Claim Of Lien Form Withdrawal

Description

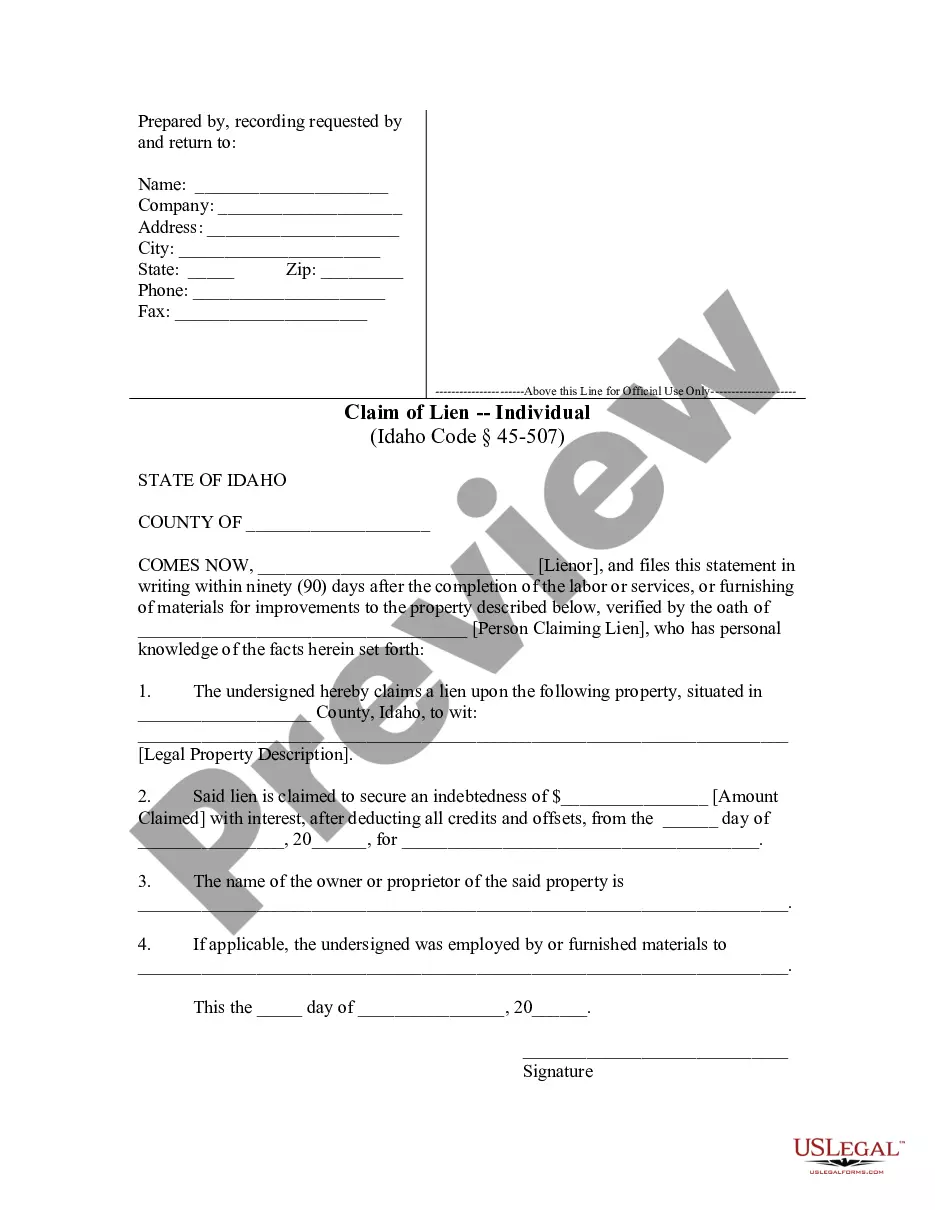

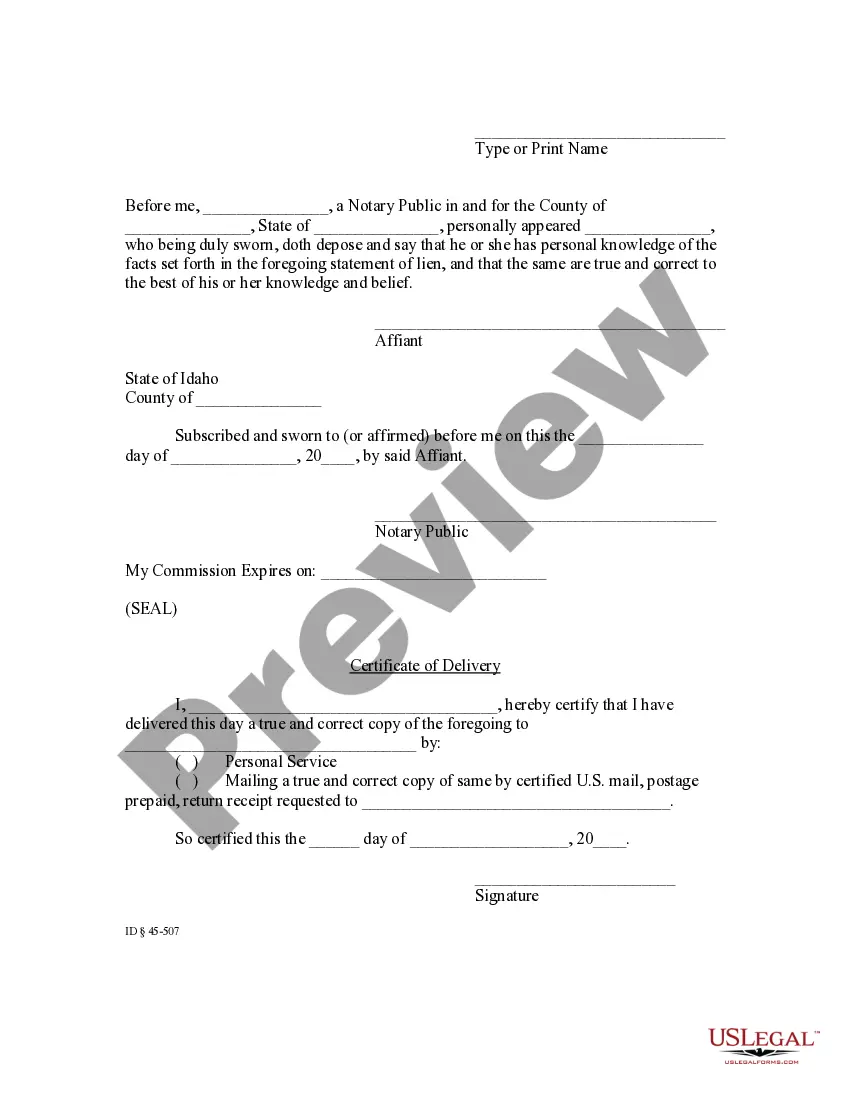

How to fill out Idaho Claim Of Lien By Individual?

It’s no secret that you can’t become a legal professional immediately, nor can you grasp how to quickly prepare Claim Of Lien Form Withdrawal without the need of a specialized set of skills. Putting together legal forms is a time-consuming venture requiring a particular education and skills. So why not leave the creation of the Claim Of Lien Form Withdrawal to the professionals?

With US Legal Forms, one of the most comprehensive legal template libraries, you can find anything from court documents to templates for internal corporate communication. We understand how important compliance and adherence to federal and state laws and regulations are. That’s why, on our platform, all forms are location specific and up to date.

Here’s start off with our platform and obtain the form you need in mere minutes:

- Find the form you need with the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to determine whether Claim Of Lien Form Withdrawal is what you’re looking for.

- Start your search again if you need a different form.

- Register for a free account and select a subscription option to buy the template.

- Choose Buy now. As soon as the payment is complete, you can download the Claim Of Lien Form Withdrawal, fill it out, print it, and send or mail it to the designated individuals or organizations.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your documents-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

Discharge means the IRS removes the lien from property so that it may transfer to the new owner free of the lien. Use Form 14135. Subordination means the IRS gives another creditor the right to be paid before the tax lien is paid. Use Form 14134.

Potential employers or creditors can still access public records that show you have a tax lien on your property. This can negatively impact your credit even after you've resolved your debt. Form 12277 is the form used to ask the IRS to remove the lien and remove the lien from public records.

After resolving a tax lien, a taxpayer can file Form 12277 with the IRS to request to have the lien removed. A taxpayer may also need to take additional action since the IRS often considers other components of your credit history when reviewing your request.

A "withdrawal" removes the public Notice of Federal Tax Lien and assures that the IRS is not competing with other creditors for your property; however, you are still liable for the amount due.

You can apply to have the lien withdrawn by using Form 12277, Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien (Internal Revenue Code Section 6323(j). A ?discharge? removes the lien from specific property.