Issuing Notices

Description

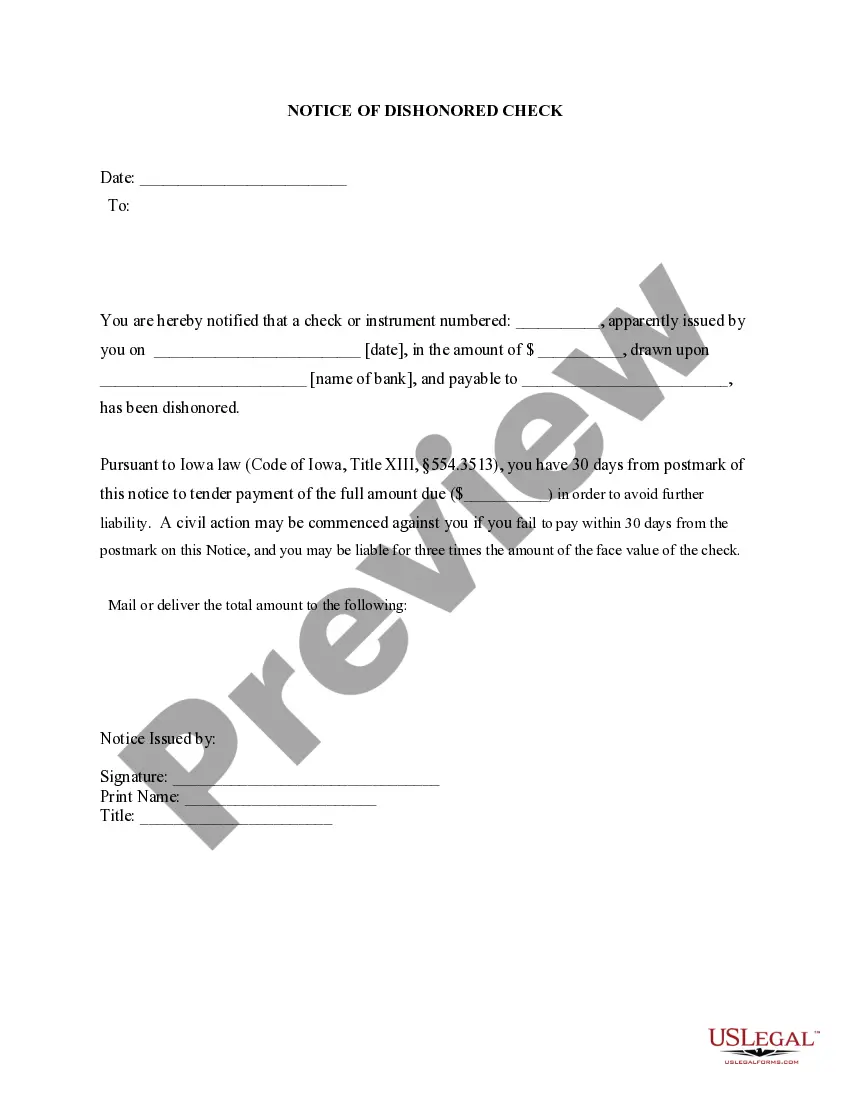

How to fill out Iowa Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

- Log in to your account if you're a returning user. Ensure your subscription is valid, and if not, renew it according to your payment plan.

- For first-time users, start by selecting a form. Check the Preview mode and description to confirm its relevance to your needs and compliance with local jurisdiction requirements.

- If necessary, search for alternative templates using the Search tab to find the most suitable option.

- Click on the Buy Now button and select your preferred subscription plan. You will need to create an account to access the full library.

- Complete your purchase by providing your payment details either through credit card or PayPal.

- Once the purchase is successful, download the form to your device. You can also access it later in the My Forms section of your profile.

By following these steps, you can easily issue notices tailored to your requirements. US Legal Forms not only offers a robust collection of legal forms but also ensures you have the guidance needed for precise form completion.

Start using US Legal Forms today and experience the benefits of a comprehensive legal document library! Sign up now for streamlined notice issuing!

Form popularity

FAQ

'Notice issued' on a tax transcript indicates that the IRS has sent a communication related to your tax return. This could involve various matters, including requests for additional information or adjustments based on discrepancies. Understanding the context of these notices is essential for effective follow-up. If you feel overwhelmed, US Legal Forms can provide guidance to help you respond correctly.

The time it takes to receive your refund after an IRS notice can vary widely. Generally, issuing notices can lead to delays in processing your refund as the IRS reviews your case. You may experience specific delays depending on the nature of the notice. To avoid these complications, consider using resources like US Legal Forms for clarity on how to respond promptly.

The IRS issues several common notices, including CP2000, which informs taxpayers of a proposed adjustment, and CP14, which communicates balance due information. Understanding these notices is crucial, as each one addresses different tax situations. By being aware of these notices, you can take appropriate action. US Legal Forms can help you understand the implications of these communications.

You can determine if your tax return has been flagged by reviewing any communication from the IRS. Often, they issue notices regarding discrepancies or issues with your filings. Additionally, you may see a notification on your tax account transcript indicating that your return is under review. If you need further clarity, consider using US Legal Forms to help navigate your situation.

To issue a notice means to formally communicate important information from the IRS to taxpayers. This action serves to notify individuals of their tax situation, required actions, or any discrepancies that may arise. Understanding the significance of issuing notices can lead to better management of your tax responsibilities.

The IRS sends different types of notices, including those that inform taxpayers of missing information, payment due dates, or audits. Understanding these notices helps taxpayers address any issues promptly and avoid complications. Ignoring these communications can lead to greater challenges, so it's wise to stay informed about the notices you receive.

The IRS may issue checks to taxpayers for various reasons, such as tax refunds, stimulus payments, or other eligible credits. If you're expecting a check, it’s beneficial to stay updated on the issuing process and any notices related to your eligibility. Keeping track of these payments ensures you know what to expect and when.

Letters from the IRS can cover a range of topics, from confirming receipt of your tax return to notices about owed taxes or corrections needed. These communications are vital for ensuring transparency and understanding your tax status. If you regularly encounter these letters, knowing the purpose behind each can greatly aid in effectively managing your tax affairs.

Yes, you can view certain IRS notices online through your IRS account. By creating an account on the IRS website, you gain access to your tax records and notifications. This feature simplifies tracking and managing your interactions with the IRS, especially when it comes to issuing notices.

Issuing a notice refers to the IRS's formal communication to taxpayers about specific actions related to their tax accounts. This process ensures that taxpayers are informed of any discrepancies, required actions, or updates necessary to maintain compliance. Issuing notices plays a crucial role in keeping taxpayers aware of their responsibilities.