Iowa Estate With Inventory Form

Description

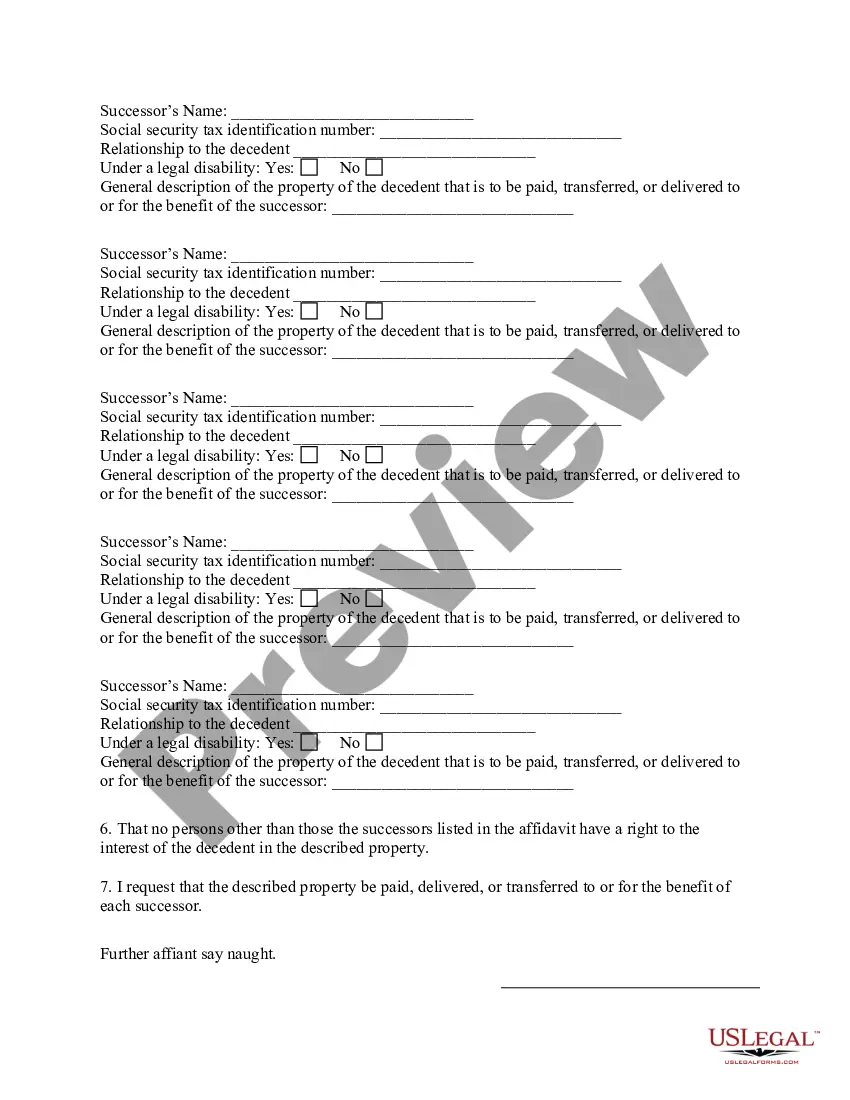

How to fill out Iowa Small Estate Affidavit For Personal Property Estates Not More Than $50,000?

Steering through the red tape of official documents and formats can be tough, particularly if one does not engage in such tasks professionally.

Even selecting the appropriate format for the Iowa Estate With Inventory Form will be labor-intensive, as it must be accurate and precise down to the final digit.

Nonetheless, you will have to invest considerably less effort in choosing a fitting format from a trustworthy source.

Obtain the correct document in a few straightforward steps: Enter the document title in the search box. Locate the suitable Iowa Estate With Inventory Form in the result list. Review the description of the document or view its preview. If the format meets your needs, click Buy Now. Then select your subscription plan. Use your email to create a secure password to establish an account at US Legal Forms. Choose a credit card or PayPal for payment. Finally, save the document file to your device in your preferred format. US Legal Forms will save you a significant amount of time verifying whether the form you found online fits your requirements. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the process of locating the correct forms online.

- US Legal Forms is a single location required to discover the latest samples of documents, inquire about their usage, and download these samples for completion.

- It is a repository containing over 85K documents applicable in various professional fields.

- When searching for an Iowa Estate With Inventory Form, you will not need to doubt its authenticity as all documents are validated.

- An account with US Legal Forms will guarantee you have all the essential samples at your fingertips.

- Keep them in your history or add them to the My documents collection.

- You can access your saved documents from any device by clicking Log In on the library site.

- If you haven’t set up an account yet, you can always search for the format you require.

Form popularity

FAQ

Inventory in an estate refers to all the assets held by the decedent, which may include real estate, financial accounts, and personal items. When filling out the Iowa estate with inventory form, make sure to include both tangible and intangible assets to give a full picture of the estate's value. This thorough inventory is essential for probate and will help navigate the estate settlement process efficiently.

Inventory property typically includes all items owned by the decedent at the time of death, such as real estate, vehicles, bank accounts, stocks, and personal possessions. The Iowa estate with inventory form allows you to list these properties clearly and concisely. Accurately documenting this information is crucial for the probate process, as it determines the estate's value for distribution.

An example of inventory of an estate might encompass real property, such as a family home, financial assets like savings and retirement accounts, and personal items including collectibles. When using the Iowa estate with inventory form, it's important to provide precise details and valuations to ensure a smooth probate process. This organized inventory will help in settling the estate effectively.

An example of inventory for probate might include a list of a decedent's real estate properties, bank accounts, investment accounts, and valuable personal items like jewelry and art. Each item should be listed with its fair market value at the time of death. By using the Iowa estate with inventory form, you can efficiently organize and present this information to the probate court.

Creating an inventory list for probate begins with identifying all assets owned by the decedent. Include tangible assets such as homes, vehicles, and personal property, as well as financial accounts and investments. Utilize the Iowa estate with inventory form to systematically categorize and document each item. After compiling the list, ensure it is comprehensive and correctly reflects the value of the estate.

To fill out the Iowa estate with inventory form, start by gathering all relevant documents and information regarding the decedent's assets. List each asset clearly, including real estate, bank accounts, and personal belongings. Ensure you provide accurate valuations for each item to reflect its market value at the time of death. Once complete, review the form for accuracy to avoid any issues during probate.

The inventory of the estate refers to a comprehensive list detailing all assets owned by the deceased at the time of their passing. This inventory is crucial for probate purposes, as it clarifies asset distribution and values for beneficiaries. Completing an Iowa estate with inventory form allows you to keep track of all required information succinctly.

In Iowa, an estate can usually avoid probate if its total value is under $50,000. This threshold applies to most individual estates, allowing for a simpler transfer of assets. By utilizing an Iowa estate with inventory form, you can efficiently determine your estate's value and understand whether probate can be avoided.

The threshold for probate in Iowa is generally set at $50,000 for most estates. If the estate is valued below this amount, it might be eligible for a simplified probate process or even to bypass probate altogether. To evaluate your situation precisely, consider using an Iowa estate with inventory form for a well-organized estate assessment.

In Iowa, an estate typically must exceed $50,000 in total value to warrant probate proceedings. This threshold allows smaller estates to avoid the complexity of formal probate processes. Hence, an Iowa estate with inventory form becomes essential for accurately assessing asset value and determining if probate is necessary.