Dissolution Dissolve Corporation With The Eu

Description

How to fill out Iowa Dissolution Package To Dissolve Corporation?

- Log in to your existing US Legal Forms account. If you're a new user, you’ll need to create an account first.

- Browse the form collection and select the dissolution form that aligns with your local jurisdiction requirements. Use the Preview mode to ensure it's the right one.

- If the desired form is not available, make use of the Search tab to find alternative templates that meet your needs.

- Purchase the selected document by clicking the 'Buy Now' button and choosing a subscription plan that suits you. This will grant you access to the entire library.

- Enter your payment details, either via credit card or PayPal, and finalize your transaction.

- Download the dissolution form onto your device. You can find it under the 'My Forms' section in your profile for future reference.

With US Legal Forms, you gain access to a wealth of resources and premium support, ensuring your legal documents are executed quickly and accurately. The service’s robust collection of over 85,000 editable forms stands out in the market, providing greater value.

Don't hesitate to leverage US Legal Forms' extensive library for your legal needs. Start your journey towards dissolving your corporation with confidence by visiting their site today!

Form popularity

FAQ

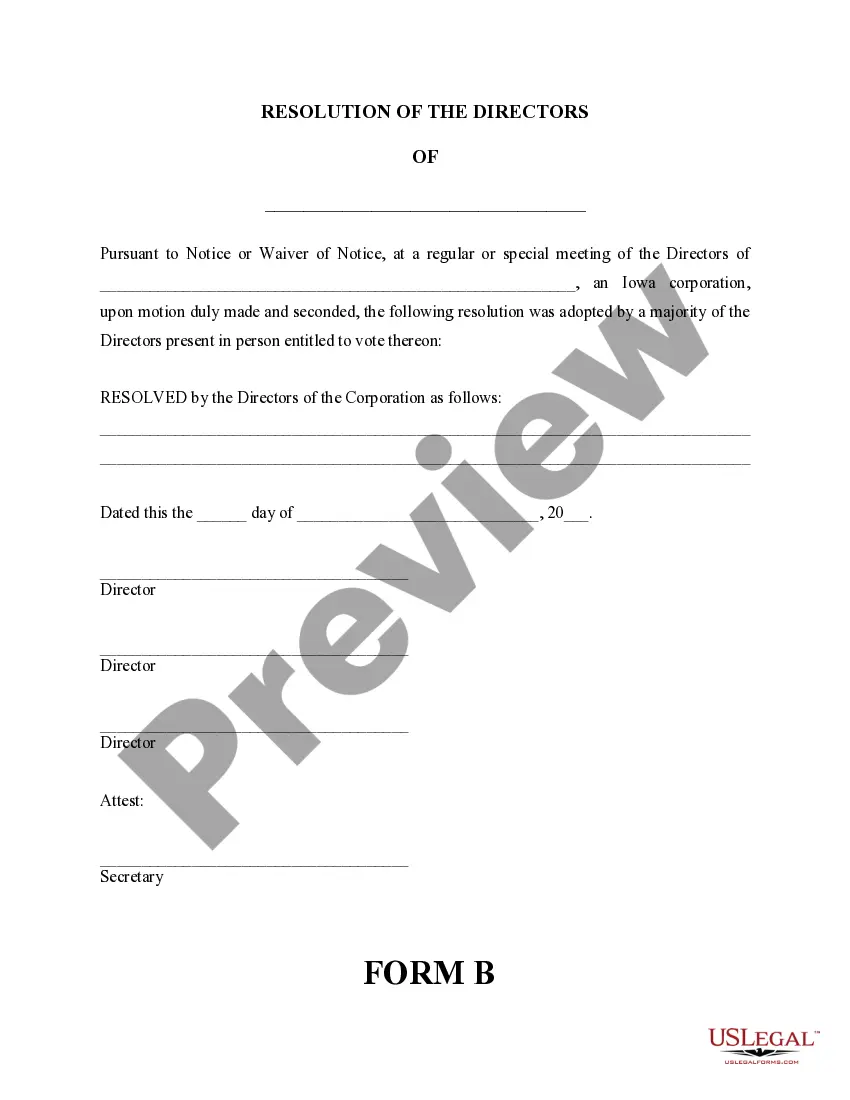

A corporate resolution to dissolve is an official statement made by the board of directors that communicates the decision to end the company’s operations. This document is crucial as it outlines the steps to liquidate assets, settle debts, and distribute any remaining resources. When contemplating how to dissolution dissolve corporation with the eu, utilizing resources like uslegalforms can simplify this process and ensure compliance with legal requirements.

Corporations can dissolve in several ways, including voluntary dissolution, where the board and shareholders agree to cease operations, or involuntary dissolution, which occurs due to legal action or failure to comply with regulations. Another method is administrative dissolution, initiated by a state when a company fails to file necessary documents. Understanding these methods can help you decide how to dissolution dissolve corporation with the eu effectively.

Dissolving a company means terminating its legal existence and ceasing all operations. This process involves settling debts, distributing remaining assets to shareholders, and filing necessary paperwork with legal authorities. When a company chooses to dissolution dissolve corporation with the eu, it signifies that the business will no longer operate, adhering to legal and financial responsibilities.

The corporate resolution of dissolution is a formal document that a company’s board of directors approves to officially begin the process of dissolving the corporation. This resolution outlines the decision to dissolve, details the necessary steps, and indicates that shareholders have been informed. By issuing this resolution, the company takes the critical step toward dissolution, helping to clarify the process and ensure legal compliance when you seek to dissolution dissolve corporation with the eu.

To fill out articles of dissolution, gather required information, such as the corporation's name, date of dissolution, and reason for dissolution. The form often requires signatures from executives or board members. Using a service like USLegalForms can guide you through the process, ensuring that your articles of dissolution comply with regulations when dissolving a corporation with the EU.

Completing a corporation's dissolution involves several key steps, including filing dissolution documents with the appropriate state authority and settling any outstanding debts. Additionally, notifying shareholders and filing a final tax return with the IRS is critical. Resources such as USLegalForms can help streamline this process, especially for those looking to dissolve a corporation with the EU.

Companies can dissolve through various methods, including voluntary dissolution, where owners decide to cease operations, and involuntary dissolution, initiated by the state or creditors. Administrative dissolution is also a common method due to failure to adhere to legal requirements. Utilizing a trusted platform like USLegalForms can simplify the dissolution process and facilitate compliance.

A corporation consists of three essential parts: shareholders, who own the corporation; the board of directors, which oversees corporate governance; and the corporate officers, responsible for daily management. Each part plays a crucial role in decision-making and operations. Understanding these components can assist in effective planning for corporate dissolution or restructuring.

To dissolve a corporation with the IRS, you must file the final tax return and mark it as 'final.' Next, fulfill any outstanding tax obligations to ensure compliance. You will also need to formally notify the state of the dissolution, ideally using resources like USLegalForms for accurate paperwork, particularly when planning to dissolve a corporation with the EU.

The three types of corporate dissolution are voluntary, involuntary, and administrative dissolution. Voluntary dissolution occurs when the corporation's owners choose to end the business. Involuntary dissolution is imposed by the state due to legal violations, while administrative dissolution takes place when regulatory authorities have reason to dissolve the entity.