Certificate Of Organization Iowa Withholding

Description

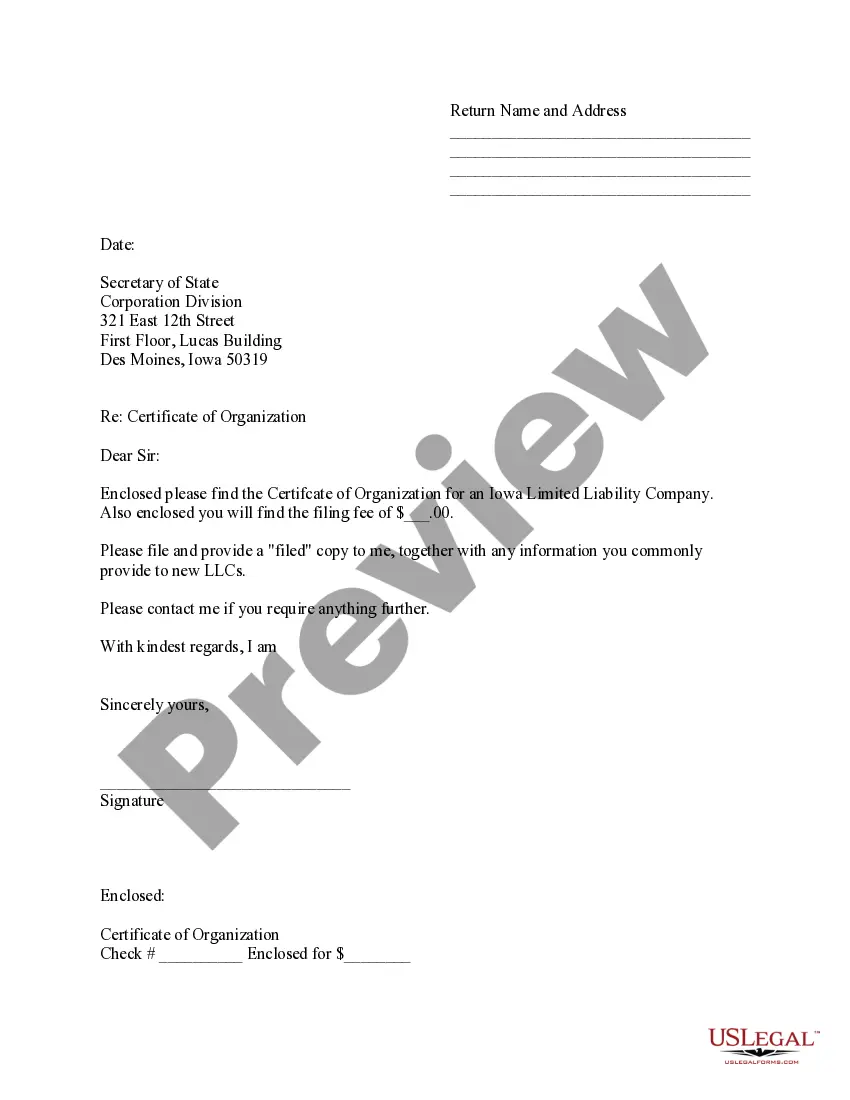

How to fill out Iowa Sample Cover Letter For Filing Of LLC Articles Or Certificate With Secretary Of State?

It’s no secret that you can’t become a law professional immediately, nor can you grasp how to quickly draft Certificate Of Organization Iowa Withholding without having a specialized set of skills. Putting together legal documents is a long venture requiring a certain education and skills. So why not leave the creation of the Certificate Of Organization Iowa Withholding to the pros?

With US Legal Forms, one of the most comprehensive legal template libraries, you can access anything from court papers to templates for internal corporate communication. We understand how important compliance and adherence to federal and local laws and regulations are. That’s why, on our platform, all forms are location specific and up to date.

Here’s how you can get started with our website and get the document you require in mere minutes:

- Find the form you need with the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to figure out whether Certificate Of Organization Iowa Withholding is what you’re searching for.

- Start your search over if you need a different form.

- Register for a free account and choose a subscription option to buy the form.

- Choose Buy now. Once the payment is through, you can download the Certificate Of Organization Iowa Withholding, complete it, print it, and send or mail it to the designated people or organizations.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your forms-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

Iowa LLCs are taxed as pass-through entities by default. This means that the profits (and losses) pass-through the LLC and onto the personal tax filings of the LLC members, who are also responsible for paying self-employment taxes (Social Security and Medicare) of 15.3%.

489.201 Formation of limited liability company ? certificate of organization. 1. One or more persons may act as organizers to form a limited liability company by signing and delivering to the secretary of state for filing a certificate of organization.

All businesses registered with the state must appoint a registered agent. The Iowa Secretary of State will reject your filing if you do not appoint one. So that the state and the general public have a reliable way to deliver to your Iowa business legal notices and other types of official mail.

A Limited Liability Company (LLC) is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner's tax return (a disregarded entity).

Iowa accepts the filing of a certificate of organization form via postal mail, in-person delivery, or electronically via the Iowa Secretary of State's Office Fast Track Filing system, the state's official portal for forming an entity.