Forms stands as the premier online legal repository with over 85,000 editable templates prepared by legal professionals for various business and personal situations.

Examine the template using the Preview feature or through the text description to ensure it meets your requirements.

- They are straightforward to navigate with all documents categorized by state and intended use.

- Our experts stay abreast of legislative changes, ensuring your paperwork is current and compliant when acquiring an Id Workman Compensation For Employees from our site.

- Acquiring an Id Workman Compensation For Employees is simple and swift for both existing and new users.

- If you already possess an account with a valid subscription, Log In and download the document sample you need in the desired format.

- If you are unfamiliar with our website, adhere to the instructions below.

Form popularity

FAQ

Yes, workers' compensation is mandatory for most employers in Idaho. This requirement ensures that employees have access to necessary benefits if they are injured on the job. When you understand the Id workman compensation for employees, you can better advocate for your rights and benefits. There may be some exceptions, but overall, compliance is essential for protecting both employees and employers.

Parts of a Business Sale Agreement Parties. The names and locations of the buyer and seller will be clearly stated in the first paragraph or two of the contract. ... Assets. The agreement will detail the specific assets being transferred. ... Liabilities. ... Terms. ... Disclosures. ... Disputes. ... Notifications. ... Signatures.

Here are ten tips on how to write a business contract: Include All The Required Information. ... Make It Easy To Understand. ... Negotiate With The Decision-makers. ... Confirm All Verbally Agreed-upon Terms Are Included. ... Describe Situations And Criteria That Call For Termination Of The Contract. ... Include Detailed Payment Obligations.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

A purchase and sale agreement, or PSA, is a document that is written up and signed after a buyer and seller mutually agree on the price and terms of a real estate transaction.

The following assets and liabilities are normally included in the sale: Working capital. Cash (but only the amount necessary to pay expenses for a reasonable period of time) Accounts receivable. Inventory. Work in progress. Prepaid expenses. Accounts payable. Wages payable. ... Furniture & fixtures. Equipment. Vehicles.

The state of Minnesota doesn't require a bill of sale for any transactions, but the document is recognized as an official record of a sale. A bill of sale needs to clearly identify the parties involved in a transaction, the item being sold, the selling price, and the date the transaction took place.

All business contracts should include fundamentals such as: The date of the contract. The names of all parties or entities involved. Payment amounts and due dates. Contract expiration dates. Potential damages for breach of contract, missed deadlines or incomplete services.

A Minnesota motor vehicle bill of sale is a legal document that serves as a recording that two (2) parties have executed the sale of a motor vehicle. The document also establishes a change of ownership and provides the required information for the vehicle's registration. This form requires notarization.