Llc Ltd

Description

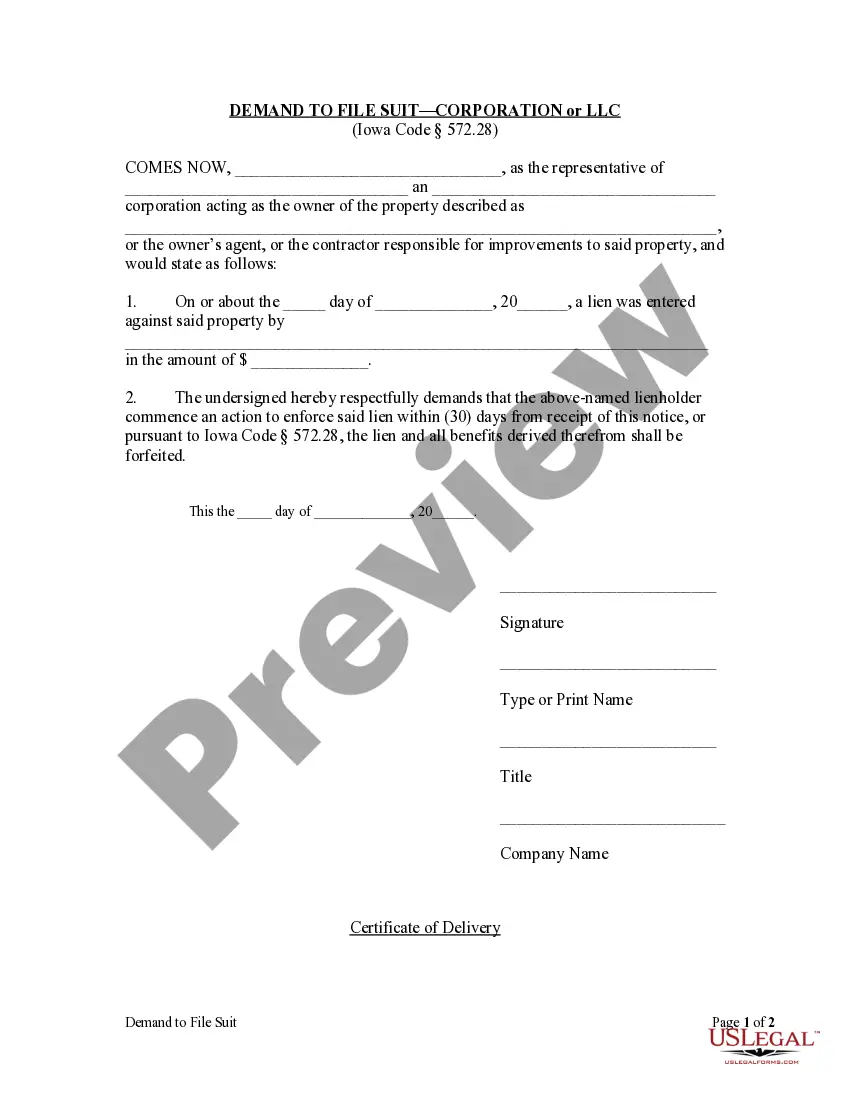

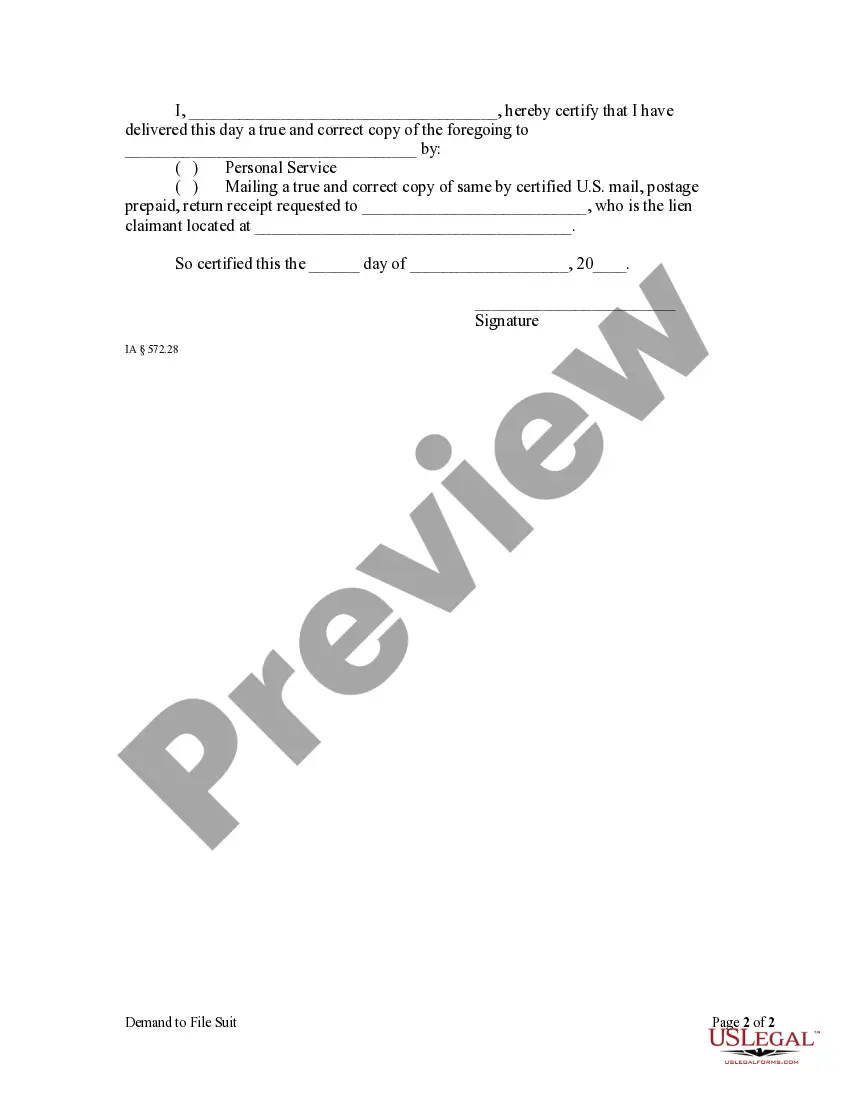

How to fill out Iowa Demand To File Suit By Corporation Or LLC?

- Log into your existing account on US Legal Forms. Ensure your subscription is active; if it's expired, renew it according to your chosen payment plan.

- Preview the form you intend to use by checking the description. Make sure it aligns with your specific needs and meets your local jurisdiction requirements.

- If you need an alternative template, utilize the Search tab to find the one that fits your criteria accurately.

- Purchase the document by clicking on the Buy Now button, and select the subscription plan that best suits you. Registration might be required for full access.

- Complete your transaction by entering your credit card information or Paypal account details to finalize your subscription.

- Download your selected form and save it to your device. You can always revisit it in the My Forms section of your profile for future reference.

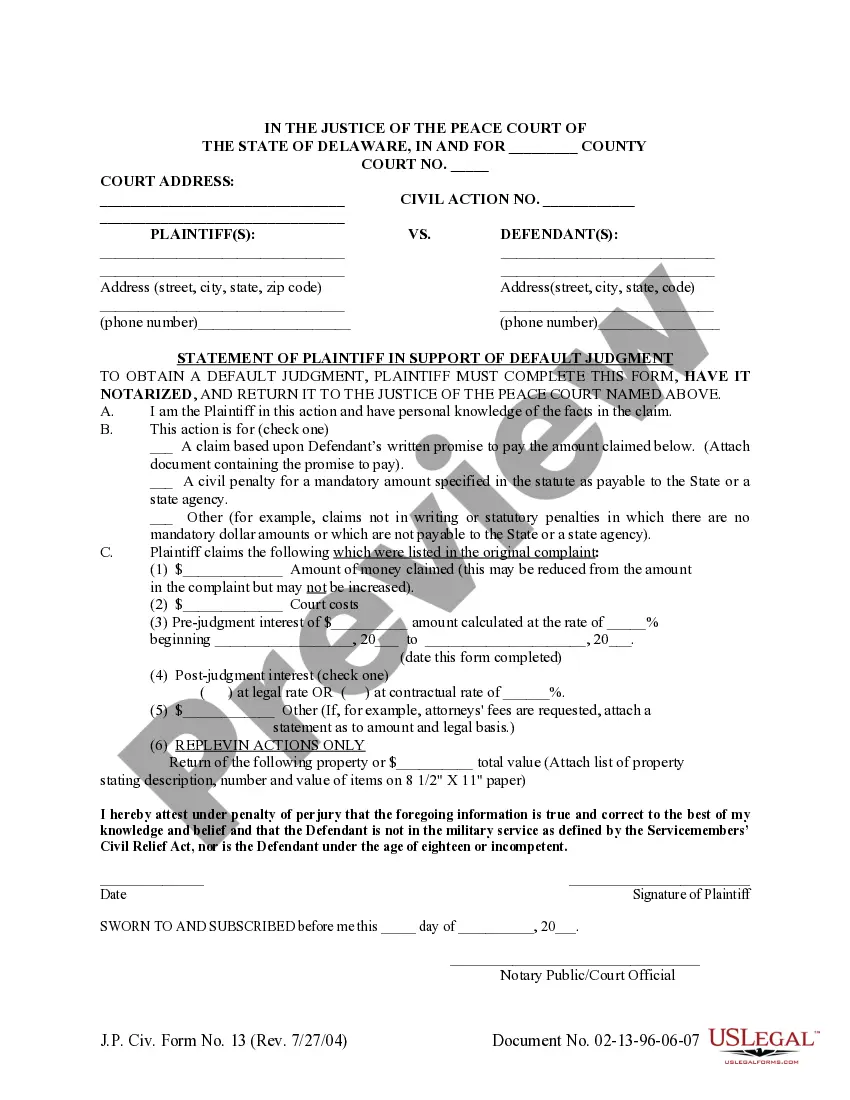

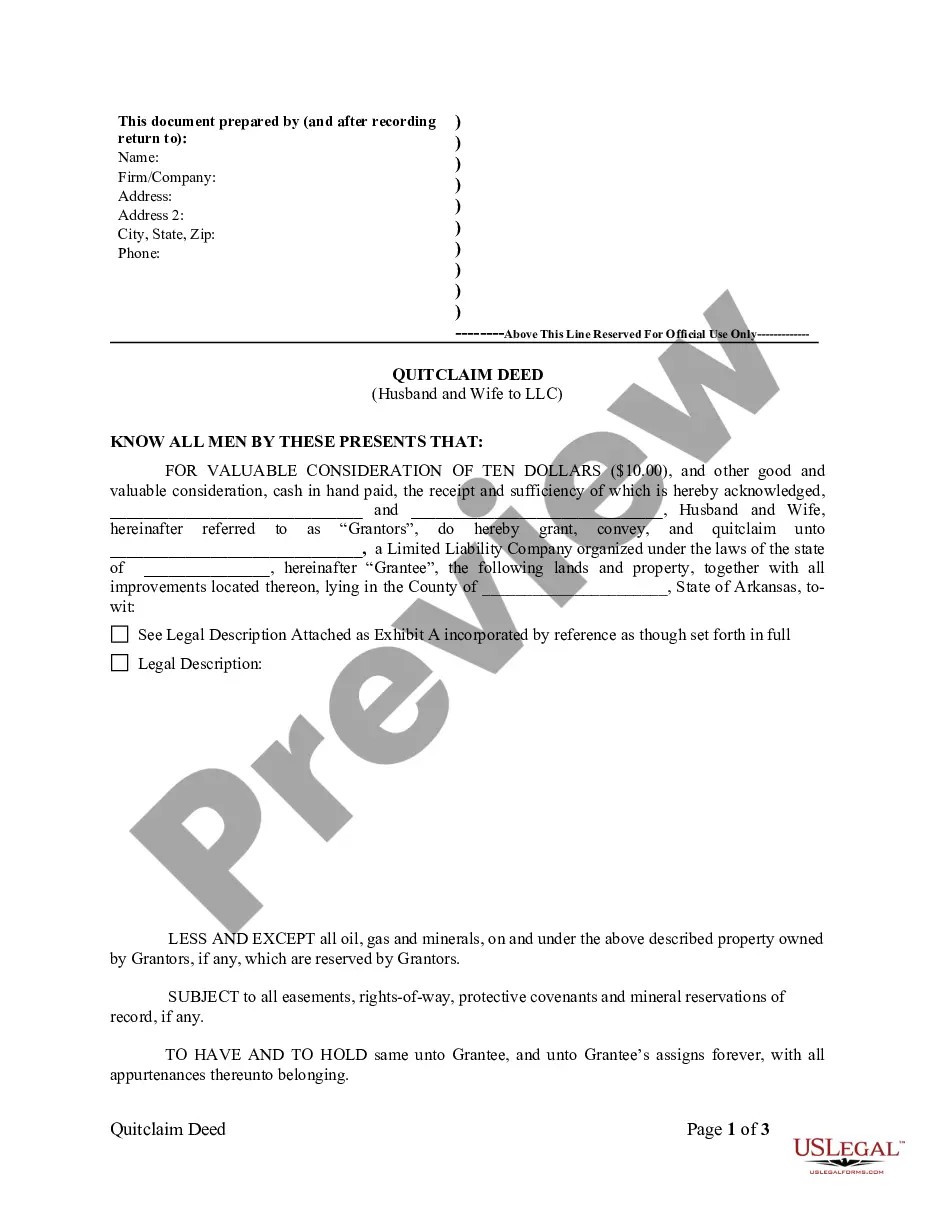

US Legal Forms equips individuals and attorneys with the tools necessary to create legal documents swiftly and accurately.

By using their vast library filled with over 85,000 fillable legal forms, you ensure your LLC ltd documentation is precise and compliant. Start your legal journey today by visiting US Legal Forms!

Form popularity

FAQ

The U.S. equivalent of Ltd is an LLC, or Limited Liability Company. This business structure shares the same limited liability benefits as an Ltd, protecting your personal assets from business debts. Additionally, LLCs provide more flexibility in management and tax treatment. If you're looking to establish a business in the U.S., forming an LLC may be the best choice for you.

Yes, an Ltd typically requires an Employer Identification Number (EIN) for various reasons, including tax reporting and hiring employees. An EIN functions like a Social Security number for your business, necessary for federal tax purposes. If you form an Ltd in the U.S., acquiring an EIN through the IRS is straightforward. Utilizing platforms like USLegalForms can make this process even easier and more efficient.

No, LLC and Ltd are not the same entity, although they both offer limited liability protections. An LLC is a specific designation used in the United States and provides flexibility in taxation and business structure. On the other hand, Ltd is more prevalent in countries outside the U.S., such as the UK. Knowing the distinctions can help you make better choices for your business formation.

While Ltd and LLC serve similar purposes, they are not the same. An Ltd, short for Limited Company, is commonly used in countries like the UK, while LLC, or Limited Liability Company, is primarily used in the United States. Both structures provide limited liability protection, but their legal frameworks and formation processes differ. Understanding these differences is vital if you're considering forming a global business structure.

To write a Limited Liability Company (LLC), you'll need to follow a few simple steps. First, choose a unique name that complies with your state's LLC naming requirements and includes 'LLC' or 'Limited Liability Company.' Next, prepare and file the Articles of Organization with your state, which outlines basic information about your LLC. Finally, create an operating agreement to define ownership and management structures, ensuring your LLC operates smoothly.

While both a Ltd and an LLC offer limited liability protection to their owners, they are not exactly the same. A Ltd, or limited company, is more common in countries like the UK, whereas an LLC, or limited liability company, is a U.S. structure. Each has its own regulations and requirements. Understanding the differences is crucial when deciding which structure best fits your business needs.

To start an LLC in Colorado, you need to file Articles of Organization with the Secretary of State. Additionally, you should create an operating agreement to outline management and ownership details. While not mandatory, obtaining an Employer Identification Number (EIN) from the IRS is advisable for banking and tax purposes. Using uslegalforms can simplify this process and ensure you meet compliance requirements.

The tax rate for an LLC in Colorado depends on various factors, such as the type of income generated. Generally, LLCs are treated as pass-through entities, meaning the income passes to members, who report it on their personal tax returns. However, LLCs can also elect to be taxed as a corporation if that suits their financial situation better. Understanding these options can help you make tax decisions that align with your business goals.

Filing for your LLC separately is possible, especially if you have personal and business income that you want to keep distinct. This separation can benefit your accounting and tax obligations significantly. Utilizing services like US Legal Forms can simplify this process, helping you ensure that all necessary documentation is filed correctly.

In many cases, you can file your LLC paperwork yourself without needing to hire a professional. Numerous resources guide you through the process, making it accessible for anyone. However, consider using platforms like US Legal Forms to ensure accuracy, as mistakes in the filing could lead to delays or potential legal issues.