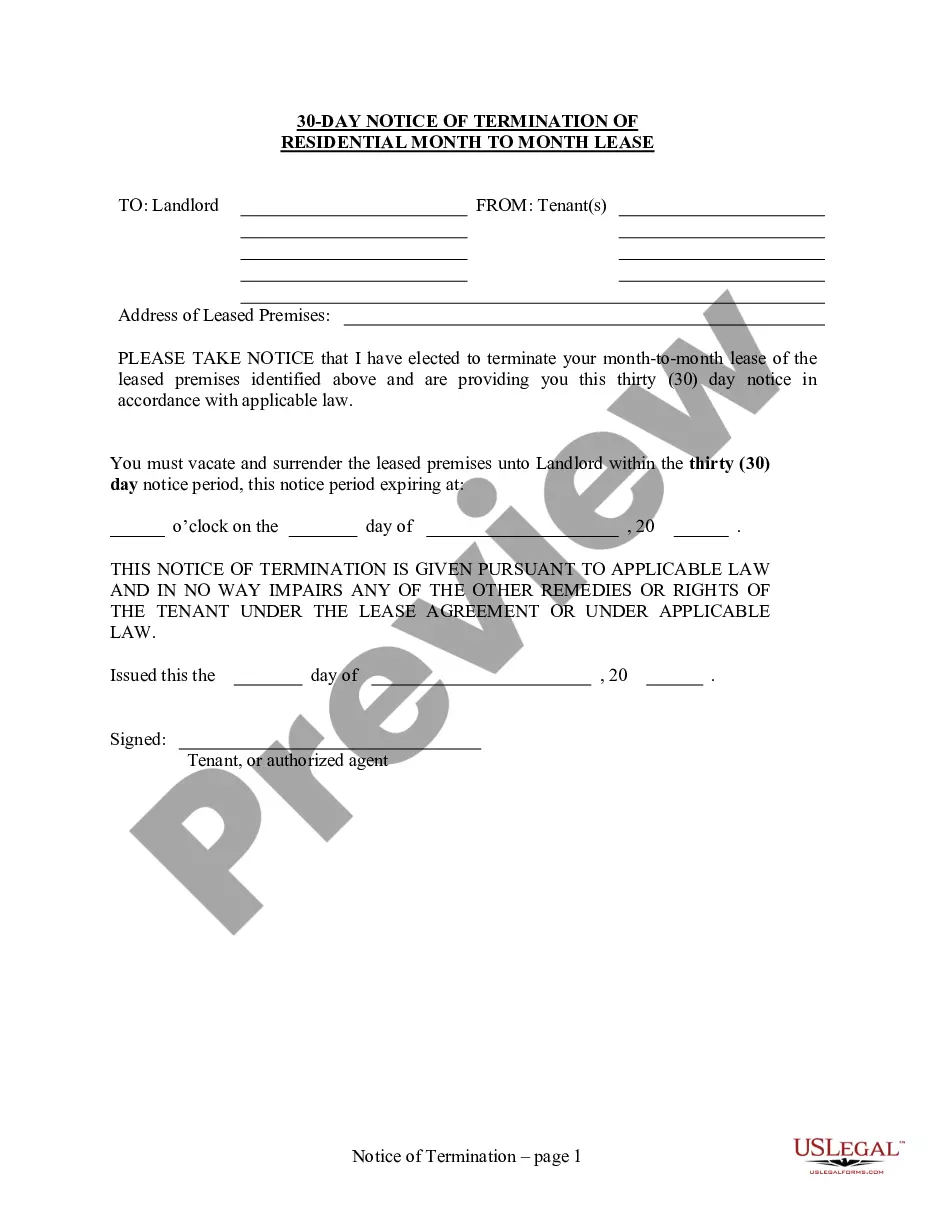

30 Day Notice to Terminate Month to Month Lease for Residential from Tenant to Landlord

Sec. 562A.27 -- Noncompliance with rental agreement--failure

to pay rent:

1. Except as provided in this chapter,

if there is a material noncompliance by the tenant with the rental agreement

or a noncompliance with section 562A.17 materially affecting health and

safety, the landlord may deliver a written notice to the tenant specifying

the acts and omissions constituting the breach and that the rental agreement

will terminate upon a date not less than seven days after receipt

of the notice if the breach is not remedied in seven days, and the rental

agreement hall terminate as provided in the notice subject to the provisions

of this section. If the breach is remediable by repairs or the payment

of damages or otherwise and the tenant adequately remedies the breach prior

to the date specified in the notice, the rental agreement shall not terminate.

If substantially the same act or omission which constituted a prior noncompliance

of which notice was given recurs within six months, the landlord may terminate

the rental agreement upon at least seven days' written notice specifying

the breach and the date of termination of the rental agreement.

2. If rent is unpaid when

due and the tenant fails to pay rent within three days after written

notice by the landlord of nonpayment and the landlord's intention to terminate

the rental agreement if the rent is not paid within that period of time,

the landlord may terminate the rental agreement.

3. Except as provided in this chapter,

the landlord may recover damages and obtain injunctive relief for noncompliance

by the tenant with the rental agreement or section 562A.17 unless the tenant

demonstrates affirmatively that the tenant has exercised due diligence

and effort to remedy any noncompliance, and that the tenant's failure to

remedy any noncompliance was due to circumstances beyond the tenant's control.

If the tenant's noncompliance is willful, the landlord may recover reasonable

attorney's fees.

4. In any action by a landlord for

possession based upon nonpayment of rent, proof by the tenant of the following

shall be a defense to any action or claim for possession by the landlord,

and the amounts expended by the claimant in correcting the deficiencies

shall be deducted from the amount claimed by the landlord as unpaid rent:

a. That the landlord

failed to comply either with the rental agreement or with section 562A.15;

and

b. That the tenant

notified the landlord at least seven days prior to the due date of the

tenant's rent payment of the tenant's intention to correct the condition

constituting the breach referred to in paragraph "a" at the landlord's

expense; and

c. That the reasonable

cost of correcting the condition constituting the breach is equal to or

less than one month's periodic rent; and

d. That the tenant

in good faith caused the condition constituting the breach to be corrected

prior to receipt of written notice of the landlord's intention to terminate

the rental agreement for nonpayment of rent.

Sec. 562A.27A -- Termination for creating a clear and present

danger to others:

1. Notwithstanding section 562A.27

or 648.3, if a tenant has created or maintained a threat constituting

a clear and present danger to the health or safety of other tenants,

the landlord, the landlord's employee or agent, or other persons on or

within one thousand feet of the landlord's property, the landlord, after

a single three days' written notice of termination and notice to

quit, may file suit against the tenant for recovery of possession of the

premises pursuant to chapter 648, except as otherwise provided in subsection

3. The petition shall state the incident or incidents giving rise to the

notice of termination and notice to quit. The tenant shall be given the

opportunity to contest the termination in the court proceedings by notice

thereof at least three days prior to the hearing.

2. A clear and present danger to

the health or safety of other tenants, the landlord, the landlord's employees

or agents, or other persons on or within one thousand feet of the landlord's

property includes, but is not limited to, any of the following activities

of the tenant or of any person on the premises with the consent of the

tenant:

a. Physical assault

or the threat of physical assault.

b. Illegal use

of a firearm or other weapon, the threat to use a firearm or other weapon

illegally, or possession of an illegal firearm.

c. Possession of

a controlled substance unless the controlled substance was obtained directly

from or pursuant to a valid prescription or order by a licensed medical

practitioner while acting in the course of the practitioner's professional

practice. This paragraph applies to any other person on the premises with

the consent of the tenant, but only if the tenant knew of the possession

by the other person of a controlled substance.

3. This section shall not apply to

a tenant if the activities causing the clear and present danger, as defined

in subsection 2, are conducted by a person on the premises other than the

tenant and the tenant takes at least one of the following measures against

the person conducting the activities:

a. The tenant

seeks a protective order, restraining order, order to vacate the homestead,

or other similar relief pursuant to chapter 236, 598, or 915, or any other

applicable provision which would apply to the person conducting the activities

causing the clear and present danger.

b. The tenant

reports the activities causing the clear and present danger to a law enforcement

agency or the county attorney in an effort to initiate a criminal action

against the person conducting the activities.

c. The tenant

writes a letter to the person conducting the activities causing the clear

and present danger, telling the person not to return to the premises and

that a return to the premises may result in a trespass or other action

against the person, and the tenant sends a copy of the letter to a law

enforcement agency whose jurisdiction includes the premises. If the tenant

has previously written a letter to the person as provided in this paragraph,

without taking an action specified in paragraph "a" or "b" or filing a

trespass or other action, and the person to whom the letter was sent conducts

further activities causing a clear and present danger, the tenant must

take one of the actions specified in paragraph "a" or "b" to be exempt

from proceedings pursuant to subsection 1.

However, in order to fall within the exemptions

provided within this subsection, the tenant must provide written proof

to the landlord, prior to the commencement of a suit against the tenant,

that the tenant has taken one of the measures specified in paragraphs "a"

through "c".