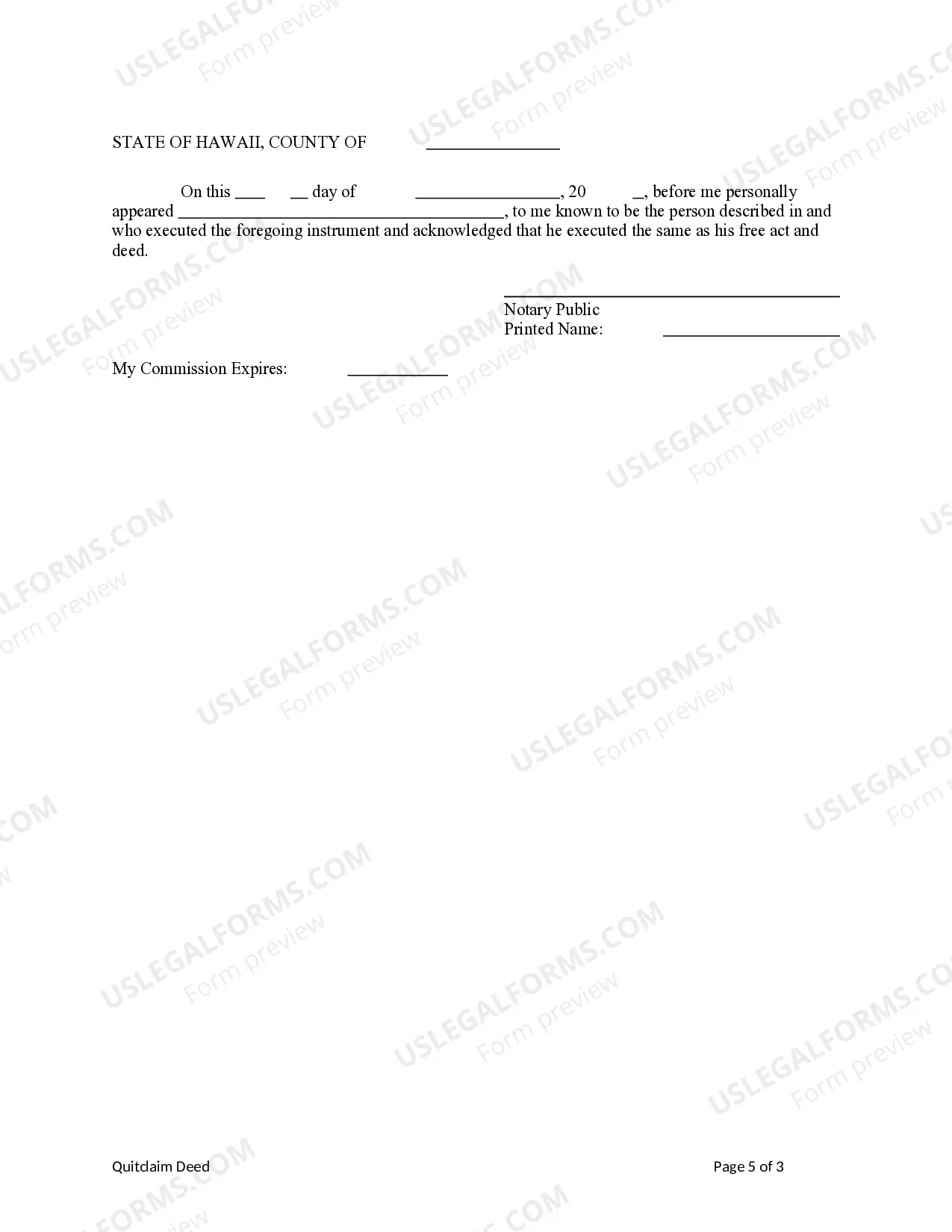

This form is a Quitclaim Deed where the grantors are two individuals and the grantee is also an individual. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

Deed State Hawaii Forms

Description

How to fill out Deed State Hawaii Forms?

How to obtain professional legal documents that adhere to your state regulations and prepare the Deed State Hawaii Forms without hiring an attorney.

Numerous services online provide templates to address various legal situations and formalities.

However, it may require time to determine which of the accessible samples meet both the intended purpose and legal standards for you.

Download the Deed State Hawaii Forms using the corresponding button next to the file name. If you do not have an account with US Legal Forms, follow the instructions below: Review the webpage you have accessed and verify if the form meets your requirements. To achieve this, use the form description and preview options if available. Search for additional samples in the header providing your state if necessary. Click the Buy Now button once you find the correct document. Select the most appropriate pricing plan, then Log In or create an account. Choose the payment method (by credit card or through PayPal). Modify the file format for your Deed State Hawaii Forms and click Download. The acquired templates remain in your control: you can always revisit them in the My documents section of your profile. Join our platform and create legal documents independently like a skilled legal expert!

- US Legal Forms is a distinguished service that assists you in locating official documents formulated according to the most recent state legislation updates and economize on legal aid.

- US Legal Forms is not an ordinary online library.

- It comprises over 85k validated templates for different business and personal scenarios.

- All documents are organized by category and state to enhance your search experience and convenience.

- Additionally, it connects with powerful solutions for PDF modification and electronic signatures, allowing users with a Premium membership to swiftly complete their paperwork online.

- It requires minimal time and effort to secure the necessary documents.

- If you already possess an account, Log In and ensure your subscription remains active.

Form popularity

FAQ

Yes, Hawaii does impose a property transfer tax when transferring ownership of real estate. The tax rate depends on the value of the property and varies by county. It is important to be aware of this when preparing to transfer property, and using the Deed state hawaii forms can help you navigate this process more efficiently. Always consult a tax professional for detailed advice.

To obtain a copy of your property deed in Hawaii, you can visit the Bureau of Conveyances or access their online portal. Search for your information using the property address or the Assessor’s Parcel Number. Alternatively, you can use services like US Legal Forms to request copies easily and ensure you're using the right Deed state hawaii forms.

The best way to transfer ownership in Hawaii typically involves using a quitclaim deed or a warranty deed, depending on your needs. Completing the Deed state hawaii forms is essential for this process. You should also consider consulting a legal professional to ensure all aspects are covered properly. Understanding your options will help you make the most informed decision.

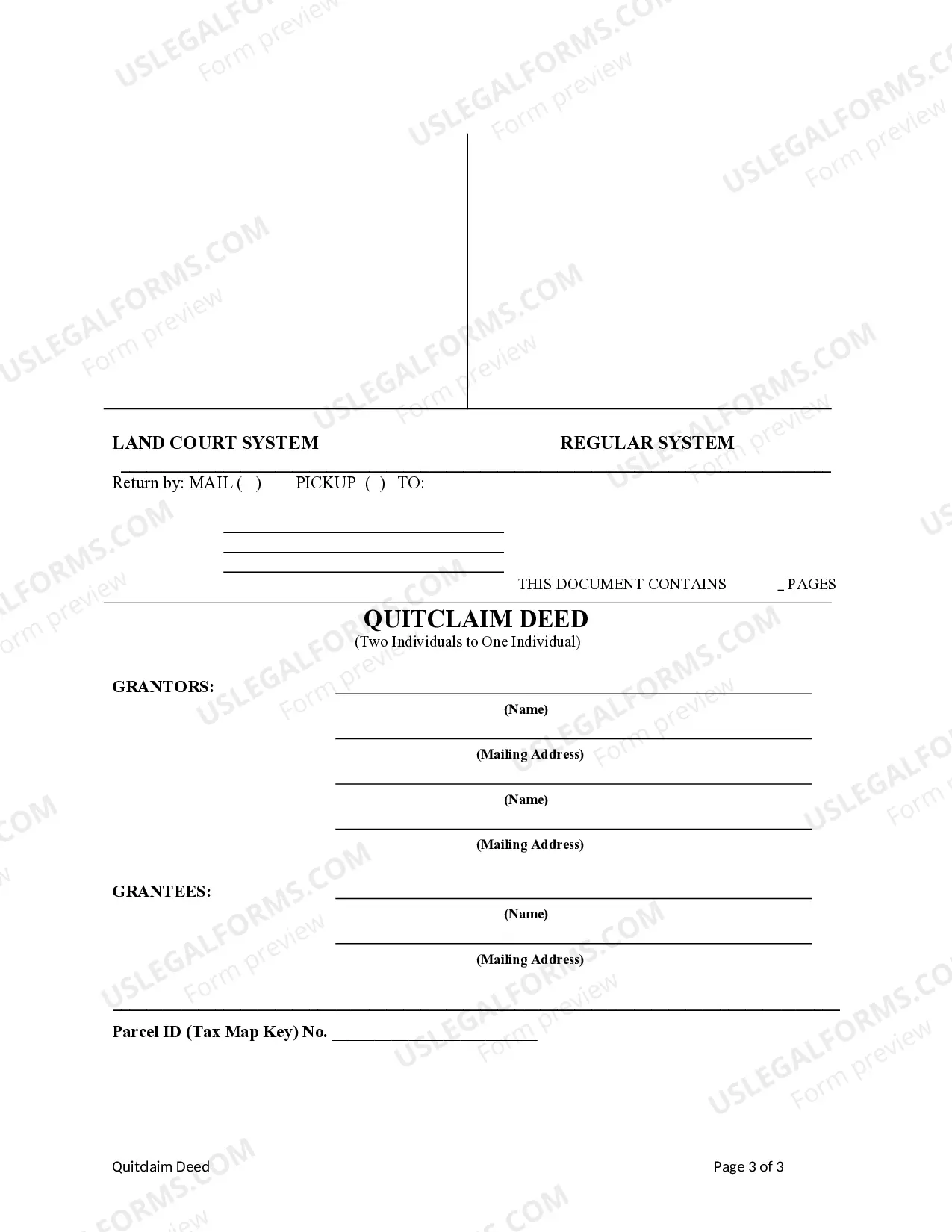

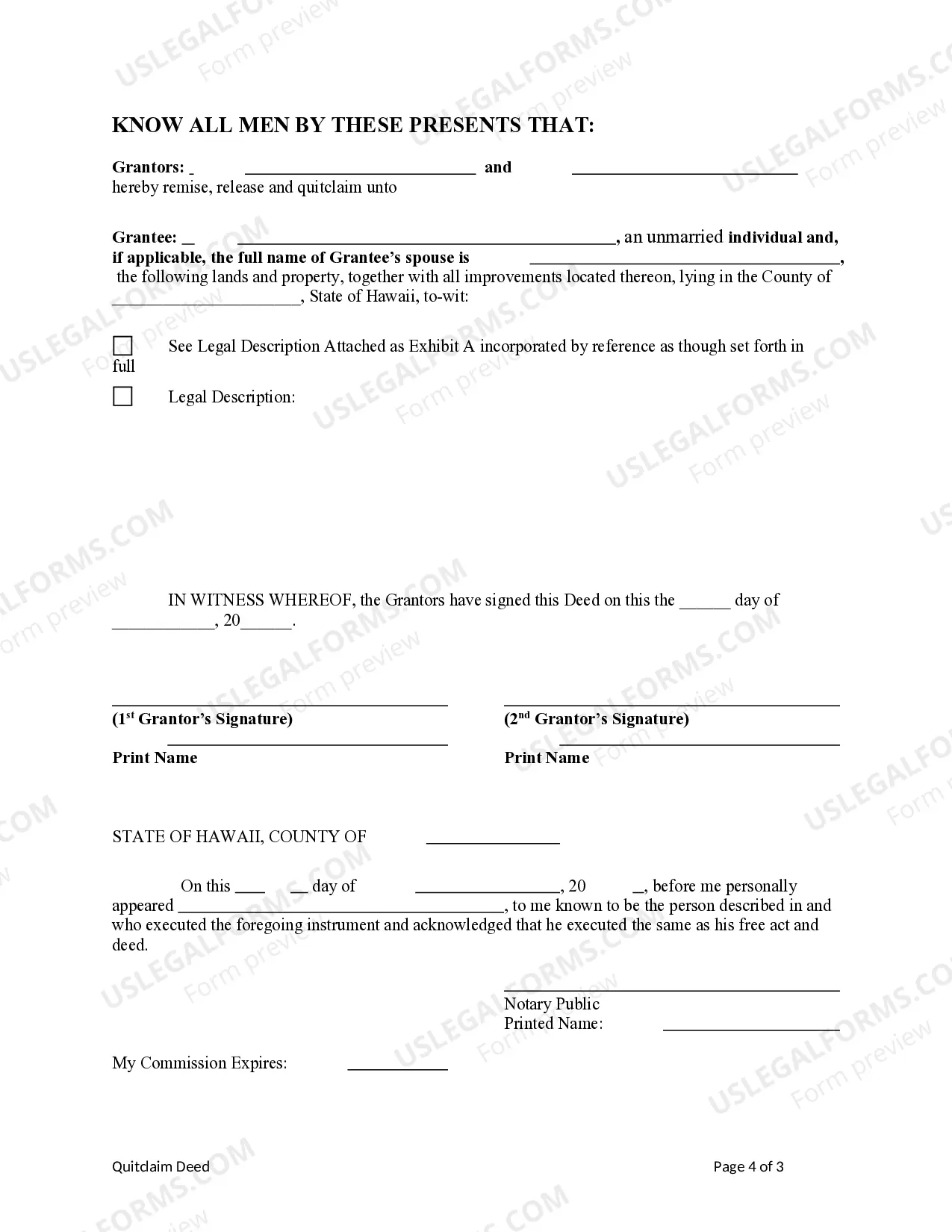

To transfer a title in Hawaii, you must complete the necessary paperwork, which includes the Deed state hawaii forms. You will need to provide details about the property, the buyer, and the seller. After filling out the form, you should have it notarized and then recorded with the county’s Bureau of Conveyances. This process ensures that the transfer is legally recognized.

Hawaii does recognize homestead exemptions, which can protect a portion of a home’s equity from creditors. Homeowners may benefit from these protections during financial hardships. It's essential to understand how this applies to your situation to make informed decisions. For guidance, consider the resources available at US Legal Forms, which provide essential deed state Hawaii forms and more.

Yes, Hawaii is a separate property state, which means that property acquired before marriage typically remains with the original owner. However, assets acquired during marriage may be subject to division upon divorce. Understanding how this affects property rights is critical for homeowners. For those looking to manage property correctly, consult US Legal Forms for access to relevant documentation.

The closing process in Hawaii can take anywhere from 30 to 60 days, depending on various factors, including financing and inspections. It's important to remain patient, as each step requires careful attention to detail. Working with professionals during this time can facilitate a smoother experience. You can find helpful templates and forms on US Legal Forms to assist in the closing process.

Hawaii is a deed state, but it also recognizes the importance of liens, especially in financing and tax situations. The deed reflects ownership, while liens may be placed on properties due to unpaid debts. Understanding the relationship between deeds and liens is crucial for property owners. For any necessary documentation, such as lien waivers, refer to the suitable forms on US Legal Forms.

Yes, Hawaii is a deed state, which means that real property titles are transferred through recorded deeds. This process provides a clear record of ownership and any encumbrances on the property. It's vital to understand the implications of this structure when buying or selling property. You can find helpful resources, including deed state Hawaii forms, on US Legal Forms.

To transfer ownership of property in Hawaii, you must complete and record a deed that reflects the new ownership. Both parties must agree on the terms, and the deed should be signed and notarized. Once the deed is recorded at the Bureau of Conveyances, the transfer is official. Consider using US Legal Forms to find appropriate deed state Hawaii forms tailored for this process.