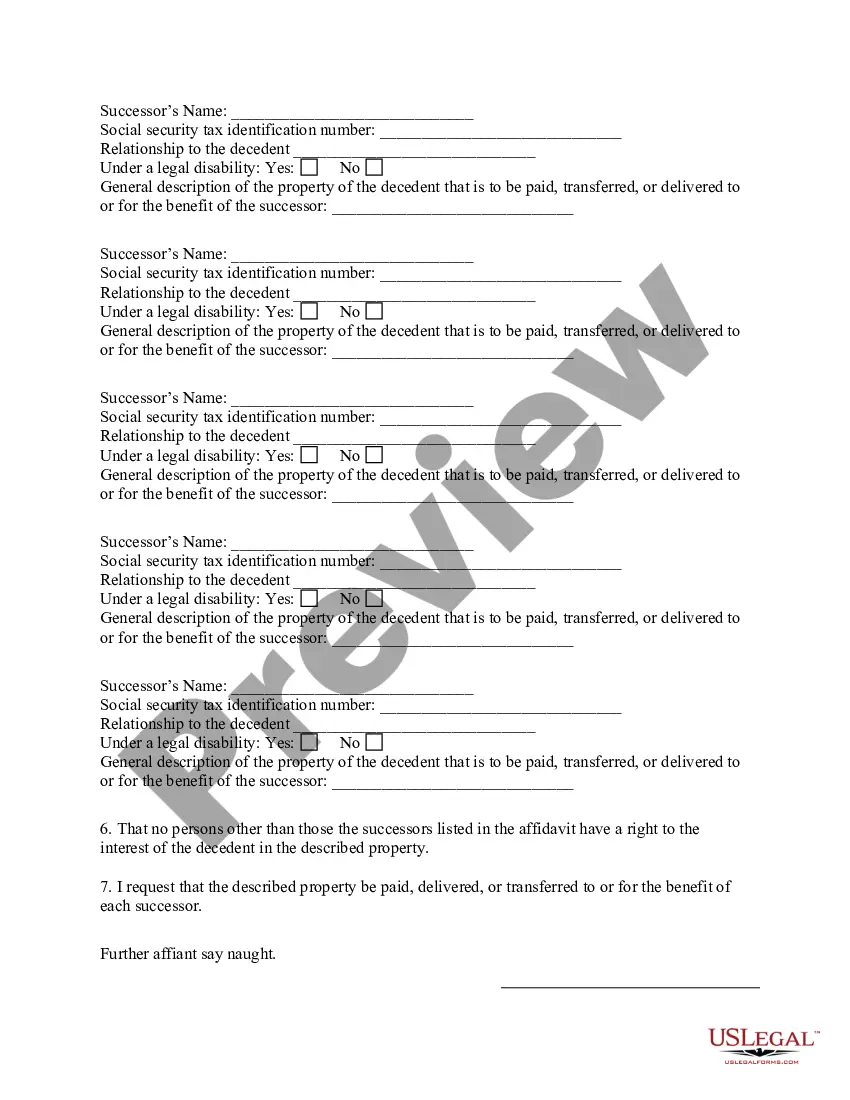

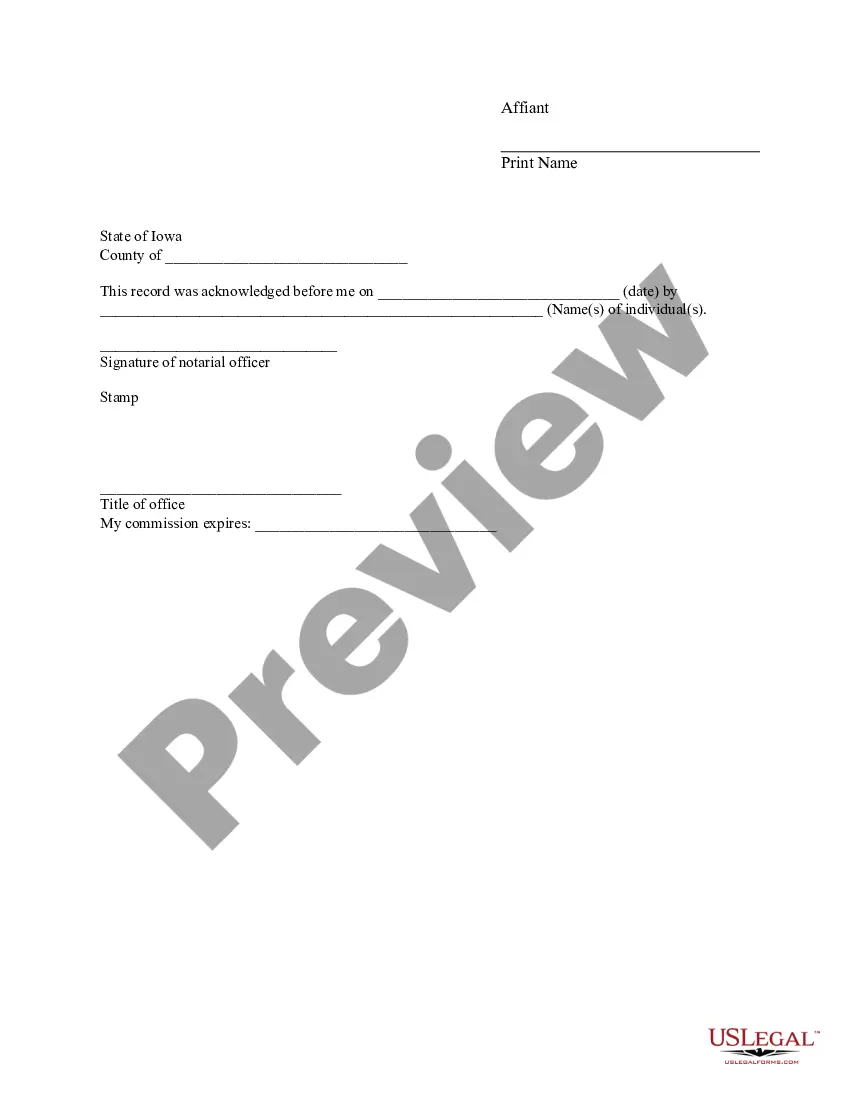

Iowa Affidavit for Distribution of Property: Explained When a loved one passes away, dealing with their estate and property distribution can be both emotionally and legally challenging. In Iowa, an important legal document that comes into play during this process is the Affidavit for Distribution of Property. This affidavit serves as a valuable tool to help streamline the distribution of assets owned by the deceased individual. The Iowa affidavit for distribution of property is a legal document that allows heirs or beneficiaries of an estate to transfer the assets of the deceased person without having to go through the probate court. This affidavit simplifies the process and saves time and money for those involved. Key elements of the Iowa affidavit for distribution of property include: 1. Executor or Administrator: The affidavit must be executed by the executor or administrator of the estate. This individual is responsible for overseeing the distribution process and ensuring it adheres to applicable laws. 2. Small Estate Limitation: The affidavit is specifically designed for small estates, limiting the total value of the estate, typically up to a certain dollar amount. This limit varies, so it is crucial to consult the Iowa probate code or seek legal advice to determine if your situation qualifies. 3. Identification of Property: The affidavit must include a detailed list of all the assets to be distributed. This can include real estate, bank accounts, vehicles, personal belongings, and other valuable items. 4. Oath and Statement: The person executing the affidavit is required to sign an oath, affirming that the information provided is true and accurate to the best of their knowledge. Additionally, they must provide a statement that there are no unpaid debts or claims against the estate. 5. Applicable Law: The Iowa affidavit for distribution of property must comply with the state's probate laws, including Chapter 635 — Uniform Probate Code. It is crucial to review the specific legal requirements and consult legal counsel to ensure compliance. Different Types of Iowa Affidavits for Distribution of Property: 1. Small Estate Affidavit: This is the most common type of Iowa affidavit for distribution of property. It is used for estates that fall below the specified small estate limit, allowing a swift transfer of assets. 2. Jointly-Held Property Affidavit: This affidavit is used when assets, such as real estate or bank accounts, are jointly owned. It allows the surviving joint owner to claim the property without the need for probate. In conclusion, the Iowa affidavit for distribution of property is a useful legal tool for simplifying the transfer of assets of a deceased person. Understanding the key elements and requirements of this affidavit is essential to ensure a smooth and efficient distribution process. Remember to consult legal professionals or review the Iowa probate code to fully comprehend the specific legal requirements as they may vary.

Iowa Affidavit For Distribution Of Property

Description

How to fill out Iowa Affidavit For Distribution Of Property?

It’s clear that you cannot instantly become a legal authority, nor can you easily understand how to swiftly create an Iowa Affidavit For Distribution Of Property without a professional background.

Assembling legal paperwork is an extensive procedure that demands specific education and expertise. So why not entrust the crafting of the Iowa Affidavit For Distribution Of Property to the specialists.

With US Legal Forms, one of the most expansive legal document repositories, you can access anything from court documents to office communication templates. We recognize how vital compliance and adherence to federal and state regulations are.

Click Buy now. Once the payment is finalized, you can download the Iowa Affidavit For Distribution Of Property, complete it, print it, and send or mail it to the intended individuals or entities.

You can retrieve your documents from the My documents section whenever needed. If you're an existing customer, simply Log In, and locate and download the template from the same section.

No matter the purpose of your paperwork—whether financial, legal, or personal—our website has you covered. Give US Legal Forms a try now!

- Start with our website and obtain the document you need within minutes.

- Find the document you require by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and review the supporting description to ascertain whether the Iowa Affidavit For Distribution Of Property meets your needs.

- If you require another template, commence your search anew.

- Establish a free account and select a subscription plan to purchase the template.

Form popularity

FAQ

In Iowa, an estate generally must have a value exceeding $50,000 before it is required to go through the probate process. If the estate is below this threshold, you might be able to use an Iowa affidavit for distribution of property, simplifying the process. Understanding these financial thresholds can significantly impact your estate planning decisions.

You can avoid probate in Iowa by establishing joint ownership, utilizing payable-on-death accounts, and creating trusts. Another effective method is to prepare an Iowa affidavit for distribution of property for smaller estates, which can bypass the lengthy probate process. Exploring these options with an estate planning expert can ensure you choose the best strategy for your situation.

In Iowa, certain assets can avoid the probate process, including jointly owned property, life insurance proceeds, and retirement accounts with designated beneficiaries. Additionally, small estates may qualify for simplified procedures using an Iowa affidavit for distribution of property. Understanding what properties are exempt can help you manage your estate planning effectively.

In Iowa, you typically have a period of six months to file a claim against an estate after the personal representative has published a notice to creditors. It's important to act promptly, as failing to file a claim within this timeframe may result in losing your opportunity to recover debts owed. Utilizing an Iowa affidavit for distribution of property may help streamline the process if you are an heir.

A 13100 affidavit is an official document used in Iowa to facilitate the distribution of a deceased person's property without the need for probate. This affidavit allows heirs to claim assets directly if they meet certain conditions. Using an Iowa affidavit for distribution of property can simplify the process, saving time and reducing costs associated with probate procedures.

Writing an Iowa affidavit for distribution of property involves a few straightforward steps. Begin with a header that identifies the document and the involved parties. List the deceased’s assets and include pertinent information, like dates and valuations. To ensure accuracy and compliance, consider using uslegalforms, which offers structured templates that help you create a legally sound document.

To obtain an Iowa affidavit for distribution of property, you should start by gathering necessary documents, including proof of the deceased’s assets and liabilities. You can then complete the affidavit form, which is available through the Iowa courts or local government offices. Additionally, using platforms like uslegalforms can simplify this process by providing templates and guidance tailored to Iowa's requirements.

In Kansas, a small estate affidavit is not typically required to be filed with the court. Instead, it serves as a legal tool for heirs to claim property without court intervention. However, you should check local regulations, as requirements can vary. Make sure to utilize reliable resources to confirm the validity of your Iowa affidavit for distribution of property.

The time it takes to get an Iowa affidavit for distribution of property approved can vary. Generally, processing times depend on the specific county and its workload. However, you can often expect a response within a few weeks, especially if all required documentation is submitted correctly. Using a streamlined service can help expedite the process.