Iowa Notice Of Lien

Description

Form popularity

FAQ

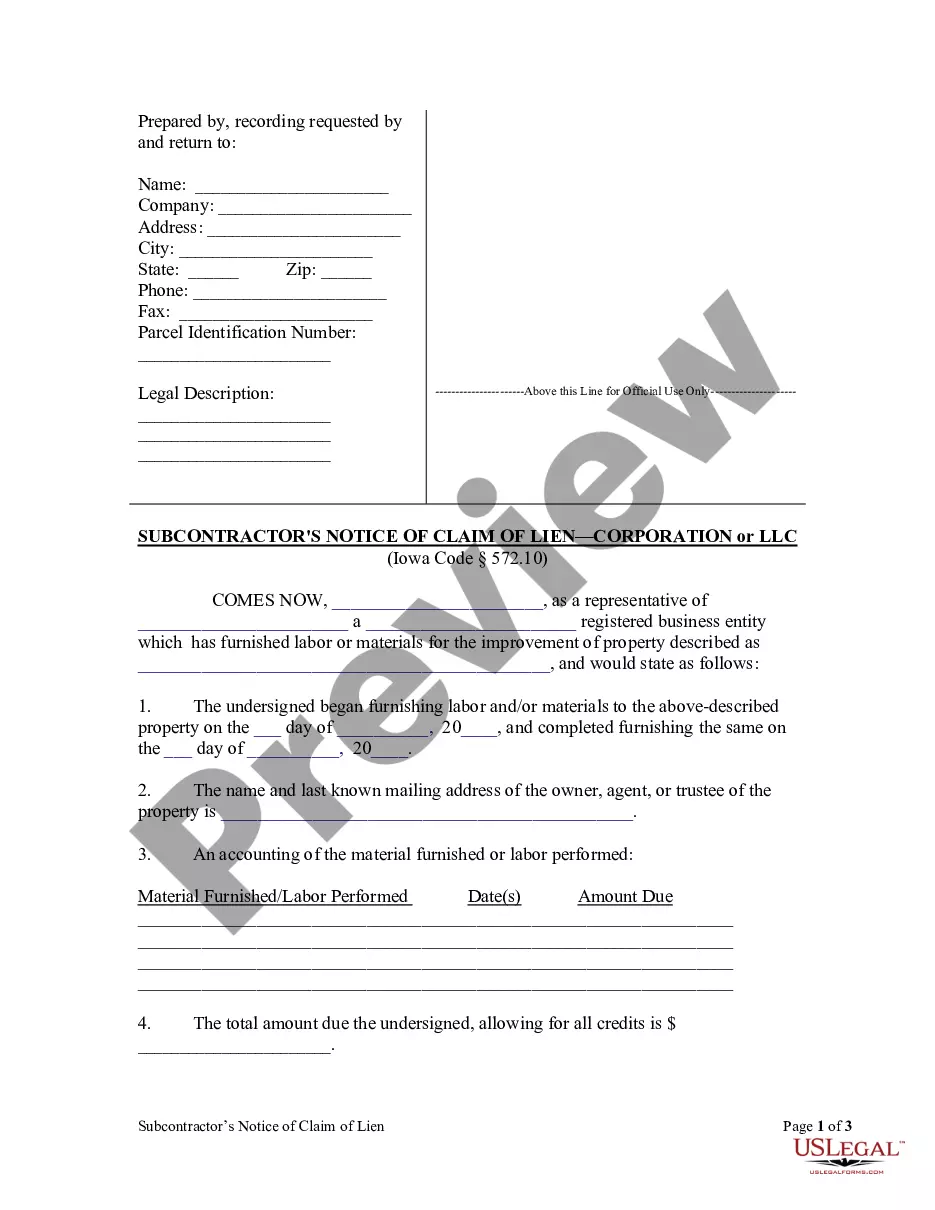

To file a lien against a property in Iowa, you must complete the Iowa notice of lien form and submit it to the county recorder's office where the property is located. Ensure you include all the necessary details, such as the property description, the amount due, and the lien claimant's information. After submitting, the recorder will file the notice, making it official. It is advisable to verify the requirements with your local office to avoid any mistakes.

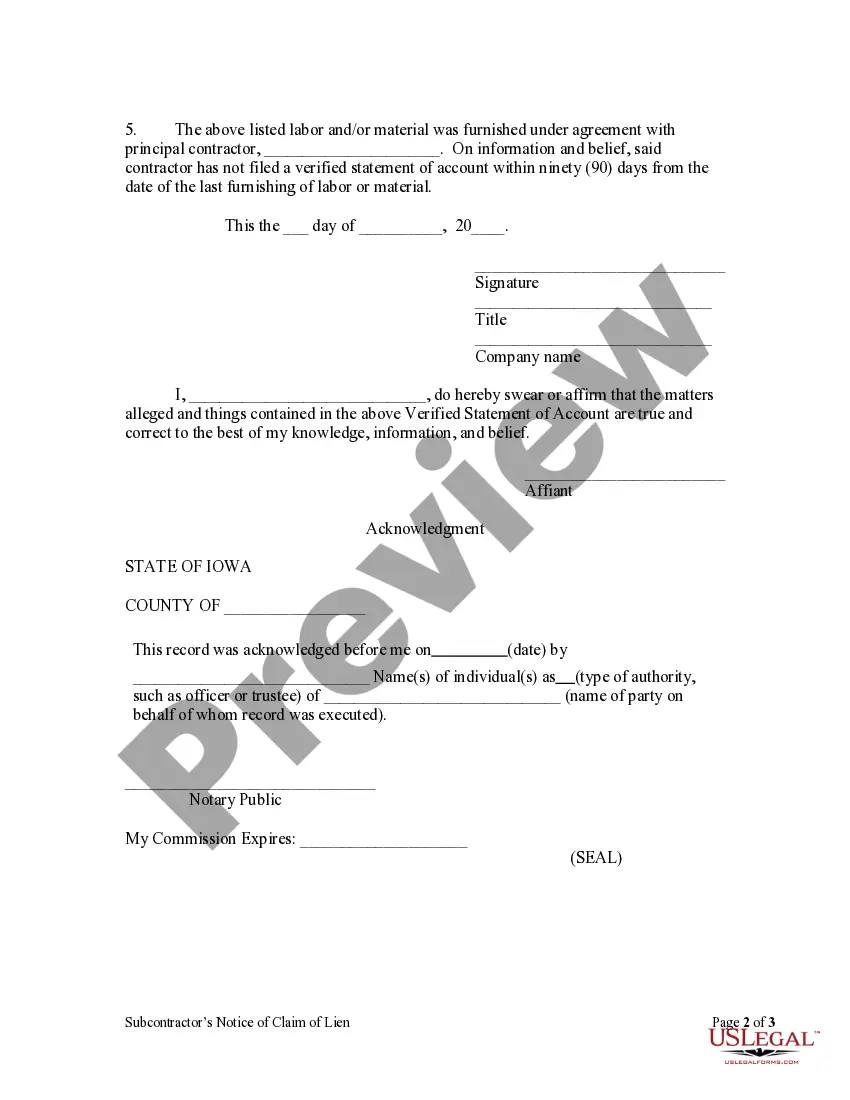

Removing a lien involves paying off the debt that caused the Iowa notice of lien. After settling the balance, request a lien release from the creditor. This document must then be filed with your local government office to update their records, ensuring the lien is officially removed. Consider using US Legal Forms for streamlined access to the required forms and instructions for this process.

To release a lien in Iowa, you must complete and file the appropriate Release of Lien form with the local county recorder. This form confirms that the debt associated with the lien has been satisfied. After filing, a copy of the release will be sent to the lien holder. For those seeking guidance in this process, uslegalforms offers convenient resources tailored for managing your Iowa notice of lien effectively.

You can look up a lien in Iowa by visiting the website of the county recorder where the property is located. Many counties offer online databases you can search using the property owner's name or the property's legal description. This method allows you to discover any existing liens, including an Iowa notice of lien, quickly and effectively. For easier navigation, consider leveraging platforms that consolidate this information.

To release a lien in Iowa, the lien claimant must file a Release of Lien form with the county recorder where the lien was originally recorded. This ensures the public record accurately reflects that the lien no longer exists. Once filed, all parties involved will be notified, and the release will take effect. Using platforms like uslegalforms can simplify this process and provide the necessary forms for your Iowa notice of lien.

In Iowa, a mechanics lien is typically good for two years from the date it was recorded. However, this timeframe can vary based on certain circumstances. It’s important to note that if the lien holder does not take action to enforce the lien within this period, the lien may be released. For more details on managing an Iowa notice of lien, consider utilizing services that specialize in lien documentation.

In Iowa, the timeframe for filing a lien depends on the type of claim you have. Generally, you must file a mechanic's lien within 90 days of the completion of the work or services provided. For other types of claims, such as judgment liens, you have up to 20 years from the date of the judgment. Understanding these deadlines is vital, as failing to file within the established time limits can result in losing your right to claim the lien. Platforms like US Legal Forms can help you track these deadlines and provide the necessary forms for your filings.

To put a lien on someone's property in Iowa, you must first have a valid claim for payment against that person. Begin by preparing the necessary lien document, outlining the debt owed and relevant details about the property. Following this, you will file the lien with the county recorder's office where the property is located. It’s advisable to consult with a professional or use US Legal Forms to ensure your lien is correctly filed and enforceable under Iowa law.

To conduct a lien search on a property in Iowa, you can start by visiting an online property records database offered by your county's assessor or recorder's office. You may also utilize third-party services, such as US Legal Forms, which provide streamlined access to property records, helping you uncover any existing liens. When searching, make sure to input accurate details about the property, such as the address or legal description, to yield the best results. This search can assist you in making informed decisions regarding potential property investments.

In Iowa, a lien typically remains in effect for a period of six years from the date it was filed. However, specific types of liens, such as judgment liens, may have different durations based on the circumstances. After this period, if you have not renewed the lien or taken appropriate legal action, it will expire and no longer have legal standing against the property. Knowing the timeline can help you manage your liens effectively and take necessary actions in a timely manner.