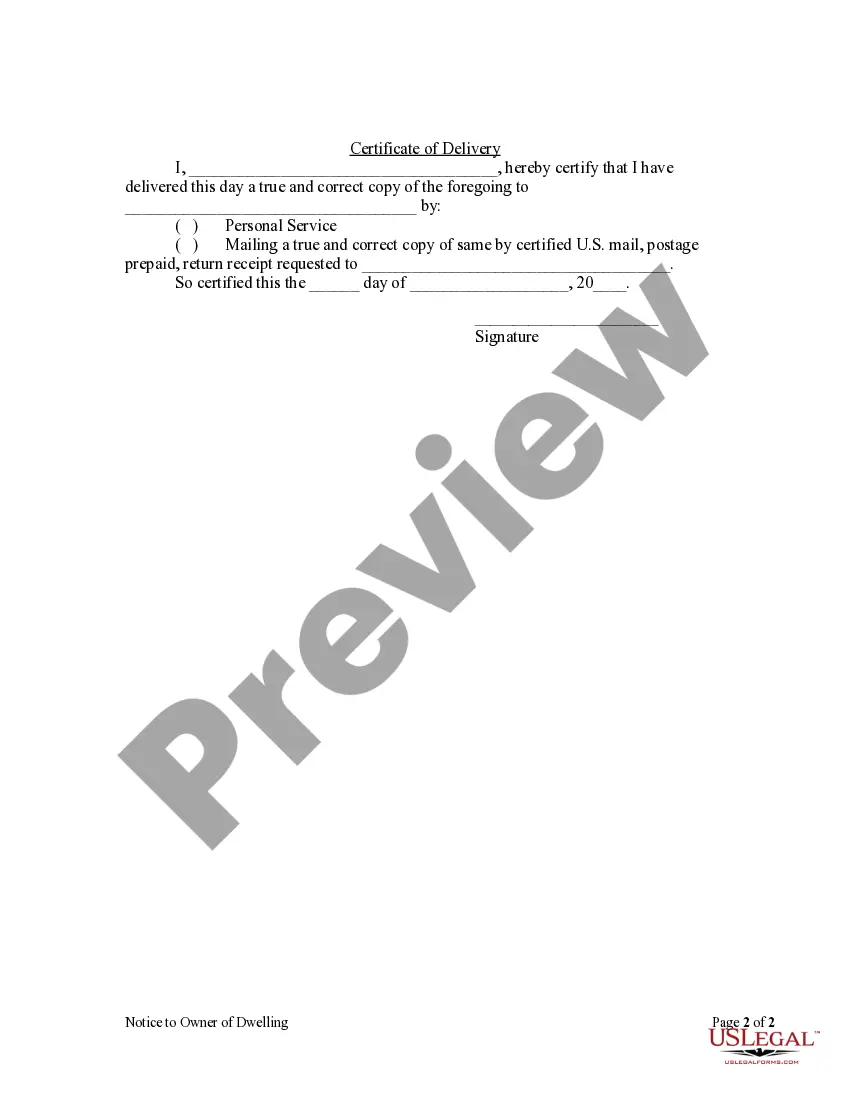

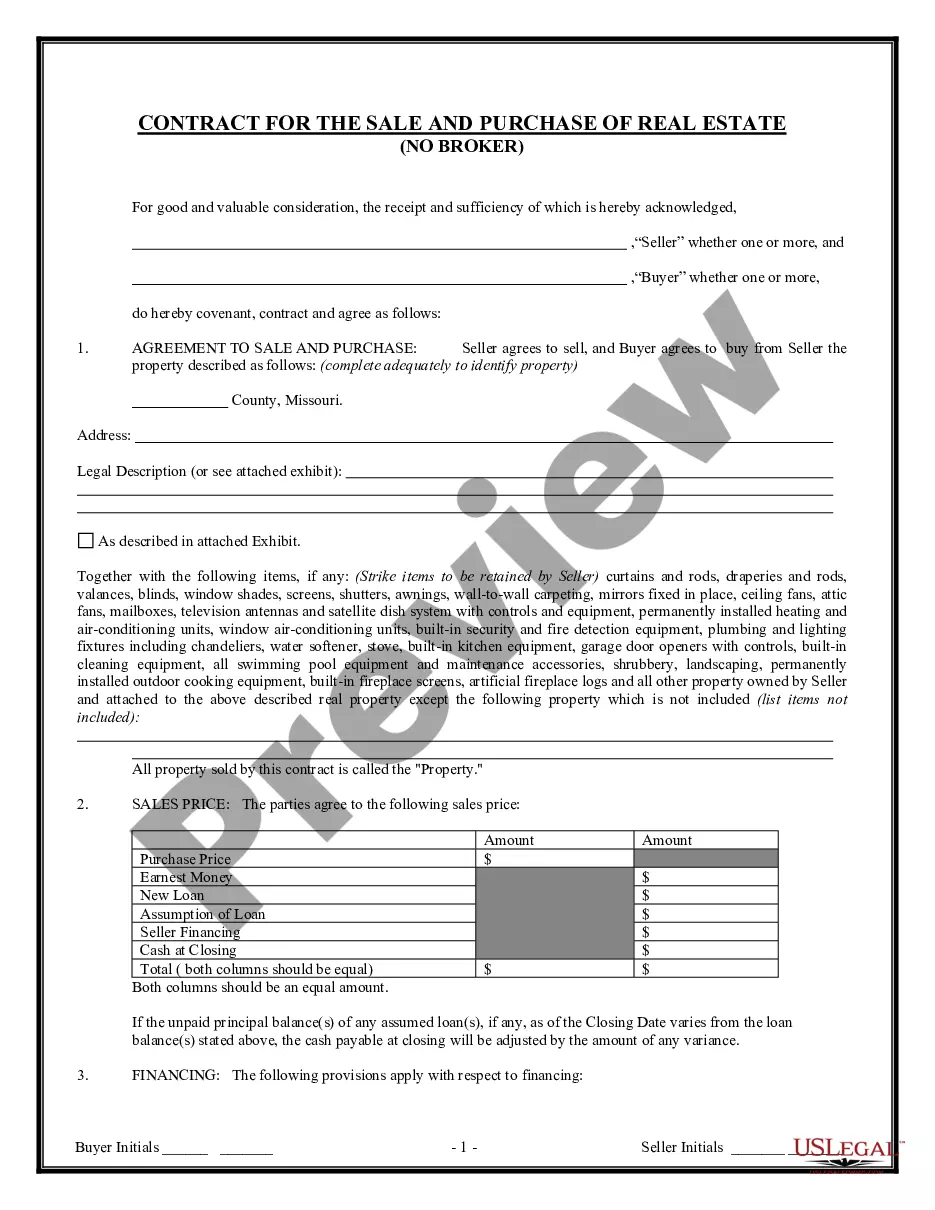

A subcontractor or party other than a principal contractor is required to provide a form notice to the property owner to perfect a lien. The notice may be delivered by personal service or by certified mail. The notice advises the owner that a lien could be filed against the property and that the owner should not make further payments to the contractor without receiving a waiver from the party providing the notice.

Corporation Limited Liability Company With 2 Owners

Description

How to fill out Iowa Notice To Owner Of Dwelling By Corporation Or LLC?

How to locate professional legal documents that adhere to your state regulations and prepare the Limited Liability Company with Two Owners without consulting a lawyer.

Numerous online services offer templates for various legal circumstances and formalities. However, it may require time to determine which of the available examples fulfill both your use case and legal standards.

US Legal Forms is a trustworthy service that assists you in locating formal paperwork crafted according to the latest updates in state law, helping you save on legal fees.

If you do not have an account with US Legal Forms, then follow the instructions below: Review the webpage you've accessed and ensure the form meets your requirements.

- US Legal Forms is not an ordinary web directory.

- It comprises over 85,000 verified templates for distinct business and personal situations.

- All documents are categorized by area and state to facilitate a quicker and smoother search.

- Additionally, it includes robust tools for PDF editing and eSignature, allowing users with a Premium subscription to quickly finalize their documentation online.

- It requires minimal effort and time to obtain the necessary documents.

- If you already possess an account, Log In and verify that your subscription is active.

- Download the Limited Liability Company with Two Owners using the related button adjacent to the file name.

Form popularity

FAQ

No, there is no specific limit on the number of owners a corporation can have, allowing for significant growth potential. In a corporation limited liability company with 2 owners, each additional owner can contribute unique skills and resources. This flexibility encourages investment opportunities and the potential for expansion. It's important to properly structure the share distribution and governance to facilitate smooth operations.

Yes, a corporation can have just one person as its owner, known as a sole shareholder. In a corporation limited liability company with 2 owners, it’s important to note that even if a corporation allows for a single owner, having multiple owners can offer diverse perspectives and shared responsibilities. A single owner enjoys full control over the business but also bears all the risks involved. This structure is often beneficial for solo entrepreneurs.

The owner of one or more shares of a corporation is called a shareholder. In a corporation limited liability company with 2 owners, both individuals may hold shares, giving them ownership stakes in the company. Shareholders benefit from the company's profits through dividends and can vote on significant business decisions. This structure aligns interests and encourages long-term commitment to the company's success.

Yes, you can have two owners of a company, making it a partnership or a corporation limited liability company with 2 owners. This setup allows both parties to actively manage the business and share in its profits and losses. Each owner contributes their skills, resources, and efforts to help the business succeed. Having multiple owners can lead to better decision-making through collaboration.

In a corporation limited liability company with 2 owners, both individuals can share responsibilities and profits equally or define their roles based on contributions. Each member has limited liability, meaning personal assets are typically protected from business debts. This structure promotes flexibility in management and operations. Additionally, forming an LLC allows for easier tax treatment, benefiting both owners.

An LLC can absolutely have two owners, known as members. Establishing a Corporation limited liability company with 2 owners provides each member with limited liability, protecting personal assets from business debts. This structure also allows for flexibility in management and decision-making among the owners. Furthermore, utilizing the USLegalForms platform can simplify the process of drafting essential documents, such as the operating agreement.

Yes, two people can be under the same LLC. In fact, a Corporation limited liability company with 2 owners allows both individuals to share the business’s profits, liabilities, and responsibilities. This arrangement can enhance collaboration, combine skills and resources, and strengthen the business’s overall potential. It is essential, however, to have a clear operating agreement that details each owner's role and obligations.

To set up an LLC with two owners, begin by choosing a unique name for your business that complies with state regulations. You will file Articles of Organization with your state’s business filing office to officially establish your Corporation limited liability company with 2 owners. It’s also advisable to create an operating agreement that outlines ownership percentages, responsibilities, and decision-making processes for both owners. Finally, ensure you obtain any required licenses or permits to run your LLC.

To start a business with two owners, first, define your business idea and create a solid business plan. Next, decide on the business structure, such as forming a Corporation limited liability company with 2 owners. This structure protects personal assets while allowing each owner to actively participate in the business. Lastly, obtain any necessary permits and licenses to legally operate your business.

Yes, 2 people can indeed start a Corporation limited liability company with 2 owners. This collaborative business structure enables both individuals to share responsibilities, resources, and profits. To get started, you’ll need to draft an operating agreement outlining each owner's roles and file the required documents with your state.