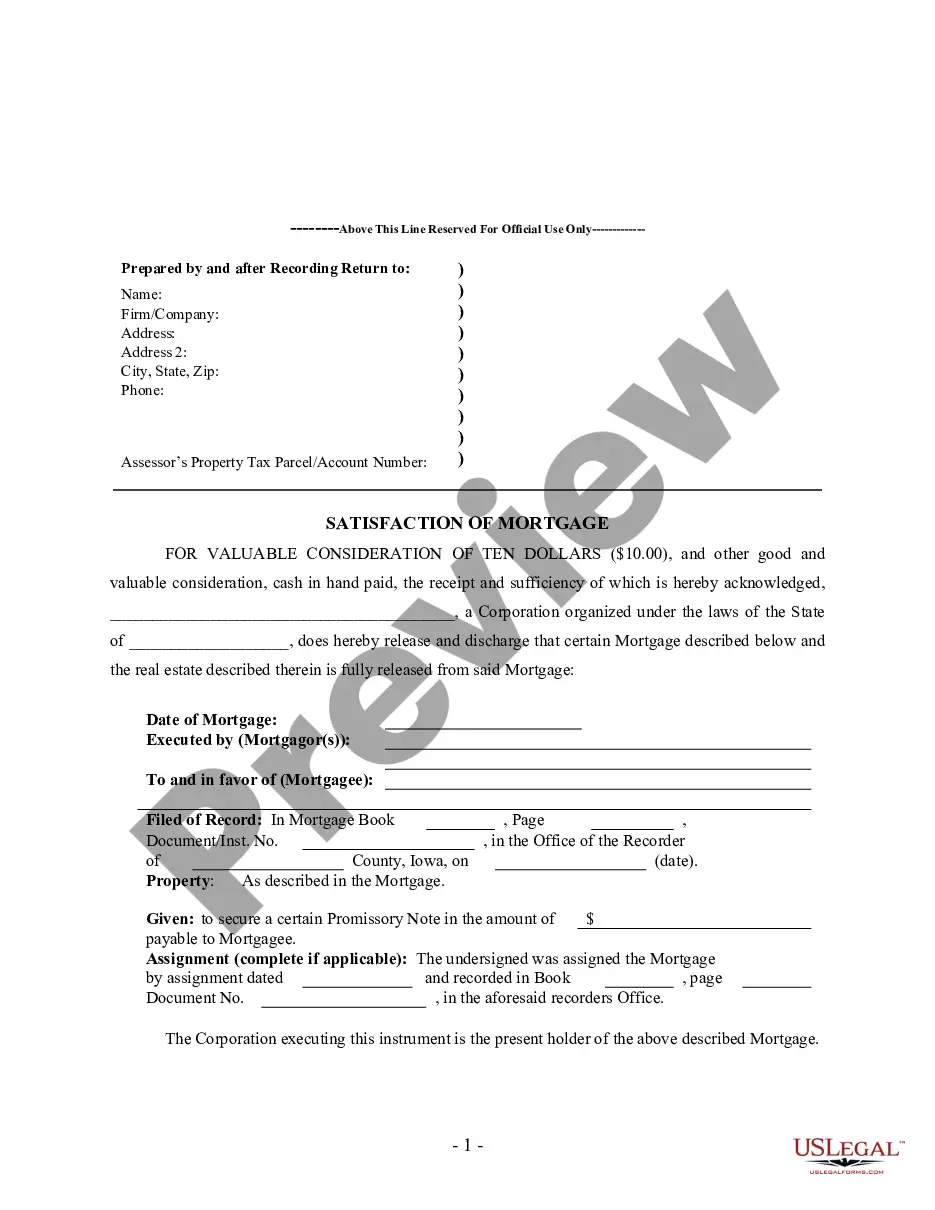

Blank Iowa Release Of Mortgage Form With 2 Points

Description

How to fill out Iowa Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

There is no longer any justification for spending hours searching for legal documents to meet your local state mandates.

US Legal Forms has gathered all of them in a single location and made them easier to access.

Our website boasts over 85,000 templates for any business and personal legal situations compiled by state and usage area.

Utilize the search bar above to find another sample if the previous one was unsuitable. Click Buy Now next to the template title once you discover the right one. Choose the desired subscription plan and either register for an account or Log In. Complete payment for your subscription using a card or via PayPal to continue. Select the file format for your Blank Iowa Release Of Mortgage Form With 2 Points and download it to your device. Print your form to fill it out manually or upload the template if you prefer to do so in an online editor. Creating official documents under federal and state laws is quick and easy with our platform. Experience US Legal Forms today to keep your paperwork organized!

- All forms are expertly crafted and confirmed for authenticity, ensuring you can confidently obtain a current Blank Iowa Release Of Mortgage Form With 2 Points.

- If you are acquainted with our service and possess an account, ensure your subscription is active before acquiring any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents anytime needed by accessing the My documents tab in your profile.

- If you are new to our service, the process will require additional steps to finish.

- Here’s how new users can secure the Blank Iowa Release Of Mortgage Form With 2 Points from our catalog.

- Examine the page content closely to confirm it contains the sample you need.

- To do this, use the form description and preview options if available.

Form popularity

FAQ

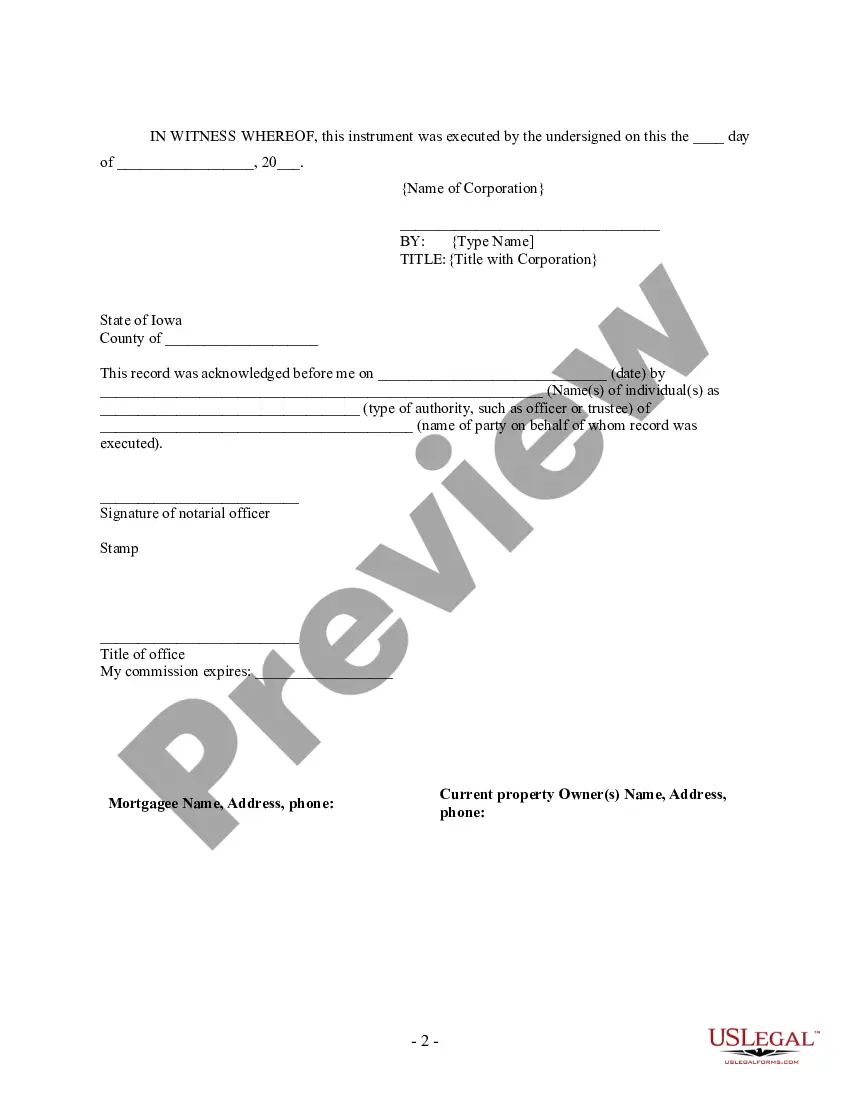

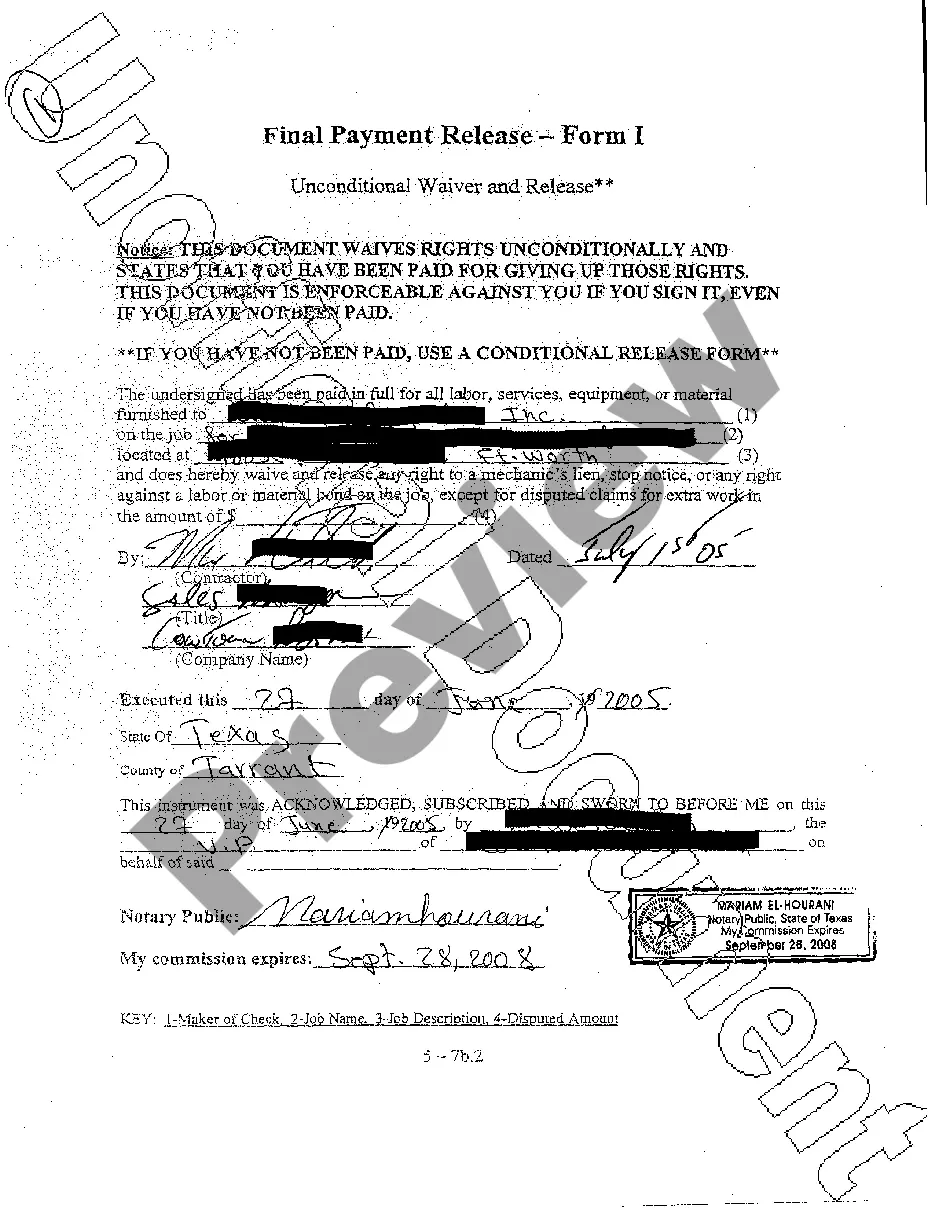

If you have cleared a debt, a mortgage satisfaction document will give you clear title to real property. In other words, mortgage satisfaction is a document that results in release or discharge of a mortgage lien, and indicates that a borrower has cleared his/her debt.

A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.

In addition the following information should be included:The Payee Name.The Owner(s) of the mortgage holder.Total amount of mortgage.Mortgage date of execution.Full and legal description of the property to include tax parcel number.Acknowledgement that all payments have been made in full.More items...?6 days ago

Timing Requirements The 3/7/3 RuleThe initial Truth in Lending Statement must be delivered to the consumer within 3 business days of the receipt of the loan application by the lender. The TILA statement is presumed to be delivered to the consumer 3 business days after it is mailed.

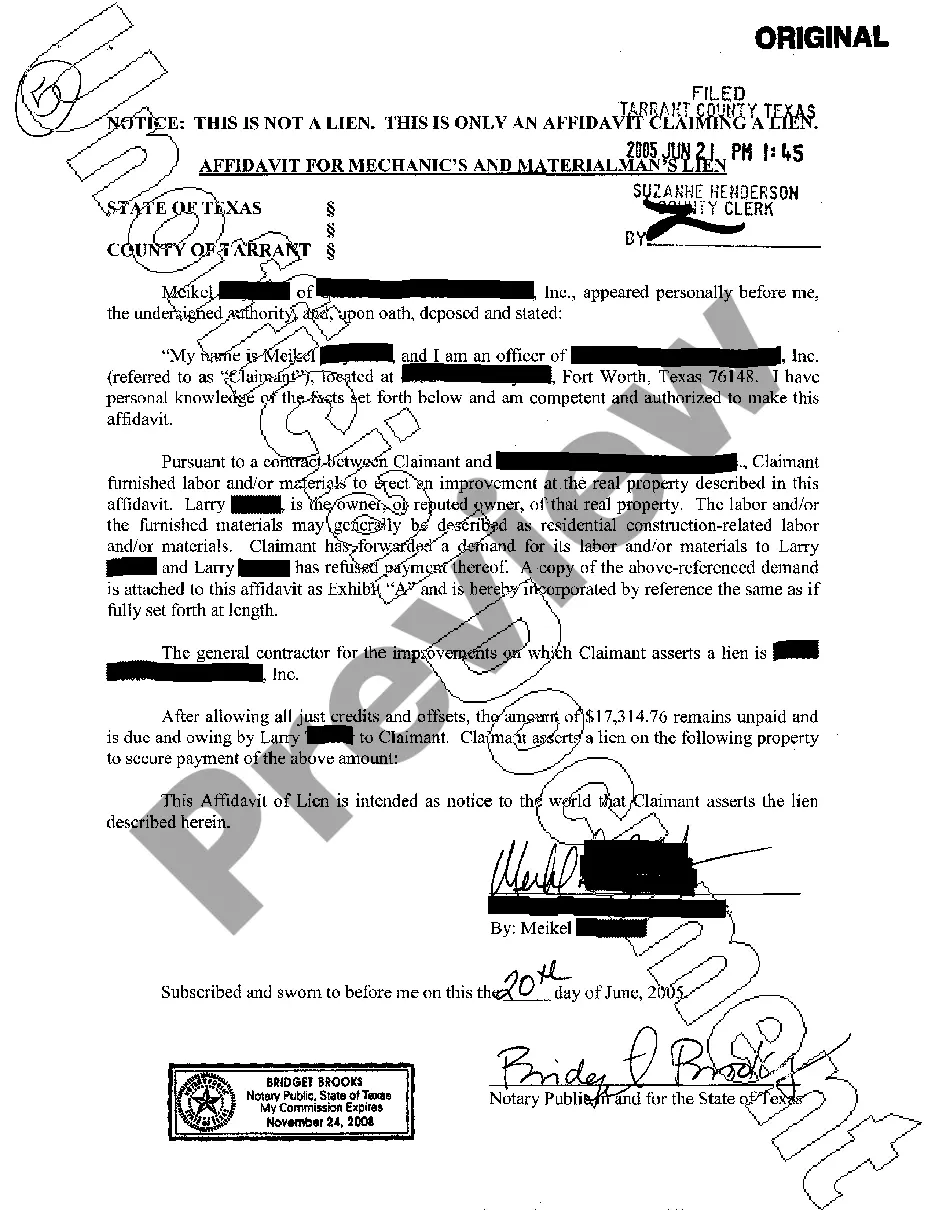

Releasing a mortgage lien often involves two or three signatures. Depending on your state, the person who's given the mortgage, the borrower, and the lender may be required to sign the release. In many states, a notary public signature and, possibly, a seal, is also needed to have a legal release of lien.