Executor Deed Iowa For Renunciation Form

Description

How to fill out Iowa Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Administration requires exactness and correctness.

If you do not manage the completion of documents like Executor Deed Iowa For Renunciation Form regularly, it may lead to some misunderstanding.

Selecting the appropriate example from the start will guarantee that your document submission proceeds seamlessly and avoid any troubles of resending a document or repeating the same task from the beginning.

Investigate the description of the forms and retain those you need at any time. If you are not a registered user, locating the necessary sample may require a few extra steps: Find the template using the search function. Ensure the Executor Deed Iowa For Renunciation Form you have found is applicable to your region or locality. Review the preview or read the description that includes the details on how to use the template. If the result matches your inquiry, click the Buy Now button. Select the appropriate choice among the offered pricing plans. Sign in to your account or create a new one. Complete the purchase using a credit card or PayPal. Save the form in the file format of your preference. Acquiring the correct and updated samples for your documentation takes just a few minutes with an account at US Legal Forms. Sidestep bureaucratic issues and simplify your paperwork process.

- You can consistently find the suitable example for your documentation in US Legal Forms.

- US Legal Forms is the largest online collection of forms that provides over 85 thousand templates for various sectors.

- You can obtain the most recent and most relevant version of the Executor Deed Iowa For Renunciation Form by simply searching for it on the site.

- Identify, store, and retain templates in your profile or verify with the description to ensure you have the correct one available.

- With an account at US Legal Forms, it is effortless to acquire, keep in one location, and browse through the templates you store to access them with a few clicks.

- When on the website, click the Log In button to authenticate.

- Then, move to the My documents page, where your document list is maintained.

Form popularity

FAQ

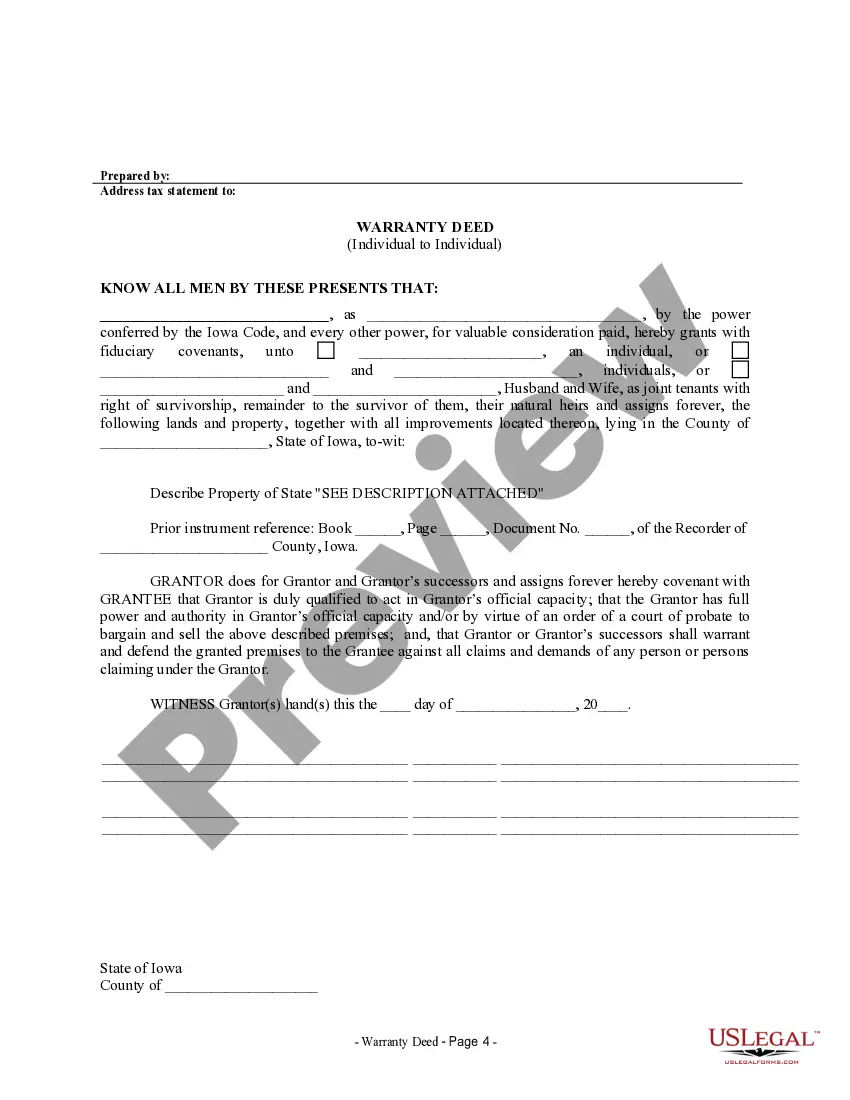

A form of renunciation is a legal document that outlines an individual's intent to give up a specific right or claim, such as inheritance. In Iowa, individuals can utilize an Executor deed for renunciation forms when they decide not to accept their inheritance. This form plays a crucial role in ensuring that the person's decision is officially recorded, aiding in a smooth distribution among remaining heirs. By using reliable platforms like USLegalForms, you can easily access and customize the necessary documents for this process.

Renunciation refers to the formal rejection of a right or claim, often related to inheritance. For instance, if a person chooses to renounce their right to inherit property from a deceased relative, they can use an Executor deed in Iowa for the renunciation form. This act allows the property to pass directly to other heirs without complications. Ultimately, renunciation can simplify the overall estate settlement process.

An executor can resign from their role by notifying the probate court and completing the necessary paperwork. The executor deed Iowa for renunciation form is often used for this purpose, making the resignation official. Additionally, it's prudent to inform the beneficiaries of your decision. Engaging with a legal professional can help ensure that your resignation process is handled correctly, preserving the estate's integrity.

In Iowa, an executor is generally required to provide an accounting of the estate’s financial activities to the beneficiaries. This report includes details on income, expenses, and distributions for transparency purposes. Although there might be some exceptions, fulfilling this duty builds trust among heirs. To facilitate these responsibilities, executors can utilize the executor deed Iowa for renunciation form should they need guidance on stepping down.

Yes, an executor can renounce their position in Iowa if they wish to decline the responsibilities associated with managing an estate. To do this, they must complete the appropriate documentation, including the executor deed Iowa for renunciation form. This form notifies the probate court and heirs that the executor will not serve. Renouncing ensures that another qualified individual can step in to handle the estate.

A renunciation form for probate is a document allowing an executor to refuse their responsibilities regarding a deceased person's estate. In Iowa, this form typically includes specific information about the estate and identifies the executor wishing to step down. Using the executor deed Iowa for renunciation form can simplify this process and provide clarity to the court. This action helps ensure that the probate process continues smoothly.

Yes, you can back out of being an executor in Iowa, especially if you file a renunciation form before officially taking any actions in the role. The law permits you to withdraw from the position, primarily by submitting the executor deed Iowa for renunciation form. However, once you have begun your duties, withdrawing may require additional legal steps. Consulting with a probate attorney can help you understand your options.

A letter of renunciation is a document that allows an executor to formally decline their role in managing an estate. This letter acts as a notification to the probate court and other interested parties. In Iowa, filling out an executor deed Iowa for renunciation form may serve as a required component of this process. It ensures that your intent to renounce is clearly communicated.

To remove yourself as an executor in Iowa, you need to file a formal notice with the probate court. This process often involves completing an executor deed Iowa for renunciation form, which declares your intention to step down. Additionally, the court may require you to provide a valid reason for your resignation. It is advisable to consult with an attorney to ensure a smooth process.

In Iowa, an executor generally has up to one year to settle an estate, but this can vary based on the estate’s complexity. Timely administration is crucial to protect the interests of beneficiaries and creditors. Understanding your rights and responsibilities through resources like the Executor deed Iowa for renunciation form can help keep the process on track.