Life Estate In Iowa With Reversionary Interest

Description

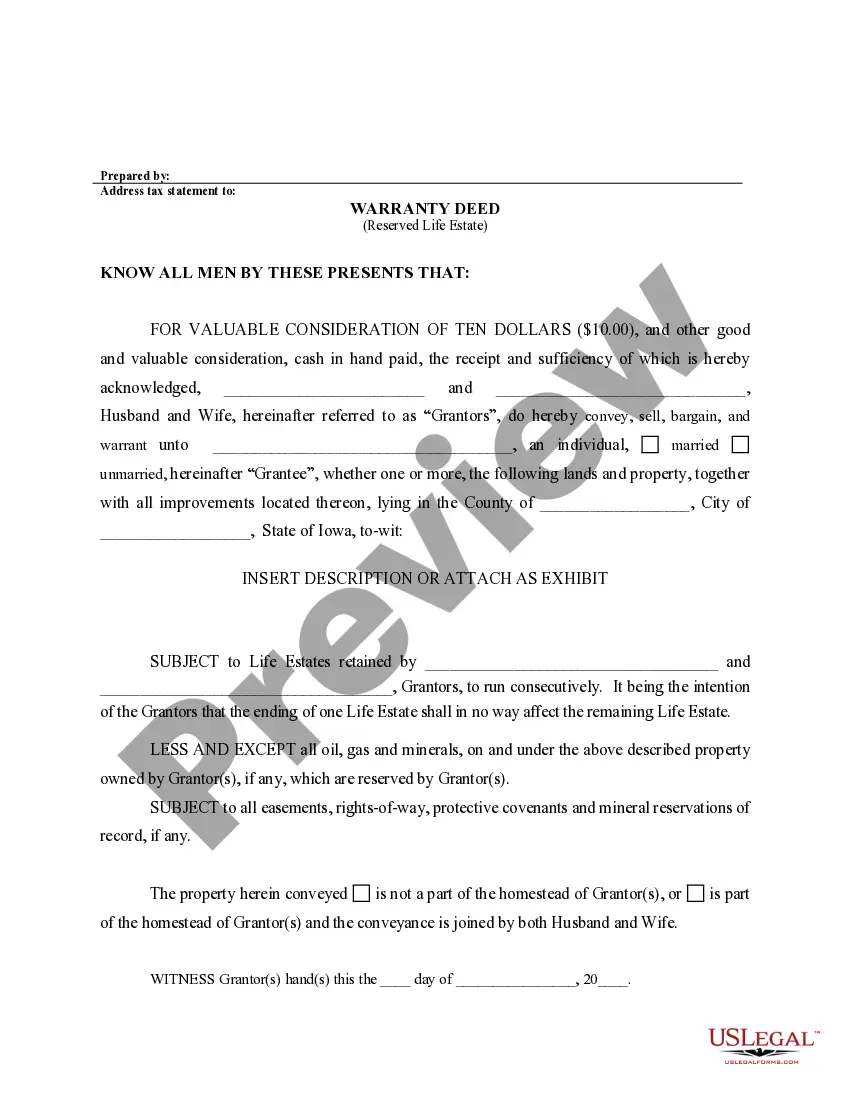

How to fill out Iowa Warranty Deed To Child Reserving A Life Estate In The Parents?

It’s no secret that you can’t become a legal professional immediately, nor can you grasp how to quickly prepare Life Estate In Iowa With Reversionary Interest without the need of a specialized background. Putting together legal forms is a long process requiring a certain training and skills. So why not leave the preparation of the Life Estate In Iowa With Reversionary Interest to the specialists?

With US Legal Forms, one of the most extensive legal template libraries, you can find anything from court papers to templates for in-office communication. We know how important compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all forms are location specific and up to date.

Here’s start off with our website and get the form you require in mere minutes:

- Discover the form you need with the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to figure out whether Life Estate In Iowa With Reversionary Interest is what you’re searching for.

- Begin your search again if you need any other form.

- Set up a free account and select a subscription plan to buy the template.

- Pick Buy now. Once the payment is through, you can get the Life Estate In Iowa With Reversionary Interest, fill it out, print it, and send or mail it to the necessary people or organizations.

You can re-access your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your documents-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

To determine the value of a life estate: First, find the line for the person's age as of the last birthday. Then, multiply the figure in the life estate column for that age by the current market value of the property.

The ordinary conventional life estate with remainder or reversion, for example, does not continue for an indefinite period but terminates when the person on whose life the estate is based, or the life tenant, becomes deceased.

To determine the value of a life estate, multiply the real value by 6%, then multiply this product by the annuity dollar at the nearest birthday of the owner of the life estate (see table below).

A remainder interest is the right to use, possess, or enjoy property when the prior interest (term or life) ends. Mathematically, the value of a remainder interest is found by subtracting the present value of the prior interest from the entire fair market value of the property.

A reversion is that portion of a fee estate that continues in the grantor after the grantor has conveyed a life estate. For example, when A conveys a life estate to B, the portion of the fee estate remaining in A is a reversion. When B's life estate ends, the right to ownership and possession will revert to A.