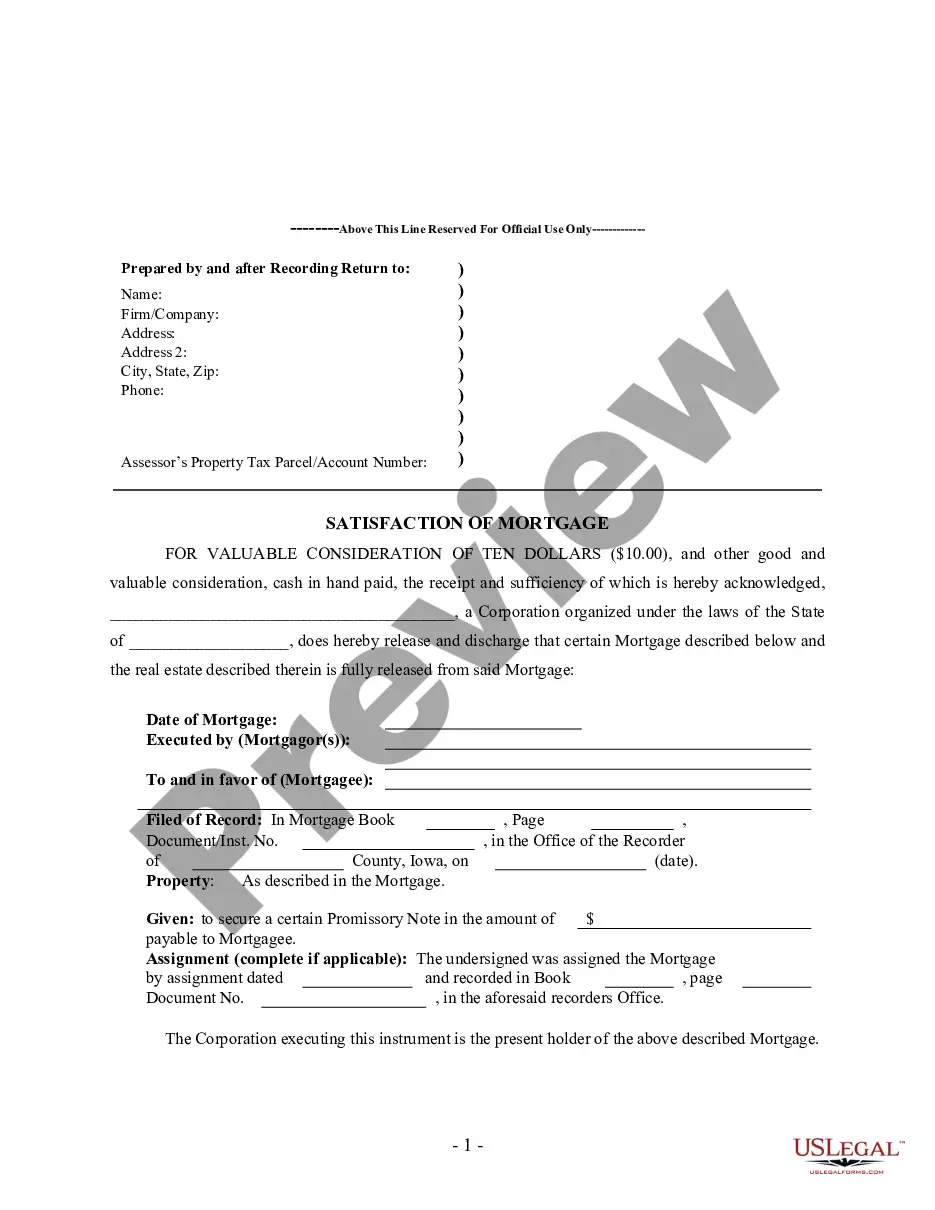

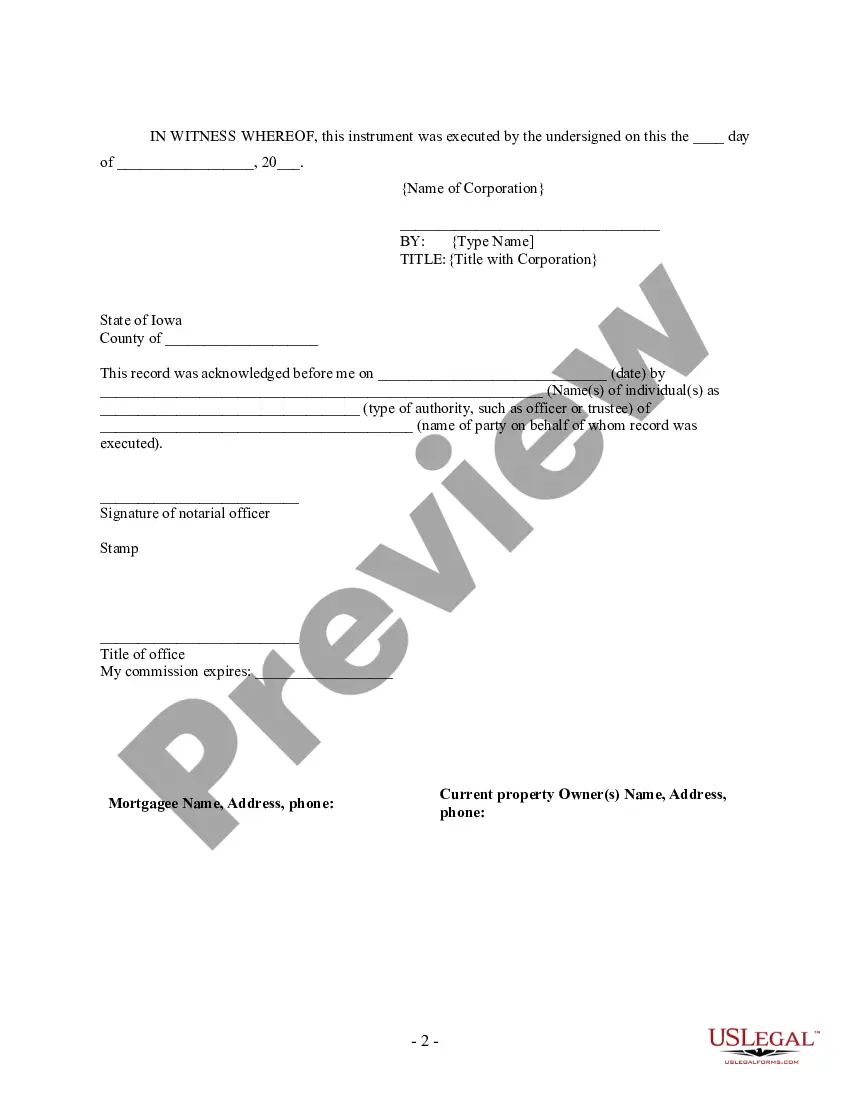

Blank Iowa Release Of Mortgage Form With Two Points

Description

How to fill out Iowa Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

There’s no longer a necessity to invest time searching for legal documents to satisfy your local state obligations.

US Legal Forms has compiled all of them in one location and streamlined their availability.

Our website offers over 85k templates for any business and individual legal circumstances categorized by state and area of usage.

Select Buy Now adjacent to the template title when you discover the suitable one. Choose your preferred subscription plan and either create an account or Log In. Process your subscription payment using a credit card or through PayPal to proceed. Pick the file format for your Blank Iowa Release Of Mortgage Form With Two Points and download it to your device. Print your form to fill it out manually or upload the sample if you wish to edit it in an online editor. Preparing legal documents under federal and state laws is quick and easy with our platform. Try US Legal Forms today to keep your documentation organized!

- All forms are expertly drafted and authenticated for legitimacy, so you can be confident in obtaining a current Blank Iowa Release Of Mortgage Form With Two Points.

- If you are acquainted with our platform and already possess an account, you need to verify that your subscription is active prior to obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents at any moment by accessing the My documents tab in your profile.

- If you have never utilized our platform before, the procedure will involve a few more steps to finalize.

- Here’s how new users can locate the Blank Iowa Release Of Mortgage Form With Two Points in our catalog.

- Examine the page content thoroughly to confirm it includes the sample you require.

- To do so, leverage the form description and preview options if available.

Form popularity

FAQ

If they decide to charge two points, the cost would be $8,000. And so on. If your loan amount is $100,000, it's simply $1,000 per point. It's a really easy calculation. Just multiply the number of points (or fraction thereof) times the loan amount.

To make sure borrowers don't pay very high fees, a lender making a Qualified Mortgage can only charge up to the following upfront points and fees: For a loan of $100,000 or more: 3% of the total loan amount or less.

2. Points or discount points are a one-time fee paid at closing to increase the yield to the investor. 3. Points give the lender more money up front so he/she will be encouraged to make a loan at a lower interest rate.

What do points cost? One mortgage point typically costs 1% of your loan total (for example, $2,000 on a $200,000 mortgage). So, if you buy two points at $4,000 you'll need to write a check for $4,000 when your mortgage closes.

Mortgage origination points are another type of mortgage points. They are fees paid to lenders to originate, review and process the loan. Origination points typically cost 1 percent of the total mortgage. So, if a lender charges 1.5 origination points on a $250,000 mortgage, the borrower must pay $4,125.