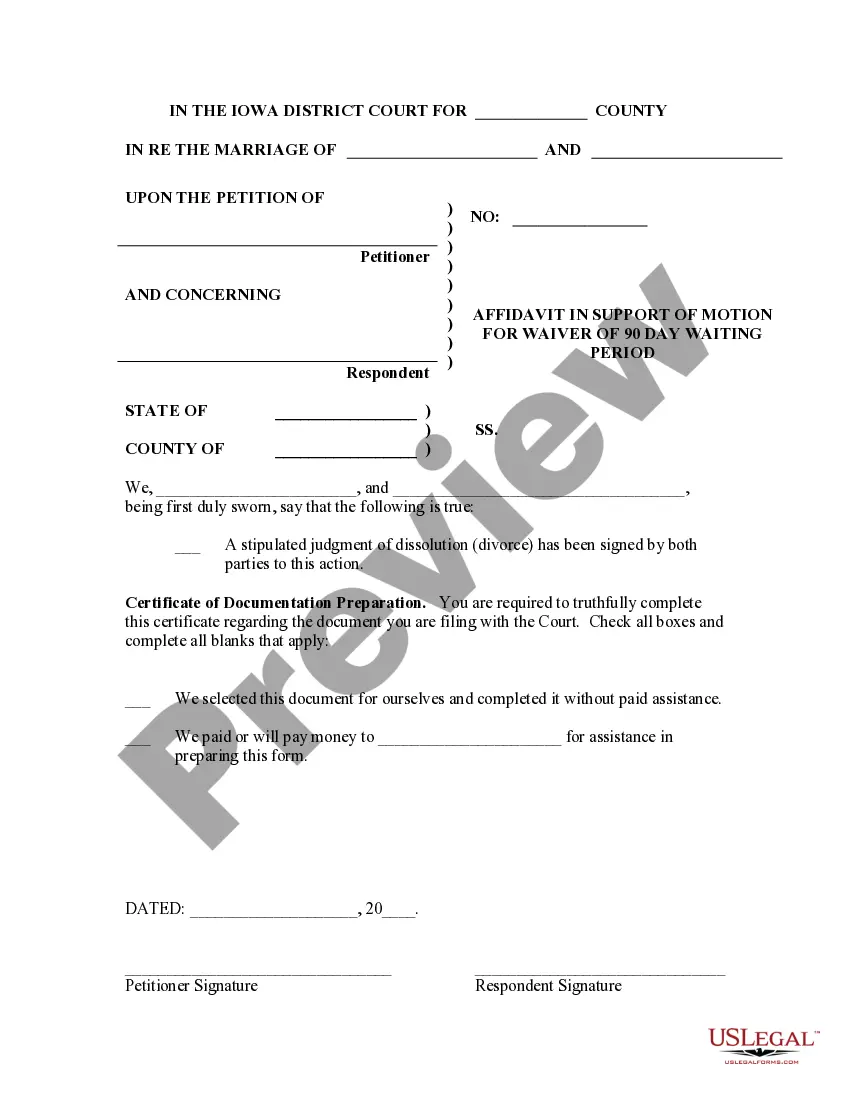

This a motion to waive the 90 day waiting period to grant a divorce.

222 Marriage Rule With Irs

Description

How to fill out Iowa Motion For Waiver Of 90 Day Waiting Period?

Regardless of whether it’s for corporate needs or personal matters, everyone eventually has to handle legal issues at some point in their life.

Completing legal paperwork demands meticulous care, starting with choosing the correct form template. For example, if you select an incorrect version of the 222 Marriage Rule With Irs, it will be rejected once you submit it.

- Obtain the template you require by using the search bar or browsing the catalog.

- Review the form’s description to ensure it aligns with your situation, jurisdiction, and region.

- Click on the form’s preview to examine it.

- If it’s the wrong document, return to the search tool to locate the 222 Marriage Rule With Irs example you need.

- Download the document if it satisfies your requirements.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you don’t have an account yet, you can acquire the form by clicking Buy now.

- Select the suitable pricing choice.

- Fill out the account registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

- Select the file format you desire and download the 222 Marriage Rule With Irs.

- Once downloaded, you can either complete the form using editing software or print it and fill it out by hand.

Form popularity

FAQ

There is no such thing as a ?legal separation? in Maryland. If you and your spouse live separate lives for at least six months, you can file for divorce based on the ground (legal reason) of a ?6-month separation.? What are legal reasons, or grounds, for divorce?

Fault Grounds: Maryland accepts seven fault grounds for an absolute divorce, including adultery, desertion, conviction of certain crimes, insanity, cruelty, and excessively vicious conduct. We will focus on adultery and desertion as examples.

Maryland is one of the unique states that requires there to be a fault ground to get an immediate divorce without a waiting period.

In Maryland, an absolute divorce on the ground of voluntary separation may be obtained by either party 12 months after the parties agree to separate and then live separate and apart in separate homes without sexual intimacy.

Divorce records are generally open to the public. Some financial information or information regarding children may have restricted access. Follow the steps in this video to get a copy of your judgment of divorce.

New Law Effective October 1, 2023 The new law scheduled to become effective in October eliminates the concept of limited divorce and changes the grounds for absolute divorce. Beginning in October, there will be only three grounds for absolute divorce: 6-month separation, irreconcilable differences, and mutual consent.

Mutual consent - You and your spouse can agree to divorce and sign a written agreement (called a marital settlement agreement) that resolves all issues related to alimony, marital property, and the care, custody, and support of any minor or dependent children.

Each county's circuit court has an index to their divorces that gives the case numbers. The Circuit Court can also supply a copy of the divorce case file. A list of Maryland Circuit Courts and their corresponding contact information can be found on the website,List of Maryland Circuit Courts.